UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

HUGOTON ROYALTY TRUST

(Exact name of registrant as specified in its charter)

|

|

|

Texas |

1-10476 |

58-6379215 |

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

c/o The Corporate Trustee: |

Argent Trust Company |

3838 Oak Lawn Ave, Suite 1720 |

Dallas, Texas 75219-4518 |

(Address of principal executive offices) (Zip Code) |

(Registrant’s telephone number, including area code) (855) 588-7839 |

(Former name, former address and former fiscal year, if change since last report) |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Units of Beneficial Interest |

|

HGTXU |

|

OTCQB |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

|

|

Smaller reporting company |

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

Indicate the number of units of beneficial interest outstanding, as of the latest practicable date:

Outstanding as of November 1, 2024

40,000,000

HUGOTON ROYALTY TRUST

FORM 10-Q FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2024

TABLE OF CONTENTS

HUGOTON ROYALTY TRUST

GLOSSARY OF TERMS

The following are definitions of significant terms used in this Form 10-Q:

|

|

|

Bbl |

|

Barrel (of oil) |

|

|

|

Mcf |

|

Thousand cubic feet (of natural gas) |

|

|

|

MMBtu |

|

One million British Thermal Units, a common energy measurement |

|

|

|

net proceeds |

|

Gross proceeds received by XTO Energy from sale of production from the underlying properties, less applicable costs, as defined in the net profits interest conveyances. |

|

|

|

net profits income |

|

Net proceeds multiplied by the net profits percentage of 80%, which is paid to the Trust by XTO Energy. “Net profits income” is referred to as “royalty income” for income tax purposes. |

|

|

|

net profits interest |

|

An interest in an oil and gas property measured by net profits from the sale of production, rather than a specific portion of production. The following defined net profits interests were conveyed to the Trust from the underlying properties: |

|

|

|

|

|

80% net profits interests- interests that entitle the Trust to receive 80% of the net proceeds from the underlying properties. |

|

|

|

underlying properties |

|

XTO Energy’s interest in certain oil and gas properties from which the net profits interests were conveyed. The underlying properties include working interests in predominantly gas-producing properties located in Kansas, Oklahoma and Wyoming. |

|

|

|

working interest |

|

An operating interest in an oil and gas property that provides the owner a specified share of production that is subject to all production expense and development costs. |

HUGOTON ROYALTY TRUST

PART I ‑ FINANCIAL INFORMATION

Item 1. Financial Statements

The condensed financial statements included herein are presented, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Unless specified otherwise, all amounts included herein are presented in U.S. dollars. Certain information and footnote disclosures normally included in annual financial statements have been condensed or omitted pursuant to such rules and regulations, although the Trustee believes that the disclosures are adequate to make the information presented not misleading. These condensed financial statements should be read in conjunction with the financial statements and the notes thereto included in the Trust’s latest Annual Report on Form 10-K. In the opinion of the Trustee, all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the assets, liabilities and trust corpus of the Hugoton Royalty Trust at September 30, 2024, and the distributable income and changes in trust corpus for the three-month and nine-month periods ended September 30, 2024 and 2023, have been included. Distributable income for such interim periods is not necessarily indicative of the distributable income for the full year.

Condensed Statements of Assets, Liabilities and Trust Corpus (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and short-term investments |

|

$ |

341,467 |

|

|

$ |

344,048 |

|

|

|

|

|

|

|

|

Net profits interests in oil and gas properties - net (Note 1) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

$ |

341,467 |

|

|

$ |

344,048 |

|

|

|

|

|

|

|

|

LIABILITIES AND TRUST CORPUS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution payable to unitholders |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

Expense reserve (a) (b) |

|

|

341,467 |

|

|

|

344,048 |

|

|

|

|

|

|

|

|

Trust corpus (40,000,000 units of beneficial interest authorized

and outstanding) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

$ |

341,467 |

|

|

$ |

344,048 |

|

(a)The expense reserve allows the Trustee to pay its obligations should it be unable to pay them out of the net profits income.

(b)Expense reserve partially replenished by one-time advance distribution of $500,000 from XTO Energy that was part of the Settlement Agreement between the Trust and XTO Energy. See Note 5 to Condensed Financial Statements.

The accompanying notes to condensed financial statements are an integral part of these statements.

Condensed Statements of Distributable Income (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30 |

|

|

Nine Months Ended

September 30 |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net profits income |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

11,467,914 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

4,710 |

|

|

|

12,810 |

|

|

|

11,220 |

|

|

|

57,458 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total income |

|

|

4,710 |

|

|

|

12,810 |

|

|

|

11,220 |

|

|

|

11,525,372 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administration expense |

|

|

171,655 |

|

|

|

374,347 |

|

|

|

513,801 |

|

|

|

790,389 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash reserves withheld (used) for Trust expenses |

|

|

(166,945 |

) |

|

|

(361,537 |

) |

|

|

(502,581 |

) |

|

|

(361,537 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributable income |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

11,096,520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributable income per unit (40,000,000 units) |

|

$ |

0.000000 |

|

|

$ |

0.000000 |

|

|

$ |

0.000000 |

|

|

$ |

0.277413 |

|

The accompanying notes to condensed financial statements are an integral part of these statements.

Condensed Statements of Changes in Trust Corpus (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30 |

|

|

Nine Months Ended

September 30 |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Trust corpus, beginning of period |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributable income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11,096,520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions declared |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,096,520 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust corpus, end of period |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

The accompanying notes to condensed financial statements are an integral part of these statements.

