UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October

11, 2013

Health Discovery Corporation

(Exact name of registrant as specified in charter)

| Georgia |

333-62216 |

74-3002154 |

| (State of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

4243 Dunwoody Club Drive, Suite 202, Atlanta

GA 30350

(Address of principal executive offices / Zip

Code)

(678) 336-5300

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o |

Written communications pursuant to Rule 425 under the Securities Act. |

| |

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act. |

| |

o |

Pre-commencement communications pursuant to Rule 14d—2(b) under the Exchange Act. |

| |

o |

Pre-commencement communications pursuant to Rule 13e—4(c) under the Exchange Act. |

| ITEM 5.02 |

Departure of Directors or Certain Officers. |

On Friday,

October 11, 2013, Health Discovery Corporation (the “Company”) held a duly called meeting of the Board of Directors

(the “Board”). In attendance were Kevin Kowbel, Chairman, Henry Kaplan, John Norris, William Quirk, and Eric

Winger; absent were Sumio Takeichi and Norman Mineta. The primary agenda item was to confirm who served on the Board,

since Messrs. Takeichi and Mineta had presented obtuse statements or behavior, or failed to present clarifying statements or behavior,

upon which the Company could rely with certainty.

Specifically,

on August 2, 2013, Mr. Takeichi verbally indicated his disappointment with the termination of his friend Mr. Norris’

employment. Additionally, he gave a verbal indication that he may not want to serve as a Director, but his language was

unclear. The Company immediately sought to confirm his resignation in writing. After numerous attempts to contact

Mr. Takeichi, who lives in Japan, the Company never received a response. Additionally, Mr. Norris indicated in several

hostile emails following the August 2, 2013, Board meeting at which he was dismissed as CEO, that Mr. Mineta would

“surely resign” from the Board. Again, in an attempt to confirm Mr. Mineta’s intent and to ascertain

whether Mr. Norris’ representations were correct, the Company tried to contact Mr. Mineta via numerous emails and

phone calls. However, Mr. Mineta never responded and was utterly silent, as he has been since his appointment to the Board

in May 2013.

At the October 11, 2013 Board meeting,

Mr. Norris represented himself to be the legally authorized proxy for both Messrs. Takeichi and Mineta. The Board delayed

the start of the meeting so Mr. Norris could contact them and encourage them to dial in to the Board meeting. Mr. Norris

was unsuccessful. He then stated that Mr. Takeichi “voted with his feet” by not attending the meeting, and

therefore the Board should consider Mr. Takeichi's resignation effective as of August 2, 2013, which the Board then accepted.

Mr.

Norris' friend Mr. Mineta accepted an appointment to the Board on May 10, 2013 and then was elected as a director at

the Annual Shareholder Meeting on July 25, 2013, which Mr. Mineta did not attend. In fact, Mr. Mineta has never

attended any Board meeting and has failed to respond to numerous attempts to communicate with him.

At the Friday, October

11, 2013, Board meeting, Mr. Norris was invited to resign as a director. Mr. Norris equivocated and said he would respond by the

end of business that day but he did not despite many attempts by Mr. Kowbel to reach him. Then on Monday, October 14,

2013, Mr. Norris emailed to Mr. Kowbel what he called a “joint resignation letter” from himself and Messrs. Takeichi

and Mineta. Mr. Mineta had only once communicated with the Company in any way, much less that he had resigned from the Board and

so, based on Mr. Norris’ representations that he was Mr. Mineta's proxy, the Board accepted all the resignations.

In this

joint resignation letter, attached as Exhibit 99.1, Messrs. Norris, Mineta and Takeichi make factually incorrect statements

and utterly unsubstantiated assertions about the Company and its current directors. However, while Mr. Norris’

attack on the current Board members is shocking since he personally recruited, interviewed, and voted to approve the nomination

or appointment of each individual, it is not surprising since his condemnation of and accusations against those very same persons

started the day he was terminated and has continued until now.

The Company is also

surprised by the assertion that Joseph McKenzie, D.V.M., the former Chairman of the Board, "is

a signatory to the SEC Complaint, resigned from the Board earlier for other reasons, and strongly supports our decision to jointly

resign in protest.” The Company has no knowledge of any SEC complaint, or any basis for a complaint. It should

also be noted that Dr. McKenzie never resigned from the Board; in fact, he chose not to stand for election and therefore his

term as a director simply expired on July 25, 2013, without any resignation.

Ever since the Board

terminated Mr. Norris as CEO, and allowed Mr. Robert Kelly’s consultant’s agreement to be non-renewed, the Company

has been on the receiving end of several coordinated, hostile and threatening emails from each of these individuals. See

Section ITEM 8.01 below for more information on Mr. Kelly’s “claims” against the Company.

