UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

INFORMATION STATEMENT PURSUANT TO

SECTION 14(c)

OF THE SECURITIES EXCHANGE ACT OF

1934

Check the appropriate box:

[ ] Preliminary Information Statement

[ ] Confidential, for Use of the Commission

only (as permitted by Rule 14c-5(d)(2))

[X] Definitive Information Statement

UNIQUE UNDERWRITERS, INC.

(Name of Registrant

As Specified In Its Charter)

Payment of Filing Fee (Check the Appropriate Box):

[X] No fee required

[ ] Fee computed on table

below per Exchange Act Rules 14c-5(g) and 0-11

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

[ ] Check

box if any party of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

UNIQUE UNDERWRITERS, INC.

121 North Commercial Drive

Mooresville, NC 28115

_______________________________________________________________

NOTICE OF SHAREHOLDER ACTION BY WRITTEN

CONSENT

TO ALL SHAREHOLDERS OF UNIQUE UNDERWRITERS,

INC.

_____________________________________________________________________

To the Shareholders of Unique Underwriters, Inc.:

We hereby inform

you of a decision made by holders of a majority of outstanding shares of Unique Underwriters, Inc. (“UUWR” or “Company”),

who have consented to the following actions:

|

1.

|

A change of domicile, or reincorporation, of the Company to the State of Nevada by means of a merger with a newly formed, wholly-owned Nevada subsidiary, and the terms of the definitive agreements related thereto; and

|

|

|

|

|

2.

|

A change of corporate name of the Company by means of a merger with a newly formed, wholly-owned Nevada subsidiary in name of JunkieDog.com Inc., and the terms of the definitive agreements related thereto; and

|

|

|

|

|

3.

|

A combination of the shares of common stock of the Company, or reverse stock split, such that each one-hundred (100) shares of common stock shall be converted into one (1) share of common stock, to be conducted in connection with the reincorporation merger.

|

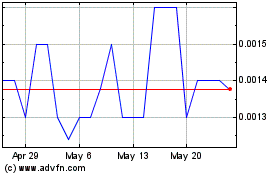

UUWR common stock

currently is traded on the OTC Bulletin Board under the symbol “UUWR.” The most recent reported closing price of UUWR

common stock on June 9, 2014 was $0.05 per share.

The holders of a

majority of our outstanding common stock, owning approximately 78.6% of the outstanding shares of our common stock, have executed

a written consent in favor of the actions described above that is described in greater detail in the Information Statement accompanying

this notice. This consent satisfies the shareholder approval requirement for the proposed action and allows us to take the proposed

action on or about June 15, 2014.

WE ARE NOT ASKING

FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Because the written consent of the holders of a majority

of our common stock satisfies any applicable shareholder voting requirement of Texas Business Organizations Code and our Articles

of Incorporation and by-laws, we are not asking for a proxy and you are not requested to send one.

On behalf of the Board of Directors,

/s/ Roberto Luciano

Roberto Luciano

Chief Executive Officer, President, Secretary,

Treasurer and Director

This Information Statement is dated

June 23, 2014, and is being first mailed to UUWR shareholders on or about June 27, 2014.

HOW TO OBTAIN ADDITIONAL INFORMATION

This Information Statement incorporates

important business and financial information about the Company that is not included in or delivered with this Information Statement. Upon

written or oral request, this information can be provided. For an oral request, please contact the Company at (704)

902-5380. For a written request, mail request to 121 North Commercial Drive, Mooresville, NC 28115.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

INFORMATION STATEMENT PURSUANT TO

SECTION 14(c)

OF THE SECURITIES EXCHANGE ACT OF

1934

AND RULE 14C PROMULGATED THERETO

UNIQUE UNDERWRITERS, INC.

Contents

|

Section

|

Page

|

|

Introduction

|

4

|

|

|

|

|

Item 1. Information Required by Items of Schedule 14A

|

4

|

|

|

|

|

A. Action 1 – Change of Domicile

|

4

|

|

B. Action 2 – Change of Corporate Name

|

12

|

|

C. Action 3 – Reverse Stock Split

|

12

|

|

D. No Time, Place or Date for Meeting of Shareholders

|

13

|

|

E. Dissenters’ Rights

|

13

|

|

F. Voting Securities and Principal Shareholders Approving the Actions

|

13

|

|

|

|

|

Item 2. Statements that Proxies are not Solicited

|

14

|

|

|

|

|

Item 3. Interest of Certain Persons or Opposition to Matters to Be Acted Upon

|

14

|

|

|

|

|

Item 4. Proposals by Security Holders

|

14

|

|

|

|

|

Item 5. Delivery of Documents to Security Holders Sharing an Address

|

14

|

|

|

|

|

Signatures

|

14

|

|

|

|

UNIQUE UNDERWRITERS, INC.

121 North Commercial Drive

Mooresville, NC 28115

________________________________________

INFORMATION STATEMENT

June 23, 2014

_______________________________________

WE ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A

PROXY.

This Information Statement is being

mailed on or about June 27, 2014 to the shareholders of record Unique Underwriters, Inc. at the close of business on June 9, 2014.

This Information Statement is being sent to you for information purposes only. No action is requested or required on

your part.

As of the close of business on the record

date, we had 77,565,608 shares of common stock outstanding. The common stock is our only class of securities entitled

to vote. Each outstanding share of common stock is entitled to one vote per share.

This Information Statement is first

being mailed on or about June 27, 2014. This Information Statement constitutes notice to our shareholders of a corporate action

consented to by shareholders without a meeting as required by Texas Business Organizations Code.

INTRODUCTION

This information

statement is being furnished to all holders of Common Stock of UUWR.

The Board of Directors

has recommended, and the majority shareholders of UUWR have adopted resolutions to effect the actions listed below in Item 1 of

this Information Statement. This Information Statement is being filed with the Securities and Exchange Commission and is provided

to UUWR’s shareholders pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended.

We are a corporation

organized under the laws of Texas. We are a 1934 Act reporting company with securities registered pursuant to Section 12(g), quoted

on the Over the Counter Bulletin Board (OTCBB) under the symbol “UUWR”. Additional information about us

can be found in our public filings that can be accessed electronically by means of the SEC’s website on the internet at http://www.sec.gov,

or at other internet sites such as http://www.freeedgar.com, as well as by such other means from the offices of the SEC.

ITEM 1. INFORMATION REQUIRED BY ITEMS OF SCHEDULE 14A

ACTION 1 – CHANGE OF DOMICILE

On June 9, 2014,

the Board of Directors and consenting shareholders holding a majority of issued and outstanding Common Stock approved a change

in domicile of the Company from Texas to Nevada. The change of domicile, or reincorporation, will be effected by means

of a merger between the Company and a newly formed wholly-owned Nevada subsidiary of the Company in name of JunkieDog.com Inc.,

in which the subsidiary will be the surviving entity. This change of domicile will become effective upon the filing

of articles of merger with the Secretary of State of the states of Texas and Nevada in accordance with applicable state laws.

Reasons for the Change of Domicile

Our board of directors

believes that it is in the best interests of the Company and its shareholders to change our state of incorporation from Texas to

Nevada. One reason for this reincorporation is to reduce the costs of operating the Company over the long term since

the annual taxes and fees charged by the State of Nevada are significantly less than those charged by the State of Texas.

In addition, reincorporation

in Nevada may help us attract and retain qualified management by reducing the risk of lawsuits being filed against the Company

and its directors. We believe that, in general, Nevada law enables us to provide greater protection to our directors

and the Company than Texas Business Organizations Code. The amount of time and money required to respond to these claims

and to defend this type of litigation can be substantial.

