By Jenny Strasburg

Deutsche Bank AG reported a EUR3.15 billion ($3.51 billion) net

loss in the second quarter, reflecting the pain of a global revamp

and a large restructuring charge that wiped out what would have

been a modest profit.

Germany's biggest bank, which is in a prolonged struggle to

stabilize its business, said it booked a EUR3.4 billion

restructuring charge in the quarter, higher than the EUR3 billion

it previously expected. Excluding the charge, second-quarter profit

was EUR231 million, slightly higher than its preliminary estimate

earlier this month when it revealed its reorganization plans.

Shares in the lender were trading 5% lower in Frankfurt on

Wednesday morning, at around EUR6.77, before recovering

partially.

Executives at the German bank say a sweeping overhaul will pay

off in coming years through a leaner, more focused lender. The bank

said it expects a full-year loss and a revenue drop from 2018.

"This decline is mainly due to our decision to exit

substantially all of our equities sales and trading business," the

bank said in a statement.

Deutsche Bank is curtailing its global ambitions through plans

to cut 18,000 jobs and largely retreat to its core European market.

For years, the lender experienced difficulties competing in core

trading businesses, deal advising and other areas where European

banks have fallen behind stronger American rivals.

The bank's challenges are exacerbated by legal and compliance

woes and a low-margin retail market in Germany. Chronically low or

negative interest rates have weighed heavily on continental

lenders.

Last quarter's sharp drop in trading revenue -- down 12% across

the securities business -- and lower deal-advisory fees contributed

to a EUR900 million pretax loss in the investment bank. All but

EUR97 million of that loss came from restructuring charges.

Executives said a substantial part of the revenue declines were a

natural result of the bank's narrowing scope of business. Analysts

say investors need convincing.

"Excluding transformation charges the bank would be profitable,

and in our more stable businesses revenues were flat or growing,"

Chief Executive Christian Sewing said in a statement Wednesday.

Still, the transaction-banking unit that finances clients' trade

flows and manages companies' cash, where Deutsche Bank is spending

money to expand, had a disappointingly flat quarter. Its revenue

was unchanged when accounting for a one-time boost a year earlier,

far from the lofty revenue increases the bank said it would

deliver.

Deutsche Bank said the big second-quarter charge will help

position it for growth because it represents a "substantial

portion" of the total costs expected from its multiyear

restructuring. Through 2022, the restructuring will cost a total of

about EUR7.4 billion, Deutsche Bank said this month.

As layoffs mount, severance expenses will too. Analysts say

Deutsche Bank faces a difficult challenge balancing cost-cutting

with the high price of the overhaul, which will strain its capital

cushion. Executives say they believe they can shoulder those costs

without asking shareholders to pony up more cash.

The bank posted EUR6.2 billion in net revenue in the second

quarter, slightly lower than the EUR6.3 billion average expected by

analysts and down 6% from a year earlier. Investment-banking

revenue fell 18% from a year earlier, while revenue at the smaller

asset-management unit rose 6%. In the retail banking division,

which includes the private-banking business, revenue fell 2%.

The restructuring has led to both planned and unplanned

departures across businesses, which started well before the bank's

formal unveiling of its reorganization. More than 900 people have

received notice they are being fired or their jobs are being cut,

the bank said Wednesday.

The bank has reorganized its management under Mr. Sewing.

Several top executives, including the head of the investment bank,

are leaving and the CEO is taking over supervision of that

division, which is the bank's most important revenue engine.

The lender created a so-called bad-bank division, called the

Capital Release Unit, to sell or wind down nearly EUR300 billion in

assets including derivatives contracts that can't be disposed of

easily. The process is expected to take several years.

As part of the shrinkage, Deutsche Bank is dismantling chunks of

its Wall Street operations, built over more than 20 years. It is

peddling portfolios of equity derivatives and other holdings to

rival banks and said it is on track to sell big portions of an

electronic-trading and prime-brokerage business serving hedge funds

to BNP Paribas SA.

Calling the moves a "fundamental rebuilding of Deutsche Bank,"

Mr. Sewing promised to shed businesses where the lender has failed

to compete, including equities trading. Investors have called for

the bank to lop off money-losing operations after years of

persistent share declines and strategic rethinking.

Earlier and shallower cuts failed to stabilize profits for the

149-year-old lender. In April, talks with smaller German rival

Commerzbank AG ended without a deal, raising fresh questions about

Deutsche Bank's direction.

--Pietro Lombardi contributed to this article.

Write to Jenny Strasburg at jenny.strasburg@wsj.com

(END) Dow Jones Newswires

July 24, 2019 05:56 ET (09:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

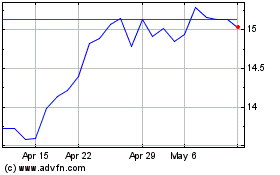

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Jan 2025 to Feb 2025

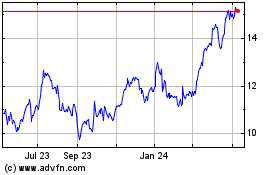

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Feb 2024 to Feb 2025