People Are Flying Again -- But Only for Cheap Vacations -- Heard on the Street

06 August 2020 - 10:38PM

Dow Jones News

By Jon Sindreu

The aviation industry is desperate to know whether people will

emerge from lockdowns eager to fly, despite the health risks and

extra safety measures on planes and in airports. The answer coming

from Europe seems to be "yes" -- but only to go on a cheap

vacation.

On Thursday, German airline giant Lufthansa posted a net

second-quarter loss of EUR1.5 billion ($1.78 billion). While

dismal, that was a bit better than analysts were expecting. Indeed,

the European earnings season has revealed encouraging signs of a

July recovery in flight demand. This may offer global investors a

more representative picture of how consumers feel about flying than

trends in the U.S., which has fallen behind in its fight against

Covid-19 and artificially inflated flight numbers by mandating that

airlines fly some routes in exchange for government aid.

However, the nature of the rebound also points to an even bigger

gap than before between legacy airlines with hub-and-spoke models

and budget players that mostly operate shorter point-to-point

routes geared toward sun seeking. Lufthansa now forecasts its

short-haul traffic volumes to be 40% of 2019 levels in the third

quarter and 50% in the fourth, compared with 20% and 50% for

long-haul figures, respectively.

This matches what other European airlines have been saying,

including British Airways owner IAG. Being prudent in bringing back

long-haul capacity is a wise choice for airlines, but muted plans

have a lot to do with worsening prospects: Trans-Atlantic travel,

where BA makes half its income, is still restricted following a

string of new cases both in the U.S. and Europe.

Corporate travel, which is what makes long-haul routes

profitable -- business fliers make up 15% of passengers, but 40% of

airline revenues -- remains virtually extinct. The International

Air Transport Association recently said that, breaking with

historical precedent, it doesn't expect corporate travel spending

to recover in lockstep with the economy.

By contrast, tourists' hunger to vacation abroad seems

undeterred by health measures in airports and even a resurgence of

coronavirus cases in key destinations like Spain, which has been

put on a quarantine list by the U.K.

Since many European countries have been racing to open their

borders in time for the summer holidays, many fliers have just

accepted airline vouchers and swapped Spain for another cheap

destination, carriers said. Others have gone there anyway:

U.K.-Spain routes haven't been materially affected over the past

two weeks, pan-European air safety organization Eurocontrol

reported this week. It underscored that traffic is in line with its

optimistic projections back in April, which were based on the

assumption that airlines and airports would successfully coordinate

on safety measures.

London-based budget airline easyJet upgraded Tuesday its

expected capacity between July and September to 40% of what it was

a year ago, from 30% before. Crucially, it said that its planes

flew 84% full in July. European low-cost leader Ryanair is

operating more flights -- despite initially posting a more

conservative schedule -- but still selling 70% of seats. It expects

to fly 57% of its normal capacity this quarter. Statements by

airlines and preliminary data also suggest, however, that filling

planes involves slashing prices much more than before.

The good news for investors is that earlier apocalyptic

predictions about the end of cheap travel are already proving

unfounded. Shares in easyJet in Europe and Spirit Airlines in the

U.S., which have been punished as harshly as those of legacy

airlines, may even be able to close the gap with their

best-in-class budget peers.

The bad news is that discount-seeking tourists and thrifty

corporations are a horrid foundation for a big chunk of the airline

industry.

Write to Jon Sindreu at jon.sindreu@wsj.com

(END) Dow Jones Newswires

August 06, 2020 08:23 ET (12:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

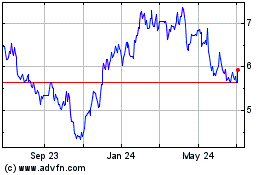

Easy Jet (QX) (USOTC:ESYJY)

Historical Stock Chart

From Nov 2024 to Dec 2024

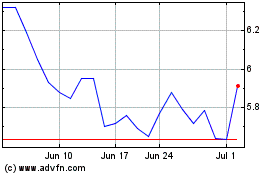

Easy Jet (QX) (USOTC:ESYJY)

Historical Stock Chart

From Dec 2023 to Dec 2024