Also, Nevada law

allows a company and its officers and directors, if personally sued, to petition the court to order a plaintiff to post a bond

to cover their costs of defense. This motion can be based upon lack of reasonable possibility that the complaint will benefit the

Company or a lack of participation by the individual defendant in the conduct alleged.

Reincorporation

in Nevada will also enable limitation of the personal liability of directors of the Company. Nevada law permits a broader

exclusion of liability of both officers and directors to the Company and its shareholders, providing for an exclusion of all monetary

damages for breach of fiduciary duty unless they arise from acts or omissions which involve intentional misconduct, fraud or a

knowing violation of law. The reincorporation will result in the elimination of any potential liability of an officer

or director for a breach of the duty of loyalty unless arising from intentional misconduct, fraud, or a knowing violation of law. A

copy of the articles of incorporation of the surviving corporation in Nevada may be found as Exhibit B to the Agreement and Plan

of Merger attached to this Information Statement as

Appendix A

.

Effects of the Reincorporation Merger to Change Domicile

In order to effect

the change of domicile described above, the Company will merge with and into its wholly owned Nevada subsidiary, JunkieDog.com,

Inc. (the “Reincorporation Merger”). The Reincorporation Merger will have no impact upon the business of

the Company, its employees or officers. Shareholders who oppose the Reincorporation Merger do not have any dissenters’

or appraisal rights.

Under the Texas Law and the Nevada Law,

when the Reincorporation Merger takes effect:

|

|

•

|

UUWR, a Texas corporation, will merge into JunkieDog.com, Inc., a Nevada corporation and the surviving entity, and the separate existence of UUWR shall cease;

|

|

|

•

|

The surviving corporation will retain the name of “JunkieDog.com, Inc.”

|

|

|

•

|

Unique Underwriters, Inc. will continue be governed by its articles of incorporation and bylaws under Nevada law;

|

|

|

•

|

The surviving corporation will immediately assume title to all property owned by UUWR immediately prior to the Reincorporation Merger; and

|

|

|

•

|

The surviving corporation will assume all of the liabilities of UUWR.

|

The Reincorporation

Merger will be consummated in accordance with the Plan of Merger, attached hereto as

Appendix A

, under which Unique Underwriters,

Inc., a Texas corporation, will merge with and into JunkieDog.com, Inc., a Nevada corporation.

We have summarized the material terms

of the Plan of Merger below.

The Reincorporation Merger will cause:

|

|

•

|

a change in our legal domicile from Texas to Nevada;

|

|

|

•

|

other changes of a legal nature, the material aspects of which are described herein.

|

However, the Reincorporation

Merger by itself will not result in any change in our business, management, location of our principal executive offices, assets,

liabilities or net worth (other than as a result of the costs incident to the Reincorporation Merger, which are immaterial). The

Company anticipates that its common stock will continue to be quoted on the OTC Bulletin Board under a new stock symbol approved

by FINRA.

Summary Term Sheet

|

|

Company:

|

Unique Underwriters, Inc., a Texas corporation initially incorporated in Texas on July 28, 2009 (“Texas Corporation”). The Company is a national, independent, mortgage protection insurance sales and marketing company located in the Dallas, Texas area.

|

|

|

|

|

|

|

|

JunkieDog.com, Inc., a Nevada corporation (“Nevada Corporation”) and wholly-owned subsidiary of the Company that prior to the Reincorporation will not have engaged in any activities except in connection with the Reincorporation.

|

|

|

|

|

|

|

Approval:

|

The Reincorporation and the terms of the Merger Agreement were approved at a meeting of the Board of Directors held on June 9, 2014.

|

|

|

Transaction Structure:

|

To effect the Reincorporation, the Company will merge with and into its subsidiary, the Nevada Corporation, and thereafter the Company will cease to exist as a separate entity. The Nevada Corporation will be the surviving entity.

|

|

|

|

|

|

|

Exchange

of Stock:

|

Each one-hundred (100) shares of common stock of Unique Underwriters, Inc., the Texas Corporation (the “Common Stock”) will automatically be converted into one (1) share of common stock of JunkieDog.com, Inc., a Nevada corporation (the “Nevada Common Stock”) at the effective time of the Reincorporation without any action required by the shareholders. (See “

Action 3 – Reverse Stock Split

”). Upon the effective time of the Reincorporation, the surviving corporation shall assume and continue any and all stock option, stock incentive and other equity-based award plans heretofore adopted by the Texas Corporation (individually, an “Equity Plan” and, collectively, the “Equity Plans”), and shall reserve for issuance under each Equity Plan a number of shares of Nevada Common Stock equal to the number of shares of Common Stock so reserved immediately prior to the effective time of the Reincorporation, as adjusted for the 100-to-1 exchange ratio. Each unexercised option or other right to purchase Common Stock granted under and by virtue of any such Equity Plan which is outstanding immediately prior to the effective time of the Reincorporation shall, upon the effective time of the Reincorporation, become an option or right to purchase Nevada Common Stock on the basis of one (1) share of Nevada Common Stock for each one-hundred (100) shares of Common Stock issuable pursuant to any such option or stock purchase right, with an exercise price appropriately adjusted (i.e. increased by a factor of 100) to reflect the applicable exchange ratio, and otherwise on the same terms and conditions applicable to any such Texas Corporation option or stock purchase right. Each other equity-based award relating to Common Stock granted or awarded under any of the Equity Plans which is outstanding immediately prior to the effective time of the Reincorporation shall, upon the effective time of the Reincorporation, become an award relating to Nevada Common Stock on the basis of one (1) share of Nevada Common Stock for each one-hundred (100) shares of Common Stock to which such award relates and otherwise on the same terms and conditions applicable to such award immediately prior to the effective time of the Reincorporation. Any and all convertible notes outstanding immediately prior to the effective time of the Reincorporation shall be appropriately adjusted such that the applicable conversion price shall reflect the exchange ration of Texas Common Stock to Nevada Common Stock.

|

|

|

|

|

|

|

Purpose:

|

The purpose of the Reincorporation is to change the Company's state of incorporation from Texas to Nevada and is intended to permit the Company to be governed by the Nevada Revised Statutes (“NRS” or “Nevada Law”) rather than by Texas Business Organizations Code.

|

|

|

|

|

|

|

Effective Time:

|

The Reincorporation will become effective on the filing of the Articles of Merger with the Secretary of State of Nevada and the Certificate of Merger with the Secretary of State of Texas. These filings are anticipated to be made as soon as practicable after fulfilling the notice requirements of the Exchange Act and Texas Business Organizations Code.

|

|

|

|

|

|

|

Effect of Merger:

|

At the effective time of the Reincorporation Merger:

|

|

·

|

the Company will cease to exist as a separate entity;

|

|

·

|

the Company will change its corporate name to JunkieDog.com, Inc. (See “Action 2 – Change of Corporate Name), with a new ticker symbol approved by FINRA;

|

|

·

|

the shareholders of the Company will become shareholders of the surviving corporation;

|

|

·

|

the outstanding shares of Common Stock will automatically be converted on a 1-for-100 basis into shares of Nevada Common Stock (See “Action 3 – Reverse Stock Split” below);

|

|

·

|

the surviving corporation shall possess all of the assets, liabilities, rights, privileges, and powers of the Company and the Nevada Corporation;

|

|

·

|

the surviving corporation shall be governed by the applicable laws of Nevada and the Nevada Corporation’s articles of incorporation (the “Nevada Articles”) and Bylaws (the “Nevada Bylaws”) in effect at the effective time of the Reincorporation; a copy of the Nevada Articles may be found as Exhibit B, and a copy of the Nevada Bylaws may be found as Exhibit C, to the Agreement and Plan of Merger attached hereto as