HUGOTON ROYALTY TRUST

Notes to Condensed Financial Statements (Unaudited)

The financial statements of Hugoton Royalty Trust (the “Trust”) are prepared on the following basis and are not intended to present the financial position and results of operations in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”):

|

|

- |

Net profits income recorded for a month is the amount computed and paid by XTO Energy Inc. (“XTO Energy”), the owner of the underlying properties, to Argent Trust Company, as trustee (the “Trustee”) for the Trust. XTO Energy is a wholly owned subsidiary of Exxon Mobil Corporation. Net profits income consists of net proceeds received by XTO Energy from the underlying properties in the prior month, multiplied by a net profits percentage of 80%. |

|

- |

Costs deducted in the calculation of net proceeds for the 80% net profits interests generally include applicable taxes, transportation, marketing and legal costs, production expense, development costs, operating charges and other costs. |

|

- |

Net profits income is computed separately for each of the three conveyances under which the net profits interests were conveyed to the Trust. If monthly costs exceed revenues for any conveyance, such excess costs must be recovered, with accrued interest, from future net proceeds of that conveyance and cannot reduce net proceeds from the other conveyances. |

|

- |

Interest income and distribution payable to unitholders include interest earned on the previous month’s investment. |

|

- |

Trust expenses are recorded based on liabilities paid and cash reserves established by the Trustee for liabilities and contingencies. |

|

- |

Distributions to unitholders are recorded when declared by the Trustee. |

The Trust’s financial statements differ from those prepared in conformity with U.S. GAAP because revenues are recognized when received rather than accrued in the month of production, expenses are recognized when paid rather than when incurred and certain cash reserves may be established by the Trustee for contingencies which would not be recorded under U.S. GAAP. This comprehensive basis of accounting other than U.S. GAAP corresponds to the accounting permitted for royalty trusts by the U.S. Securities and Exchange Commission, as specified by Staff Accounting Bulletin Topic 12:E, Financial Statements of Royalty Trusts.

Most accounting pronouncements apply to entities whose financial statements are prepared in accordance with U.S. GAAP, directing such entities to accrue or defer revenues and expenses in a period other than when such revenues were received or expenses were paid. Because the Trust’s financial statements are prepared on the modified cash basis, as described above, most accounting pronouncements are not applicable to the Trust’s financial statements.

Net profits interests in oil and gas properties

The initial carrying value of the net profits interests of $247,066,951 represents XTO Energy’s historical net book value for the interests on December 1, 1998, the date of the transfer to the Trust. During the second quarter 2016, the carrying value of the net profits interests was written down to its fair value of $28,801,000, resulting in an impairment of $57,306,527 charged directly to trust corpus. During the third quarter 2019, the carrying value of the net profits interests was written down to its fair value of zero, resulting in an impairment of $15,681,533 charged directly to trust corpus. Amortization of the net profits interests is calculated on a unit-of-production basis using proved reserves and is charged

directly to trust corpus. Accumulated amortization was $174,078,891 as of September 30, 2019, when the net profits interests was written down to its fair value of zero.

Liquidity and Going Concern

The accompanying condensed financial statements have been prepared assuming that the Trust will continue as a going concern. Financial statements prepared on a going concern basis assume the realization of assets and the settlement of liabilities in the normal course of business.

Accumulated excess costs for the Kansas, Oklahoma and Wyoming conveyances have resulted in insufficient net proceeds to the Trust which have resulted in no unitholder distributions since July 2023, and a reduction in the Trust’s expense reserve. These conditions raise substantial doubt about the Trust’s ability to continue as a going concern as the Trust does not have sufficient cash to meet its obligations during the one-year period after the dates that the financial statements are issued. Factors attributable to the cash shortage are primarily the previously disclosed development costs to drill four non-operated wells in Major County, Oklahoma, lower oil and natural gas prices, and excess cost positions on the Kansas, Oklahoma and Wyoming conveyances including accumulated interest.

The Trustee has prepared a preliminary budget estimating the administrative expenses for the year ending December 31, 2024, and the 11 months ending November 30, 2025, which assumes no cash inflow from either net profits income or from other sources other than the $500,000 advance distribution received in second quarter 2024 from the Settlement Agreement with XTO Energy. To help control costs, the Trustee has reviewed all administrative functions and has attempted to reduce or eliminate costs for functions other than those required to comply with SEC regulations or the Trust Indenture; however, there can be no assurance that there will be sufficient funds available to continue such functions in the future. To further reduce administrative costs to the Trust, the Trustee has deferred payment of its monthly fee of approximately $7,300 since April 2024.

As previously disclosed, the Trustee has reviewed and may in the future review financing as an option to pay Trust obligations during the one-year period after the date the financial statements are issued; however, there can be no assurance that financing will be available on acceptable terms or at all. If financing became available to the Trust, it would have to be repaid, together with interest, and the Trust’s expense reserve would have to be replenished prior to any distributions to unitholders. Currently the Trustee believes that financing is unlikely to be a viable option for the Trust moving forward. As a result, the Trustee intends to review options for the Trust which may include alternatives to continuing as a going concern such as seeking to terminate the Trust or marketing the Trust's interest (which are Net Profits Interests burdened by excess costs) for a potential sale.

On July 9, 2020, the Trustee notified XTO Energy of the Trustee’s claim to indemnification to the Trust Estate for all liability, expense, claims, damages or loss incurred by the Trustee in connection with the administration of the Trust. The Trustee stated it anticipates seeking reimbursement from XTO Energy upon depletion of the Trust’s cash reserve. XTO Energy responded that any indemnity claim to XTO Energy is premature before the Trust Estate is exhausted. Nothing in the Trust Indenture obligates the Trustee to pay for the Trust's expenses if the Trust's expense reserve were to be completely depleted.

