Larger Asia Markets Resilient; Currencies Gain Strength

15 November 2016 - 2:30PM

Dow Jones News

Larger markets in Asia showed resilience Tuesday despite a

selloff in the emerging world, as shares were broadly mixed and

local currencies gained some strength.

The Hang Seng Index Index reversed Monday's steep losses and was

recently up 0.5%; the Shanghai Composite was down 0.1%. Meanwhile,

the Nikkei Stock Average was recently down 0.1% even the yen rose

0.5% against the U.S. dollar. The pair was last trading at 108.04

yen; it crossed the critical ¥ 108 mark earlier in the morning

session.

"I don't think the dollar's uptrend will be disrupted easily,

but it would not be a surprise to see an adjustment of speed," said

Takuya Kanda, a senior researcher at Gaitame.Com Research

Institute. Investors took profits in the currency pair after it

touched a five-month high of ¥ 108.54 overnight, he said.

The S&P/ASX 200 was recently down 0.4%, following an

overnight decline in commodity prices. BHP Billiton was 0.6% lower

and Rio Tinto fell 0.7%. Korea's Kospi recently gained 0.2% after

opening lower.

Broadly speaking, Asian currencies got a reprieve Tuesday

morning. The Thai baht and the Taiwan dollar were up 0.4% against

the U.S. dollar, according to Thomson Reuters. The Indonesian

rupiah, which has been battered by outflows seeking higher yielding

U.S. assets, was up 0.2%. The Malaysian ringgit was about flat and

the Korean won was up 0.1%.

Last week, traders in Asia were optimistic that the policies of

U.S. President-elect Donald Trump would lift Asian markets and

economies, according to Greg McKenna, chief market strategist at

forex broker AxiTrade. Mr. Trump has promised to roll out fiscal

stimulus, lower corporate taxes and increase infrastructure

spending.

That optimism turned sour after U.S. Treasury yields jumped,

which had the effect of pulling cash from emerging markets in Asia.

Investors bet that Trump-driven inflation would give the U.S.

Federal Reserve room to rapidly raise interest rates.

Hiroyuki Kachi contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

November 14, 2016 22:15 ET (03:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

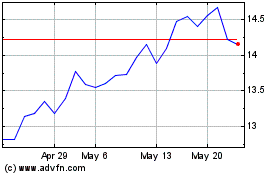

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

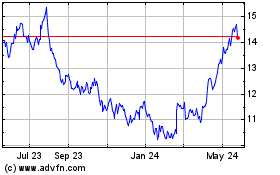

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024