Table of Contents

As filed with the Securities and Exchange Commission

on August 1, 2022.

Registration No. 333-251016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

CANNAPHARMARX,

INC.

(Exact name of Registrant as specified in its charter)

Delaware

(State or Other Jurisdiction of

Incorporation or Organization) |

|

2834

(Primary Standard Industrial

Classification Code Number) |

|

27-4635140

(I.R.S. Employer

Identification Number) |

Suite 3600, 888 – 3rd Street SW

Calgary, Alberta, CanadaT2P 5C5

949-652-6838

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

CANNAPHARMARX, INC.

Suite 3600, 888 – 3rd Street SW

Calgary, Alberta, CanadaT2P 5C5

Attn: Domenic Colvin

Tel: 949-652-6838

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Please send copies of all communications to:

Joshua D. Brinen

Brinen & Associates, LLC

90 Broad Street, Tenth Floor

New York, New York 10004

(212) 330-8151

Approximate date of commencement of the proposed

sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☐

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule

462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states

that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as

amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant

to said Section 8(a), may determine.

The information in this prospectus is not

complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the selling stockholder is not soliciting

offers to buy these securities in any state or other jurisdiction where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED August 1, 2022

PROSPECTUS

435,951,370 Shares

Common Stock

This prospectus relates to the sale of up to

435,951,370 shares of our common stock by TYSADCO PARTNERS, LLC.

The shares of our common stock to which this

prospectus relates have been or may be issued by CANNAPHARMARX, INC. pursuant to a purchase agreement, dated as of April 28, 2022, we

entered into with TYSADCO PARTNERS, LLC, which we refer to in this prospectus as the Purchase Agreement. On April 28, 2022, we sold 50,000,000

shares of our common stock to TYSADCO PARTNERS, LLC in an initial purchase under the Purchase Agreement for a total purchase price of

$5,000,000. We also issued 10,000,000 shares of our common stock to TYSADCO PARTNERS, LLC as consideration for its irrevocable commitment

to purchase our common stock under the Purchase Agreement.

We will not receive proceeds from the sale of

the shares by TYSADCO PARTNERS, LLC. However, we may receive proceeds of up to an additional $4,500,000 from the sale of our common stock

to TYSADCO PARTNERS, LLC pursuant to the purchase agreement from time to time after the registration statement of which this prospectus

is a part is declared effective.

TYSADCO PARTNERS, LLC is referred to herein as

the selling stockholder.

The selling stockholder is an “underwriter”

within the meaning of the Securities Act of 1933, as amended. TYSADCO PARTNERS, LLC may sell the shares of common stock described in

this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” for

more information about how the selling stockholder may sell the shares of common stock being registered pursuant to this prospectus.

We will pay the expenses of registering these

shares, but all selling and other expenses incurred by the selling stockholder will be paid by the selling stockholder. See “Plan

of Distribution.”

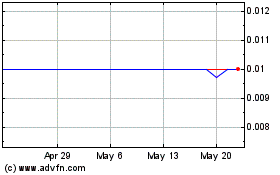

Our common stock is quoted on the Over the Counter

Venture (OTC Markets PINK (OTCPINK)) exchange under the trading symbol “CPMD” On July 11, 2022, the last reported sale price

per share of our common stock was $0.012955 per share.

You should read this prospectus, together with

additional information described under the headings “Incorporation of Certain Information by Reference”

and “Where You Can Find More Information”, carefully before you invest in any of our securities.

Investing in our securities involves a high

degree of risk. See “Risk Factors” on page 8 of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is August 1, 2022.

TABLE

OF CONTENTS

Page

We incorporate by reference important information

into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under the

section of this prospectus entitled “Where You Can Find More Information.” You should carefully read

this prospectus as well as additional information described under the section of this prospectus entitled “Incorporation

of Certain Information by Reference,” before deciding to invest in our common shares.

Unless the context otherwise requires, the terms

“CPMD,” “we,” “us” and “our” in this prospectus refer to CANNAPHARMARX, INC., and “this

offering” refers to the offering contemplated in this prospectus.

Neither we nor the selling stockholder authorized

anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing

prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance

as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered

hereby, but only under the circumstances and in the jurisdictions where it is lawful to do so. The information contained in this prospectus

or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares

of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are

not, and the selling stockholder is not, making an offer of these securities in any jurisdiction where such offer is not permitted.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated

by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or

the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that involve a number of

risks and uncertainties and that are intended to be covered by the “safe harbor” created by those sections. Although our

forward-looking statements reflect the good faith judgment of our management, these statements can only be based on facts and factors

currently known by us. Consequently, these forward-looking statements are inherently subject to known and unknown risks, uncertainties

and other factors that may cause actual results and outcomes to differ materially from results and outcomes discussed in the forward-looking

statements.

Forward-looking statements can generally be identified

by the use of forward-looking terms such as “believe,” “hope,” “expect,” “may,” “will,”

“should,” “could,” “would,” “seek,” “intend,” “plan,” “estimate,”

“anticipate” and “continue,” or other comparable terms (including their use in the negative), or by discussions

of future matters. All statements other than statements of historical facts included in this prospectus and the documents incorporated

by reference herein are forward-looking statements. These statements include but are not limited to statements under the captions “Prospectus

Summary—The Company,” “Risk Factors,” “Use of Proceeds”

and “The TYSADCO PARTNERS, LLC Transaction” and in other sections included in this prospectus or incorporated

by reference from our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q as applicable, as well as our other filings with

the SEC. You should be aware that the occurrence of any of the events discussed under the heading “Risk Factors”

in this prospectus and any documents incorporated by reference herein could substantially harm our business, operating results and financial

condition and that if any of these events occurs, it could adversely affect the value of an investment in our securities.

The cautionary statements made in this prospectus

supplement are intended to be applicable to all related forward-looking statements wherever they may appear in this prospectus, or any

documents incorporated by reference herein. We urge you not to place undue reliance on these forward-looking statements, which speak

only as of the date they are made. Except as required by law, we assume no obligation to update our forward-looking statements, even

if new information becomes available in the future.

PROSPECTUS

SUMMARY

This summary highlights selected information

that is presented in greater detail elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information

you should consider before investing in our common stock and it is qualified in its entirety by, and should be read in conjunction with,

the more detailed information included elsewhere in this prospectus. Before you decide whether to purchase shares of our common stock,

you should read this entire prospectus carefully, including the risks of investing in our securities discussed under the section of this

prospectus entitled “Risk Factors” and similar headings in the other documents that are incorporated

by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including

our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

The Company

Overview and History

The Company was originally incorporated in the

State of Colorado in August 1998 under the name “Network Acquisitions, Inc.” The Company changed our name to Cavion Technologies,

Inc. in February 1999 and subsequently to Concord Ventures, Inc. in October 2006.

On December 21, 2000, the Company filed for protection

under Chapter 11 of the United States Bankruptcy Code. In connection with the filing, on February 16, 2001, the Company sold our entire

business, and all of our assets, for the benefit of our creditors. After the sale, the Company still had liabilities of $8.4 million

and were subsequently dismissed by the Court from the Chapter 11 reorganization, effective March 13, 2001, at which time the last of

the Company’s remaining directors resigned. On March 13, 2001, the Company had no business or other source of income, no assets,

no employees or directors, outstanding liabilities of approximately $8.4 million and had terminated their duty to file reports under

securities law. In February 2008, the Company was re-listed on the OTC Bulletin Board.