The Trust’s financial statements do not include any adjustments that might result from the outcome of these uncertainties.

For federal income tax purposes, the Trust constitutes a fixed investment trust that is taxed as a grantor trust. A grantor trust is not subject to tax at the trust level. Accordingly, no provision for income taxes has been made in the financial statements. The unitholders are considered to own the Trust’s income and principal as though no trust were in existence. The income of the Trust is deemed to have been received or accrued by each unitholder at the time such income is received or accrued by the Trust and not when distributed by the Trust. Impairments recorded for book purposes will not result in a loss for tax purposes for the unitholders until the loss is recognized.

All revenues from the Trust are from sources within Kansas, Oklahoma or Wyoming. Because it distributes all of its net income to unitholders, the Trust has not been taxed at the trust level in Kansas or Oklahoma. While the Trust has not owed tax, the Trustee is generally required to file Kansas and Oklahoma income tax returns reflecting the income and deductions of the Trust attributable to properties located in each state, along with a schedule that includes information regarding distributions to unitholders.

Wyoming does not impose a state income tax.

Pursuant to a Settlement Agreement with XTO Energy, the Trust will be required to bear a portion of the settlement costs arising from the Chieftain royalty class action settlement. For information on contingencies, including the Chieftain class action, see Note 3 to Condensed Financial Statements. In arbitration between the Trustee and XTO Energy, the panel determined that the Trust is responsible for a portion of the Chieftain royalty class action settlement costs. For unitholders, the portion of legal settlement costs for which the Trust is responsible will be reflected through a reduction in net profits income received from the Trust and thus in a reduction in the gross royalty income reported by and taxable to the unitholders.

Each unitholder should consult their own tax advisor regarding income tax requirements, if any, applicable to such person’s ownership of Trust units.

Unitholders should consult the Trust’s latest Annual Report on Form 10-K for a more detailed discussion of federal and state tax matters.

Litigation

Royalty Class Action and Arbitration

As previously disclosed, XTO Energy advised the Trustee that it reached a settlement with the plaintiffs in the Chieftain class action royalty case. Based on the final plan of allocation approved by the court, XTO Energy advised the Trustee that it believes approximately $24.3 million in additional production costs should be allocated to the Trust. On May 2, 2018, the Trustee submitted a demand for arbitration seeking a declaratory judgment that the Chieftain settlement is not a production cost and that XTO Energy is prohibited from charging the settlement as a production cost under the conveyance or otherwise reducing the Trust’s payments now or in the future as a result of the Chieftain litigation (the “Chieftain Claim”).

On January 20, 2021, the arbitration panel issued its Corrected Interim Final Award (i) “reject[ing] the Trust’s contention that XTO [Energy] has no right under the Conveyance to charge the Trust with amounts XTO [Energy] paid under section 1.18(a)(i) as royalty obligations to settle the Chieftain litigation” and (ii) stating “[t]he next phase will determine how much of the Chieftain settlement can be so charged, if any of it can be, in the exercise of the right found by the Panel.” Following briefing by both parties, on May 18, 2021, the Panel issued its second interim final award over the amount of XTO Energy’s settlement in the Chieftain class action lawsuit that can be charged to the Trust as a production cost.

In the arbitration, the Trustee also disputed certain amounts related to the computation of the Trust’s net proceeds for 2014 through 2019 and 2021 (the “Overhead Claims”).

On June 18, 2024, the Trustee and XTO Energy entered into a Settlement Agreement to resolve the pending arbitration. Pursuant to the Settlement Agreement, effective as of June 1, 2024, XTO Energy and the Trustee agreed:

•that the value of the Chieftain Claim, with interest, to the benefit of XTO Energy is stipulated to be $18,105,467 (net to the Trust);

•that the value of the Overhead Claims, with interest, to the benefit of the Trust is stipulated to be $17,275,086 (net to the Trust);

•that the stipulated value of the Chieftain Claim and the Overhead Claims would be offset against one another, on a cumulative basis and without respect to which conveyance the particular claim arose, leaving a balance, to the benefit of XTO Energy of $830,381 (net to the Trust), which balance shall be treated as a production cost under the Oklahoma conveyance, and subject to the recoupment and interest charges under that conveyance; and

•that XTO Energy will provide the Trust a one-time advance distribution of $500,000 (net to the Trust), that can be treated as a production cost, except that it can be recouped, together with interest, from what would otherwise be distributable net profits under any of the three conveyances; provided, however that XTO Energy shall only be entitled to withhold distributions of net proceeds as recoupment to the extent that such recoupment does not leave the Trust with less than $250,000 of available cash.

The Trustee used the $500,000 advance distribution to partially replenish the Trust’s cash expense reserve in June 2024. The $830,381 balance due to XTO Energy was recorded as a production cost in third quarter 2024.

Additionally, the Settlement Agreement provides that XTO Energy will modify certain accounting practices with respect to the Overhead Claims effective as of June 1, 2024.

Other Lawsuits and Governmental Proceedings

Certain of the underlying properties are involved in various other lawsuits and governmental proceedings arising in the ordinary course of business. XTO Energy has advised the Trustee that, based on the information available at this stage of the various proceedings, it does not believe that the ultimate resolution of these claims will have a material effect on the financial position or liquidity of the Trust, but may have an effect on annual distributable income.

Other

Several states have enacted legislation requiring state income tax withholding from payments made to nonresident recipients of oil and gas proceeds. After consultation with its tax counsel, the Trustee believes that it is not required to withhold on payments made to the unitholders. However, regulations are subject to change by the various states, which could change this conclusion. Should amounts be withheld on payments made to the Trust or the unitholders, distributions to the unitholders would be reduced by the required amount, subject to the filing of a claim for refund by the Trust or unitholders for such amount.

