As filed with the Securities and Exchange Commission on April 7, 2023

Registration No. 333-269076

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

|

| COSTAS, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | | 3843 | | 88-0411500 |

| (State or other jurisdiction of | | (Primary Standard Industrial | | (I.R.S. Employer |

| incorporation or organization) | | Classification Code Number) | | Identification Number) |

# 424 E Central Blvd, Suite 308,

Orlando, FL, 32801

321-465-9899

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

With a copy to:

William (Bill) Macdonald Esq.

641 Lexington Avenue, 13th Floor

New York, NY 10022

Tel: (212) 271-4272

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Approximate Date of Commencement of Proposed Sale to the Public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Prospectus number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| ☐ Large accelerated filer | ☐ Accelerated filer | ☐ Non-accelerated filer | ☒ Smaller reporting company |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

| The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. |

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED April ____, 2023 |

319,890,000 common shares underlying previously issued convertible promissory notes

750,000 common shares previously issued pursuant to asset acquisition

8,333,333 common shares issuable pursuant to purchase agreement

The date of this Prospectus is April__, 2023.

Costas, Inc. (“Costas”, “we”, “us”, “our” and “our company”) is registering 328,973,333 shares of common stock underlying previously issued convertible promissory notes, an asset purchase agreement and a purchase agreement for the future issuance of common shares as drawn down by our company, which may be resold from time to time held by nine selling security holders (the “ Selling Security Holders ”). This aggregate of 328,973,333 shares of common stock consists of: 319,890,000 shares of common stock underlying previously issued convertible promissory notes issued by our company to certain Selling Security Holders; 750,000 shares issued to one Selling Security Holder for the acquisition of certain assets; and 8,333,333 shares issuable upon drawdowns under the Purchase Agreement with another Selling Security Holder, World Amber Corporation. The convertible promissory notes were acquired by the Selling Security Holders directly from us in private offerings that were exempt from registration requirements of the Securities Act of 1933. A registration statement under the Exchange Act relating to these securities will have been filed with the Securities and Exchange Commission once declared effective. Our Selling Security Holders may not offer or sell their shares of our common stock until this registration statement is declared effective. We have been advised by the Selling Security Holders that they may offer to sell all or a portion of their shares of common stock being offered in this prospectus from time to time. Please see “Plan of Distribution” at page 26 for a detailed explanation of how the securities may be sold. The Selling Security Holders may sell all or a portion of their shares through public or private transactions at the fixed price of $0.00975 per share until such time as the shares are listed on a national securities exchange or quoted on the OTCQB or OTCQX operated by the OTC Markets Inc. We will not receive any of the proceeds from the sale of shares by the Selling Security Holders. None of the Selling Security Holders are affiliates of our company.

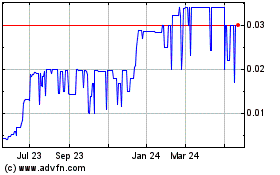

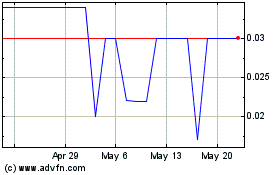

Our common stock is quoted under the trading symbol “CSSI” on the Pink tier of the OTC quotation service operated by OTC Markets Inc.

The Selling Security Holders may sell all or a portion of their shares through public or private transactions at the fixed price of $0.00975 per share until such time as the shares are listed on a national securities exchange or quoted on the OTCQB or OTCQX operated by the OTC Markets Inc., and thereafter at prevailing market prices or at privately negotiated prices. We have arbitrarily set the $0.00975 price per share set out in this registration statement solely for the purpose of determining the amount of the registration fee pursuant to Rule 457(c), based on the average of the high and low prices of the common stock as reported on the OTC Markets on December 19, 2022. The price does not reflect net worth, total asset value, or any other objective accounting measure of the value of our securities.

The Selling Security Holders are underwriters, within the meaning of section 2(a)(11) of the Securities Act. Any broker-dealers or agents that participate in the sale of the common stock or interests therein may also be deemed to be an “underwriter” within the meaning of section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit earned on any resale of the shares may be underwriting discounts and commissions under the Securities Act. We will not receive any proceeds from the sale of shares of our common stock by the Selling Security Holders. We will incur all costs associated with this Prospectus.

Our sole director and officer is James Brooks: Chief Executive and Financial Officer, Secretary, President, Chairman of the Board and Director.

Our common stock is presently not traded on any national securities exchange or the NASDAQ stock market. We do not intend to apply for listing on any national securities exchange or the NASDAQ stock market. The purchasers in this offering may be receiving an illiquid security.

An investment in our securities is speculative. See the section entitled “Risk Factors” beginning on page 8 of this Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this Prospectus. Any representation to the contrary is a criminal offense.

The information in this Prospectus is not complete and may be changed. The Selling Security Holders may not sell these securities until this registration statement is declared effective by the Securities and Exchange Commission. This Prospectus shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall the Selling Security Holders sell any of these securities in any state where such an offer or solicitation would be unlawful before registration or qualification under such state’s securities laws.

You should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with information different from that contained in this Prospectus. The Selling Security Holders are offering to sell, and seeking offers to buy, their common shares. The information contained in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus or of any sale of our common shares.

Dealer Prospectus Delivery Obligation

Until __________________ (90th day after the later of (1) the effective date of the registration statement; or (2) the first date on which the securities are offered publicly), all dealers that effect in transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The date of this Prospectus is April ____, 2023.

Table of Contents

PROSPECTUS SUMMARY

We qualify all the forward-looking statements contained in this Prospectus by the following cautionary statements.

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section beginning on page 9 of this Prospectus and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section elsewhere in this Prospectus.

The company currently conducts business using its acquired trade names Standard Dental Labs Inc. and Prime Dental Lab LLC, operating its first acquired dental lab assets, and seeking additional lab operations to expand its holdings with the purpose of consolidating several smaller regional lab operations into a single owned and operated lab facility in various locations across the United States. Our initial operational focus is in Florida.

In May 2022 the company acquired the trade name Standard Dental Labs Inc. (“SDL”), as well as certain other assets including a fully developed branding package and business plan including a model for acquisition and consolidation of small to medium sized dental lab operations on a market-by-market basis across North America, from a company controlled by our majority shareholder, and sole officer and director, Mr. James Brooks.