In April 2010, the Company re-domiciled in Delaware

under the name CCVG, Inc. (“CCVG”). Effective December 31, 2010, CCVG completed an Agreement and Plan of Merger and Reorganization

(the “Reorganization") which provided for the merger of two of their wholly-owned subsidiaries. As a result of this reorganization,

the Company’s name was changed to “Golden Dragon Inc.”, which became the surviving publicly quoted parent holding company.

On May 9, 2014, the Company entered into

a Share Purchase Agreement (the “Share Purchase Agreement”) with CannaPharmaRx, Inc., a Colorado corporation (“Canna

Colorado”), and David Cutler, a former President, Chief Executive Officer, Chief Financial Officer and director of the Company.

Under the Share Purchase Agreement, Canna Colorado purchased 1,421,120 shares of our common stock from Mr. Cutler and an additional 9,000,000

restricted common shares directly from the Company.

On May 15, 2014, as amended and effective January

29, 2015, the Company entered into an Agreement and Plan of Merger (the “Merger”) pursuant to which Canna Colorado became

a subsidiary of our Company.

In October 2014, the Company changed their

legal name to “CannaPharmaRx, Inc.”

Pursuant to the Merger all of the shares of the

Company’s common stock previously owned by Canna Colorado were canceled. As a result of the aforesaid transactions, the Company

became an early-stage pharmaceutical company whose purpose was to advance cannabinoid research and discovery using proprietary formulation

and drug delivery technology then under development.

In April 2016, we ceased operations. The Company’s

then management resigned their respective positions with our Company with the exception of Mr. Gary Herrick, who remained one of the

Company’s officers and directors until April 23, 2019.

Effective December 31, 2018, the Company and

Hanover CPMD Acquisition Corp. (“CPMD Hanover”) a newly formed, wholly-owned subsidiary, entered into a Securities Purchase

Agreement with Alternative Medical Solutions, Inc., an Ontario, Canada corporation (“AMS”), its shareholders, wherein the

Company acquired all of the issued and outstanding securities of AMS. AMS is a corporation organized under the laws of the Province of

Ontario, Canada.

As a result of the completion of the acquisition

of AMS on December 31, 2019, the Company no longer fit the definition of a “shell company,” as defined in Rule 405 of the

Securities Act and Rule 12b-2 of the Exchange Act. It filed the required disclosure on Form 8-K/A with the SEC on February 14, 2019,

advising that it was no longer a shell company pursuant to the aforesaid Rule.

On January 6, 2021, the Company executed an Agreement

of Purchase and Sale through its wholly-owned subsidiary, Alternative Medical Solutions Inc for the sale of the lands and premises located

at Hanover, Ontario, Canada. The price was $2,000,000 CAD. As a result, and in anticipation of the closing, the Company recorded an impairment

of goodwill and fixed assets relating to the property of $7,962,694 at December 31, 2020. This property was security for a $1,000,000

US Note with Koze Investments LLC by way of a first ranking charge. This transaction closed on July 9, 2021 and the note was repaid in

full as principal of $1,000,000 plus accrued interest of $124,735 and penalties of $475,265. The note was discharged accordingly.

Effective February 25, 2019, the Company acquired

3,936,500 shares and 2,500,000 Warrants to purchase 2,500,000 shares of Common Stock of GN Ventures, Ltd, Alberta, Canada, f/k/a Great

Northern Cannabis, Ltd. (“GN”), in exchange for an aggregate of 7,988,963 shares of its Common Stock, from a former shareholder

of GN who is now the Company’s President and CEO. While no assurances can be provided, the Company believes this is the initial

step in its efforts to acquire all or a significant portion of the issued and outstanding stock of GN. In May 2020, the Company exchanged

5,507,400 of its shares for 3,671,597 shares of GN.

GN owns a 60,000 square foot cannabis cultivation

and grow facility located on 38 acres in Stevensville, Ontario, Canada. Because the Company is a minority shareholder of GN and GN is

a privately held company, the Company cannot confirm that the information it currently has on GN’s operations is complete or fully

reliable. GN estimates annual total production capacity from the Stevensville facility of up to 5,000 kilograms of cannabis. GN believes

the Stevensville facility to be complete, and GN’s subsidiary, 9869247 Canada Limited, received a license to cultivate from the

Canadian Ministry of Health on July 5, 2019. As a result, in October 2019, GN commenced cultivation activities and began generating revenues

during the first calendar quarter of 2020.

On January 1, 2022, the Company entered into

a 20 year finance lease with Formosa Mountain Ltd., for a cannabis production facility in Cremona, Alberta, Canada. The facility is a

55,000 square foot, 6,000 kg per year plant, built in 2015. The licensing process is currently underway, and production and sales are

anticipated in Q3, 2022.

COVID-19

On March 11, 2020, the World Health Organization

(“WHO”) declared the Covid-19 outbreak to be a global pandemic. In addition to the devastating effects on human life, the

pandemic is having a negative ripple effect on the global economy, leading to disruptions and volatility in the global financial markets.

Most U.S. states and many countries have issued policies intended to stop or slow the further spread of the disease.

The global pandemic related to an outbreak of

the novel coronavirus disease (“COVID-19”) has cast uncertainty on each of these assumptions. There can be no assurance that

they continue to be valid. The situation is dynamic and the ultimate duration and magnitude of the impact of COVID-19 on the economy

and the financial effect on our business remain unknown at this time. These impacts could include, amongst others, an impact on our ability

to obtain debt or equity financing, impairment of investments, net realizable value of inventory, impairments in the value of our long-lived

assets, or potential future decreases in revenue or profitability of our ongoing operations.

Wholly-Owned Subsidiaries

Our wholly-owned subsidiaries are:

CannaPharmaRx Canada Corp. (Alberta). CannaPharmaRx

Canada Corp. is a wholly owned subsidiary of the Company. This subsidiary’s sole purpose and business is to hold the shares of

Alternative Medical Solutions Inc. (Ontario).

Alternative Medical Solutions Inc. (Ontario).

Alternative Medical Solutions Inc. (Ontario) is a wholly owned subsidiary of the CannaPharmaRx Canada Corp.

2323414 Alberta Ltd is a wholly owned subsidiary

of CannaPharmaRx Inc. This subsidiary’s role is the business and operations of our Cremona, Alberta, Canada, production facility,

currently being readied for operations anticipated in Q3 of 2022.

Our executive offices are located at Suite 3600,

888 3rd Street SW, Calgary, Alberta Canada, T2P 5C5 phone (949) 652-6838. Our website address is www.cannapharmarx.com.

We have not generated any revenues during the

past five years. Following is our current Plan of Operation.

PLAN OF OPERATION

We are involved in the cannabis industry in Canada

and are reviewing opportunities in other jurisdictions where cannabis has been legalized, including the US. Our principal business activities

to date have been to negotiate, acquire and develop various cannabis cultivation projects throughout Canada. As of the date of this Report

we do not own or operate any businesses in the US.