If monthly costs exceed revenues for any of the three conveyances (one for each of the states of Kansas, Oklahoma and Wyoming), such excess costs must be recovered, with accrued interest, from future net proceeds of that conveyance and cannot reduce net proceeds from other conveyances.

The following summarizes excess costs activity, cumulative excess costs balances and accrued interest to be recovered by conveyance as calculated by XTO Energy:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underlying |

|

|

|

KS |

|

|

OK |

|

|

WY |

|

|

Total |

|

Cumulative excess costs remaining at 12/31/23 |

|

$ |

497,677 |

|

|

$ |

1,394,986 |

|

|

$ |

1,718,791 |

|

|

$ |

3,611,454 |

|

Net excess costs (recovery) for the quarter ended 3/31/24 |

|

|

492,120 |

|

|

|

(528,804 |

) |

|

|

376,393 |

|

|

|

339,709 |

|

Net excess costs (recovery) for the quarter ended 6/30/24 |

|

|

264,416 |

|

|

|

968,719 |

|

|

|

2,345,327 |

|

|

|

3,578,462 |

|

Net excess costs (recovery) for the quarter ended 9/30/24 |

|

|

80,267 |

|

|

|

668,249 |

|

|

|

1,582,487 |

|

|

|

2,331,003 |

|

Cumulative excess costs remaining at 9/30/24 |

|

|

1,334,480 |

|

|

|

2,503,150 |

|

|

|

6,022,998 |

|

|

|

9,860,628 |

|

Accrued interest at 9/30/24 |

|

|

85,604 |

|

|

|

344,128 |

|

|

|

239,941 |

|

|

|

669,673 |

|

Total remaining to be recovered at 9/30/24 |

|

$ |

1,420,084 |

|

|

$ |

2,847,278 |

|

|

$ |

6,262,939 |

|

|

$ |

10,530,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NPI |

|

|

|

KS |

|

|

OK |

|

|

WY |

|

|

Total |

|

Cumulative excess costs remaining at 12/31/23 |

|

$ |

398,141 |

|

|

$ |

1,115,989 |

|

|

$ |

1,375,032 |

|

|

$ |

2,889,162 |

|

Net excess costs (recovery) for the quarter ended 3/31/24 |

|

|

393,697 |

|

|

|

(423,043 |

) |

|

|

301,114 |

|

|

|

271,768 |

|

Net excess costs (recovery) for the quarter ended 6/30/24 |

|

|

211,533 |

|

|

|

774,975 |

|

|

|

1,876,261 |

|

|

|

2,862,769 |

|

Net excess costs (recovery) for the quarter ended 9/30/24 |

|

|

64,213 |

|

|

|

534,599 |

|

|

|

1,265,990 |

|

|

|

1,864,802 |

|

Cumulative excess costs remaining at 9/30/24 |

|

|

1,067,584 |

|

|

|

2,002,520 |

|

|

|

4,818,397 |

|

|

|

7,888,501 |

|

Accrued interest at 9/30/24 |

|

|

68,483 |

|

|

|

275,302 |

|

|

|

191,953 |

|

|

|

535,738 |

|

Total remaining to be recovered at 9/30/24 |

|

$ |

1,136,067 |

|

|

$ |

2,277,822 |

|

|

$ |

5,010,350 |

|

|

$ |

8,424,239 |

|

For the quarter ended September 30, 2024, excess costs were $80,267 ($64,213 net to the Trust) on properties underlying the Kansas net profits interests.

For the quarter ended September 30, 2024, excess costs were $668,249 ($534,599 net to the Trust) on properties underlying the Oklahoma net profits interests. The excess costs balance includes items from the Settlement Agreement that were recorded in third quarter 2024.

For the quarter ended September 30, 2024, excess costs were $1,582,487 ($1,265,990 net to the Trust) on properties underlying the Wyoming net profits interests.

Underlying cumulative excess costs for the Kansas, Oklahoma and Wyoming conveyances remaining as of September 30, 2024, totaled $10.5 million ($8.4 million net to the Trust), including accrued interest of $0.7 million ($0.5 million net to the Trust).

In the second quarter of 2024, XTO Energy provided the Trust a one-time advance distribution of $500,000 (net to the Trust), that can be treated as a production cost, except that it can be recouped, together with interest, from what would otherwise be distributable net profits under any of the three conveyances; provided, however that XTO Energy shall only be entitled to withhold distributions of net proceeds as recoupment to the extent that such recoupment does not leave the Trust with less than $250,000 of available cash.

|

|

|

|

|

|

|

NPI |

|

|

|

Total |

|

Advance Distribution at 9/30/24 |

|

$ |

500,000 |

|

Accrued interest at 9/30/24 |

|

|

7,225 |

|

Total remaining to be recovered at 9/30/24 |

|

|

507,225 |

|

Administrative expenses are incurred so that the Trustee may meet its reporting obligations to the unitholders and regulatory entities and otherwise manage the administrative functions of the Trust. These obligations include, but are not limited to, all expenses, taxes, compensation to the Trustee for managing the Trust, fees to consultants, accountants, attorneys, transfer agents, other professional and expert persons, expenses for clerical and other administrative assistance, and fees and expenses for all other services.

Item 2. Trustee’s Discussion and Analysis

The following discussion should be read in conjunction with the Trustee’s discussion and analysis contained in the Trust’s 2023 Annual Report on Form 10-K, as well as the condensed financial statements and notes thereto included in this Quarterly Report on Form 10-Q. The Trust’s Annual Report on Form 10-K, Quarterly Reports on Form 10‑Q, Current Reports on Form 8-K and all amendments to those reports are available on the Trust’s website at www.hgt-hugoton.com.