On August 15, 2022, the company subsequently acquired its first operating assets , including a customer base and manufacturing equipment from its first target dental lab, Prime Dental Lab LLC, based in Florida, including the tradename Prime Dental Lab, LLC. (“PDL”) and commenced operations as PDL on September 1, 2022. The company’s existing dental lab operation includes the manufacture of dental prosthetics, including crowns, bridges and other oral prosthetics for sale directly to dental offices. In order to facilitate ongoing lab operations and seamlessly service its acquired customer base the company entered into a service contract with Mr. John Kim, whereunder Mr. Kim will provide ongoing labor, quality control and delivery services during a period of up to two years while the company seeks additional lab assets and operations in order to consolidate several independent lab operations into its first large regional lab facility in Florida. To this end the company has plans to acquire several additional independent lab operations from owners who may be looking to exit the market, by either retiring from the industry, or who may want to sell their businesses.

Acquiring additional lab operations will be the focus of our operational and growth strategy. Ultimately, the fixed assets and key employees of acquired lab operations will be consolidated into one regionally central lab on a market-by-market basis, and from where we can service various client lists with technicians working side by side, sharing resources and overhead. Economies of scale are expected to improve profitability, while the acquisition of lab operations will add incremental revenue to the company's income statement. All North American markets with populations over 1 million are targets. The company is currently headquartered in Orlando, Florida.

While the company’s management, specifically James Brooks, is primarily focused on growth and further acquisitions, day-to-day manufacturing is supervised by contracted dental lab managers and technicians. Once the company has acquired at least 3 labs, it expects to consolidate those operations into one, central facility where the company can benefit from economies of scale. Our goal is that this facility should be able to accommodate 75 people, which would accommodate 15 to 20 independent labs. There are numerous risks associated with our proposed acquisition program, as noted herein under “Risk Factors”, specifically including that such program is currently dependent upon the actions of our sole director and officer James Brooks, as the loss of Mr. Brooks would seriously and negatively impact such activities.

The creation of a central dental lab facility, and the amalgamation of small dental labs into this facility, could greatly enhance the profitability of the company by reducing the day-to-day overhead, and by giving technicians access to shared equipment they might not have otherwise had access to in a smaller facility, that makes the technicians more productive.

We have a limited operating history in the acquisition and operation of dental labs and have a history of net losses, which we anticipate will continue for the immediate future.

Actual results may vary from those expected. Undue reliance should not be placed on any forward-looking statements, which are appropriate only for the date made. We do not plan to subsequently revise these forward-looking statements to reflect current circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Corporate Background

Costas, Inc. was incorporated in the State of Nevada on December 10, 1998. Costas was a development stage company that had a primary business plan to acquire, improve, and re-market undeveloped real estate in Las Vegas, Nevada and its surrounding communities.

The company had pursued a number of different industries since its inception in 1998, including real estate speculation, financial technologies in 2014 through 2018, and in 2019, the company attempted to acquire a surgical materials supplier in Mexico (such acquisition was not completed).

In 2017, James Brooks commenced an action against the company and was awarded a judgment in the 8th Circuit against the company for breach of contract, and non-payment. A portion of that judgment was later converted into shares, and a controlling interest in Costas, Inc. Specifically, on September 20, 2017, the court filed an order effective September 18, 2017, whereby Mr. Brooks, as a creditor of the company was granted a judgment against the company in the principal amount of $1,114,500. On October 21, 2020, Mr. Brooks filed a motion requesting the appointment of a Receiver over the company. On March 25, 2021, the Receiver filed a motion with the Court requesting approval to appoint Mr. Brooks as an officer and director of the company and to increase the authorized capital of the issuer and subsequently to issue sufficient common and preferred shares on terms to be finalized with Mr. Brooks, whereby Mr. Brooks became the controlling shareholder of the company. On February 9, 2022, an Order was entered by the Eighth Judicial District Court, Clark County, Nevada, Case No. A-17-749977D, terminating the receivership for the company.

Mr. Brooks is now guiding the company into becoming a Florida - based dental laboratory services company. Our current operations are conducted through our acquired tradenames, Standard Dental Labs Inc. and Prime Dental Lab LLC .

The Offering

The 328,973,333 shares of common stock offered by the Selling Security Holders will represent approximately 42.2% of our issued and outstanding common stock as of March 31 2023, assuming all of the notes are converted and all drawdowns under the Purchase Agreement are completed.

We have entered into a registration rights agreement pursuant to which we are obligated to register 8,333,333 of the shares being registered in this Prospectus. We are not currently a reporting company with the SEC. We are bearing all costs associated with registering the shares being offered.

| Common Stock Outstanding Prior to the Offering | | 445,728,363 shares (774,701,696 shares upon issuance of the shares in the offering) |

| | | | | |

| Common Stock to be Outstanding Following the Offering | | 774,701,696 shares |

| | | | | |

| Common Stock Offered | | 328,973,333 shares of common stock consisting of: |

| | | | | |

| | | | · | 319,890,000 shares of common stock underlying previously issued convertible promissory notes |

| | | | | |

| | | | · | 750,000 shares issued for the acquisition of certain assets |

| | | | | |

| | | | · | 8,333,333 shares issuable upon drawdowns under a Purchase Agreement. |

| | | | | |

| Offering Price | | The Selling Shareholders will sell common shares being offered at the fixed price of $0.00975 per share (estimated solely for the purpose of determining the amount of the registration fee pursuant to Rule 457(c) based on the average of the high and low prices of the common stock as reported on the OTC Markets on December 19, 2022). The Selling Security Holders may sell all or a portion of their shares through public or private transactions at the fixed price of $0.00975 per share until such time as the shares are listed on a national securities exchange or quoted on the OTCQB or OTCQX operated by the OTC Markets Inc. |

| | | | | |

| Aggregate Offering Price | | N/A |

| | | | | |

| Number of Selling Security Holders | | 19 |

| | | | | |

| Use of Proceeds | | We will not receive any of the proceeds of the shares offered by the Selling Security Holders. Our company will pay all the expenses of this offering estimated at approximately $50,000. |