Following is a description of the projects we

are pursuing as of the date of this Report:

Great Northern

In early 2019, we retained new members of management

who are actively engaged in the Canadian cannabis industry, including former management of GN Ventures, Ltd, Alberta, Canada, f/k/a Great

Northern Cannabis, Ltd. (“GN”). Not coincidentally, effective February 25, 2019, we acquired 3,712,500 shares and 2,500,000

Warrants to purchase 2,500,000 shares of Common Stock of GN in exchange for an aggregate of 7,988,963 shares of our Common Stock, from

our current CEO, who is a former shareholder of GN.

We cannot state any definitive information concerning

Great Northern because it is a privately held Canadian company who is keeping its business activities confidential. We expect that we

will obtain additional information on the business activities of GN as we renew discussions to acquire additional interests and can perform

our due diligence.

Based on information currently available in the

marketplace we believe that GN owns a 60,000 square foot cannabis cultivation and grow facility located on 38 acres in Stevensville,

Ontario, Canada. GN estimates annual total production capacity from the Stevensville facility of up to 5,000 kilograms of cannabis. GN

advised that the Stevensville facility is complete, and GN’s subsidiary, 9869247 Canada Limited, received a license to cultivate

from the Canadian Ministry of Health on July 5, 2019. As a result, in October 2019 GN commenced cultivation activities, with the initial

harvest in the first quarter of 2020. Additionally, it is our current understanding that GN intends to increase cannabis production by

building additional cannabis cultivation facilities on the excess land presently owned adjacent to the existing Stevensville facility,

provided that additional funding can be obtained on commercially reasonable terms. Neither we nor GN have any firm commitment to provide

any of the funds necessary for expansion as of the date of this report..

On May 8, 2020, we agreed to acquire an additional

3,671,597 shares of GN common stock in exchange for an aggregate of 5,507,400 shares of our Common Stock. We presently own 7,384,097

shares of GN common stock which we believe, based on information provided by the management of GN, equals approximately 10% of the total

issued and outstanding shares of GN common stock. Additionally, we own Warrants to purchase an additional 2,500,000 shares of GN common

stock with each Warrant having an exercise price of CAD$1.00 per share.

Cremona

On January 1, 2022, the Company entered into

a 20 year finance lease with Formosa Mountain Ltd for a cannabis production facility in Cremona, Alberta, Canada. The facility is a 55,000

square foot, 6,000 Kg per year plant, built in 2015 as a state of the art facility. Retooling of the facility is currently underway,

as is the licensing process. Production and sales are anticipated in Q3 of 2022.

We intend to license, improve and/or develop

our products and identify and select distribution channels. We intend to establish agreements with distributors to get products to market

quickly as well as to undertake and engage in our own direct marketing efforts. We will determine the most effective method of distribution

for each unique product that we include in our portfolio.

We intend to engage third party research and

development firms who specialize in the creation of cannabis products to assist us in the development. We intend to apply for trademarks

and patents as we develop proprietary products.

For a complete description of our business, financial

condition, results of operations and other important information, we refer you to our filings with the SEC that are incorporated by reference

in this Annual Report, including our Annual Report on Form 10-K for the year ended December 31, 2021 filed on April 15, 2022 and our

Quarterly Reports on Form 10-Q for the periods ended March 31, 2022, June 30, 2021 and September 30, 2021, as amended by the filings

of Quarterly Reports on Form 10-Q/A for the periods ended March 31, 2022, June 30, 2021 and September 30, 2021 filed with the Securities

and Exchange Commission on May 23, 2022, August 16, 2021, and November 15, 2021. For instructions on how to find copies of these documents,

see the section entitled “Where You Can Find More Information.”

Corporate Information

CANNAPHARMARX, INC. was formed as a Delaware

corporation in August 1998. Our principal executive offices are located at Suite 3600, 888 – 3rd Street SW, Calgary, Alberta, Canada

T2P 5C5. The registration statement effectuating our initial public offering became effective in February 2008.

Currently our shares of common stock are quoted

on the OTC Markets PINK (OTCPINK) exchange and there is currently 2,860,470 public market for our common stock.

THE

OFFERING

| Common Stock

Being Offered by the Selling Stockholder |

|

435,951,370

shares of common stock, consisting of: |

| |

|

· |

10,000,000 shares of common

stock issued to TYSADCO PARTNERS, LLC upon the execution of the Purchase Agreement (the “Commitment Shares”). |

| |

|

|

|

| |

|

· |

50,000,000 shares of

common stock issued to TYSADCO PARTNERS, LLC upon the execution of the Purchase Agreement for a total purchase price of $500,000

(the “Initial Purchase Shares”); and |

| |

|

|

|

| |

|

· |

385,951,370 additional

shares of common stock that we may sell to TYSADCO PARTNERS, LLC pursuant to the Purchase Agreement from time to time after the registration

statement of which this prospectus is a part is declared effective. |

| Common Stock Outstanding Before

the Offering |

|

222,667,059 shares (as of July 14,

2022) (including the 10,000,000 Commitment Shares and 50,000,000 Initial Purchase Shares already issued to TYSADCO PARTNERS, LLC

pursuant to the Purchase Agreement). |

| |

|

|

| Common Stock Outstanding

After the Offering |

|

608,618,429 shares (assuming

the issuance after the date of this prospectus by us to the selling stockholder pursuant to the Purchase Agreement of all of the

shares that are being offered by this). |

| |

|

|

| Use of proceeds |

|

We will receive no proceeds

from the sale of shares of common stock by TYSADCO PARTNERS, LLC in this offering. We have received $5,000,000 gross proceeds from

TYSADCO PARTNERS, LLC in the initial purchase under the Purchase Agreement, which we completed at the time we executed the Purchase

Agreement, and we may receive up to an additional $4,500,000 in gross proceeds that we may sell to TYSADCO PARTNERS, LLC pursuant

to the Purchase Agreement from time to time after the registration statement of which this prospectus is a part is declared effective.

Any proceeds from the TYSADCO PARTNERS, LLC that we receive under the Purchase Agreement are expected to be used for general corporate

purposes, capital expenditures, working capital and general and administrative expenses. As the remainder of the proceeds are intended

to be used for working capital, research and development and operational expenses, some of such proceeds may be used from time to

time to pay officer and director compensation. |

| |

|

|

| Risk factors |

|

Investing in our securities

involves a high degree of risk. See “Risk Factors” beginning on page 8 and the other information

included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| |

|

|

| OTC Markets PINK Trading

Symbol |

|

“CPMD” |

The number of shares of common stock to be outstanding

after this offering is based on 222,667,059 shares of common stock outstanding at July 14, 2022, (including 10,000,000 Commitment Shares

issued to TYSADCO PARTNERS, LLC and 50,000,000 Initial Purchase Shares purchased by TYSADCO PARTNERS, LLC upon execution of the Purchase

Agreement that are being registered herein) plus an additional 385,951,370 shares being registered herein July 14, 2022

RISK

FACTORS

Before you make a decision to invest in our

securities, you should consider carefully the risks described below, together with other information in this prospectus and the information

incorporated by reference herein, including those risks identified under “Item 1A. Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2021, as filed with the SEC on April 15, 2022, and our Quarterly Reports on Form 10-Q for the

periods ended March 31, 2022, June 30, 2021 and September 30, 2021, as filed with the SEC on May 23, 2022, August 16, 2021 and November

15, 2021, respectively March 31, 2022, June 30, 2021and September 30, 2021, which are incorporated by reference in this prospectus and

which may be amended, supplemented or superseded by other reports that we subsequently file with the SEC. If any of the following events

actually occur, our business, operating results, prospects or financial condition could be materially and adversely affected. This could

cause the trading price of our common stock to decline, and you may lose all or part of your investment. The risks described below are

not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also significantly

impair our business operations and could result in a complete loss of your investment. Please also read carefully the section entitled

“Special Note Regarding Forward-Looking Statements.”