Distributable Income

Quarter

For the quarter ended September 30, 2024, net profits income was $0 compared to $0 for third quarter 2023. This was primarily the result of decreased development costs ($5.0 million), decreased overhead ($0.3 million), decreased taxes, transportation and other costs ($0.3 million), increased oil production ($0.3 million), and higher oil prices ($0.1 million), partially offset by net excess costs activity ($3.5 million), increased production expenses ($1.5 million), lower gas prices ($0.7 million) and decreased gas production ($0.3 million). See “Net Profits Income” below.

After adding interest income of $4,710, deducting administration expense of $171,655, and utilizing $166,945 of the cash reserve for the payment of Trust expenses, distributable income for the quarter ended September 30, 2024, was $0 or $0.000000 per unit of beneficial interest. Administration expense for the quarter decreased $202,692 compared to the prior year quarter, primarily related to the timing of receipt and payment of Trust expenses and terms of professional services. Changes in interest income are attributable to fluctuations in net profits income, cash reserve and interest rates. For third quarter 2023, distributable income was $0 or $0.000000 per unit.

Distributions to unitholders for the quarter ended September 30, 2024, were:

|

|

|

|

|

|

|

Record Date |

|

Payment Date |

|

Distribution per Unit |

|

July 31, 2024 |

|

August 14, 2024 |

|

$ |

0.000000 |

|

August 30, 2024 |

|

September 16, 2024 |

|

|

0.000000 |

|

September 30, 2024 |

|

October 15, 2024 |

|

|

0.000000 |

|

|

|

|

|

$ |

0.000000 |

|

Nine Months

For the nine months ended September 30, 2024, net profits income was $0 compared with $11,467,914 for the same 2023 period primarily due to lower gas prices ($16.4 million), increased production expenses ($2.1 million), decreased gas production ($1.9 million), net excess costs activity ($1.4 million), partially offset by decreased development costs ($6.0 million), decreased taxes, transportation, and other costs ($3.0 million), increased oil production ($1.1 million), and decreased overhead ($0.2 million). See “Net Profits Income” below.

After adding interest income of $11,220 and deducting administration expense of $513,801, and utilizing $502,581 of the cash reserve for the payment of Trust expenses, distributable income for the nine months ended September 30, 2024, was $0 or $0.000000 per unit of beneficial interest. Administration expense for the nine months ended September 30, 2024, decreased $276,588 as compared to the same 2023 period, primarily related to the timing of receipt and payment of Trust expenses and terms of professional services. Changes in interest income are attributable to fluctuations in net profits income, cash reserve and interest rates. For the nine months ended September 30, 2023, distributable income was $11,096,520 or $0.277413 per unit.

Net Profits Income

Net profits income is recorded when received by the Trust, which is the month following receipt by XTO Energy, and generally two months after oil and gas production. Net profits income is generally affected by three major factors:

|

|

1. |

oil and gas sales volumes, |

2. |

oil and gas sales prices, and |

3. |

costs deducted in the calculation of net profits income. |

The following is a summary of the calculation of net profits income received by the Trust:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months |

|

|

|

Nine Months |

|

|

|

|

Ended September 30 (a) |

|

Increase |

|

Ended September 30 (a) |

|

Increase |

|

|

2024 |

|

2023 |

|

(Decrease) |

|

2024 |

|

2023 |

|

(Decrease) |

Sales Volumes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas (Mcf) (b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underlying properties |

|

|

2,133,138 |

|

|

2,313,603 |

|

(8%) |

|

|

6,103,166 |

|

|

6,931,971 |

|

(12%) |

Average per day |

|

|

23,186 |

|

|

25,148 |

|

(8%) |

|

|

22,274 |

|

|

25,392 |

|

(12%) |

Net profits interests |

|

|

— |

|

|

— |

|

− |

|

|

— |

|

|

990,526 |

|

(100%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil (Bbls) (b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underlying properties |

|

|

51,512 |

|

|

45,936 |

|

12% |

|

|

140,314 |

|

|

121,555 |

|

15% |

Average per day |

|

|

560 |

|

|

499 |

|

12% |

|

|

512 |

|

|

445 |

|

15% |

Net profits interests |

|

|

— |

|

|

— |

|

− |

|

|

— |

|

|

11,205 |

|

(100%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Sales Prices |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas (per Mcf) |

|

$ |

2.40 |

|

$ |

2.80 |

|

(14%) |

|

$ |

2.87 |

|

$ |

5.82 |

|

(51%) |

Oil (per Bbl) |

|

$ |

75.84 |

|

$ |

72.10 |

|

5% |

|

$ |

74.78 |

|

$ |

74.86 |

|

(0%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas sales |

|

$ |

5,115,614 |

|

$ |

6,468,254 |

|

(21%) |

|

$ |

17,499,744 |

|

$ |

40,360,597 |

|

(57%) |

Oil sales |

|

|

3,906,813 |

|

|

3,311,987 |

|

18% |

|

|

10,492,601 |

|

|

9,099,957 |

|

15% |

Total Revenues |

|

|

9,022,427 |

|

|

9,780,241 |

|

(8%) |

|

|

27,992,345 |

|

|

49,460,554 |

|

(43%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxes, transportation and other |

