Asian Shares Flat on Investor Caution Over U.S. Election Race

08 November 2016 - 3:20PM

Dow Jones News

Asian equity markets were mostly flat early Tuesday ahead of the

U.S. presidential election, as investors remained cautious over the

close race between Hillary Clinton and Donald Trump.

Some investors have said that a win by Mrs. Clinton could leave

markets relatively calm, with investors generally preferring the

Democratic nominee because of her perceived predictability on

economic policies. However, her lead in the polls have been

narrowing.

"I think we have seen all of the upsides from Sunday's news,"

said Alex Furber, a sales trader at CMC Markets, referring to the

decision by the Federal Bureau of Investigation not to pursue

charges against Mrs. Clinton on her use of a private email

server.

Mr. Furber expects a broad-based selloff in markets and a shift

from risky assets if Mr. Trump wins the election.

Stocks in Asia initially opened higher to track Wall Street's

overnight strength, but several key markets soon reversed into

negative territory. Japan's Nikkei Stock Average gave up earlier

gains of 0.3% and was last down 0.2%, while Australia's S&P/ASX

200 fell 0.1% and Korea's Kospi was flat.

In the U.S., by contrast, the S&P 500 on Monday made its

biggest gain since March, closing 2.2% higher and the Dow Jones

Industrial Average gained 2.1%.

The Nikkei fell Tuesday despite a 0.1% gain in the U.S. dollar

against the Japanese yen. A weaker yen makes Japanese exports more

competitive and improves corporate profitability.

Shares of life insurers and banks benefited from higher,

long-term government bond yields in the U.S. and Japan. Dai-ichi

Life Holdings was up 1.3%, while T&D Holdings rose 1.9%,

Sumitomo Mitsui Financial Group gained 0.6% and Nomura added

0.4%.

Prices for Brent crude, the international oil benchmark, rose on

reports that Russia signaled it would take part in a deal with

members of the Organization of the Petroleum Exporting Countries to

cut production. Brent was last up 0.2% at $46.25 a barrel in

morning Asian trade, though Nymex futures were flat.

Commodity prices also rose amid increased hopes of a victory for

Mrs. Clinton. In Australia, BHP Billiton rose 2.6% and Rio Tinto

added 1.7%. Woodside Petroleum and Oil Search were up by 1.2% and

1.4%, respectively, following gains in crude oil prices.

Stocks in Greater China were higher, though the markets have

been stuck in range-bound trade for several sessions. Hong Kong's

Hang Seng Index was up 0.3% and the Shanghai Composite Index added

0.2%.

Tuesday's equity market performance in Asia contrasted with

Monday's strong buying momentum, though the gains in the previous

session were mainly due to traders covering their short positions,

Chris Weston, chief market strategist at broker IG, said.

"Clients are overwhelmingly asking how much can you trust the

polls" for the U.S. election, he said. "Everyone has been burned

before," he said, referring to the shock outcome of the Brexit vote

in June.

Kosaku Narioka and Jenny Hsu contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

November 07, 2016 23:05 ET (04:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

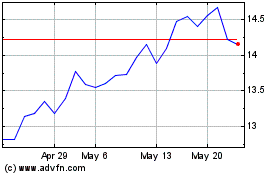

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

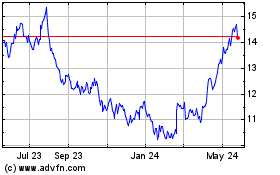

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024