By Patricia Kowsmann and Margot Patrick

European banks are using the pandemic to make changes investors

have wanted for years: slash jobs, shut branches and force

customers online.

Germany's second-largest lender, Commerzbank AG, said Thursday

that it would cut a third of its domestic staff and almost half of

its bricks-and-mortar presence after pressure from U.S. shareholder

Cerberus Capital Management. Bank mergers under way in Italy and

Spain are expected to close thousands of overlapping branches.

Business consulting firm Kearney predicts one-quarter of Europe's

165,000 bank branches will be gone in three years.

Banks are one of Europe's economic weak links, and they have

been slow to change. Compared with U.S. peers, European banks

struggle to make enough money to support lending growth. They came

into the Covid-19 crisis still digesting a mountain of bad loans

from the sovereign-debt crisis that started more than a decade

ago.

The pandemic injected urgency into the situation. The European

Central Bank has leaned on banks to reform and has paved the way

for cost-saving mergers. National governments, long resistant to

approving bank mergers that would result in job cuts, have changed

their tune. Dreary stock-market valuations have spurred CEOs to

act.

"The pandemic, to some extent, has been a catalyst for banks to

bite the bullet and start addressing these weaknesses in a more

radical way," Andrea Enria, head of banking supervision at the ECB,

said recently.

European banks' costs are high compared to the revenue they

generate. One area of low-hanging fruit is bank branches. Spain's

top five banks closed 8% of their branches last year, and have

vowed to shut more. Despite years of cuts, the country had one of

the highest number of commercial bank branches per capita in the

eurozone -- 49 for every 100,000 people in 2019 -- according to the

International Monetary Fund, compared with 30 in the U.S.

Caixabank SA, which is buying smaller Bankia SA to scale up,

said it would save EUR770 million a year, the equivalent of $930

million, a large part of which analysts expect to come from

shutting as many as half of its 6,300 branches.

The hope is that the pandemic has taught customers how to live

without frequent trips to bank branches, which are expensive to

maintain and staff.

Anna de Juan, a 60-year-old Bankia customer, used to go to a

branch almost every day for at least an hour to make cash transfers

and manage investment funds for a small asset-holding firm she

works for. Since the pandemic, she has done almost everything

online or over the phone.

"It has been a great change for me; I have saved time and

energy," she said.

Branch foot traffic dropped 30% during the pandemic at Ireland's

AIB Group PLC. That led to an unexpected benefit for the bank.

Over-65s, who have been resistant to using online tools, are now

the fastest-growing group on AIB's digital channels, said CEO Colin

Hunt. He said branches can be an important "shop window." But it is

merging some, cutting back on office space and eliminating 1,500

jobs to cut costs 10%.

So far, investors remain skeptical about whether the newfound

resolve for cutting will be enough. European bank shares have

languished for years. Europe's largest banks, despite having

balance sheets on par with U.S. rivals, trade at a fraction of

their market value.

At Commerzbank, years of slow progress on cost-cutting agitated

its second-largest shareholder, Cerberus. Last summer it demanded a

sharper turnaround, after which the bank's CEO and chairman

resigned. The private-equity giant is sitting on a paper loss of

over EUR300 million from its 2017 investment.

"If we want to make the bank future-proof, we need to carry out

in-depth restructuring, and as quickly as possible," Manfred Knof,

Commerzbank's CEO, said Thursday. The sharp cuts have been

supported by the German government, the bank's largest shareholder,

and have so far faced little resistance from unions.

A person familiar with Cerberus's thinking said the plan, which

includes exiting international locations and unprofitable

operations, is largely in line with what it has long called

for.

In Italy, Intesa Sanpaolo SpA shed 10,000 jobs and hundreds of

branches after it merged with a smaller rival last year. Chief

Executive Carlo Messina said parts of the strategy were "reset due

to the pandemic" as customers moved online, and the combined bank's

annual cost savings rose 37% to EUR700 million.

Even still, Italy's largest bank by assets has more than 4,000

branches, on par with JPMorgan Chase & Co. and Bank of America

Corp., despite operating in a smaller market. Intesa plans to keep

at least 3,000 branches and turn them into advice centers to sell

investments and insurance. It is also channeling customers who

don't want to go online toward drugstores and espresso bars through

a venture with a payments processor.

--Xavier Fontdegloria contributed to this article.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com and

Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

February 14, 2021 05:44 ET (10:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

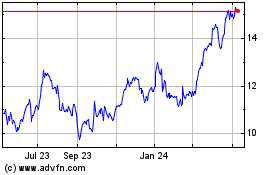

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Jan 2025 to Feb 2025

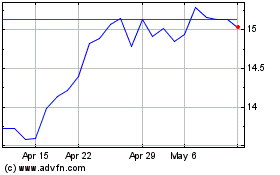

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Feb 2024 to Feb 2025