Hong Kong Property-Tax Rise Shakes Shares of Developers

07 November 2016 - 5:50PM

Dow Jones News

HONG KONG—Hong Kong property stocks slumped Monday after a

decision by the city's government late last week to increase

property taxes in an effort to cool a surging market.

The new measures, which will see the stamp duty on home

purchases by an individual or corporation almost double to 15% from

8.5%, are meant to tamp down prices that have risen nearly 9% this

year, the government said.

Hong Kong developers led the top decliners in morning trading,

with New World Development Co., Sun Hung Kai Properties Ltd. and

Wheelock & Co. each diving more than 9%. Henderson Land

Development Co., Sino Land Co., Kerry Properties Ltd. and Sino Land

Co. were all down more than 6%. The broader Hang Seng Index was up

0.5% by the middle of the day.

Hong Kong property prices, already among the world's most

expensive, have headed upward this year thanks to low mortgage

rates and rising interest from mainland Chinese buyers eager to

park their money in non-yuan denominated assets. The Chinese

currency has dropped 4.35% against the dollar this year.

Hong Kong Chief Executive Leung Chun-ying said Friday that

investment demand in the housing market had risen in the past few

months and the cooling measures were in part aimed to counter

this.

Analysts at Bank of America Merrill Lynch on Monday downgraded

their outlook for Hong Kong developers saying "the higher stamp

duty will likely impact about 25% of transactions and drive out

investors and some mainlanders (at least in the short term)." BAML

now forecasts a 5% drop in Hong Kong property prices in the next

six months.

High property prices have long been a flashpoint in Hong Kong, a

city of seven million that is part of China but has its own legal

and government system.

First-time home buyers who are also Hong Kong residents will be

exempt from the new tax rate, the government said.

Analysts expect the new tax measures to fuel reluctance on the

part of both buyers and sellers in the housing market, suppressing

volume and reducing liquidity.

For equity market investors, this should be a trigger for

profit-taking since property stocks have rallied over the past few

months on the back of strong sales, said Jonas Kan, head of Hong

Kong research at Daiwa Capital Markets.

Write to Anjie Zheng at Anjie.Zheng@wsj.com and Gregor Stuart

Hunter at gregor.hunter@wsj.com

(END) Dow Jones Newswires

November 07, 2016 01:35 ET (06:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

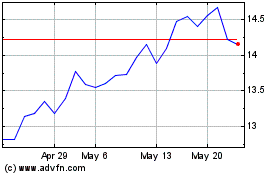

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

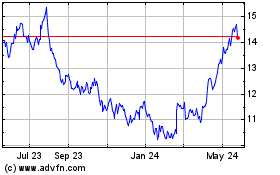

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024