Appendix A

;

|

|

.

|

the officers and directors of the Company will be the officers and directors of the surviving corporation; and

|

|

|

|

|

Tax Consequences:

|

The Reincorporation is intended to qualify as a tax-free reorganization for federal income tax purposes. If the Reincorporation does so qualify, (i) no gain or loss would generally be recognized by the shareholders of the Company upon conversion of shares of Common Stock into shares of Nevada Common Stock, (ii) each former holder of Common Stock will have the same aggregate basis in the Nevada Common Stock received or deemed received by such person pursuant to the Reincorporation as such holder had in the Common Stock held by such person in the pre-Reincorporation shares immediately prior to the consummation of the Reincorporation, and such person's holding period with respect to such Nevada Common Stock will include the period during which such holder held the corresponding Common Stock, provided the latter was held by such person as a capital asset immediately prior to the consummation of the Reincorporation, and (iii) no gain or loss will be recognized by the Company or the Nevada Corporation. State, local or foreign income tax consequences may vary from the federal income tax consequences described above. The Company has not requested a ruling from the Internal Revenue Service, nor an opinion from its outside legal counsel, with respect to the federal income tax consequences of the Reincorporation under the Code, and we cannot assure you that the Internal Revenue Service will conclude that the Reincorporation qualifies as a reorganization under Section 368(a) of the Code.

|

Filing of the Articles of Merger

The Reincorporation

Merger will not be effective until articles of merger are filed with the offices of the Secretary of State for Texas and Nevada,

respectively. This will occur no sooner than thirty (30) days after the mailing of this Information Statement.

Some Implications of the Reincorporation

The Merger Agreement

provides that Unique Underwriters, Inc. will merge with and into JunkieDog.com, Inc., with JunkieDog.com, Inc. being the surviving

corporation. Under the Merger Agreement, JunkieDog.com, Inc. will assume all of Unique Underwriters, Inc.’s assets

and liabilities, and Unique Underwriters, Inc. (the Texas corporation) will cease to exist as a corporate entity. The

surviving corporation will retain the name of “JunkieDog.com, Inc.” The directors of Unique Underwriters,

Inc. (the Texas corporation) will continue as the new directors of the Nevada surviving corporation.

At the effective

time of the Reincorporation Merger, each one-hundred (100) outstanding shares of Unique Underwriters, Inc. common stock, $.001

par value per share, automatically will be converted into one share of common stock of JunkieDog.com, Inc., $0.001 par value per

share. Shareholders may, but will not be required to exchange their existing stock certificates for stock certificates

of JunkieDog.com, Inc. Upon request, we will issue new certificates to any shareholder that holds old Unique Underwriters,

Inc. stock certificates, provided that such holder has surrendered the certificates representing new post-Reincorporation JunkieDog.com,

Inc.’s shares in accordance with the Merger Agreement. Any request for new certificates will be subject to normal

requirements including proper endorsement, signature guarantee and payment of any applicable fees and taxes.

Shareholders whose

shares of common stock were freely tradable before the Reincorporation Merger will own shares of the surviving corporation that

are freely tradable after the Reincorporation Merger. Similarly, any shareholders holding securities with transfer restrictions

before the Reincorporation Merger will hold shares of the surviving corporation that have the same transfer restrictions after

the Reincorporation Merger. For purposes of computing the holding period under Rule 144 of the Securities Act of 1933,

shares issued pursuant to the reincorporation will be deemed to have been acquired on the date the holder thereof originally acquired

Unique Underwriters, Inc.’s shares.

After the reincorporation,

the surviving corporation will continue to be a publicly-held corporation, with its common stock quoted on the OTC Bulletin Board

under a new ticker symbol approved by FINRA. The surviving corporation will also file with the Securities and

Exchange Commission and provide to its shareholders the same types of information that Unique Underwriters, Inc. has previously

filed and provided.

Effective Date of Reincorporation

Merger

Pursuant to Rule

14c-2 under the Exchange Act, the Reincorporation Merger shall not occur until a date at least twenty (20) days after the date

on which this Information Statement has been mailed to shareholders, and further, pursuant to Texas Business Organizations Code,

the Reincorporation Merger shall not occur until at least 30 days after the mailing of this Information Statement to shareholders.

Certain Differences Between the Corporate

Laws of Nevada and Texas

Although it is not

practical to compare all of the differences between (a) Texas Business Organizations Code (“Texas BOC”) and our current

articles of incorporation and bylaws and (b) the Nevada Revised Statutes (“NRS”) and the articles of incorporation

and bylaws of the surviving corporation, the following is a summary of differences which we believe may significantly affect the

rights of shareholders. This summary is not intended to be relied upon as an exhaustive list of all differences or a

complete description of the differences, and is qualified in its entirety by reference to the NRS, the Texas BOC and the forms

of the articles of incorporation and bylaws of the surviving corporation.

Classified Board of Directors

The Texas BOC permits

classification of a corporation’s board of directors into one, two or three classes, with each class composed of as equal

a number of directors as is possible, if provided for in a corporation’s articles of incorporation, in its initial bylaws

or in subsequent bylaws adopted by a vote of the shareholders.

The NRS also permits

corporations to classify boards of directors provided that at least one-fourth of the total number of directors is elected annually.

The articles of

incorporation and bylaws of the current Texas Corporation and surviving Nevada Corporation do not provide for multiple classes

of directors.

Cumulative Voting

Cumulative voting

for directors entitles shareholders to cast a number of votes that is equal to the number of voting shares held multiplied by the

number of directors to be elected. Shareholders may cast all such votes either for one nominee or distribute such votes among up

to as many candidates as there are positions to be filled. Cumulative voting may enable a minority shareholder or group of shareholders

to elect at least one representative to the board of directors where such shareholders would not otherwise be able to elect any

directors.

Under Texas BOC,

cumulative voting is not available unless provided in the corporation’s articles of incorporation. The NRS permits

cumulative voting in the election of directors if provided in the articles of incorporation and as long as certain procedures are

followed. The articles of incorporation of the Texas Corporation and Nevada Corporation do not permit cumulative voting.

Removal of Directors

The Texas BOC provides

that shareholders may remove directors with or without cause at a meeting expressly called for that purpose by a vote of the holders

of a majority of shares entitled to vote at an election of directors, unless the corporation’s articles of incorporation

provide that directors may be removed only for cause. If a director is elected by a voting group, only shareholders of that voting

group may take part in the vote to remove the director. A director may be removed only if the number of votes cast in favor of

removal exceeds the number of votes cast against removal. However, in the event directors are elected by cumulative

voting, directors may not be removed if the number of votes sufficient to elect the director under cumulative voting is voted against

such removal.

Under NRS, a director

of a corporation may be removed with or without cause only with the approval of at least two-thirds of the voting power of the

outstanding shares entitled to vote. In addition, under the NRS, a corporation’s articles of incorporation may

require the concurrence of more than two-thirds of the voting power of the outstanding shares entitled to vote to remove a director

in office.