|

|

1,747,086 |

|

|

2,081,264 |

|

(16%) |

|

|

5,902,701 |

|

|

9,650,454 |

|

(39%) |

Production expense |

|

|

6,233,224 |

|

|

4,299,551 |

|

45% |

|

|

17,148,793 |

|

|

14,549,105 |

|

18% |

Development costs |

|

|

469,797 |

|

|

6,695,562 |

|

(93%) |

|

|

1,749,709 |

|

|

9,254,699 |

|

(81%) |

Overhead |

|

|

2,929,000 |

|

|

3,361,650 |

|

(13%) |

|

|

9,465,993 |

|

|

9,652,052 |

|

(2%) |

Excess costs (c) |

|

|

(2,331,003) |

|

|

(6,657,786) |

|

(65%) |

|

|

(6,249,174) |

|

|

(7,980,648) |

|

(22%) |

Total Costs |

|

|

9,048,104 |

|

|

9,780,241 |

|

(7%) |

|

|

28,018,022 |

|

|

35,125,662 |

|

(20%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Proceeds |

|

$ |

25,677 |

|

|

— |

|

− |

|

$ |

25,677 |

|

|

— |

|

− |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Proceeds |

|

|

— |

|

|

— |

|

− |

|

|

— |

|

|

14,334,892 |

|

(100%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Profits Percentage |

|

|

80% |

|

|

80% |

|

|

|

|

80% |

|

|

80% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Profits Income |

|

$ |

— |

|

$ |

— |

|

− |

|

$ |

— |

|

$ |

11,467,914 |

|

(100%) |

(a)Because of the two-month interval between time of production and receipt of net profits income by the Trust, (1) gas and oil sales for the quarter ended September 30 generally represent production for the period May through July and (2) gas and oil sales for the nine months ended September 30 generally represent production for the period November through July.

(b)Gas and oil sales volumes are allocated to the net profits interests by dividing Trust net cash inflows by average sales prices. As gas and oil prices change, the Trust’s allocated production volumes are impacted as the quantity of production necessary to cover expenses changes inversely with price. As such, the underlying property production volume changes may not correlate with the Trust’s allocated production volumes in any given period. Therefore, comparative discussion of gas and oil sales volumes is based on the underlying properties.

(c)See Note 4 to Condensed Financial Statements.

The following are explanations of significant variances on the underlying properties from third quarter 2023 to third quarter 2024 and from the first nine months of 2023 to the comparable period in 2024:

Sales Volumes

Gas

Gas sales volumes decreased eight percent for third quarter 2024 and decreased 12 percent for the nine-month period as compared with the same 2023 periods primarily because of timing of cash receipts and natural production decline, partially offset by gas sales from new wells in Major County, Oklahoma.

Oil

Oil sales volumes increased 12 percent for third quarter 2024 and increased 15 percent for the nine-month period as compared with the same 2023 periods primarily because of oil sales from new wells in Major County, Oklahoma, partially offset by timing of cash receipts and natural production decline.

The estimated rate of natural production decline on the underlying oil and gas properties is approximately six to eight percent a year.

Sales Prices

Gas

The third quarter 2024 average gas price was $2.40 per Mcf, a 14 percent decrease from the third quarter 2023 average gas price of $2.80 per Mcf. For the nine-month period, the average gas price decreased 51 percent to $2.87 per Mcf in 2024 from $5.82 per Mcf in 2023.

Oil

The third quarter 2024 average oil price was $75.84 per Bbl, a five percent increase from the third quarter 2023 average oil price of $72.10 per Bbl. The year-to-date average oil price remained relatively flat at $74.78 per Bbl in 2024 from $74.86 per Bbl in 2023.

Costs

Taxes, Transportation and Other

Taxes, transportation and other costs decreased 16 percent for third quarter 2024 and decreased 39 percent for the nine-month period as compared with the same 2023 periods primarily because of decreased gas production taxes and gas deductions due to lower revenues.

Production Expense

Production expense increased 45 percent for third quarter 2024 primarily because of the Chieftain Settlement, increased labor costs, repairs and maintenance costs, partially offset by decreased field costs, chemical costs, and measurement costs. Production expense increased 18 percent for the nine-month period as compared with the same 2023 periods primarily because of increased labor costs, the Chieftain Settlement, plug and abandonment expenses, and pipeline costs, partially offset by decreased repairs and maintenance costs, field costs, and measurement costs.

Development Costs

Development costs decreased 93 percent for third quarter 2024 and decreased 81 percent for the nine-month period primarily due to the timing of drilling costs related to non-operated wells in Major County, Oklahoma. Changes in oil or natural gas prices could impact future development plans on the underlying properties.

As previously disclosed, XTO Energy advised the Trustee that it elected to participate in the development of four non-operated wells in Major County, Oklahoma. XTO Energy advised the Trustee that the total development costs for the four non-operated wells was anticipated to be approximately $10 million underlying ($8 million net to the Trust). Two wells were completed in second quarter of 2023, the third was completed in fourth quarter 2023, and the fourth was completed in first quarter 2024. No assurances can be made as to the estimated costs of the non-operated wells or timing of receipt of costs for completing the wells.

Overhead

Overhead decreased 13 percent for third quarter 2024 and decreased two percent for the nine-month period. Overhead is charged by XTO Energy and other operators for administrative expenses incurred to support operations of the underlying properties. Overhead fluctuates based on changes in the active well count and drilling activity on the underlying properties, as well as an annual cost level adjustment based on an industry index.

Excess Costs

If monthly costs exceed revenues for any conveyance, these excess costs must be recovered, with accrued interest, from future net proceeds of that conveyance and cannot reduce net profits income from another conveyance. Underlying cumulative excess costs for the Kansas, Oklahoma and Wyoming conveyances remaining as of September 30, 2024, totaled $10.5 million ($8.4 million net to the Trust), including accrued interest of $0.7 million ($0.5 million net to the Trust). For further information on excess costs, see Note 4 to Condensed Financial Statements.

