Singapore Developer of Alzheimer's Drug Plans U.S. IPO

31 December 2015 - 7:10PM

Dow Jones News

KUALA LUMPUR, Malaysia—A Singaporean company focused on

developing treatments for Alzheimer's disease has invited banks to

pitch for a mandate to advise it on a potential public offering

after results come in from late-stage clinical drug trials,

expected in the middle of 2016.

The owners of TauRx Pharmaceuticals Ltd., which counts Singapore

state investment company Temasek and Southeast Asia's largest

casino operator, Genting, as investors, are looking at listing on

the Nasdaq Stock Market as early as 2017 in a deal that could value

the company at about $15 billion, according to people familiar with

the matter.

A spokesperson for TauRx said the company was holding

exploratory discussions with a number of investment banks. The

talks have focused primarily on identifying likely options

available to the group, one of which could be an IPO in 2017, the

spokesperson said, adding that no decision would be made until the

results of its Alzheimer's drug trials were available. The company

didn't say how much it was seeking to raise in a possible IPO.

Development of Alzheimer's treatments has proven difficult.

Between 2002 and 2012, 99.6% of clinical trials of drugs aimed at

curing and preventing the memory-robbing disorder have failed or

have been discontinued, according to a study by scientists at the

Cleveland Clinic Lou Ruvo Center for Brain Health and the Touro

University Nevada College of Osteopathic Medicine. This compares

with a failure rate of 81% for cancer drugs.

Founded in 2002, TauRx specializes in developing therapies and

diagnostics for neurodegenerative diseases of the central nervous

system. TauRx's researchers are working on cutting down the

clumping of a protein called tau—which forms twisted fibers known

as tangles inside the brain cells of Alzheimer's patients. Research

elsewhere has targeted a different protein, beta amyloid, which

forms sticky plaques in the brains of sufferers.

Proceeds from the IPO will be used in part to fund the continued

development of the tau-protein focused treatment, the people

familiar with the matter said.

An IPO would provide an avenue for shareholders to exit their

investment in TauRx. The firm has raised $350 million to date from

the likes of Temasek, the Development Bank of Singapore and the

Dundee Corp. of Canada, according to its official website. Genting,

a Malaysian casino-to-plantations conglomerate, is the largest

shareholder with a total exposure of $120 million.

(END) Dow Jones Newswires

December 31, 2015 02:55 ET (07:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

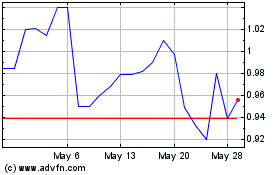

Dundee (PK) (USOTC:DDEJF)

Historical Stock Chart

From Nov 2024 to Dec 2024

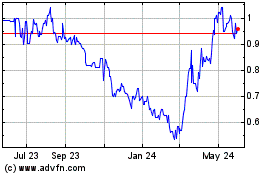

Dundee (PK) (USOTC:DDEJF)

Historical Stock Chart

From Dec 2023 to Dec 2024