If a director is

elected by a voting group, only shareholders of that voting group may take part in the vote to remove the director. In

such case, a director of a corporation may be removed with or without cause only with the approval of at least two-thirds of the

voting power of the voting group.

Under NRS, in the

event directors are elected by cumulative voting, any director or directors who constitute fewer than all of the incumbent directors

may not be removed from office except upon the vote of shareholders owning sufficient shares to prevent each director’s election

under cumulative voting.

The Texas Corporation’s

articles of incorporation do not contain a provision stating that directors may only be removed for cause. However, the Texas Corporation’s

bylaws specifically provide that the directors may be removed with or without cause by a vote of two-thirds of the shareholders. Likewise,

the articles of incorporation of the Nevada Corporation do not contain a provision stating directors may only be removed for cause

but the bylaws specifically provide that a director may be removed with or without cause by a vote of two-thirds of the shareholders.

Vacancies on the Board of Directors

Under the Texas

BOC, subject to the rights, if any, of any series of preferred stock to elect directors and to fill vacancies on the board of directors,

vacancies on the board of directors may be filled by the affirmative vote of a majority of the remaining directors then in office,

even if less than a quorum or by the shareholders, unless the articles of incorporation provide otherwise. The Texas Corporation’s

articles of incorporation do not provide otherwise.

Nevada law provides

that vacancies may be filled by a majority of the remaining directors, though less than a quorum, unless the articles of incorporation

provide otherwise. The Nevada Corporation’s articles of incorporation also do not provide otherwise.

Indemnification of Officers and Directors

and Advancement of Expenses

Texas and Nevada

laws have substantially identical provisions regarding indemnification by a corporation of its officers, directors, employees and

agents. Both Texas and Nevada generally permit a corporation to indemnify its officers, directors, employees and agents

against liability, if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests

of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was

unlawful.

Both Texas and Nevada

laws require that to the extent that such officers, directors, employees and agents have been successful in defense of any proceeding,

they shall be indemnified by the corporation against expenses actually and reasonably incurred in connection therewith.

The Texas BOC also

provides that, unless a corporation’s articles of incorporation provide otherwise, if a corporation does not so indemnify

such persons, they may seek, and a court may order, indemnification under certain circumstances even if the board of directors

or shareholders of the corporation have determined that the persons are not entitled to indemnification if it determines that the

director, officer, employee or agent is entitled to mandatory indemnification, or is entitled to indemnification in view of all

the relevant circumstances, regardless of whether such person met the standard of conduct required by Texas BOC. NRS does not have

a comparable provision although Nevada laws provide that a court may order a corporation to provide indemnification to a director,

officer, employee or agent to the extent it deems proper in view of all circumstances.

Texas and Nevada

law differ in their provisions for advancement of expenses incurred by an officer or director in defending a civil or criminal

action, suit or proceeding. The Texas BOC provides that expenses incurred by an officer or director in defending any civil, criminal,

administrative or investigative action, suit or proceeding may be paid by the corporation in advance of the final disposition of

the action, suit or proceeding upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if

it is ultimately determined that he or she is not entitled to be indemnified by the corporation.

Under the NRS, the

articles of incorporation, bylaws or an agreement may provide that the corporation must pay advancements of expenses in advance

of the final disposition of the action, suit or proceedings upon receipt of an undertaking by or on behalf of the director or officer

to repay the amount if it is ultimately determined that he or she is not entitled to be indemnified by the corporation.

The articles of

incorporation and the bylaws of the Texas Corporation and Nevada Corporation do not address the indemnification of officers and

directors and the advancement of expenses.

Limitation on Personal Liability

of Directors

Under Texas BOC,

a director is not personally liable for monetary damages to the corporation, shareholders or any other person for any statement,

vote, decision or failure to act, regarding corporate management or policy, unless (a) the director breached or failed to perform

his duties as a director and (b) such breach or failure constitutes (1) a violation of criminal law, unless the director had reasonable

cause to believe his conduct was lawful or had no reasonable cause to believe his conduct was unlawful, (2) a transaction from

which the director derived an improper personal benefit, (3) a circumstance resulting in an unlawful distribution, (4) in a proceeding

by or in the right of the corporation to procure a judgment in its favor or by or in the right of a shareholder, conscious disregard

for the best interests of the corporation or willful misconduct, or (5) in a proceeding by or in the right of one other than the

corporation or a shareholder, recklessness or an act or omission committed in bad faith or with malicious purpose or in a manner

exhibiting wanton and willful disregard of human rights, safety, or property.

Nevada law has a

similar provision permitting the adoption of provisions in the bylaws limiting personal liability.

The articles of

incorporation and the bylaws of the Texas Corporation and Nevada Corporation do not provide for limiting the liability of directors.

Dividends

Under Texas BOC,

unless otherwise provided in the articles of incorporation, a corporation may pay distributions, including repurchases of stock,

unless after giving effect to the dividend or distribution, the corporation would be unable to pay its debts as they become due

in the usual course of business, or if the total assets of the corporation would be less than the sum of its total liabilities

plus the amount needed, if the corporation were dissolved at the time the distribution was paid, to satisfy the preferential rights

of shareholders whose preferential rights upon dissolution of the corporation are greater than those of the shareholders receiving

the dividend.

The NRS provides

that no distribution (including dividends on, or redemption or repurchases of, shares of capital stock) may be made if, after giving

effect to such distribution, the corporation would not be able to pay its debts as they become due in the usual course of business,

or, except as specifically allowed in the articles of incorporation, the corporation’s total assets would be less than the

sum of its total liabilities plus the amount that would be needed at the time of a liquidation to satisfy the preferential rights

of preferred stockholders.

Under the bylaws

of the Texas Corporation, dividends may be paid out of any funds available determined by the board, without consideration to the

corporation’s shareholders. Under the bylaws of the Nevada Corporation, no dividends may be made if, after giving

effect to such distribution, the corporation would not be able to pay its debts as they become due in the usual course of business,

or, except as specifically allowed in the articles of incorporation, the corporation’s total assets would be less than the

sum of its total liabilities plus the amount that would be needed at the time of a liquidation to satisfy the preferential rights

of preferred stockholders.

Amendment to Articles of Incorporation

The Texas BOC and

the NRS require the approval of the holders of a majority of all outstanding shares entitled to vote, with each shareholder being

entitled to one vote for each share so held, to approve proposed amendments to a corporation’s articles of incorporation,

unless the articles of incorporation or the bylaws provide for different proportions. Neither the articles of incorporation or

bylaws of Texas Corporation and Nevada Corporation provide for different proportions.

Neither state requires

shareholder approval for the board of directors of a corporation to fix the voting powers, designations, preferences, limitations,

restrictions and rights of a class of stock, prior to issuance, provided that the corporation’s organizational documents

grant such power to its board of directors.

The holders of the

outstanding shares of a particular class are entitled to vote as a class on a proposed amendment if the amendment would alter or

change the power, preferences or special rights of one or more series of any class so as to affect them adversely.

Special Meetings of Shareholders

The Texas BOC permits

special meetings of shareholders to be called by the board of directors or by any other person authorized in the articles of incorporation

or bylaws to call a special shareholder meeting or by written request by the holders of not less than ten percent of all shares

entitled to vote (unless a greater percentage, not to exceed 50%, is specified in the articles of incorporation). Nevada law does

not address the manner in which special meetings of shareholders may be called.

The current bylaws

of the Texas Corporation provide that a special meeting of shareholders may be called by the Board of Directors or such persons

authorized by the Board of Directors. The bylaws of the Nevada Corporation provide that a special meeting of the shareholders

may be called by entire Board of Directors, any two directors or the president.

