First Energy Metals Ltd. (CSE: FE) (OTCQB: FEMFF) Continues To Release Lithium Drill Results As Lithium Demand Continues to Grow Globally

19 August 2021 - 12:08AM

InvestorsHub NewsWire

First

Energy Metals Ltd. (CSE: FE) (OTCQB: FEMFF) Continues

To

Release

Lithium Drill Results As Lithium Demand Continues to Grow

Globally

- Company reported

various lithium oxide volumes at LC21-22 and LC21-003 drill

holes

- The drilling

showed irregular values of rare metals, including niobium,

rubidium, tantalum, beryllium, cesium, and

iron

- Analysis of the

samples is done through a process called Code Ultratrace 7 using

Peroxide Fusion, ICP, and ICP/MS

- First Energy

Metals granted incentive stock options to certain directors,

officers, and consultants to purchase up to 900,000 common shares

under the Stock Options Plan, exercisable for five years at a price

of $0.25 per share

- Global Li-ion

Battery Market to Reach $80.5 Billion by

2024

August 18, 2021 -- InvestorsHub NewsWire -- via

MiningNewsWire -- First

Energy Metals Ltd. (CSE: FE) (OTCQB: FEMFF)

(WKN: A2JC89) , a publicly-traded

Canadian mineral exploration company with a primary focus on

developing a multi-commodity mineral property portfolio by

identifying, acquiring, and exploring the North American mineral

prospects, has announced the results of drill hole LC21-22 at the

Augustus Lithium Property in Quebec. The drill hole intersected a

10.5-meter-wide zone with 1.22% lithium oxide at 69 meters drilled

depth (https://nnw.fm/GxN0y).

There were irregular

values of other rare metals found, including average values of

niobium, rubidium, tantalum, beryllium, cesium, and iron. The

samples collected were bagged, tagged, and delivered to Activation

Laboratories in Ancaster, Ontario, for sample preparation and

analysis. Activation Laboratories is an independent commercial,

accredited ISO-Certified laboratory.

Earlier in July,

First Energy Metals announced the results from another drill hole

at the Augustus Lithium Property. Drill hole LC21-003 intersected a

six-meter-wide zone with 0.62% lithium oxide at 45 meters drilled

depth, including a two-meter intersection with 1.35% lithium oxide

at 48 meters depth. A second two-meter intersection at 73 meters

depth assayed 0.63% lithium oxide (https://nnw.fm/RQjPC).

Samples from both

Augustus Lithium Property drill holes were analyzed using

Code Ultratrace

7 –

Peroxide Fusion – ICP and ICP/MS. Code Ultratrace

7 fuses

the samples with sodium peroxide in a Zirconium crucible. The fused

sample is acidified with concentrated nitric and hydrochloric

acids. The solution is then diluted and measured by ICP-OES and

ICP-MS.

The Augustus Lithium

Property and the surrounding areas total 14,367.71 hectares and are

equipped with excellent infrastructure support, including a road

network, railway, water, electricity, and trained manpower

available locally. Highlights of the property also

include:

• A geographically

similar structure to Sayona

Mining's

Authier

Lithium

project and Mine Quebec Lithium Project, which is located

approximately 6 to 12 km away

• Documented

historical drilling in over 62 drill holes that amount to $2

million in present-day exploration expenditures

• Two prominent

lithium and one silver prospect located on the property

• A potential

high-grade lithium resource target of 4 million tonnes at 1%

lithium oxide

• Potential for

large volume low-grade bulk tonnage near the surface

• A two-phase

exploration work program

First Energy Metals

also has other mining properties located

in Quebec. In addition to

Augustus Lithium Property,

the

Company

has the

Titan

Gold, located in the Detour-Fenlon Greenstone Belt in east-central

Quebec.

Additionally, the

company granted incentive stock options to certain directors,

officers, and consultants to purchase up to an aggregate of 900,000

common shares under its Stock Option Plan. These will be

exercisable for a period of five years at a price of $0.25 per

share. The option is subject to a four-month hold period and

subject to Canadian Securities Exchange approval.

First Energy Metals

is well positioned to leverage growing opportunities on the global

lithium-ion battery market:

Lithium-ion

batteries (Li-ion batteries or LiB)

are increasingly becoming the rage due to its potential for use in

a wide range of products and applications ranging from smartphones

and smartwatches to electric vehicles (EVs) and energy storage

systems. Since being launched commercially in 1991, Li-ion

batteries have witnessed significant improvements in performance

and capabilities, thus making them indispensable for a range of

products.

Amid the COVID-19

crisis, the global market for Li-ion Battery is projected to reach

US$80.5 Billion by 2024, registering a compounded annual growth

rate (CAGR) of 15.2% over the analysis period. Europe represents

the largest regional market for Li-ion Battery, accounting for an

estimated 32.4% share of the global total. The market is projected

to reach US$32.8 Billion by the close of the analysis period.

Europe is forecast to emerge as the fastest growing regional market

with a CAGR of 17.0% over the analysis period.

https://www.prnewswire.com/news-releases/global-li-ion-battery-market-to-reach-80-5-billion-by-2024--301353029.html

For more

information, visit the company's website at www.firstenergymetals.com

SOURCE: MiningNewsWire

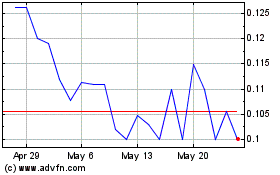

Linear Minerals (QB) (USOTC:FEMFF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Linear Minerals (QB) (USOTC:FEMFF)

Historical Stock Chart

From Feb 2024 to Feb 2025