Other Proceeds

The calculation of net profits income for the quarter and nine-month period ended September 30, 2024 included $25,677 ($20,542 net to the Trust) from XTO Energy due to interest received on past due payments.

Contingencies

For information on contingencies, see Note 3 to Condensed Financial Statements.

Forward-Looking Statements

Certain information included in this Quarterly Report and other materials filed, or to be filed, by the Trust with the Securities and Exchange Commission (as well as information included in oral statements or other written statements made or to be made by XTO Energy or the Trustee) contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, relating to the Trust, operations of the underlying properties and the oil and gas industry. Such forward-looking statements may concern, among other things, excess costs, continuation of the Trust as a going-concern, or alternatives to a going-concern, reserve-to-production ratios, future production, development activities and associated operating expenses, future development plans by area, increased density drilling, maintenance projects, development, production, regulatory and other costs, oil and gas prices and expectations for future demand, the impact of inflation and economic downturns on economic activity, government policy and its impact on oil and gas prices and future demand, the development and competitiveness of alternative energy sources, pricing differentials, proved reserves, future net cash flows, production levels, expense reserve budgets, availability of financing, arbitration, litigation, liquidity, financing, political and regulatory matters, such as tax and environmental policy, climate policy, trade barriers, sanctions, competition, war and other political or security disturbances. Such forward-looking statements are based on XTO Energy’s and the Trustee’s current plans, expectations, assumptions, projections and estimates and are identified by words such as “may,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “should,” “could,” “would,” and similar words that convey the uncertainty of future events. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, including those detailed in Part I, Item 1A of the Trust’s Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by this reference as though fully set forth herein. Therefore, actual financial and operational results may differ materially from expectations, estimates or assumptions expressed in, implied in, or forecasted

in such forward-looking statements. XTO Energy and the Trustee assume no duty to update these statements as of any future date.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not applicable. Upon qualifying as a smaller reporting company, this information is no longer required.

Item 4. Controls and Procedures

As of the end of the period covered by this report, the Trustee carried out an evaluation of the effectiveness of the Trust’s disclosure controls and procedures pursuant to Exchange Act Rules 13a-15 and 15d-15. Based upon that evaluation, the Trustee concluded that the Trust’s disclosure controls and procedures are effective in recording, processing, summarizing and reporting, on a timely basis, information required to be disclosed by the Trust in the reports that it files or submits under the Securities Exchange Act of 1934 and are effective in ensuring that information required to be disclosed by the Trust in the reports that it files or submits under the Securities Exchange Act of 1934 is accumulated and communicated to the Trustee to allow timely decisions regarding required disclosure. In its evaluation of disclosure controls and procedures, the Trustee has relied, to the extent considered reasonable, on information provided by XTO Energy. There has not been any change in the Trust’s internal control over financial reporting during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

Royalty Class Action and Arbitration

As previously disclosed, XTO Energy advised the Trustee that it reached a settlement with the plaintiffs in the Chieftain class action royalty case. Based on the final plan of allocation approved by the court, XTO Energy advised the Trustee that it believes approximately $24.3 million in additional production costs should be allocated to the Trust. On May 2, 2018, the Trustee submitted a demand for arbitration seeking a declaratory judgment that the Chieftain settlement is not a production cost and that XTO Energy is prohibited from charging the settlement as a production cost under the conveyance or otherwise reducing the Trust’s payments now or in the future as a result of the Chieftain litigation (the “Chieftain Claim”).

On January 20, 2021, the arbitration panel issued its Corrected Interim Final Award (i) “reject[ing] the Trust’s contention that XTO [Energy] has no right under the Conveyance to charge the Trust with amounts XTO [Energy] paid under section 1.18(a)(i) as royalty obligations to settle the Chieftain litigation” and (ii) stating “[t]he next phase will determine how much of the Chieftain settlement can be so charged, if any of it can be, in the exercise of the right found by the Panel.” Following briefing by both parties, on May 18, 2021, the Panel issued its second interim final award over the amount of XTO Energy’s settlement in the Chieftain class action lawsuit that can be charged to the Trust as a production cost.

In the arbitration, the Trustee also disputed certain amounts related to the computation of the Trust’s net proceeds for 2014 through 2019 and 2021 (the “Overhead Claims”).

On June 18, 2024, the Trustee and XTO Energy entered into a Settlement Agreement to resolve the pending arbitration. Pursuant to the Settlement Agreement, effective as of June 1, 2024, XTO Energy and the Trustee agreed:

•that the value of the Chieftain Claim, with interest, to the benefit of XTO Energy is stipulated to be $18,105,467 (net to the Trust);

•that the value of the Overhead Claims, with interest, to the benefit of the Trust is stipulated to be $17,275,086 (net to the Trust);

•that the stipulated value of the Chieftain Claim and the Overhead Claims would be offset against one another, on a cumulative basis and without respect to which conveyance the particular claim arose, leaving a balance, to the benefit of XTO Energy of $830,381 (net to the Trust), which balance shall be treated as a production cost under the Oklahoma conveyance, and subject to the recoupment and interest charges under that conveyance; and

•that XTO Energy will provide the Trust a one-time advance distribution of $500,000 (net to the Trust), that can be treated as a production cost, except that it can be recouped, together with interest, from what would otherwise be distributable net profits under any of the three conveyances; provided, however that XTO Energy shall only be entitled to withhold distributions of net proceeds as recoupment to the extent that such recoupment does not leave the Trust with less than $250,000 of available cash.