Actions by Written Consent of Shareholders

Both Texas law and

Nevada law provide that, unless the articles of incorporation provide otherwise, any action required or permitted to be taken at

a meeting of the shareholders may be taken without a meeting if the holders of outstanding stock, having at least the minimum number

of votes that would be necessary to authorize or take such action at a meeting, consent to the action in writing. Additionally,

the Texas BOC requires the corporation to give notice within ten days of the taking of corporate action without a meeting by less

than unanimous written consent to those shareholders who did not consent in writing.

The articles of

incorporation and bylaws of the Texas Corporation and Nevada Corporation both state that any action may be taken without a meeting

if written consents are signed by a majority of the shareholders of the corporation.

Shareholder Inspection Rights

Under the Texas

BOC, a shareholder is entitled to inspect and copy the articles of incorporation, bylaws, certain board and shareholders resolutions,

certain written communications to shareholders, a list of the names and business addresses of the corporation’s directors

and officers, and the corporation’s most recent annual report during regular business hours only if the shareholder gives

at least five business days’ prior written notice to the corporation. In addition, a shareholder of a Texas corporation

is entitled to inspect and copy other books and records of the corporation during regular business hours only if the shareholder

gives as least five business days’ prior written notice to the corporation and (a) the shareholder’s demand is made

in good faith and for a proper purpose, (b) the demand describes with particularity its purpose and the records to be inspected

or copied and (c) the requested records are directly connected with such purpose. The Texas BOC also provides that a corporation

may deny any demand for inspection if the demand was made for an improper purpose or if the demanding shareholder has, within two

years preceding such demand, sold or offered for sale any list of shareholders of the corporation or any other corporation, has

aided or abetted any person in procuring a list of shareholders for such purpose or has improperly used any information secured

through any prior examination of the records of the corporation or any other corporation.

Under the NRS, any

person who has been a shareholder of record for at least six months preceding his demand or any person holding or authorized in

writing by the holders of at least 5% of all outstanding shares in order to have the right to inspect the corporation’s stock

ledger upon proper notice. In addition, Nevada law provides the right to inspect the corporation’s financial records for

a shareholder who owns at least 15% of the corporation’s issued and outstanding shares, or has been authorized in writing

by the holder(s) of at least 15% of the issued and outstanding shares. This financial record inspection right does not apply to

any corporation that furnishes its shareholders a detailed annual financial statement. Nor does it apply to any corporation that

is listed and traded on any recognized stock exchange.

The articles of

incorporation and bylaws of the Texas Corporation and Nevada Corporation do not address shareholder inspection rights.

Dissolution

Under Texas BOC,

the board of directors of a corporation may submit a proposal of voluntary dissolution to the shareholders. The board of directors

must recommend dissolution to the shareholders as part of the dissolution proposal, unless the board of directors determines that

because of a conflict of interest or other special circumstances, it should make no recommendation and communicates the basis for

its determination to the shareholders. The board of directors may condition the dissolution proposal on any basis. The shareholders

must then approve the voluntary dissolution proposal by a majority vote of all votes entitled to be cast on that proposal, unless

the articles of incorporation, bylaws adopted by the shareholders or the board of directors in making the dissolution proposal

require a greater vote.

Alternatively, Texas

BOC also provides that shareholders, without any action on the part of the board of directors, may decide to dissolve a corporation

by written consent. In this case, the action must be approved by a majority vote of all votes entitled to be cast on that proposal.

Within 10 days of obtaining the written consent of the shareholders, the corporation must notify all other shareholders who did

not so consent concerning the nature of the action authorized. This notice is required to be sent to shareholders regardless of

whether or not they were entitled to vote on the action.

Similarly, under

Nevada law, a board of directors may adopt a resolution that the corporation be dissolved. The directors must recommend the dissolution

proposal to the shareholders. The corporation must notify each shareholder entitled to vote on the dissolution proposal and the

shareholders entitled to vote must approve the dissolution by a majority vote, unless the articles of incorporation or bylaws requires

a greater percentage.

Neither the Texas

Corporation’s articles of incorporation nor the articles of incorporation of Nevada Corporation contain a provision requiring

a greater percentage than a majority to approve a dissolution.

Shareholder Vote for Mergers and Other Corporate Reorganizations

In general, both

Texas law and Nevada law provide that mergers, share exchanges or a sale of substantially all of the assets of the corporation

other than in the usual and regular course of business, must be approved by a majority vote of each voting group of shares entitled

to vote on such transaction. However, under both Texas law and Nevada law, the articles of incorporation or the board of directors

recommending the transaction may require a greater affirmative vote.

Neither the Texas

Corporation’s articles of incorporation nor the articles of incorporation of the Nevada Corporation require a greater affirmative

vote.

Merger with Subsidiary

Under the NRS, a

parent corporation may merge with its subsidiary, without shareholder approval, where the parent corporation owns at least 90%

of the outstanding shares of each class of capital stock of its subsidiary and will be the surviving entity. The Texas

BOC allows a merger with a subsidiary without shareholder approval if the parent owns 80% of each class of capital stock of the

subsidiary and there is no material change to the articles of incorporation of the parent company as they existed before the merger.

The articles of

incorporation and bylaws of the Texas Corporation and Nevada Corporation do not address the issue of merger with a subsidiary.

Affiliated Transactions

Both Texas law and

Nevada law contain provisions restricting the ability of a corporation to engage in business combinations with an interested shareholder.

The Texas BOC provides

that an “affiliated transaction” with an “interested shareholder” must generally be approved by the affirmative

vote of the holders of two-thirds of the voting shares, other than the shares owned by the interested shareholder. An interested

shareholder is any person who is the beneficial owner of more than 10% of the outstanding voting stock of the corporation. The

transactions covered by the statute include, with certain exceptions, (a) mergers and consolidations to which the corporation and

the interested shareholder are parties, (b) sales or other dispositions of substantial amounts of the corporation’s assets

to the interested shareholder, (c) issuances by the corporation of substantial amounts of its securities to the interested shareholder,

(d) the adoption of any plan for the liquidation or dissolution of the corporation proposed by or pursuant to an arrangement with

the interested shareholder, (e) any reclassification of the corporation’s securities that has the effect of substantially

increasing the percentage of outstanding voting shares of the corporation beneficially owned by the interested shareholder, and

(f) the receipt by the interested shareholder of certain loans or other financial assistance from the corporation.

Under Texas BOC,

the two-thirds approval requirement does not apply if, among other things: (a) the transaction has been approved by a majority

of the corporation’s disinterested directors (as defined in the statute), (b) the interested shareholder has been the beneficial

owner of at least 80% of the corporation’s outstanding voting shares for at least five years preceding the transaction, (c)

the interested shareholder is the beneficial owner of at least 90% of the outstanding voting shares, (d) the corporation has not

had more than 300 shareholders of record at any time during the preceding three years, (e) the corporation is an investment

company under the Investment Company Act of 1940, or (f) certain fair price and procedural requirements are satisfied.

Texas BOC permits

a corporation to elect out of provisions imposing restrictions on affiliate transactions.

The NRS applies

solely to domestic corporations with 200 or more shareholders when at least 100 shareholders are residents of Nevada, unless the

articles of incorporation of the corporation provides otherwise. The NRS provides that an “affiliated transaction”

with an “interested shareholder” that occurs within three years after an interested shareholder acquires shares must

generally have been approved by the board of directors of the corporation prior to the acquisition of shares by the interested

shareholder.