| | | | | |

| Underwriters | | The Selling Security Holders are underwriters, within the meaning of section 2(a)(11) of the Securities Act. |

| | | | | |

| Plan of Distribution | | The Selling Security Holders named in this Prospectus are making this offering and may sell at market or privately negotiated prices. |

| World Amber Purchase Agreement On November 22, 2022, 2021, we entered into a purchase agreement (the “Purchase Agreement”), and a registration rights agreement (the “Registration Rights Agreement”) with World Amber pursuant to which World Amber committed to purchase up to $2,500,000 of our common stock. Under the terms and subject to the conditions of the Purchase Agreement, we have the obligation, to sell to World Amber, and World Amber is obligated to purchase up to $2,500,000 of shares of our common stock. Future sales of common stock under the Purchase Agreement, if any, will be subject to certain limitations, and may occur from time to time, over the 24-month period commencing on the date that a registration statement of which this prospectus forms a part, which we agreed to file with the Securities and Exchange Commission (the “SEC”) pursuant to the Registration Rights Agreement, is declared effective by the SEC and a final prospectus in connection therewith is filed and the other conditions set forth in the Purchase Agreement are satisfied (such date on which all of such conditions are satisfied, the “Commencement Date”). After the Commencement Date, for every month over the term of the Purchase Agreement, we have the right, in our sole discretion, to direct World Amber to purchase up to 346,667 shares of common stock per business day, at $0.30 per share (each, a “Regular Purchase”). In each case, World Amber’s maximum commitment in any single Regular Purchase may not exceed $104,000. Pursuant to the terms of the Purchase Agreement, in no event may we issue or sell to World Amber any the shares of our common stock under the Purchase Agreement which, when aggregated with all other shares of common stock then beneficially owned by the World Amber and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in the beneficial ownership by World Amber and its affiliates of more than 9.99% of the then issued and outstanding shares of common stock (the “Beneficial Ownership Limitation”). The Purchase Agreement and the Registration Rights Agreement contain customary representations, warranties, agreements, conditions and indemnification obligations of the parties. We have the right to terminate the Purchase Agreement at any time, at no cost or penalty. Issuances of our common stock in this aspect of the offering will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage of our total outstanding shares after any such issuance to World Amber. |

This summary does not contain all the information that should be considered before making an investment in Costas, Inc.’s common stock. The entire prospectus should be read including the “Risk Factors” on page 9 and financial statements before deciding to invest in our common stock.

Financial Summary Information

All references to currency in this Prospectus are to U.S. Dollars, unless otherwise noted.

The following table sets forth selected financial information, which should be read in conjunction with the information set forth in the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section and the accompanying financial statements and related notes included elsewhere in this Prospectus.

Income Statement Data

| | | Year Ended December 31, 2022 (audited) $ | | | Year Ended December 31, 2021 (audited) $ | |

| Revenue | | | 173,329 | | | | - | |

| Operating Expenses | | | 391,646 | | | | 76,727 | |

| Net Income (Loss) | | | (1,651,896 | ) | | | (10,254,127 | ) |

| Net Earnings (Loss) Per Share | | | (0.00 | ) | | | (0.21 | ) |

Balance Sheet Data

| | | As at December 31, 2022 (audited) | | | As at December 31, 2021 (audited) | |

| Working Capital (Deficit) | | | (1,685,506 | ) | | | (133,023 | ) |

| Total Assets | | | 188,013 | | | | - | |

| Total Liabilities | | | 1,698,629 | | | | (133,023 | ) |

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

You should carefully consider the risks described below. Together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in, or incorporated into, this registration statement that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks occur, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Associated with Our Business

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

Our company has no operating history and an evolving business model which raises doubt about our ability to achieve profitability or obtain financing.

Our company has no operating history. Moreover, our business model is still evolving, subject to change, and will rely on the ability to make additional acquisitions of dental labs on commercially viable terms. Our company's ability to continue as a going concern is dependent upon our ability to obtain adequate financing and to reach profitable levels of operations has and we no proven history of performance, earnings, or success. There can be no assurance that we will achieve profitability or obtain future financing.

Acquiring additional dental labs is a key aspect of our business and growth strategy.

In order to grow and achieve the level of operations and margins that we hope to achieve, a key component of our strategy is the acquisition and integration of additional dental lab operations. While we are confident in our ability to execute on this, there can be no assurances that we will be able to identify suitable dental labs for acquisition, or that we will be able to acquire such labs on commercially viable terms. In the event that we are unable to make such additional acquisitions, or successfully integrate any acquired labs into existing operations, our growth prospects will be severely limited.

Conflicts of interest between our company and our sole director and officer may result in a loss of business opportunity.

Our sole director and officer is not obligated to commit his full time and attention to our business and, accordingly, he may encounter a conflict of interest in allocating his time between our future operations and those of other businesses. In the course of his other business activities, he may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which he owes a fiduciary duty. As a result, he may have conflicts of interest in determining to which entity a particular business opportunity should be presented. He may also in the future become affiliated with entities, engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are required to present business opportunities to a corporation if:

| | · | the corporation could financially undertake the opportunity; |

| | · | the opportunity is within the corporation’s line of business; and |

| | · | it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation. |

We plan to adopt a code of ethics that obligates our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent. Despite our intentions, conflicts of interest may nevertheless arise which may deprive our company of a business opportunity, which may impede the successful development of our business and negatively impact the value of an investment in our company.

The speculative nature of our business plan may result in the loss of your investment.

Our operations are in the start-up or stage only and are unproven. We may not be successful in implementing our business plan to become profitable. There may be less demand for our services than we anticipate. There is no assurance that our business will succeed, and you may lose your entire investment.

General economic factors may negatively impact the market for our dental products.

The willingness of dental practices and their patients/consumers to spend money on our products may be dependent upon general economic conditions; and any material downturn may reduce the likelihood of such parties incurring costs toward what some consumers may consider a discretionary expense item.

A wide range of economic and logistical factors may negatively impact our operating results.

Our operating results will be affected by a wide variety of factors that could materially affect revenues and profitability, including the timing and cancellation of customer orders and projects, competitive pressures on pricing, availability of personnel, and market acceptance of our services. As a result, we may experience material fluctuations in future operating results on a quarterly and annual basis which could materially affect our business, financial condition and operating results.