Risks Related to This Offering

The sale or issuance of our common stock

to TYSADCO PARTNERS, LLC may cause dilution and the sale of the shares of common stock acquired by TYSADCO PARTNERS, LLC, or the perception

that such sales may occur, could cause the price of our common stock to fall.

On April 28, 2022, we entered into the Purchase

Agreement with TYSADCO PARTNERS, LLC and on that date, we sold 25,000,000 shares of our common stock to TYSADCO PARTNERS, LLC in an initial

purchase under the Purchase Agreement for a total purchase price of $5,000,000. We also issued 10,000,000 shares of our common stock

to TYSADCO PARTNERS, LLC as consideration for its irrevocable commitment to purchase our common stock under the Purchase Agreement. The

remaining shares of our common stock that may be issued under the Purchase Agreement may be sold by us to TYSADCO PARTNERS, LLC at our

discretion from time to time over a Twenty-four months period commencing after the satisfaction of certain conditions set forth in the

Purchase Agreement, including that the SEC has declared effective the registration statement of which this prospectus is a part and that

such registration statement remains effective. The purchase price for the shares that we may sell to TYSADCO PARTNERS, LLC under the

Purchase Agreement will fluctuate based on the price of our common stock. Depending on market liquidity at the time, sales of such shares

may cause the trading price of our common stock to fall.

Subject to the terms of the Purchase Agreement,

we generally have the right to control the timing and amount of any future sales of our shares to TYSADCO PARTNERS, LLC. Additional sales

of our common stock, if any, to TYSADCO PARTNERS, LLC will depend upon market conditions and other factors to be determined by us. We

may ultimately decide to sell to TYSADCO PARTNERS, LLC all, some, or none of the additional shares of our common stock that may be available

for us to sell pursuant to the Purchase Agreement. If and when we do sell shares to TYSADCO PARTNERS, LLC, after TYSADCO PARTNERS, LLC

has acquired the shares, TYSADCO PARTNERS, LLC may resell all or some of those shares at any time or from time to time in its discretion.

Therefore, sales to TYSADCO PARTNERS, LLC by us could result in substantial dilution to the interests of other holders of our common

stock. Additionally, the sale of a substantial number of shares of our common stock to TYSADCO PARTNERS, LLC, or the anticipation of

such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that

we might otherwise wish to effect sales.

We may require additional financing to

sustain our operations, without which we may not be able to continue operations, and the terms of subsequent financings may adversely

impact our stockholders.

We may direct TYSADCO PARTNERS, LLC to purchase

up to $4,500,000 worth of shares of our common stock under our agreement over a Twenty-four months period generally in amounts up to

385,951,370 shares of our common stock (such purchases, “Regular Purchases”), which may be increased to up to 385,951,370

shares of our common stock depending on the market price of our common stock at the time of sale, and, TYSADCO PARTNERS, LLC committed

obligation under any Regular Purchase shall not exceed $1,000,000.

The extent we rely on TYSADCO PARTNERS, LLC as

a source of funding will depend on a number of factors including the prevailing market price of our common stock and the extent to which

we are able to secure working capital from other sources. If obtaining sufficient funding from TYSADCO PARTNERS, LLC were to prove unavailable

or prohibitively dilutive, we will need to secure another source of funding in order to satisfy our working capital needs. Even if we

sell all $5,000,000 under the Purchase Agreement to TYSADCO PARTNERS, LLC, we may still need additional capital to finance our future

production plans and working capital needs, and we may have to raise funds through the issuance of equity or debt securities. Depending

on the type and the terms of any financing we pursue, stockholders’ rights and the value of their investment in our common stock

could be reduced. A financing could involve one or more types of securities including common stock, convertible debt or warrants to acquire

common stock. These securities could be issued at or below the then prevailing market price for our common stock. In addition, if we

issue secured debt securities, the holders of the debt would have a claim to our assets that would be prior to the rights of stockholders

until the debt is paid. Interest on these debt securities would increase costs and negatively impact operating results. If the issuance

of new securities results in diminished rights to holders of our common stock, the market price of our common stock could be negatively

impacted.

Should the financing we require to sustain our

working capital needs be unavailable or prohibitively expensive when we require it, the consequences could be a material adverse effect

on our business, operating results, financial condition and prospects.

Our management will have broad discretion

over the use of the net proceeds from our sale of shares of common stock to TYSADCO PARTNERS, LLC, you may not agree with how we use

the proceeds, and the proceeds may not be invested successfully.

Our management will have broad discretion as

to the use of the net proceeds from our sale of shares of common stock to TYSADCO PARTNERS, LLC, and we could use them for purposes other

than those contemplated at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management

with regard to the use of those net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether

the proceeds are being used appropriately. It is possible that, pending their use, we may invest those net proceeds in a way that does

not yield a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material adverse

effect on our business, financial condition, operating results and cash flows.

An active trading market for our common

stock may not be sustained.

Although our common stock is listed on the OTC

Markets PINK Market, the market for our shares has demonstrated varying levels of trading activity. Furthermore, the current level of

trading may not be sustained in the future. The lack of an active market for our common stock may impair investors’ ability to

sell their shares at the time they wish to sell them or at a price that they consider reasonable, may reduce the fair market value of

their shares and may impair our ability to raise capital to continue to fund operations by selling shares and may impair our ability

to acquire additional intellectual property assets by using our shares as consideration.

We do not anticipate paying dividends on

our common stock and, accordingly, stockholders must rely on stock appreciation for any return on their investment.

We have never declared or paid cash dividends

on our common stock and do not expect to do so in the foreseeable future. The declaration of dividends is subject to the discretion of

our board of directors and limitations under applicable law, and will depend on various factors, including our operating results, financial

condition, future prospects and any other factors deemed relevant by our board of directors. You should not rely on an investment in

our company if you require dividend income from your investment in our company. The success of your investment will likely depend entirely

upon any future appreciation of the market price of our common stock, which is uncertain and unpredictable. There is no guarantee that

our common stock will appreciate in value.

We face risks related to health epidemics

and other outbreaks, which could significantly disrupt our operations.

Our business has been and could continue to be

adversely impacted by the effects of Novel Coronavirus (“COVID-19”) or other epidemics. A public health epidemic, including

COVID-19 poses the risk that we or our employees, contractors, suppliers, and other partners may be prevented from conducting business

activities for an indefinite period of time, including due to shutdowns that may be requested or mandated by governmental authorities.

The extent to which COVID-19 impacts our results will depend on future developments that are highly uncertain and cannot be predicted,

including new information that may emerge concerning the severity of the virus and the actions to contain its impact.

