Form 8-K - Current report

10 January 2014 - 3:37AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): January 8, 2014

_______________________________

Hannover House, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester Street, Springdale,

AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target Development Group,

Inc."

f/k/a "Mindset Interactive Corp."

330 Clematis Street, Suite 217, West

Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| S |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 1 — REGISTRANT'S

BUSINESS AND OPERATIONS

| Item 1.01 |

Entry into a Material Definitive Agreement. Not Applicable. |

|

| Item 1.02 |

Termination of a Material Definitive Agreement.

Hannover House, Inc. ("Company") has terminated a corporate financing agreement that had been previously entered into

on August 13, 2013 with Greenwood Finance Group, LLC ("Greenwood"). The purpose of the agreement with Greenwood was to

provide payables relief under a "Debt-Conversion" transaction for the benefit of qualified and eligible debt holders

of Company. As a result of the termination of this agreement, a total of 6,200,000 shares of "unrestricted" stock will

be immediately retired back into treasury stock of the Company, and removed from the market of issued shares. Company does not

feel that the termination of this "Debt Conversion" transaction will have a materially, negative impact on current operations.

Separately, Company officers D. Frederick Shefte (President)

and Eric F. Parkinson (C.E.O.) have each cancelled a previously announced and registered 10(b)5-1 Trading Plan transaction which

would have facilitated the sale of up to five-million (5,000,000) shares for each officer. These shares will be converted back

into Rule 144 Sale Restricted Shares for each of the officers.

The net result to the Company's current share structure

resulting from both the termination of both the Greenwood venture, and the return of officer owned shares back into sale-restricted

status, is as follows:

Current Total Shares In Issue (Jan. 8, 2013):

583,732,365

Above amount under Restriction: 130,651,743

Total Shares available for trading: 453,080,622

Revised Total Shares in Issue (Jan. 8, 2013):

577,532,365

Above amount under Restriction: 140,651,743

Total Shares available for trading: 437,880,622

As previously disclosed, the Company has limited its

total authorized stock shares to six-hundred-million (600,000,000). The above termination of the Greenwood debt financing venture,

and the return of officer-owned shares into sale restricted status has reduced the total amount of shares that are publicly available

for trading by 16,200,000 (representing a reduction of approximately 2.8% of publicly-available shares to the market).

|

|

| Item 1.03 |

Bankruptcy or Receivership. Not Applicable. |

|

SECTION 2 — FINANCIAL INFORMATION

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. Not Applicable. |

|

| Item 2.02 |

Results of Operations and Financial Condition. Not Applicable. |

|

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. Not Applicable. |

|

| Item 2.04 |

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. Not Applicable. |

|

| Item 2.05 |

Costs Associated with Exit or Disposal Activities. Not Applicable. |

|

| Item 2.06 |

Material Impairments. Not Applicable. |

|

SECTION 3 — SECURITIES AND

TRADING MARKETS

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. Not Applicable. |

|

| Item 3.02 |

Unregistered Sales of Equity Securities. Not Applicable. |

|

| Item 3.03 |

Material Modification to Rights of Security Holders. Not Applicable. |

|

SECTION 4 — MATTERS RELATED

TO ACCOUNTANTS AND FINANCIAL STATEMENTS

| Item 4.01 |

Changes in Registrant’s Certifying Accountant. Not Applicable. |

|

| Item 4.02 |

Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. Not Applicable. |

|

SECTION 5 — CORPORATE GOVERNANCE

AND MANAGEMENT

| Item 5.01 |

Changes in Control of Registrant. Not Applicable. |

|

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. Not Applicable. |

|

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. Not Applicable. |

|

| Item 5.04 |

Temporary Suspension of Trading Under Registrant's Employee Benefit Plans. Not Applicable. |

|

| Item 5.05 |

Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics. Not Applicable. |

|

| Item 5.06 |

Change in Shell Company Status. Not Applicable. |

|

SECTION 6 — ASSET-BACKED

SECURITIES

| Item 6.01 |

ABS Informational and Computational Material. Not Applicable. |

|

| Item 6.02 |

Changes in Servicer or Trustee. Not Applicable. |

|

| Item 6.03 |

Change in Credit Enhancement or Other External Support. Not Applicable. |

|

| Item 6.04 |

Failure to Make a Required Distribution. Not Applicable. |

|

| Item 6.05 |

Securities Act Updating Disclosure. Not Applicable. |

|

SECTION 7 — REGULATION FD

| Item 7.01 |

Regulation FD Disclosure. Not Applicable. |

|

SECTION 8 — OTHER EVENTS

| Item 8.01 |

Other Events. Not Applicable. |

|

SECTION 9 — FINANCIAL STATEMENTS

AND EXHIBITS

| Item 9.01 |

Financial Statements and Exhibits. |

|

| |

(a) Financial statements of businesses acquired. Not Applicable. |

|

| |

(b) Pro forma financial information. Not Applicable. |

|

| |

(c) Shell company transactions. Not Applicable. |

|

| |

(d) Exhibits. Not Applicable. |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: January 8, 2014 |

Hannover House, Inc. |

| |

By |

/s/

Eric F. Parkinson |

| |

|

Name: Eric F. Parkinson

Title: C.E.O. |

INDEX TO EXHIBITS

| Exhibit No. |

|

Description |

| 1 |

|

Not Applicable. |

| |

|

|

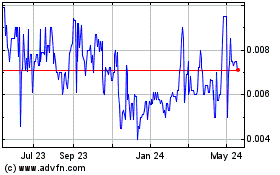

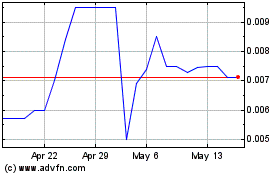

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Dec 2023 to Dec 2024