If we fail to effectively and efficiently advertise, the growth of our business may be compromised.

The future growth and profitability of our business will be dependent in part on the effectiveness and efficiency of our advertising and promotional expenditures, including our ability to (i) create greater awareness of our services, (ii) determine the appropriate creative message and media mix for future advertising expenditures, and (iii) effectively manage advertising and promotional costs in order to maintain acceptable operating margins. There can be no assurance that we will experience benefits from advertising and promotional expenditures in the future. In addition, no assurance can be given that our planned advertising and promotional expenditures will result in increased revenues, will generate levels of service and name awareness or that we will be able to manage such advertising and promotional expenditures on a cost-effective basis.

Our success is dependent on our unproven ability to attract qualified personnel.

We depend on our ability to attract, retain and motivate our management team, consultants and advisors. There is strong competition for qualified technical and management personnel in the dental business sector, and it is expected that such competition will increase. Our planned growth will place increased demands on our existing resources and will likely require the addition of technical personnel and the development of additional expertise by existing personnel. There can be no assurance that our compensation packages will be sufficient to ensure the continued availability of qualified personnel who are necessary for the development of our business.

We have a limited operating history with losses, and we expect the losses to continue, which raises concerns about our ability to continue as a going concern.

We have generated minimal revenues since our inception and will, in all likelihood, continue to incur operating expenses with minimal revenues until we are able to successfully develop our business. Our business plan will require us to incur further expenses. We may not be able to ever become profitable. These circumstances raise concerns about our ability to continue as a going concern. We have a limited operating history and must be considered in the start-up stage.

There is an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended December 31, 2022 and 2021, with respect to their doubt about our ability to continue as a going concern. As discussed in Note 2 to our financial statements for the years ended December 31, 2022 and 2021, we have incurred cumulative losses of $(16,531,420) and $(14,879,523) which raises substantial doubt about its ability to continue as a going concern. Our management has been able, thus far, to finance the operations through equity financing and cash on hand. There is no assurance that our company will be able to continue to finance our company on this basis.

Without additional financing to develop our business plan, our business may fail.

Because we have generated only minimal revenue from our business and cannot anticipate when we will be able to generate meaningful revenue from our business, we will need to raise additional funds to conduct and grow our business. We do not currently have sufficient financial resources to completely fund the development of our business plan. We anticipate that we will need to raise further financing. With the exception of our Purchase Agreement with World Amber, we do not currently have any other arrangements for financing, and we can provide no assurance to investors that we will be able to find such financing if required. The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing security-holders.

We may not be able to obtain all of the licenses necessary to operate our business, which would cause our business to fail.

Our operations require licenses and permits from various governmental authorities related to the operation of our acquired dental laboratory facilities. We believe that we will be able to obtain all necessary licenses and permits under applicable laws and regulations for our operations and believe we will be able to comply in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that we will be able to obtain or maintain all necessary licenses and permits.

If we are unable to recruit or retain qualified personnel, it could have a material adverse effect on our operating results and stock price.

Our success depends in large part on the continued services of our sole executive officer and third-party relationships. We currently do not have key person insurance on these individuals. The loss of these people, especially without advance notice, could have a material adverse impact on our results of operations and our stock price. It is also very important that we be able to attract and retain highly skilled personnel, including technical personnel, to accommodate our acquisition and expansion plans and to replace personnel who leave. Competition for qualified personnel can be intense, and there are a limited number of people with the requisite knowledge and experience. Under these conditions, we could be unable to recruit, train, and retain employees. If we cannot attract and retain qualified personnel, it could have a material adverse impact on our operating results and stock price.

If we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with our business plan, we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. We will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.

Coronavirus (COVID-19) Pandemic

On March 11, 2020 the World Health Organization declared the novel strain of coronavirus (“COVID-19”) a global pandemic and recommended containment and mitigation measures worldwide. The global outbreak of COVID-19 continues to rapidly evolve, and the extent to which COVID-19 may impact our business and the dental products and services market will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the ultimate geographic spread of the disease, the duration of the outbreak, travel restrictions and social distancing in the United States, Canada and other countries, business closures or business disruptions, and the effectiveness of actions taken in the United States and other countries to contain and treat the disease. We are continuing to vigilantly monitor the situation with our primary focus on the health and safety of our employees and contractors.

Risks Associated with the Shares of Our Company

Because we do not intend to pay any dividends on our shares, investors seeking dividend income or liquidity should not purchase our shares.

We have not declared or paid any dividends on our shares since inception, and do not anticipate paying any such dividends for the foreseeable future. We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

Investors seeking dividend income or liquidity should not invest in our shares.

Because we can issue additional shares, purchasers of our shares may incur immediate dilution and may experience further dilution.

We are authorized to issue up to 2,000,000,000 shares. The board of directors of our company has the authority to cause us to issue additional shares, and to determine the rights, preferences and privileges of such shares, without consent of any of our stockholders. Consequently, our stockholders may experience more dilution in their ownership of our company in the future.

Risks Associated with our Market and Governing Documents

Trading on the OTC markets may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Pink tier operated by OTC Markets Group Inc. Trading in stock quoted on the OTC markets is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Pink tier not a stock exchange, and trading of securities on the OTC is often more sporadic than the trading of securities listed on a quotation system like Nasdaq or a stock exchange like the NYSE. Accordingly, shareholders may have difficulty reselling any of the shares.

Our stock is a penny stock. Trading of our stock may be restricted by the Securities and Exchange Commission’s penny stock regulations which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States, Canada, or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our company to carry on our business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

Because we can issue additional shares, purchasers of our shares may incur immediate dilution and may experience further dilution.

We are authorized to issue up to 2,000,000,000 shares. The board of directors of our company has the authority to cause us to issue additional shares, and to determine the rights, preferences and privileges of such shares, without consent of any of our stockholders. Consequently, our stockholders may experience more dilution in their ownership of our company in the future.

Our by-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our by-laws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

Investors’ interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities.

Our constating documents authorize the issuance of 2,000,000,000 shares of common stock with a par value of $0.001. In the event that we are required to issue any additional shares or enter into private placements to raise financing through the sale of equity securities, investors” interests in our company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we issue any such additional shares, such issuances also will cause a reduction in the proportionate ownership and voting power of all other shareholders. Further, any such issuance may result in a change in our control.