USE

OF PROCEEDS

This prospectus relates to shares of our common

stock that may be offered and sold from time to time by TYSADCO PARTNERS, LLC. We will receive no proceeds from the sale of shares of

common stock by TYSADCO PARTNERS, LLC in this offering. We received $500,000 from TYSADCO PARTNERS, LLC as its initial purchase pursuant

to the Purchase Agreement, and we may receive up to an additional $4,500,000 in gross proceeds under the Purchase Agreement from any

sales we make to TYSADCO PARTNERS, LLC pursuant to the Purchase Agreement after the date of this prospectus. We estimate that the net

proceeds to us from the sale of our common stock to TYSADCO PARTNERS, LLC pursuant to the Purchase Agreement would be up to $$5,000,000

over an approximately Twenty-four months period, assuming that we sell the full amount of our common stock that we have the right, but

not the obligation, to sell to TYSADCO PARTNERS, LLC under the Purchase Agreement, and after other estimated fees and expenses. See “Plan

of Distribution” elsewhere in this prospectus for more information.

Any proceeds from the TYSADCO PARTNERS, LLC that

we receive under the Purchase Agreement are expected to be used for general corporate purposes, capital expenditures, working capital

and general and administrative expenses. As the remainder of the proceeds are intended to be used for working capital, research and development

and operational expenses, some of such proceeds may be used from time to time to pay officer and director compensation. As we are unable

to predict the timing or amount of potential issuances of all of the additional shares issuable to the Purchase Agreement, we cannot

specify with certainty all of the particular uses for the net proceeds that we will have from the sale of such additional shares. Accordingly,

our management will have broad discretion in the application of the net proceeds. We may use the proceeds for purposes that are not contemplated

at the time of this offering. It is possible that no additional shares will be issued under the Purchase Agreement.

We will incur all costs associated with this prospectus and the registration

statement of which it is a part.

MARKET

FOR COMMON STOCK AND DIVIDEND POLICY

Our common stock is traded on the OTC Markets

PINK Market under the symbol “CPMD.” The last reported sale price of our common stock on July 11, 2022 on the OTC Markets

PINK Market was $0.012955 per share. As of July 11, 2022, there were 375 holders of record of our common stock.

We cannot provide any assurance that we will

declare or pay cash dividends on our common stock. Any future determination to declare cash dividends will be made at the discretion

of our board of directors, subject to applicable laws, and will depend on our financial condition, results of operations, capital requirements,

general business conditions and other factors that our board of directors may deem relevant.

MANAGEMENT

Executive Officers and Directors

Set forth below are the directors and executive

officers of the Company as of July 7, 2022. Except as set forth below, there are no other persons who have been nominated or chosen to

become directors, nor are there any other persons who have been chosen to become executive officers. Other than as set forth below, there

are no arrangements or understandings between any of the directors, officers and other persons pursuant to which such person was selected

as a director or an officer.

| Name |

|

Position Held with Company |

|

Age |

|

Date First Elected or Appointed |

| Dominick Colvin |

|

Chief Executive Officer, President, and Director |

|

53 |

|

April 2018 |

| Marc Branson |

|

Director |

|

45 |

|

April 2019 |

| Richard Orman |

|

Director |

|

72 |

|

April 2019 |

| Andrew Steedman |

|

Chief Operating Officer |

|

60 |

|

April 2019 |

| John Cassels |

|

Chief Financial Officer |

|

73 |

|

April 2019 |

Our Board of Directors believes that all members

of the Board and all executive officers encompass a range of talent, skill, and experience sufficient to provide sound and prudent guidance

with respect to our operations and interests. The information below with respect to our sole officer and director includes his experience,

qualifications, attributes, and skills necessary for him to serve as a director and/or executive officer.

Biographies

Dominick Colvin, 53, was appointed

as our Chief Executive Officer, President and a director in April 2018. He resigned these positions in November 2018 but was re-appointed

to these positions again in February 2019. In addition to his positions with our Company, since June 2007 Mr. Colvin has been President

of PLC International Investments, Inc., a private held Canadian company engaged in power production, oil and coal mining.

Marc Branson, 45, was appointed

as a director of our Company in April 2019. In addition, since January 2018 he has been the owner and co-founder of Titan Technologies,

Inc., Vancouver, British Columbia, Canada, a development stage privately held technology company focused on AI powered block chain solutions

for businesses. Since October 2016 he has also been the President and director of Catalina Gold Corp., a publicly traded Canadian company.

Previously, from October 2013 through June 2015 he was President and a director of Lightning Ventures Inc., a publicly held manufacturer

and distributor of specialty oil and gas products. Since 2007 he has also been President and a director of CapWest Investments., a private

investment corporation that focuses on development stage companies. He received a degree in International Business from Open Learning

University in 2000 and received a Business Management certificate from Capilano College in 1997.

Richard D. Orman, 72, was appointed

as a director of our Company in April 2019. In addition, he is currently the President of PLM Consultants, LTD, Calgary, Alberta, Canada,

a privately held business consulting company, a position he has held since 1982. In 1986 Mr. Orman was elected to the Legislative Assembly

of Alberta and was appointed to the provincial cabinet as Minister of Career Development and Employment. In 1988 he was appointed Minister

of Labor. He was re-elected in 1989 and was then appointed Minster of Energy. He has over 35 years of experience with publicly traded

companies in Canada, including Chairman and CEO of Kappa Energy Company, Inc., from 19914 to 2001, a director of Vanguard Oil Corp. from

1998 through 2001, and Executive Vice Chairman of Exceed Energy Company, Inc. from 2003 through 2005, Each of the aforesaid companies

had their securities traded on the Toronto Stock Exchange. In addition, he was Vice Chairman of Novatel Inc., a company traded on NASDAQ

from 2004 through 2007 and from 2007 through 2011 he was the lead director of Daylight Energy Ltd, also traded on the TSX. From 2015

through February 2019, he was a consultant and senior counsel at Canadian Strategy Group, a government relations firm located in Edmonton,

Alberta. In 2012 he was elected to the Board of Directors and currently serves as Chairman of the Board of Wescan Energy Corp. a company

traded on the TSX. In 2016 he was elected and currently serves as an independent non-executive director of Persta Resources, Inc., a

company traded on the Hong Kong Stock Exchange. Mr. Orman received a Bachelor of Arts degree with honors from Eastern Washington University

in 1971.

Andrew Steedman, 60, Chief Operating Officer.

Mr. Steedman is Chief Operating Officer of CannaPharmaRx, Inc. Prior to joining CannaPharmaRx, Mr. Steedman was the President

of his own management consulting firm. From 2005 to 2015 he was Vice President of Operations for NXT Energy Solutions Inc. where he was

responsible for the signing and execution of over $50 million in contracts in Canada, the USA and internationally. From 2001 to 2003

he was President and CEO of Wireless Networks and was responsible for the overall strategic direction of the company. From 1999 to 2001,

he was Senior Manager of Business Development with Nortel Networks. In this role he was responsible for developing Nortel's unlicensed

wireless strategy, identifying strategic partners, developing relationships with key customers and negotiating OEM agreements with key

partners. From 1994 to 1999, Mr. Steedman held various positions within Nortel including product management, project management, international

business development and marketing. From 1991 to 1994, Mr. Steedman consulted in Bangkok to the Telephone Organization of Thailand (TOT).