Under Nevada law,

an affiliated transaction with an interested shareholder that occurs after the expiration of three years after an interested shareholder

acquires shares must generally be either approved by the affirmative vote of the holders of a majority of the voting shares, other

than the shares owned by the interested shareholder, or by the board of directors of the corporation prior to the acquisition of

shares by the interested shareholder, unless the consideration received by the shareholders meets certain fair value requirements. The

definition of “affiliated transaction” and interested shareholder” are substantially the same as under Texas

BOC.

A Nevada corporation

may also opt-out of the provisions imposing restrictions on affiliate transactions.

The articles of

incorporation of the Texas Corporation do not contain a clause electing not to be governed by the affiliate transaction provisions

of the Texas BOC. The articles of incorporation of the Nevada Corporation do not contain a clause electing not to be governed by

the affiliate transaction provisions of the Nevada law.

Control-Share Acquisitions

Both Texas and Nevada

law contain provisions that are intended to benefit companies that are the object of takeover attempts and their shareholders.

The Texas BOC applies to Texas corporations that have (1) 100 or more shareholders, (2) its principal place of business, its principal

office or substantial assets in Texas, and (3) either (a) more than 10% of its shareholders reside in Texas, (b) more than 10%

of its shares are owned by residents of Texas, or (c) 1,000 of its shareholders reside in Texas. Shares held by banks (except as

trustee or guardian), brokers, or nominees are disregarded for purposes of calculating the percentage or number of residents.

The Texas BOC’s

control share acquisition statute provides that a person who acquires shares in an issuing public corporation in excess of certain

specified thresholds will generally not have any voting rights with respect to such shares unless such voting rights are approved

by a majority of the shares entitled to vote, excluding the interested shares. The thresholds specified in the FBCA are the acquisition

of a number of shares representing: (a) 20% or more, but less than 33% of the voting power of the corporation, (b) 33% or more

but less than a majority of the voting power of the corporation, or (c) a majority or more of the voting power of the corporation.

This statute does not apply if, among other things, the acquisition is (a) approved by the corporation’s board of directors

before the acquisition, (b) pursuant to a pledge or other security interest created in good faith and not for the purpose of circumventing

the statute, (c) pursuant to the laws of intestate succession or pursuant to gift or testamentary transfer, or (d) pursuant to

a statutory merger or share exchange to which the corporation is a party. This statute also permits a corporation to adopt a provision

in its articles of incorporation or bylaws providing for the redemption by the corporation of such acquired shares in certain circumstances.

Unless otherwise provided in the corporation’s articles of incorporation or bylaws prior to the pertinent acquisition of

shares, in the event that such shares are accorded full voting rights by the shareholders of the corporation and the acquiring

shareholder acquires a majority of the voting power of the corporation, all shareholders who did not vote in favor of according

voting rights to such acquired shares are entitled to dissenters’ rights.

Nevada’s control-share

acquisition statutes prohibit an acquirer, under certain circumstances, from voting shares of a target corporation’s stock

after crossing certain threshold ownership percentages unless the acquirer obtains the approval of the target corporation’s

shareholders. This statute is designed to prevent any party from obtaining control of the voting rights of a corporation without

approval of the shareholders of the corporation.

The Nevada statute

applies solely to domestic corporations that do business in Nevada directly or through an affiliated corporation and the corporation

has 200 or more shareholders when at least 100 shareholders are residents of Nevada.

Under the Nevada

statute, any person (“Acquiring Person”) who acquires shares of any public corporation in excess of 20% will not be

permitted to vote those shares or any other shares acquired within 90 days or acquired pursuant to a plan to make a control-share

acquisition unless the remaining shareholders vote to enfranchise the control-shares. The issue of voting rights for the Acquiring

Person’s control-shares must be submitted to a shareholder vote, if requested by the Acquiring Person, at a special meeting

to be held within 50 days of the request, provided the Acquiring Person delivers a statement with prescribed disclosures at the

time of the request and undertakes to pay the cost of the special meeting.

If the measure is

approved, all shareholders are entitled to dissenters’ rights based on the highest price paid for the control-shares by the

Acquiring Person unless otherwise provided in the corporation’s articles of incorporation or bylaws. Moreover, if so provided

in the articles of incorporation or bylaws, if the measure is not approved, or if the Acquiring Person elects not to deliver a

disclosure statement to the issuing public corporation within 10 days after the last acquisition of control-shares by the Acquiring

Person, the corporation has the right to acquire the control-shares for “fair value.” A corporation who does not desire

to be bound by the Nevada control-share acquisition statutes, may opt out of them if its articles of incorporation or bylaws as

in effect on the tenth day following the acquisition of a controlling interest state that the sections do not apply. Neither

the articles of incorporation of the Texas Corporation or Nevada Corporation contain provisions opting out of this provision.

Dissenters’ Rights

Appraisal rights

permit dissenting shareholders of a corporation engaged in certain major corporate transactions to receive cash.

Under Texas BOC,

dissenting shareholders who follow prescribed statutory provisions, are, in certain circumstances, entitled to appraisal rights

in the event of (a) the consummation of a plan of merger or consolidation; (b) the consummation of a sale or exchange of all of

substantially all the assets of a corporation other than in the usual and regular course of business; (c) amendments to the articles

of incorporation if the shareholder is entitled to vote on the amendment and if such amendment would adversely affect the rights

of preferences of shareholders; (d) consummation of a plan of share exchange to which the corporation is a party as the corporation,

the shares of which will be acquired, if the shareholder is entitled to vote on the plan; (e) the approval of a control-share acquisition

pursuant to Texas BOC; and (f) any corporate action taken, to the extent the articles of incorporation provide that a voting or

nonvoting shareholder is entitled to dissent and obtain payment for his shares.

Under Texas BOC,

unless the articles of incorporation provide otherwise, no appraisal rights are available for the shares of any class or series

of stock, which, at the record date for the meeting held to approve such transaction, were either (1) listed on a national securities

exchange or designated as a national market system security on an interdealer quotation system by the National Association of Securities

Dealers, Inc. (“NASD”) or (2) held of record by more than 2,000 shareholders. The Texas Corporation’s

articles of incorporation do not provide otherwise.

Under Nevada law,

shareholders are entitled to dissenters’ rights in the event of (a) a merger in which the shareholder is entitled to vote

or if the corporation is a subsidiary that is merged with its parent; (b) consummation of a plan of share exchange to which the

corporation is a party as the corporation shares of which will be acquired, if the shareholder is entitled to vote on the plan;

and (c) any corporate action taken pursuant to a vote of the shareholders that the articles of incorporation, by laws or a resolution

of the board of directors provided that voting or non-voting shareholders are entitled to dissent and obtain payment for their

shares.

Under Nevada law,

unless provided in the articles of incorporation or certain other conditions are met, no appraisal rights are available for the

shares of any class or series of stock, which, at the record date for the meeting to approve such transaction, were either listed

on a national securities exchange, included in the National Market System by the NASD or held of record by more than 2,000 shareholders. The

Nevada Corporation’s articles of incorporation do not provide otherwise.