We are authorized to issue up to 2,000,000,000 shares. The board of directors of our company have the authority to cause us to issue additional shares, and to determine the rights, preferences and privileges of such shares, without consent of any of our stockholders. Consequently, our stockholders may experience more dilution in their ownership of our company in the future.

Our by-laws do not contain anti-takeover provisions, which could result in a change of our management and directors if there is a take-over of our company.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our By-laws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and directors.

Risks related to unknown trends, risks and uncertainties.

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized. There are numerous possible scenarios with sufficient potential impact to risk the future of the company as an independent business operating in the dental lab industry. For example, significant reputational impact as a result of a major issue resulting in injury to patients, possibly compounded by apparently negligent management behavior; extreme adverse press or social media coverage, would lead to a catastrophic share price fall, very significant loss of consumer confidence and inability to retain and recruit quality people. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common shares.

USE OF PROCEEDS

This Prospectus relates to our common stock shares that will be offered on a continuous basis by the Selling Security Holders beginning immediately after the registration statement’s effective date, which is included in this Prospectus, and may continue for a period in excess of ninety (90) days from this effective date. We are completing this registration statement to allow the Selling Security Holders to sell their shares. The Selling Security Holders will receive all proceeds from this offering and, if all of the shares being offered by this Prospectus are sold at $0.00975 per share, those proceeds would be $3,207,490.00 (estimated based on, solely for the purpose of determining the amount of the registration fee pursuant to Rule 457(c), the average of the high and low prices of the common stock as reported on the OTC on December 19, 2022). The Selling Security Holders may actually sell all or a portion of their shares through public or private transactions at prevailing market prices or at privately negotiated prices.

We, the issuer, will not receive any of the proceeds from the common stock sale by the Selling Security Holders in this offering. Our company will pay all expenses of this offering estimated at $50,000. See Part II, Item 13.

This prospectus also relates to shares of our common stock that may be offered and sold from time to time by World Amber. We may receive up to $2,500,000 aggregate gross proceeds under the Purchase Agreement from any sales we make to World Amber pursuant to the Purchase Agreement after the date of this prospectus. However, we may not be registering for sale or offering for resale under the registration statement of which this prospectus is a part all of the shares issuable pursuant to the Purchase Agreement.

In any event, we will receive no proceeds from the sale of any shares of common stock by World Amber pursuant to this prospectus. As we are unable to predict the timing or amount of potential issuances of all of the shares offered hereby, we have not allocated any proceeds of such issuances to any particular purpose. Accordingly, all such proceeds actually received under the Purchase Agreement are expected to be used for general working capital and general corporate purposes. Regardless of the actual proceeds raised, we intend to apply available proceeds in the following approximate order of priority: general corporate maintenance, compensation of essential employees and/or consultants, professional fees and expenses related to our public reporting requirements, and expenses related to the evaluation and acquisition of additional dental labs. In the event the proceeds actually received under the Purchase Agreement are insufficient for our planned purposes, we intend to limit or defer our planned acquisition activities, until such time as we have sufficient working capital.

Pending other uses, we intend to invest any proceeds from the offering in short-term investments or hold them as cash. We cannot predict whether the proceeds invested will yield a favorable return. Our management will have broad discretion in the use of the net proceeds from this offering, and investors will be relying on the judgment of our management regarding the application of the net proceeds.

DETERMINATION OF OFFERING PRICE

The Selling Security Holders will sell their shares at prevailing market prices or privately negotiated prices. The number of securities that may be actually sold by a Selling Shareholder will be determined by each Selling Shareholder. The Selling Security Holders are under no obligation to sell all or any portion of the securities offered, nor are the Selling Security Holders obligated to sell such shares immediately under this Prospectus. A security holder may sell securities at any price depending on privately negotiated factors, such as a “shareholders” own cash requirements, or objective criteria of value such as the market value of our assets.

We have arbitrarily established the offering price of the common stock and it should not be considered to bear any relationship to our assets, book value or net worth and should not be considered to be an indication of our value. No valuation or appraisal has been prepared for our business.

Among the factors considered by our management were:

| | · | the market price for our common stock on the OTC; |

| | · | the potential of our acquisition program; |

| | · | our capital structure; |

| | · | the background of our management; and |

| | · | our cash requirements relative to our business operations. |

WORLD AMBER TRANSACTION

General

On November 22, 2022 (the “Execution Date”), we entered into a Purchase Agreement and a Registration Rights Agreement with World Amber. Pursuant to the terms of the Purchase Agreement, World Amber has agreed to purchase from us up to $2,500,000 of our common stock from time to time during the term of the Purchase Agreement, subject to certain limitations.

We do not have the right to commence any sales to World Amber under the Purchase Agreement until the Commencement Date (defined below) has occurred. Thereafter, we may, from time to time, in any one month period, direct World Amber to purchase shares of our common stock in amounts up to 346,667 shares, and subject to a maximum commitment by World Amber of $104,000 per Regular Purchase. The purchase price per share sold will be $0.30 per share of common stock. World Amber may not assign or transfer its rights and obligations under the Purchase Agreement.

Pursuant to the terms of the Purchase Agreement, in no event may we issue or sell to World Amber any shares of our common stock under the Purchase Agreement which, when aggregated with all other shares of Common Stock then beneficially owned by World Amber and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in the beneficial ownership by World Amber and its affiliates of more than 9.99% of the then issued and outstanding shares of common stock.

Pursuant to the Registration Rights Agreement, the company is required to register the shares of common stock that may be issued to World Amber under the Purchase Agreement. We have filed the registration statement with the SEC that includes this prospectus to register for resale under the Securities Act, up to 8,333,333 shares of common stock, representing 18% of our issued and outstanding shares of common stock on December 19, 2022 and assuming all shares under the Purchase Agreement are issued

Purchase of Shares Under the Purchase Agreement

Under the terms and subject to the conditions of the Purchase Agreement, the Company has the obligation, to sell to World Amber, and World Amber is obligated to purchase up to $2,500,000 of shares of common stock. Such sales of common stock by the Company, if any, will be subject to certain limitations, and may occur from time to time, over the 24-month period commencing on the Commencement Date when the registration statement covering the resale of shares of common stock that have been and may be issued under the Purchase Agreement, which the Company agreed to file with the SEC pursuant to the Registration Rights Agreement, is declared effective by the SEC and a final prospectus in connection therewith is filed and the other conditions set forth in the Purchase Agreement are satisfied, all of which are outside the control of World Amber.

