Stock Selloff Hits Limits as Investors Undo Bets

09 November 2016 - 7:10PM

Dow Jones News

U.S. stock futures plunged overnight as early election results

showed Republican presidential nominee Donald Trump leading in

several key states.

E-mini S&P 500 futures fell 5% around midnight Eastern Time,

hitting a limit designed to halt further drops, before recently

paring losses to 4.1%. Equities futures are limited to a 5% loss or

gain during overnight trading, CME Group Inc. spokeswoman Alex

Gorbokon said. The last time stock-market futures fell 5% in

after-hours trading was in the aftermath of Brexit on June 23.

Investors were once again caught off guard late Tuesday.

The S&P 500 jumped 2.2% on Monday—its biggest gain since

March—and rose another 0.4% on Tuesday as investors and traders

appeared more confident about a victory for Democratic presidential

candidate Hillary Clinton. That came after the index posted nine

consecutive sessions of losses through the end of last week as

polls tightened.

"Monday and Tuesday, the assumption was Clinton would take the

election in a cakewalk. Based on what we see right now, that

assumption is wrong," said Jack Ablin, chief investment officer at

wealth manager BMO Private Bank.

Mr. Ablin added that this selloff "isn't an emotional avalanche,

this is simply a rational unwinding of a fallacious assumption."

Still, if Mr. Trump wins, he said, there could be a steep selloff

on Wednesday.

Stocks in Asia tumbled, with Japan's Nikkei Stock Average losing

5.4% and Hong Kong's Hang Seng falling 2.9%.

Dow Jones Industrial Average futures dropped 700 points, or

3.8%, to 17585. The last time the Dow closed below 17600 was June

28, five days after the U.K. voted to leave the European Union.

Changes in stock futures don't always accurately predict moves in

the stock market after the opening bell.

Several investors and analysts had cited Brexit as a reason to

be cautious heading into the U.S. election. The S&P 500 rose

1.3% on June 23, before the results came out, then tumbled more

than 5% over the following two trading sessions. However, stocks

recovered and rose to new highs over the summer.

With clients texting and asking what they should do as the U.S.

results were announced, David Kotok, chief investment officer at

Cumberland Advisors, had one piece of advice: "I say to them, 'You

should probably get some sleep.'"

Some said the market was overreacting—that the race remained

close and selling was likely to be short-lived.

"Everyone wants to be the first to panic, not the last," said

Brian Jacobsen, chief portfolio strategist at Wells Fargo Funds

Management.

Ryan Wibberley, chief executive of Gaithersburg, Md.-based CIC

Wealth, said that if the Dow Jones Industrial Average opened down

700 points on Wednesday morning, his firm would probably be buying

on Wednesday, no matter who wins the presidential election. "I just

think regardless, I'm not surprised the market is down, but I don't

think it's going to hold for more than a week."

"There'll be good deals," he added, paused, and said, "I don't

know what yet."

Write to Corrie Driebusch at corrie.driebusch@wsj.com, Aaron

Kuriloff at aaron.kuriloff@wsj.com and Akane Otani at

akane.otani@wsj.com

(END) Dow Jones Newswires

November 09, 2016 02:55 ET (07:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

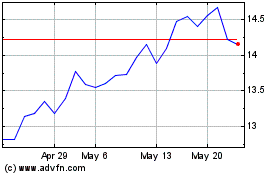

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

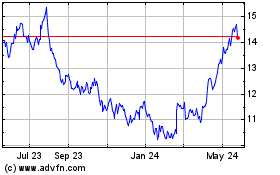

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024