Current Report Filing (8-k)

03 October 2022 - 11:33PM

Edgar (US Regulatory)

false000172999700017299972022-10-032022-10-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 3, 2022 |

Grayscale® Digital Large Cap Fund LLC

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Cayman Islands |

000-56284 |

98-1406784 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

c/o Grayscale Investments, LLC 290 Harbor Drive, 4th Floor |

|

Stamford, Connecticut |

|

06902 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 668-1427 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Grayscale Digital Large Cap Fund LLC Shares |

|

GDLC |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On October 3, 2022, Grayscale Investments, LLC, the manager (the “Manager”) of Grayscale Digital Large Cap Fund LLC (the “Fund”) entered into a distribution and marketing agreement (the “Distribution and Marketing Agreement”) with Grayscale Securities, LLC, a Delaware limited liability company, (“Grayscale Securities”) to assist the Manager in distributing the shares of the Fund (the “Shares”), developing an ongoing marketing plan for the Fund, preparing marketing materials regarding the Shares, including the content on the Fund’s website, and executing the marketing plan for the Fund. As a result, effective October 3, 2022, Grayscale Securities is the distributor and marketer of the Shares. Grayscale Securities is a registered broker-dealer with the SEC and is a member of FINRA.

On October 3, 2022, the Manager entered into a participant agreement (the “Participant Agreement”) with Grayscale Securities, pursuant to which Grayscale Securities has agreed to act as an authorized participant of the Fund (in such capacity, the “Authorized Participant”). The Participant Agreement provides the procedures for the creation of Shares of the Fund through the Authorized Participant, which are substantially similar to the procedures for the creation of Shares set forth in the Fund’s existing participant agreement with Genesis Global Trading, Inc. (“Genesis”), except that the Authorized Participant may engage one or more service providers (any such service provider, a “Liquidity Provider”) to source digital assets on behalf of the Authorized Participant in connection with the creation of Shares. In addition to being a registered broker-dealer and entering into a Participant Agreement with the Manager, Grayscale Securities or its Liquidity Provider will own digital asset wallet addresses that are known to Coinbase Custody Trust Company, LLC, the custodian of the Fund, as belonging to the Authorized Participant or its Liquidity Provider. Effective October 3, 2022, Grayscale Securities is the only acting Authorized Participant of the Fund. Grayscale Securities has engaged Genesis as a Liquidity Provider.

Grayscale Securities is a wholly-owned subsidiary of the Manager and is an affiliate and related party of the Fund. While the Index Provider (as defined in the Fund’s Annual Report on Form 10-K for the year ended June 30, 2022 (the “Annual Report”)) does not currently utilize data from over-the-counter markets or derivatives platforms, it may decide to include pricing and trading data from such markets or platforms in the future, which could include Grayscale Securities and/or Genesis. In addition, several employees of the Manager and the Manager’s parent company, Digital Currency Group Inc., are FINRA-registered representatives who will maintain their FINRA licenses through Grayscale Securities in the future.

The foregoing description is a summary, and does not purport to be a complete description, of each of the Distribution and Marketing Agreement or the Participant Agreement, and is qualified in its entirety by reference to the Distribution and Marketing Agreement, dated October 3, 2022, and the Participant Agreement, dated October 3, 2022, which are filed as Exhibit 4.1 and 10.1, respectively, hereto and are incorporated by reference herein. Capitalized terms used but not defined herein have the meanings set forth in the Annual Report.

Item 1.02. Termination of a Material Definitive Agreement.

On October 3, 2022, in connection with the entry into the Distribution and Marketing Agreement with Grayscale Securities, the Manager and Genesis agreed to terminate the distribution and marketing agreement, dated November 15, 2019, among the Manager, the Fund and Genesis, pursuant to which Genesis assisted the Manager in distributing the Shares. As a result, effective October 3, 2022, Genesis is no longer acting as the distributor and marketer of the Shares of the Fund.

On October 3, 2022, the Manager and Genesis agreed to terminate the participant agreement, dated January 11, 2019, among the Manager, the Fund and Genesis, which provided the procedures for the creation of Shares. As a result, effective October 3, 2022, Genesis is no longer acting as an Authorized Participant of the Fund but will continue to serve as a Liquidity Provider.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Grayscale Investments, LLC as Manager of Grayscale Digital Large Cap Fund LLC |

|

|

|

|

Date: |

October 3, 2022 |

By: |

/s/ Michael Sonnenshein |

|

|

|

Michael Sonnenshein

Chief Executive Officer |

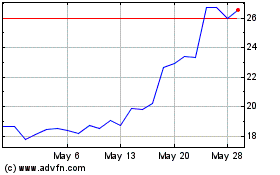

Grayscale Digital Large ... (QX) (USOTC:GDLC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Grayscale Digital Large ... (QX) (USOTC:GDLC)

Historical Stock Chart

From Dec 2023 to Dec 2024