Federal Income Tax Consequences of

the Reincorporation

The Reincorporation

of the Texas Corporation pursuant to the Merger Agreement will be a tax-free reorganization under the Internal Revenue Code of

1986, as amended. Accordingly, a holder of the common stock (a “Holder”) will not recognize gain or loss

in respect of Holder’s common stock as a result of the Reincorporation. The Holder’s basis in a share of

the Nevada Corporation will be the same as Holder’s basis in the corresponding share of the Texas Corporation held immediately

prior to the Reincorporation. The Holder’s holding period in a share of the Nevada Corporation will include the

period during which Holder held the corresponding share of the Texas Corporation, provided the Holder held the corresponding share

as a capital asset at the time of the Reincorporation. In addition, neither the Texas Corporation nor the Nevada Corporation

will recognize gain or loss as a result of the Reincorporation, and the Nevada Corporation will generally succeed, without adjustment,

to the tax attributes of the Texas Corporation.

The Texas Corporation

has not requested a ruling from the Internal Revenue Service (the “IRS”) or an opinion of counsel with respect to the

federal income tax consequences of the Reincorporation under the Internal Revenue Code. A successful IRS challenge to

the reorganization status of the Reincorporation would result in a shareholder recognizing gain or loss with respect to each share

of the Texas Corporation’s common stock exchanged in the Reincorporation equal to the difference between the shareholder’s

basis in such shares and the fair market value, as of the time of the Reincorporation, of the shares of the Nevada Corporation

common stock received in exchange therefor. In such event, a shareholder’s aggregate basis in the shares of the

Nevada Corporation common stock received in the exchange would equal their fair market value on such date, and the shareholder’s

holding period for such shares would not include the period during which the shareholder held shares of the Texas Corporation’s

Common Stock.

State, local, or

foreign income tax consequences to shareholders may vary from the federal tax consequences described above. Shareholders

should consult their own tax advisors as to the effect of the Reincorporation under applicable federal, state, local, or foreign

income tax laws.

Accounting Treatment

The transaction

is expected to be accounted for as a reverse acquisition in which the Company is the accounting acquirer and the Nevada Corporation

is the legal acquirer. The management of the Company will be the management of the surviving corporation. Because

the Reincorporation is expected to be accounted for as a reverse acquisition and not a business combination, no goodwill is expected

to be recorded in connection therewith and the costs incurred in connection with the Reincorporation are expected to be accounted

for as a reduction of additional paid-in capital.

Regulatory Approvals

The Company does

not expect the Reincorporation to occur until it has all required consents of governmental authorities, including the filing of

articles of merger with the Secretary of State of the States of Nevada and Texas.

Securities Act Consequences

Pursuant to Rule

145(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”), a merger which has the sole purpose

of changing an issuer’s domicile within the United States does not involve a sale of securities for the purposes of the Securities

Act. Accordingly, separate registration of shares of common stock of Nevada Corporation will not be required.

Operations Following the Reincorporation

The surviving corporation is expected

to continue the business of the Company, and the Reincorporation will have no effect on operations.

Abandonment of the Reincorporation

The board of directors will have the

right to abandon the merger agreement and Reincorporation, and take no further action towards reincorporating us in Nevada at any

time before the effective date if for any reason the board determines that it is not advisable to proceed with the Reincorporation.

ACTION 2 – CHANGE OF CORPORATE

NAME

On June 9, 2014,

UUWR’s Board of Directors approved and recommended a change in corporate name to “JunkieDog.com, Inc.”, referred

to as “Name Change Proposal”. Since it was contemplated that the Name Change Proposal would occur simultaneously with

the Reincorporation, management determined that the objective and substantive effect of the Name Change Proposal would be accomplished

under and pursuant to the Merger Agreement, which would feature that Unique Underwriters, Inc. would merge with and into JunkieDog.com,

Inc., with JunkieDog.com, Inc. being the surviving corporation. The surviving corporation will retain the name of “JunkieDog.com,

Inc.”.

The Company believes

that the name change would be in the best interest of the Company because we feel that changing the name of the Company would more

accurately describe the Company’s business after the changes in control. The Company is an online e-commerce company that

specializes in importing, product sourcing, and global distribution of various products ranging from consumer electronics to department

store merchandise. The company has agreements and relationships overseas with manufacturers and in the U.S. with many major,

big box retailers that enable the company to have strong competitive advantages over its competitors. The Company offers

various products and distributes across multiple distribution channels including but not limited to, retail e-commerce, wholesale,

liquidation, and bulk sales of liquidated merchandise.

The board of directors

feels the name change is a relatively simple corporate action that demonstrates our good faith commitment to accurately describe

our current business. The Company will obtain a new CUSIP number for the Common Stock at the time of the name change. The Company

will also change its stock symbol on the Over the Counter Bulletin Board. This Name Change Proposal will become effective upon

the filing of articles of merger with the Secretary of State of the states of Texas and Nevada in accordance with applicable state

laws.

ACTION 3 – REVERSE STOCK SPLIT

Reverse Split Proposal

On June 9, 2014,

UUWR’s Board of Directors approved and recommended a combination of the shares of common stock of UUWR, such that every one-hundred

(100) shares of common stock $.001 par value would be combined into one (1) share of common stock. In the proposed share

combination, referred to as a reverse stock split or “Reverse Split”, the par value of Common Stock will not change. All

the fractional shares resulting from the combination will be rounded up to the nearest whole share. With the exception of adjustments

for those shareholders with fractional shares, the reverse stock split will not affect any shareholder’s proportional equity

interest in the company in relation to other shareholders or rights, preferences, privileges or priorities. Since it

was contemplated that the reverse stock split would occur simultaneously with the Reincorporation, management determined that the

objective and substantive effect of the reverse stock split would be accomplished under and pursuant to the Merger Agreement, which

would feature an exchange ratio in which every one-hundred (100) shares of Texas Corporation common stock will be converted into

one (1) share of Nevada Corporation common stock. For purposes of the following discussion, the transaction contemplated

under the Merger Agreement, which includes the Reincorporation, the Corporate Name Change and the Reverse Split, is sometimes referred

to as the “Transaction”.

Reasons for the Reverse Split Proposal

The reverse stock split will decrease

the number of shares of Common Stock and increase the per share market price for the Common Stock. The precise effect

of the reverse stock split upon the market price for its Common Stock cannot be predicted. There can be no assurance

that the market price per share of UUWR’s Common Stock after the reverse stock split will rise in proportion to the reduction

in the number of shares of its Common Stock outstanding resulting from the reverse stock split. The market price of

UUWR’s Common Stock may also be based on its performance and other factors, some of which may be unrelated to the number

of shares outstanding. There are currently no immediate plans to issue additional shares of Common Stock available as a result

of the reverse stock split.

Effect of Reverse Split

The principal effects of the reverse

split will be as follows:

Based upon 77,565,608 shares of Common

Stock outstanding on June 9, 2014, the reverse split would decrease the outstanding shares of Common Stock by approximately 99%

or to 775,657 shares of Common Stock issued and outstanding. Further, any outstanding options, warrants and rights to purchase

Common Stock as of the effective date that are subject to adjustment will be decreased accordingly.

UUWR will obtain a new CUSIP number

for the Common Stock at the time of the reverse split. Following the effectiveness of the reverse split, every one-hundred (100)

shares of Texas Corporation common stock presently outstanding, without any action on the part of the shareholder, will represent

one (1) share of Nevada Corporation common stock.

As a result of the reverse stock split,

some shareholders may own less than 100 shares of Common Stock. A purchase or sale of less than 100 shares, known as

an “odd lot” transaction, may result in incrementally higher trading costs through certain brokers, particularly “full

service” brokers. Therefore, those shareholders who own less than 100 shares following the reverse stock split

may be required to pay higher transaction costs if they sell their shares.