He was responsible for the construction of a network management center that would monitor the TOT's national network. Mr. Steedman holds

a B.Sc. in Electrical Engineering and an MBA both from the University of Calgary.

John H. Cassels, 73, Chief Financial Officer.

Mr. Cassels’s career focus for more than three decades has been the junior oil and gas exploration and production

sector of the energy industry in Canada, the United States and Argentina. A CPA, CA. He has served as a CEO or CFO and a Director of

twelve early-stage companies, all but one of which were eventually TSX or NYSE listed companies. With a sharp financial bent, Mr. Cassels

has provided a guiding hand to the entities through initiatives to raise capital from under $1 million to $33 million and developed internally

generated cash flow for sustained growth while actively participating in accretive mergers, strategic acquisitions and value-added divestitures.

Mr. Cassels served as CFO for Purdy & Partners (a private equity firm), CEO of Highview Resources (sold to Wild River Resources),

CFO of Redwood Energy and Landover Energy (both subsequently sold), CEO of Raider Resources and Fortune Energy, CFO of PanContinental

Oil and Tri-Power Petroleum (both sold) and CFO of Anschutz Canada Exploration (sold to Pembina Resources).

Family Relationships

There are no family relationships between and

among any of our directors or executive officers.

Involvement in Certain Legal Proceedings

No director, executive officer, significant employee

or control person of the Company has been involved in any legal proceeding listed in Item 401(f) of Regulation S-K in the past 10 years.

Committees of the Board

Our Board of Directors held no formal meeting

in the year ended December 31, 2021. Otherwise, all proceedings of the Board of Directors were conducted by resolutions consented to

in writing by the sole director and filed with the minutes of the Company.

Board Nominations and Appointments

In considering whether to nominate any particular

candidate for election to the Board of Directors, we will use various criteria to evaluate each candidate, including an evaluation of

each candidate’s integrity, business acumen, knowledge of our business and industry, experience, diligence, conflicts of interest

and the ability to act in the interests of our stockholders. The Board of Directors plans to evaluate biographical information

and interview selected candidates in the next fiscal year and also plans to consider whether a potential nominee would satisfy the listing

standards for “independence” of The Nasdaq Stock Market and the SEC’s definition of “audit committee financial

expert.” The Board of Directors does not plan to assign specific weights to particular criteria and no particular criterion will

be a prerequisite for each prospective nominee.

We do not have a formal policy with regard to

the consideration of director candidates recommended by our stockholders, however, stockholder recommendations relating to director nominees

may be submitted in accordance with the procedures set forth below under the heading “Communicating with the Board

of Directors”.

Communicating with the

Board of Directors

Stockholders who wish to send communications

to the Board of Directors may do so by writing to 888 – 3rd Street SW, Suite 3600 Calgary, Alberta, CanadaT2P 5C5. The mailing

envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication.” All such

letters must identify the author as a stockholder and must include the stockholder’s full name, address and a valid telephone number.

The name of any specific intended recipient should be noted in the communication. We will forward any such correspondence to the intended

recipients; however, prior to forwarding any such correspondence, and we will review such correspondence, and in our discretion, may

not forward communications that relate to ordinary business affairs, communications that are primarily commercial in nature, personal

grievances or communications that relate to an improper or irrelevant topic or are otherwise inappropriate for the Board of Director’s

consideration.

Compensation of Directors

The Company has been accruing $10,000 per month

per director since January 1, 2019, however to date none of these have been paid. As of March 31, 2022, there was $995,495 in unpaid

director fees, which includes $150,000 owed to former directors accrued since 2016. Directors are not paid for meetings attended. However,

we intend to review and consider future proposals regarding board compensation. All travel and lodging expenses associated with corporate

matters are reimbursed by us, if and when incurred.

Compensation Committee Interlocks and Insider

Participation

No interlocking relationship exists between our

Board of Directors and the board of directors or compensation committee of any other company, nor has any interlocking relationship existed

in the past.

Code of Ethics

As part of our system of corporate governance,

our Board of Directors has adopted a Code of Business Conduct and Ethics (the “Code”) for directors and executive officers

of the Company. This Code is intended to focus each director and executive officer on areas of ethical risk, provide guidance to directors

and executive officer to help them recognize and deal with ethical issues, provide mechanisms to report unethical conduct, and help foster

a culture of honesty and accountability. Each director and executive officer must comply with the letter and spirit of this Code. We

have also adopted a Code of Ethics for Financial Executives applicable to our Chief Executive Officer and senior financial officers to

promote honest and ethical conduct; full, fair, accurate, timely and understandable disclosure; and compliance with applicable laws,

rules and regulations. We intend to disclose any changes in or waivers from our Code of Business Conduct and Ethics and our Code of Ethics

for Financial Executives by filing a Form 8-K or by posting such information on our website.

Compliance with Section 16(a) of the Securities

Exchange Act of 1934

Section 16(a) of the Securities Exchange Act

requires our executive officers and directors, and persons who own more than 10% of our common stock, to file reports regarding ownership

of, and transactions in, our securities with the SEC and to provide us with copies of those filings.

Based solely on our review of the copies of such

forms received by us, or written representations from certain reporting persons, we believe that during the year ended December 31, 2018,

none of our greater than 10% percent beneficial owners failed to comply on a timely basis with all applicable filing requirements under

Section 16(a) of the Exchange Act.

| |

d. |

Executive Compensation, Corporate Governance |

General Philosophy

Our Board of Directors is responsible for establishing

and administering the Company’s executive and director compensation.

Executive Compensation

The following summary compensation table indicates

the cash and non-cash compensation earned from the Company during the years ended December 31, 2021, 2020 and 2019 for our named executive

officers.

| Name and

Position |

|

|

|

Year |

|

|

Salary

($) |

|

|

|

|

Bonus

($) |

|

|

Total

($) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nick Colvin |

|

(1) |

|

|

2021 |

|

|

|

94,652 |

|

|

|

|

|

– |

|

|

|

94,652 |

|

| |

|

|

|

|

2020 |

|

|

|

94,251 |

|

|

|

|

|

– |

|

|

|

94,251 |

|

| |

|

|

|

|

2019 |

|

|

|

89,038 |

|

|

|

|

|

|

|

|

|

89,038 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| John Cassels |

|

(2) |

|

|

2021 |

|

|

|

94,652 |

|

|

|

|

|

– |

|

|

|

94,652 |

|

| |

|

|

|

|

2020 |

|

|

|

94,251 |

|

|

|

|

|

0 |

|

|

|

94,251 |

|

| |

|

|

|

|

2019 |

|

|

|

63,265 |

|

|

|

|

|

20,000 |

|

|

|

83,265 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Andrew Steedman |

|

(3) |

|

|

2021 |

|

|

|

94,652 |

|

|

|

|

|

– |

|

|

|

94,652 |

|

| |

|

|

|

|

2020 |

|

|

|

94,251 |

|

|

|

|

|

0 |

|

|

|

94,251 |

|

| |

|

|

|

|

2019 |

|

|

|

63,265 |

|

|

|

|

|

20,000 |

|

|

|

83,265 |

|

| (1) |

Was

appointed as director in April 2018. Mr. Colvin resigned his positions with our Company in November 2018. In February 2019 he was

again appointed as President, CEO and Director. |

| |

|

| (2) |

Was appointed to Chief

Financial Officer in April 2019. |

| |

|

| (3) |

Was appointed to Chief

Operating Officer in April 2019. |

The amounts in these columns represent the fair

value of the award as of the grant date as computed in accordance with ASC 718. These amounts represent restricted stock awards and stock

options granted to the named executive officers, and do not reflect the actual amounts that may be realized by those officers.