Under the Purchase Agreement, in any one-month period over the term of the Purchase Agreement, the Company has the right to present World Amber with a purchase notice (each, a "Purchase Notice") directing World Amber to complete a Regular Purchase up to 346,667 shares of common stock per month In each case, World Amber's maximum commitment in any single Regular Purchase may not exceed $104,000. The Purchase Agreement provides for a purchase price per Purchase Share (the "Purchase Price") equal to $0.30 per Share.

Events of Default

Events of default under the Purchase Agreement include the following:

| | · | the effectiveness of a registration statement registering the resale of the common stock issued or issuable to World Amber lapses for any reason (including, without limitation, the issuance of a stop order or similar order) or such registration statement (or the prospectus forming a part thereof) is unavailable to World Amber for resale of any or all of the Securities to be issued to World Amber, and such lapse or unavailability continues for a period of ten (10) consecutive Business Days or for more than an aggregate of thirty (30) Business Days in any 365-day period, but excluding a lapse or unavailability where (i) the Company terminates a registration statement after World Amber has confirmed in writing that all of the Securities covered thereby have been resold or (ii) the Company supersedes one registration statement with another registration statement, including (without limitation) by terminating a prior registration statement when it is effectively replaced with a new registration statement covering Securities (provided in the case of this clause (ii) that all of the Securities covered by the superseded (or terminated) registration statement that have not theretofore been resold are included in the superseding (or new) registration statement); |

| | · | the suspension of the common stock from trading on the OTCQB or any other market on which the common stock trades for a period of one (1) Business Day, provided that the Company may not direct World Amber to purchase any shares of common stock during any such suspension; |

| | · | the delisting of the common stock from the OTCQB, provided, however, that the common stock is not immediately thereafter trading on The Nasdaq Capital Market, the New York Stock Exchange, The Nasdaq Global Market, The Nasdaq Global Select Market, the NYSE American, the NYSE Arca, the OTC Bulletin Board, the OTCQX operated by the OTC Markets Group, Inc. (or nationally recognized successor to any of the foregoing); |

| | · | the failure for any reason by the Company’s Transfer Agent to issue Purchase Shares to World Amber within two (2) Business Days after the applicable Purchase Date, on which World Amber is entitled to receive such Purchase Shares; |

| | · | the Company breaches any representation, warranty, covenant or other term or condition under any Transaction Document if such breach has or could have a Material Adverse Effect (as defined in the Purchase Agreement) and except, in the case of a breach of a covenant which is reasonably curable, only if such breach continues for a period of at least five (5) Business Days; |

| | · | if any Person commences a proceeding against the Company pursuant to or within the meaning of any Bankruptcy Law; |

| | · | if the Company is at any time insolvent, or pursuant to or within the meaning of any Bankruptcy Law, the Company (i) commences a voluntary case, (ii) consents to the entry of an order for relief against it in an involuntary case, (iii) consents to the appointment of a custodian of it or for all or substantially all of its property, or (iv) makes a general assignment for the benefit of its creditors or is generally unable to pay its debts as the same become due; |

| | · | a court of competent jurisdiction enters an order or decree under any Bankruptcy Law that (i) is for relief against the Company in an involuntary case, (ii) appoints a Custodian of the Company or for all or substantially all of its property, or (iii) orders the liquidation of the Company or any Subsidiary; or |

| | · | if at any time the Company is not eligible to transfer its common stock electronically as DWAC Shares. |

World Amber does have the right to terminate the Purchase Agreement upon any of the events of default set forth above. During an event of default, all of which are outside of World Amber’s control, we may not direct World Amber to purchase any shares of our common stock under the Purchase Agreement.

Termination Rights of the Company

We have the unconditional right, at any time, for any reason and without any payment or liability to World Amber, to give notice to World Amber to terminate the Purchase Agreement.

No Short-Selling or Hedging by World Amber

World Amber has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior to the termination of the Purchase Agreement.

Effect of Performance of the Purchase Agreement on Our Stockholders

All 8,333,333 shares registered in this offering which have been and may be issued or sold by us to World Amber under the Purchase Agreement are expected to be freely tradable. It is anticipated that shares registered in this offering may be sold over a period of up to 24-months commencing on the date that the registration statement including this prospectus becomes effective. The sale by World Amber of a significant number of shares registered in this offering at any given time could cause the market price of our common stock to decline and to be highly volatile. Sales of our common stock to World Amber, if any, will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to World Amber all, some or none of the additional shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement. If and when we do sell shares to World Amber, after World Amber has acquired the shares, World Amber may resell all, some or none of those shares at any time or from time to time in its discretion. Therefore, sales to World Amber by us under the Purchase Agreement may result in substantial dilution to the interests of other holders of our common stock. In addition, if we sell a substantial number of shares to World Amber under the Purchase Agreement, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with World Amber may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales. However, we have the right to control the timing and amount of any additional sales of our shares to World Amber and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

The Purchase Agreement prohibits us from issuing or selling to World Amber under the Purchase Agreement any shares of our common stock if those shares, when aggregated with all other shares of our common stock then beneficially owned by World Amber and its affiliates, would exceed the Beneficial Ownership Limitation.