To put

things into some context, during Mr. Norris’ 8-month tenure as Chief Executive Officer from December 18, 2012 to August

2, 2013, he was paid over $200,000, granted 1,000,000 shares of Company common stock at no cost to Mr. Norris, and was awarded

16,500,000 options that potentially represented over 5% of the ownership of the Company's stock. Furthermore, the day

after the Shareholders Meeting, Mr. Norris demanded lucrative long-term employment contracts both for himself and for

Mr. Kelly, which the Board declined to grant.

Following

his dismissal a week later, the Company had only approximately $871,000 in cash equivalents (based on the value of stock held in

NeoGenomics, Inc.) and zero new prospects for near-term revenue from any of the extremely large companies he was pursuing.

Mr. Norris began with the Company in September 2009 with the specific task of generating revenue in the health field; however in

the 40 months before Dr. McKenzie named him as CEO, Mr. Norris never produced any material revenue or new business relationships

for the Company.

The

joint resignation letter claims that the current Board is wasting Company assets. That is false. In fact, due to the efforts

of current management, the Company’s monthly burn rate has been reduced more than 60% from the approximately $185,000

during Mr. Norris’ tenure. The Company has also identified our likeliest projects for near-term

revenue and our current efforts are focused on these real-world opportunities. This is in stark contrast to the financial

and business management during Mr. Norris' tenure.

The Company

believes the hostility exhibited in the joint resignation letter is based solely upon Mr. Norris' (and Mr. Kelly’s) departure

from the Company and that the allegations therein are nothing more than a pretext for criticizing a Board that fired them.

| ITEM 8.01 |

Other Information. |

On

September 10, 2013, the Company was informed by Mr. Kelly that he had filed a complaint with the Securities and Exchange Commission

(the “SEC”) against the Company. The substance and even the nature of Mr. Kelly’s complaint remains unclear,

as well as what office at the SEC received the complaint. In fact, the Company has no copy of the alleged complaint and no

evidence of any complaint actually being filed beyond Mr. Kelly’s assertions in his emails. In fact, soon after he was informed

on July 31, 2013 that his consulting contract would not be renewed, he emailed the Company that he would communicate with a personal

friend who headed a department at the SEC.

Mr. Kelly was a

long time friend of Mr. Norris who hired him as a consultant soon after his appointment as CEO. His consulting agreement

began on February 1, 2013 and was not renewed when it expired on July 31, 2013 and for which he was fully compensated. During

this time, he was paid $128,000 for his work on a part-time basis. On September 11, 2013, Mr. Kelly informed the Company that

he had filed a complaint with the State of Massachusetts Department of Labor for unpaid wages and expenses. Mr. Kelly was

never an employee of the Company and therefore is not owed any wages. Mr. Kelly submitted expense reports in late July 2013,

which the Company is reviewing and will reimburse in the ordinary course of business if the supporting material is complete. In

addition, the Company believes Mr. Kelly has violated several components of the consulting agreement including, but not limited

to, non-disparagement and returning all Company property.

The Company fully

intends to aggressively defend itself from the claims made by Messrs. Norris, Takeichi, Mineta and Kelly. In connection

with these matters, the Company has concluded that it should review with fresh eyes the actions and decisions taken by officers

and directors of the Company over the past few years. Based upon that review, the Company may call for an independent investigation

by appropriate authorities if the findings reflect possibly improper dealings.

| Item 9.01. |

Financial Statements and Exhibits. |

| (a) |

Not applicable |

| (b) |

Not applicable |

| (c) |

Not applicable |

| (d) |

Exhibits. |

| |

|

| |

99.1 – Copy of Resignation

Letter from Messrs. Norris, Takeichi and Mineta |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

HEALTH DISCOVERY CORPORATION |

|

|

|

|

|

| |

|

|

|

| Dated: October 17, 2013 |

By: |

/s/ Kevin Kowbel |

|

| |

|

Interim Chief Executive Officer |

| |

|

|

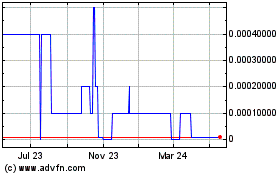

Health Discovery (CE) (USOTC:HDVY)

Historical Stock Chart

From Jan 2025 to Feb 2025

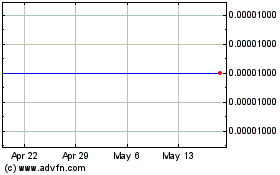

Health Discovery (CE) (USOTC:HDVY)

Historical Stock Chart

From Feb 2024 to Feb 2025