Key Employee Employment Agreements

The Company has an Employment Agreement with

Dominic Colvin to serve as the Company’s Chief Executive Officer. The Agreement is dated April 23, 2019. The Contracts provide

for an annual salary of CAD $120,000 and a signing bonus of US$20,000. During 2019 and 2020 the salaries were accrued but not paid. The

unpaid amounts were accrued in the financial statements of the Company.

The Company has an Employment Agreement with

Andrew Steedman to serve as Chief Operating Officer. The Agreement is dated April 23, 2019. The Contracts provide for an annual salary

of CAD $120,000 and a signing bonus of US$20,000. During 2019 the salaries were paid intermittently and in 2020 not at all from July.

The unpaid amounts were accrued in the financial statements of the Company.

The Company has Employment Agreements with John

Cassels to serve as Chief Financial Officer. The Agreement dated April 23, 2019. The Contracts provide for an annual salary of CAD $120,000

and a signing bonus of US$20,000.

During 2019 the salaries were paid intermittently

and in 2020 not at all from July. The unpaid amounts were accrued in the financial statements of the Company.

Key Employee Employment Agreements

The Company has an Employment Agreement with

Dominic Colvin to serve as the Company’s Chief Executive Officer. The Agreement is dated April 23, 2019. The Contracts provide

for an annual salary of CAD $120,000 and a signing bonus of US$20,000. During 2019 the salaries were paid intermittently and in 2020

not at all from February. The unpaid amounts were accrued in the financial statements of the Company.

The Company has an Employment Agreement with

Andrew Steedman to serve as Chief Operating Officer. The Agreement is dated April 23, 2019. The Contracts provide for an annual salary

of CAD $120,000 and a signing bonus of US$20,000. During m2019 the salaries were paid intermittently and in 2020 not at all from February.

The unpaid amounts were accrued in the financial statements of the Company.

The Company has Employment Agreements with John

Cassels to serve as Chief Financial Officer. The Agreement dated April 23, 2019. The Contracts provide for an annual salary of CAD $120,000

and a signing bonus of US$20,000. During m2019 the salaries were paid intermittently and in 2020 not at all from February. The unpaid

amounts were accrued in the financial statements of the Company.

Options Granted to Named Executives

None

Outstanding Equity Awards at Fiscal Year-End

None

Equity Compensation Plan Information and Issuances

Our current policy is that all full-time key

employees are considered annually for the possible grant of stock options, depending upon qualifying performance criteria. The criteria

for the awards are experience, uniqueness of contribution to our business and the level of performance shown during the year. Stock options

are intended to enhance the ability of the Company and its Affiliates to attract and retain exceptionally qualified individuals upon

whom, in large measure, the sustained progress, growth and profitability of the Company depend.

Pension Benefits

None of our named executive officers is covered

by a pension plan or other similar benefit plan that provides for payments or other benefits at, following, or in connection with retirement.

Nonqualified Deferred Compensation

None of our named executive officers is covered

by a defined contribution or other plan that provides for the deferral of compensation on a basis that is not tax-qualified.

Equity Incentive Plan

As of the date of this Report we do not have any equity compensation

plan but may adopt one or more in the future.

In accordance with the ACS 718, Compensation

– Stock Compensation, awards granted are valued at fair value at the grant date. The Company recognizes compensation expense

on a pro rata straight-line basis over the requisite service period for stock-based compensation awards with both graded and cliff vesting

terms. The Company recognizes the cumulative effect of a change in the number of awards expected to vest in compensation expense in the

period of change. The Company has not capitalized any portion of its stock-based compensation.

Director Compensation

We paid each of our current officers and directors

a one-time fee of $27,500 in 2018. In January 2019, the Board authorized and approved a monthly director fee of $10,000 (U.S.) for each

director. All of these fees have been accrued.

We do not believe risks arising from our compensation

policies and practices for our employees are reasonably likely to have a material adverse effect upon us

| |

e. |

Security Ownership of Certain Beneficial Owners and Management |

Except as otherwise stated, the table below sets

forth information concerning the beneficial ownership of Common Stock as of December 31, 2021 for: (1) each director currently serving

on our Board of Directors; (2) each of our named executive officers; (3) our directors and executive officers as a group; and (4) each

person known to the Company to beneficially own more than 5% of the outstanding shares of Common Stock. As of December 31,, 2020, there

were 47,611,794 shares of Common Stock outstanding, 60,000 Preferred A Shares convertible into 1,250 Shares of Common Stock, and 475,000

Series B Preferred Shares for a total of 123,086,794 shares. Except as otherwise noted, each stockholder has sole voting and investment

power with respect to the shares beneficially owned.

| Title

of Class |

|

Name and Address

of Beneficial Owner1 |

|

Amount and Nature

of Beneficial Ownership |

|

Percent

of Class2 |

| Common |

|

Dominic Colvin

Suite 206, 1180 Sunset Drive

Kelowna, BC Z1Y 9W6 |

|

1,004,454 |

|

0.5% |

| |

|

Dominic Colvin

Suite 206, 1180 Sunset Drive

Kelowna, BC Z1Y9W6 |

|

8,715,000 |

|

4.1% |

| Series A Preferred |

|

Andrew Steedman

3600, 888 – 3rd Street SW

Calgary, Alberta, T2P 5C5 |

|

11,000,000 |

|

5.2

% |

| Common |

|

Andrew Steedman

3600,888 – 3rd Street SW

Calgary, Alberta T2P 5C5 |

|

375,000 |

|

0.2% |

| Series A Preferred |

|

John Cassels

3600, 888 - 3rd Street SW

Calgary, Alberta, T2P 0C5 |

|

5,000,000 |

|

2.4

% |

| Common |

|

John Cassels

3600,888 – 3rd Street SW

Calgary, Alberta T2P 5C5 |

|

881,637 |

|

0.4% |

| Common |

|

Richard Orman

3600, 888-3rd Street SW

Calgary, Alberta T2P 5C5 |

|

625,000 |

|

0.3% |

| |

|

Total Beneficial Holders

as a Group |

|

27,601,091 |

|

13.0

% |

1 The address of record is c/o CannaPharmaRx, Inc., 888

– 3rd Street SW, Suite 3600, Calgary, Alberta, CanadaT2P 5C5.

2 Applicable percentages are based

212,096,088 beneficially owned shares outstanding as of December 31, 2021 and includes issued and outstanding shares of common stock

as well as vested but unissued restricted shares. Beneficial ownership is determined under the rules of the SEC and generally includes

voting or investment power with respect to securities. A person is deemed to be the beneficial owner of securities that can be acquired

by such person within 60 days whether upon the exercise of options or otherwise. Shares of Common Stock subject to options and warrants

currently exercisable, or exercisable within 60 days after the date of this report, are deemed outstanding for computing the percentage

of the person holding such securities but are not deemed outstanding for computing the percentage of any other person. Unless otherwise

indicated in the footnotes to this table, the Company believes that each of the shareholders named in the table has sole voting power.