DILUTION

The Company intends to sell 8,333,333 shares of common stock, to World Amber, at a purchase price of $0.30 per share for the duration of the Offering (the “Offering”) for a period of two years from the effective date of this prospectus, unless extended by our Board of Directors for up to an additional ninety (90) days. Once a “Put Notice” is presented to World Amber, shares will be issued to World Amber. The Company is registering these shares on behalf of the selling shareholder. The following table sets forth the number of shares of Common Stock being registered for sale, the total consideration paid and the price per share. The table assumes all 8,333,333 shares of Common Stock will be sold.

| | | Shares Issued | | | Total Consideration | | | | |

| | | Number of Shares | | | Percent | | | Amount | | | Percent | | | Price Per Share | |

| Purchasers of Shares | | | 8,333,333 | | | | 100 | % | | $ | 2,500,000 | | | | 100 | % | | $ | 0.30 | |

| Total | | | 8,333,333 | | | | 100 | % | | $ | 2,500,000 | | | | 100 | % | | | | |

The following table sets forth the difference between the offering price of the shares of our Common Stock being sold by the Company to World Amber, and registered to World Amber, the net tangible book value per share, and the net tangible book value per share after giving effect to the Offering by us, assuming that 100%, 75%, 50%, 25% and 10% of the offered shares are sold. Net tangible book value per share represents the amount of total tangible assets less total liabilities at December 31, 2022, divided by the number of shares outstanding as of December 31, 2022. Totals may vary due to rounding. Note - the table below does not reflect offering costs estimated to be $50,000 which will be borne by the Company and not deducted from gross proceeds.

| | 100% of offered shares are sold | 75% of offered shares are sold | 50% of offered shares are sold | 25% of offered shares are sold | 10% of offered shares are sold |

| Offering Price | $0.30 per share | $0.30 per share | $0.30 per share | $0.30 per share | $0.30 per share |

| Net tangible book value at December 31, 2022 (1) | ($0.003) per share | ($0.003) per share | ($0.003) per share | ($0.003) per share | ($0.003) per share |

| Net tangible book value after giving effect to the Offering proceeds | $0.002 per share | $0.001 per share | $(0.001) per share | $(0.002) per share | $(0.003) per share |

| Increase in net tangible book value per share attributable to cash payments made by new investors | $0.005 per share | $0.004 per share | $0.002 per share | $0.001 per share | $0.00 per share |

| Per Share Dilution to New Investors | $0.298 per share | $0.299 per share | $0.301 per share | $0.302 per share | $0.303 per share |

| Percent Dilution to New Investors | 99% | 100% | 100% | 101% | 101% |

| (1) | Based on 445,728,363 shares issued and outstanding as of December 31, 2022 |

SELLING SECURITY HOLDERS

We are registering an aggregate of 328,973,333 shares of common stock held by the Selling Security Holders. The Selling Security Holders have the option to sell the 328,973,333 shares of our common stock at prevailing market prices or privately negotiated prices.

This Prospectus covers the offering of up to an aggregate of 328,973,333 shares of common stock, consisting of: 319,890,000 shares of common stock underlying previously issued convertible promissory notes issued by our company to certain Selling Security Holders; 750,000 shares issued pursuant to one Selling Security Holder for the acquisition of certain assets; and 8,333,333 shares issuable upon drawdowns under the Purchase Agreement with another Selling Security Holder, World Amber Corporation. The aggregate of 328,973,333 common shares issued or issuable to the nine Selling Security Holders are restricted under applicable federal and state security laws and are being registered to give them the opportunity to sell their shares.

They are offering for sale a total of 328,973,333 shares of common stock of our company. This comprises approximately 33% percent of the total issued and outstanding shares assuming all convertible notes are converted, and the Purchase Agreement is fully draw down. To the best of our knowledge, the Selling Security Holders have sole voting and investment power and rights over all their shares and are the beneficial owners. They have given all information regarding share ownership. The shares being offered are being registered to permit public secondary trading and the Selling Security Holders may offer all or part of their respective shares from time to time but is under no obligation to immediately sell them pursuant to this Prospectus. Thus, our company cannot guarantee that any shares will be sold after this registration statement is declared effective.

The offering of 319,890,000 shares of our issued and outstanding common stock by the Selling Security Holders were originally issued or are issuable pursuant to private placements, transactions or agreements as described herein.

Our common stock is quoted on the OTC Pink tier under the trading symbol “CSSI”.

The Selling Security Holders will have the option to sell their shares at an initial offering price of $0.00975 per share (estimated solely for the purpose of determining the amount of the registration fee pursuant to Rule 457(c) based on the average of the high and low prices of the common stock as reported on the OTC Markets on December 19, 2022) or at prevailing market prices or privately negotiated prices.

All of these shares were issued in reliance upon an exemption from registration pursuant to Section 4(2), Regulation S, or Regulation D under the Securities Act of 1933 (the “Securities Act ”). Our reliance upon Rule 903 of Regulation S was based on the fact that the sales of the securities were completed in an “offshore transaction”, as defined in Rule 902(h) of Regulation S. We did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the securities.

The following table provides information as of March 31, 2023, regarding the beneficial ownership of our common stock by each of the Selling Security Holders, including:

| | · | the identity of the beneficial holder that owns the shares being offered |

| | | |

| | · | the number of shares owned by each prior to this offering; |

| | | |

| | · | the number of shares being offered by each; |

| | | |

| | · | the number of shares that will be owned by each upon completion of the offering, assuming that all the shares being offered are sold; and |

| | | |

| | · | the percentage of shares owned by each. |

Additional information regarding the holders of the 319,890,000 common shares underlying the convertible promissory notes, the 750,000 common shares issued pursuant to the asset acquisition with Prime Dental Lab LLC and the 8,333,333 common shares issuable pursuant to the Purchase Agreement with World Amber is included the following table.

| Name of Selling Security Holder | | Shares underlying Convertible Promissory Notes Owned Prior to this offering | | | Percent % | | | Maximum Number Shares being offered | | | Beneficial Ownership after offering | | | Percentage of Owned upon completion of the offering | |

| Ilya Aharon | | | 10,000,000 | | | | 1.3 | | | | 10,000,000 | | | | 0 | | | | 0 | |

| Yohanan Aharon | | | 20,000,000 | | | | 2.6 | | | | 20,000,000 | | | | 0 | | | | 0 | |

| Rosa Shimonov | | | 20,000,000 | | | | 2.6 | | | | 20,000,000 | | | | 0 | | | | 0 | |

| Aaron Abraham | | | 12,000,000 | | | | 1.5 | | | | 12,000,000 | | | | 0 | | | | 0 | |

| Shannon Sekhri | | | 20,900,000 | | | | 2.7 | | | | 20,900,000 | | | | 0 | | | | 0 | |