The Trustee used the $500,000 advance distribution to partially replenish the Trust’s cash expense reserve in June 2024. The $830,381 balance due to XTO Energy was recorded as a production cost in third quarter 2024.

Additionally, the Settlement Agreement provides that XTO Energy will modify certain accounting practices with respect to the Overhead Claims effective as of June 1, 2024.

Other Lawsuits and Governmental Proceedings

Certain of the underlying properties are involved in various other lawsuits and governmental proceedings arising in the ordinary course of business. XTO Energy has advised the Trustee that, based on the information available at this stage of the various proceedings, it does not believe that the ultimate resolution of these claims will have a material effect on the financial position or liquidity of the Trust, but may have an effect on annual distributable income.

Item 1A. Risk Factors

Except as set forth below, there have been no material changes in the risk factors disclosed under Part I, Item 1A of the Trust’s Annual Report on Form 10-K for the year ended December 31, 2023.

The Trust may not have sufficient cash to meet its obligations during the one-year period after the date that the financial statements are issued and intends to review alternatives to the Trust continuing as a going concern.

All three of the Trust’s conveyances are in excess costs resulting in no net proceeds to the Trust and a reduction in the Trust’s expense reserve, which have resulted in no unitholder distributions since July 2023. These conditions raise substantial doubt about the Trust’s ability to continue as a going concern as the Trust does not have sufficient cash to meet its obligations during the one-year period after the date the financial statements are issued. The Trust’s financial statements do not include any adjustments that might result from the outcome of this uncertainty. Pursuant to the Settlement Agreement, XTO Energy has advanced $500,000 to the Trust (which may be recouped, together with interest from what would otherwise be distributable net profits under any of the three conveyances; provided, however, that such recoupment does not leave the Trust with less than $250,000 of available cash). There are no assurances that even with such advance, the Trust will receive net profits income sufficient to pay its obligations during the one-year period after the date the financial statements are issued. The Trustee currently believes that financing is unlikely to be a viable option for the Trust moving forward. Nothing in the Trust Indenture obligates the Trustee to pay for the Trust’s expenses if the Trust’s cash reserves were to be completely depleted. As a result, the Trustee intends to review options for the Trust, which may include alternatives to the Trust continuing as a going concern such as seeking to terminate the Trust or marketing the Trust’s interests (which are Net Profits Interests burdened by excess costs) for a potential sale. If the Trust is unable to continue as a going concern, unitholders could incur significant losses on their investment in the Trust or lose their entire investment in the Trust altogether. For further information see Notes to Condensed Financial Statements - 1. Basis of Accounting – Liquidity and Going Concern.

Item 5. Other Information

The Trust does not have any directors or officers, and as a result, no such persons adopted or terminated a “Rule 10b5-1 trading arrangement” or “non-Rule 10b5-1 trading arrangement,” as each term is defined in Item 408(a) of Regulation S‑K.

Item 6. Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

HUGOTON ROYALTY TRUST |

|

By ARGENT TRUST COMPANY, TRUSTEE |

|

|

|

|

|

|

|

|

|

|

By |

/s/ NANCY WILLIS |

|

|

Nancy Willis |

|

|

Director of Royalty Trust Services |

|

|

|

|

EXXON MOBIL CORPORATION |

|

|

|

|

|

|

|

|

|

Date: November 13, 2024 |

By |

/s/ KRISTY WALKER |

|

|

Kristy Walker |

|

|

Unconventional Finance General Manager |

(The Trust has no directors or executive officers.)

EXHIBIT 31

CERTIFICATIONS

I, Nancy Willis, certify that:

1.I have reviewed this report on Form 10-Q of Hugoton Royalty Trust, for which Argent Trust Company acts as Trustee;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, distributable income and changes in trust corpus of the registrant as of, and for, the periods presented in this report;

4.I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)), or for causing such controls and procedures to be established and maintained, for the registrant and I have:

(a)Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to me by others within those entities, particularly during the period in which this report is being prepared;

(b)Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under my supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes;

(c)Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report my conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant’s auditors:

(a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b)Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

In giving the certifications in paragraphs 4 and 5 above, I have relied to the extent I consider reasonable on information provided to me by XTO Energy Inc.

|

|

|

|

Date: November 13, 2024 |

|

By |

/s/ NANCY WILLIS |

|

|

Nancy Willis |

|

|

Director of Royalty Trust Services |

|

|

Argent Trust Company |

EXHIBIT 32

Certification pursuant to 18 U.S.C. Section 1350,

as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

In connection with the Quarterly Report of Hugoton Royalty Trust (the “Trust”) on Form 10-Q for the quarterly period ended September 30, 2024, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), the undersigned, not in its individual capacity but solely as the Trustee of the Trust, certifies pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to its knowledge:

(1)The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

(2)The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Trust.

|

|

|

|

|

Argent Trust Company, |

|

|

Trustee for Hugoton Royalty Trust |

|

|

|

|

|

|

|

|

|

November 13, 2024 |

By |

/s/ NANCY WILLIS |

|

|

Nancy Willis |

|

|

Director of Royalty Trust Services |

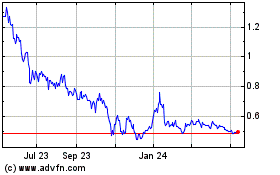

Hugoton Royalty (QB) (USOTC:HGTXU)

Historical Stock Chart

From Jan 2025 to Feb 2025

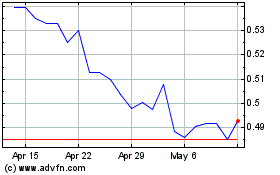

Hugoton Royalty (QB) (USOTC:HGTXU)

Historical Stock Chart

From Feb 2024 to Feb 2025