Exchange of Certificates and Elimination

of Fractional Share Interests

On the effective date of the Transaction,

and pursuant to the Merger Agreement, one-hundred (100) shares of Texas Corporation common stock will automatically be combined

and changed into one (1) share of Nevada Corporation common stock. No additional action on our part or any shareholder

will be required in order to affect the Transaction. Shareholders will be requested to exchange their certificates representing

shares of Common Stock held prior to the Transaction for new certificates representing shares of Common Stock. Shareholders

will be furnished with the necessary materials and instructions to affect such exchange promptly following the effective date of

the Transaction. Shareholders should not submit any certificates until requested to do so. In the event any

certificate representing shares of Common Stock outstanding prior to the Transaction are not presented for exchange upon request

by the Company, any dividends that may be declared after the date of the Transaction with respect to the Common Stock represented

by such certificate will be withheld by the Company until such certificate has been properly presented for exchange. At

such time, all such withheld dividends which have not yet been paid to a public official pursuant to relevant abandoned property

laws will be paid to the holder thereof or his designee, without interest.

No fractional shares of post-Transaction

Common Stock will be issued to any shareholder. All the fractional shares will be rounded up to the nearest whole share. In lieu

of any such fractional share interest, each holder of pre-Transaction Common Stock who would otherwise be entitled to receive a

fractional share of post-Transaction Common Stock will in lieu thereof receive one full share upon surrender of certificates formerly

representing pre-Transaction Common Stock held by such holder.

GENERAL INFORMATION REGARDING THE

COMPANY, THE PROPOSALS

AND SHAREHOLDER ACTION

No Time, Place or Date for Meeting

of Shareholders

There WILL NOT be

a meeting of the shareholders and none is required under applicable Texas BOC when an action has been approved by written consent

by holders of a majority of the outstanding shares of our Common Stock. This Information Statement is first being mailed

on or about June 27, 2014 to the holders of Common Stock as of the Record Date of June 9, 2014.

Dissenters’ Rights

UUWR is distributing

this Information Statement to its shareholders in full satisfaction of any notice requirements it may have under the Securities

and Exchange Act of 1934, as amended, and the Texas BOC. No dissenters’ rights under the Texas BOC are afforded

to the Company’s shareholders in connection with the actions described in this Information Statement.

Voting Securities and Principal Shareholders

Approving the Actions

On June 9, 2014,

our Board of Directors approved the proposals to amend our corporate charter to authorize reincorporation into Nevada with the

new corporate name as “JunkieDog.com, Inc.”, in addition to a share combination or reverse split of our common stock

such that every one-hundred shares of pre-Transaction common stock would be converted into one share of post-Transaction common

stock. Action 1 (Change of Domicile), Action 2 (Change of Corporate Name) and Action 3 (Reverse Stock Split) were also

approved by the written consent of the holder of a majority of all shares outstanding and entitled to vote on the Record Date. The

actual affirmative vote was 78.6% of all shares of common stock issued and outstanding.

The proposals are

effective upon compliance with the requirements of Section 14(c), and the mailing or delivery of a definitive Information Statement

to shareholders at least 20 days prior to the date that this corporate action may take place.

Voting Securities of the Company

As of June 9, 2014

(the “Record Date”), UUWR had 77,565,608 shares of Common Stock issued and outstanding out of 1,000,000,000 authorized

shares of Common Stock. We also had 100,000,000 shares of Class A preferred stock and 50,000,000 shares of Class B preferred

stock authorized, with no preferred shares issued and outstanding.

Only holders of

record of the Common Stock at the close of business on the Record Date were entitled to participate in the written consent of our

shareholders. Each share of Common Stock was entitled to one vote.

Security Ownership of Certain Beneficial

Owners and Management

The classes of equity

securities of UUWR issued and outstanding are Common Stock, $.001 par value, Class A Preferred Stock, $.001 par value and Class

B Preferred Stock, $.001 par value. The table on the following page sets forth, as of the Record Date, certain information with

respect to the Common Stock and Preferred Stock beneficially owned by (i) each Director, nominee and executive officer of UUWR;

(ii) each person who owns beneficially more than 5% of the Common Stock; and (iii) all Directors, nominees and executive officers

as a group. The percentage of shares beneficially owned is based on there having been 77,565,608 shares of Common Stock outstanding

and zero shares of Preferred Stock as of the Record Date.

|

Name and Address of

Beneficial Owner

|

|

Common Stock

Beneficially Owned[1]

|

|

Percent

of Class

|

|

Roberto Luciano

121 North Commercial Drive

Mooresville, NC 28115

|

|

|

30,500,000

|

|

|

|

39.3

|

%

|

|

Bennie Manion

121 North Commercial Drive

Mooresville, NC 28115

|

|

|

30,500,000

|

|

|

|

39.3

|

%

|

|

All officers and directors as a group

(2 persons)

|

|

|

61,000,000

|

|

|

|

78.6

|

%

|

|

|

|

|

|

|

|

|

|

|

|

[1]

|

Based on 77,565,608 issued and outstanding shares of common stock.

|

|

|

|

Recent Changes of Control

Effective as of

March 14, 2014, Samuel Wolfe, the Company’s former chief executive officer president and director executed a Share Purchase

Agreement with Roberto Luciano, the Company’s newly appointed chief executive office, president, secretary, treasurer and

director, whereby Mr. Wolfe sold to Mr. Luciano 30,500,000 shares of the Company’s common stock in consideration for payment

of $5,000. Mr. Wolfe retained ownership of 2,000,000 shares of the Company’s common stock.

The purchase of

the 30,500,000 shares of the Company’s common stock represents approximately 39.3% of the Company’s issued and outstanding

shares of common stock.

A copy of the Share

Purchase Agreement was attached as Exhibit 10.1 of Form 8-K previously filed with SEC on April 8, 2014.

Effective as of

March 14, 2014, Ralph Simpson, the Company’s former chief financial officer, Chairman and director executed a Share Purchase

Agreement with Bennie Manion, the Company’s newly appointed chief operating office, vice president and director, whereby

Mr. Simpson sold to Mr. Manion 30,500,000 shares of the Company’s common stock in consideration for payment of $5,000. Mr.

Simpson retained ownership of 2,000,000 shares of the Company’s common stock.

The purchase of

the 30,500,000 shares of the Company’s common stock represents approximately 39.3% of the Company’s issued and outstanding

shares of common stock.

A copy of the Share

Purchase Agreement was attached as Exhibit 10.2 of Form 8-K previously filed with SEC on April 8, 2014.

For further information

about our prior change of control, please refer to UUWR’s reports filed with the Securities and Exchange Commission.

Amendment of Charter, Bylaws or Other

Documents

Reference is made

to the section entitled “Effects of the Reincorporation Merger to Change Domicile” in this Item 1 above. The

copy of the articles of incorporation of the Nevada Corporation may be found as Exhibit B to the Agreement and Plan of Merger included

with this Information Statement as

Appendix A

. The copy of the bylaws of the Nevada Corporation may be found

as Exhibit C to the Agreement and Plan of Merger included with this Information Statement as

Appendix A

.

ITEM 2. STATEMENTS

THAT PROXIES ARE NOT SOLICITED.

WE ARE NOT ASKING FOR A PROXY AND

SHAREHOLDERS ARE NOT REQUESTED TO SEND US A PROXY.

ITEM 3. INTEREST

OF CERTAIN PERSONS.

Reference is made