Asia Stocks Slide on Oil Slip

17 November 2016 - 2:10PM

Dow Jones News

A drop in oil prices weighed on Asia stocks on Thursday, ahead

of inflation, jobs and exports data expected from the U.S. and

testimony from Federal Reserve Chairwoman Janet Yellen on the

economic outlook to Congress later in the day.

Australia's S&P/ASX 200 recovered to trade up 0.1% after

being in the red for most of the morning session, with BHP Billiton

declining 0.2% and Rio Tinto recovering to trade higher by 0.2%.

However Oil Search fell 0.9% with Woodside Petroleum losing

2.3%.

"The strengthening U.S. dollar is buffeting commodity prices,"

said Michael McCarthy, chief market strategist at CMC Markets in

Sydney. Stock market declines in the U.S. and Europe also weighed

on equities in Asia, he said.

The dollar touched a 13-year high on Wednesday, boosted by

rising U.S. bond yields and expectations of a significant fiscal

stimulus under the administration of President-elect Donald Trump.

The ICE Dollar Index, which measures the U.S. currency against a

basket of six others, rose to 100.57 earlier in the session, its

highest level since April 2003. It was last trading 0.2% down at

100.23.

Crude prices declined following data from the U.S. Energy

Information Administration on Wednesday that crude oil inventories

in the country were higher than expected last week on rising

imports and a buildup in Oklahoma. Inventories of crude rose for

the third consecutive week to 5.3 million barrels in the week

ending Nov. 11, compared with expectations of an increase of 1.5

million barrels. Brent crude, the international benchmark, was last

trading down 0.3% at $46.48 a barrel.

The data overshadowed comments from Russian Energy Minister

Alexander Novak who told reporters at a Moscow energy forum that

Russia would "support any decision" adopted by the Organization of

the Petroleum Exporting Countries. Crude prices had surged nearly

6% Tuesday on news that OPEC would try to limit production ahead of

a meeting in Vienna.

In Japan, the Nikkei Stock Average was down 0.3% with Japan

Petroleum Exploration down 0.7%, recovering from a decline of 1.2%.

A 0.1% gain in the yen against the dollar hurt equities as a

stronger currency weighs on corporate profits.

Korea's Kospi index also slipped, by 0.2%, and Hong Kong's Hang

Seng lost 0.1% and the Shanghai Composite fell 0.3%.

Investors also sold shares to hold cash ahead of expected

volatility. Later in the U.S. on Thursday, data on October consumer

prices, weekly jobless claims and export sales are due. But the

market will be focused on a U.S. congressional testimony from U.S.

Federal Reserve Chairwoman Janet Yellen. New York Fed President

William Dudley and Fed Board Governor Lael Brainard will also be

speaking at public events.

"Assets are repricing for the likelihood of a Trump-as-Reagan

scenario," said Timothy Condon, head of research for Asia at ING

Financial Markets, meaning he expects Mr. Trump to spend

aggressively. The asset repricing had taken a breather Wednesday,

he said.

Gold, considered a hedge against volatility, was up 0.3% in

early Asian trade.

Ese Erheriene contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

November 16, 2016 21:55 ET (02:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

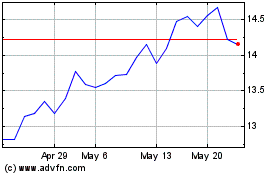

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

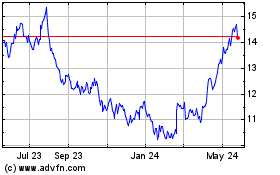

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024