Changes in Control.

There are currently no arrangements which may

result in a change of control of our company.

Non-Cumulative Voting

The holders of our shares of common stock do

not have cumulative voting rights, which means that the holders of more than 50% of such outstanding shares, voting for the election

of Directors, can elect all of the Directors to be elected, if they so choose. In such event, the holders of the remaining

shares will not be able to elect any of our Directors.

| |

f. |

Transactions with Related Persons, Promoters, and Certain Control Persons |

Transactions with Related Persons

As of December 31, 2019, there have been no transactions,

or currently proposed transactions, in which we were or are to be a participant and the amount involved exceeds the lesser of $120,000

or one percent of the average of our total assets at year-end for the last two completed years, and in which any of the following persons

had or will have a direct or indirect material interest.

Named Executive Officers and Current Directors

For information regarding compensation for our

named executive officers and current directors, see “Executive Compensation.”

Director Independence

Our securities are quoted on the OTC Markets

Group, Pink, which does not have any director independence requirements. We evaluate independence by the standards for director independence

established by applicable laws, rules, and listing standards including, without limitation, the standards for independent directors established

by The New York Stock Exchange, Inc., the NASDAQ National Market, and the Securities and Exchange Commission.

Subject to some exceptions, these standards generally

provide that a director will not be independent if (a) the director is, or in the past three years has been, an employee of ours; (b)

a member of the director’s immediate family is, or in the past three years has been, an executive officer of ours; (c) the director

or a member of the director’s immediate family has received more than $120,000 per year in direct compensation from us other than

for service as a director (or for a family member, as a non-executive employee); (d) the director or a member of the director’s

immediate family is, or in the past three years has been, employed in a professional capacity by our independent public accountants,

or has worked for such firm in any capacity on our audit; (e) the director or a member of the director’s immediate family is, or

in the past three years has been, employed as an executive officer of a company where one of our executive officers serves on the compensation

committee; or (f) the director or a member of the director’s immediate family is an executive officer of a company that makes payments

to, or receives payments from, us in an amount which, in any twelve-month period during the past three years, exceeds the greater of

$1,000,000 or two percent of that other company’s consolidated gross revenues. Based on these standards, we have determined

that our director is not an independent director.

Our board of directors has determined Marc Branson

is an “independent director” as defined in the NASDAQ listing standards and applicable SEC rules.

Pension Benefits

We currently do not maintain any pension plan

or arrangement under which our named executive officers are entitled to participate or receive post-retirement benefits.

Non-Qualified

Deferred Compensation

We currently do not maintain any nonqualified

deferred compensation plan or arrangement under which our named executive officers are entitled to participate.

Employee

Benefit Plans

We currently

do not maintain any employee benefit plan of any kind for our employees.

Limitation

of Liability and Indemnification Matters

Our articles of incorporation contain provisions

that limit the liability of our directors for monetary damages to the fullest extent permitted by Delaware law.

Our articles of incorporation and bylaws authorize

our company to provide indemnification to our directors and officers and persons who are or were serving at our request as a director,

officer, manager or trustee of another corporation or of a partnership, limited liability company, joint venture, trust or other enterprise

to the fullest extent permitted by Delaware law. Our articles of incorporation and bylaws also authorize our company, by action of our

board of directors, to provide indemnification to employees and agents of our company and persons who are serving or did serve at our

request as an employee or agent of another corporation or of a partnership, limited liability company, joint venture, trust or other

enterprise with the same scope and effect as provided to our directors and officers as described above.

No pending litigation or proceeding involving

a director, officer, employee or other agent of our company currently exists as to which indemnification is being sought. We are not

aware of any threatened litigation that may result in claims for indemnification by any director, officer, employee or other agent of

our company.

We anticipate obtaining director and officer

liability insurance with respect to possible director and officer liabilities arising out of certain matters, including matters arising

under the Securities Act. See “Disclosure of SEC Position on Indemnification for Securities Act Liabilities.”

THE

TYSADCO PARTNERS, LLC TRANSACTION

General

On April 28, 2022, we entered into the Purchase

Agreement with TYSADCO PARTNERS, LLC, which we refer to in this prospectus as the Purchase Agreement, pursuant to which TYSADCO PARTNERS,

LLC has agreed to purchase from us up to an aggregate of $ 5,647,750.00 of our common stock (subject to certain limitations) from time

to time over the term of the Purchase Agreement. Also on April 28, 2022, we entered into a registration rights agreement with TYSADCO

PARTNERS, LLC, which we refer to in this prospectus as the Registration Rights Agreement, pursuant to which we have filed with the Securities

and Exchange Commission (the “SEC”) the registration statement that includes this prospectus to register for resale under

the Securities Act of 1933, as amended, or the Securities Act, the shares of common stock that have been or may be issued to TYSADCO

PARTNERS, LLC under the Purchase Agreement.

This prospectus covers the resale by the TYSADCO

PARTNERS, LLC of 435,951,370 shares of our common stock, comprised of: (i) 10,000,000 shares that we already issued to TYSADCO PARTNERS,

LLC as Commitment Shares for making the commitment under the Purchase Agreement, (ii) 50,000,000 shares that we sold to TYSADCO PARTNERS,

LLC for $ 500,000 on April 28, 2022 as Initial Purchase Shares under the Purchase Agreement, and (iii) an additional 385,951,370 shares

we may issue to TYSADCO PARTNERS, LLC in the future under the Purchase Agreement, if and when we sell shares to TYSADCO PARTNERS, LLC

under the Purchase Agreement.

Other than 10,000,000 Commitment Shares that

we have already issued to TYSADCO PARTNERS, LLC pursuant to the terms of the Purchase Agreement as consideration for its commitment to

purchase shares of our common stock under the Purchase Agreement, and 50,000,000 Initial Purchase Shares issued to TYSADCO PARTNERS,

LLC for its initial $ 500,000 purchase of common stock on April 28, 2022, we do not have the right to commence any sales of our common

stock to TYSADCO PARTNERS, LLC under the Purchase Agreement until all of the conditions set forth in the Purchase Agreement have been

satisfied, including that the SEC has declared effective the registration statement that includes this prospectus registering the shares

that will be issued and sold to TYSADCO PARTNERS, LLC, which we refer to in this prospectus as the Commencement. Thereafter, we may,

from time to time and at our sole discretion for a period of Twenty-four months, on any business day that we select, direct TYSADCO PARTNERS,

LLC to purchase up to 435,951,370 shares of common stock, which amounts may be increased depending on the market price of our common

stock at the time of sale, which we refer to in this prospectus as “regular purchases.” In addition, at our discretion, TYSADCO

PARTNERS, LLC has committed to purchase other “accelerated amounts” and/or “additional accelerated amounts” under

certain circumstances. We will control the timing and amount of any sales of our common stock to TYSADCO PARTNERS, LLC. The purchase

price of the shares that may be sold to TYSADCO PARTNERS, LLC in regular purchases under the Purchase Agreement will be based on an agreed

upon fixed discount to the market price of our common stock immediately preceding the time of sale as computed under the Purchase Agreement.

The purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, or