| Nirmal Sekhri | | | 119,240,000 | | | | 15.4 | | | | 119,240,000 | | | | 0 | | | | 0 | |

| Kenneth Brown | | | 10,000,000 | | | | 1.3 | | | | 10,000,000 | | | | 0 | | | | 0 | |

| Maddalena Popowich | | | 20,000,000 | | | | 2.6 | | | | 20,000,000 | | | | 0 | | | | 0 | |

| David Popowich | | | 5,000,000 | | | | 0.6 | | | | 5,000,000 | | | | 0 | | | | 0 | |

| George Alvarez Professional Corp | | | 20,000,000 | | | | 2.6 | | | | 20,000,000 | | | | 0 | | | | 0 | |

| Faisal Karmali | | | 25,000,000 | | | | 3.2 | | | | 25,000,000 | | | | 0 | | | | 0 | |

| Daniel & Debra Burrows | | | 2,500,000 | | | | 0.3 | | | | 2,500,000 | | | | 0 | | | | 0 | |

| Alek Dvoskin | | | 3,750,000 | | | | 0.5 | | | | 3,750,000 | | | | 0 | | | | 0 | |

| Vanessa Iorio | | | 3,250,000 | | | | 0.4 | | | | 3,250,000 | | | | 0 | | | | 0 | |

| Scott and Jennifer Sucharzewski | | | 2,500,000 | | | | 0.3 | | | | 2,500,000 | | | | 0 | | | | 0 | |

| Brian Koprowski and Vanessa D Belmares | | | 500,000 | | | | 0.1 | | | | 500,000 | | | | 0 | | | | 0 | |

| Luke Jacob Pascale | | | 12,500,000 | | | | 1.6 | | | | 12,500,000 | | | | | | | | | |

| Arcanumus Capital (Nirmal Sekhri) | | | 9,000,000 | | | | 1.2 | | | | 9,000,000 | | | | 0 | | | | 0 | |

| William Diaz | | | 3,750,000 | | | | 0.5 | | | | 3,750,000 | | | | 0 | | | | 0 | |

| | | | 319,890,000 | | | | 41 | % | | | 319,890,000 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | Shares previously issued pursuant to asset acquisition | | | | | | | | | | | | | | | | | |

| John Jonpil Kim | | | 750,000 | | | | 0.1 | % | | | 750,000 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | Shares issuable underlying Purchase Agreement | | | | | | | | | | | | | | | | | |

| World Amber Corporation(4) | | | 8,333,333 | | | | 1.1 | % | | | 8,333,333 | | | | 0 | | | | 0 | |

| Total | | | 328,973,333 | | | | 42.5 | % | | | 328,973,333 | | | | 0 | | | | 0 | |

NOTES:

| (1) | The number and percentage of shares beneficially owned is determined to the best of our knowledge in accordance with the Rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the selling security holder has sole or shared voting or investment power and also any shares which the selling security holder has the right to acquire within 60 days of the date of this Prospectus. |

| | |

| (2) | The percentages are based on a diluted basis assuming all 319,890,000 shares are issued upon conversion of the notes, 8,333,333 shares are issued under the Purchase Agreement and based on 445,728,363 shares of our common stock issued and outstanding as at March 31, 2023 for an aggregate of 774,701,696 issued and outstanding shares post-conversion. |

| | |

| (3) | Yohanan Aharon, the Chief Executive Officer of World Amber Corporation, is deemed to be beneficial owner of all of the shares of common stock owned by World Amber Corporation. Mr. Aharon has voting and investment power over the shares being offered under the prospectus filed with the SEC in connection with the transactions contemplated under the Purchase Agreement. World Amber Corporation is not a licensed broker dealer or an affiliate of a licensed broker dealer. |

Except as otherwise noted in the above lists, the named party beneficially owns and has sole voting and investment power over all the shares or rights to the shares. The numbers in this table assume that none of the Selling Security Holders will sell shares not being offered in this Prospectus or will purchase additional shares and assumes that all the shares being registered will be sold. There has been no material relationship between any of the Selling Security Holders and the company and its affiliates during the prior three years.

PLAN OF DISTRIBUTION

We are registering an aggregate of 328,973,333 shares of common stock, issuable pursuant to: the Purchase Agreement with World Amber, shares of common stock previously issued to Prime Dental Lab LLC, and shares of common stock underlying previously issued convertible promissory notes by our company, by Selling Security Holders. The Selling Security Holders have the option to sell the 328,973,333 shares of our common stock at prevailing market prices or privately negotiated prices.

The shares may be sold in a lawful manner using any one or more of the following methods: private transaction; ordinary brokerage transactions; transactions in which the broker-dealer solicits purchasers; broker-dealer as principal purchasers and resale by the broker-dealer for its own account; block trades in which the broker-dealer will attempt to sell the shares as an agent, but may position and resell a portion of the block as principal to facilitate the transaction; broker-dealer agreements with the selling shareholder to sell a specified number of such shares at a stipulated price per share; exchange distribution following the rules of the applicable exchange; short sales that are not violations of the laws and regulations of any state of the United States; through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; or through a combination of any such methods or other lawful means.

The Selling Security Holders are underwriters, within the meaning of section 2(a)(11) of the Securities Act. Any broker-dealers or agents that participate in the sale of the common stock or interests therein may also be deemed to be an “underwriter” within the meaning of section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit earned on any resale of the shares may be underwriting discounts and commissions under the Securities Act. The Selling Security Holders, who are “underwriters” within the meaning of section 2(a)(11) of the Securities Act, are subject to the prospectus delivery requirements of the Securities Act.

The brokers or dealers may receive commissions or discounts from the Selling Security Holders, if any of the broker-dealer acts as an agent for the purchaser of said shares, from the purchaser in the amount to be negotiated which are not expected to exceed those customary in the types of transactions involved. Broker-dealers may agree with the Selling Security Holders to sell a specified number of the shares of common stock at a stipulated price per share. In connection with such re-sales, the broker-dealer may pay to or receive from the purchasers of the shares, commissions as described above. Any broker or dealer participating in any distribution of the shares may be required to deliver a copy of this Prospectus, including any prospectus supplement, to any individual who purchases any shares from or through such broker-dealer.

Our common stock is quoted on the Pink tier of the OTC markets.