Asia Shares Rise as Weaker Yen Sends Nikkei to 10-Month High

18 November 2016 - 3:00PM

Dow Jones News

A weaker yen sent Japan's Nikkei to a 10-month high on Friday,

helping drive gains across key Asian markets as robust U.S.

economic data buoyed expectations of an interest-rate hike next

month.

The Nikkei Stock Average was up 0.8%, having traded at its

highest level since Jan. 7 earlier in the session at 18043.72

points. Australia's S&P/ASX 200 was 0.3% higher, the Hang Seng

Index in Hong Kong added 0.3%, and Singapore's FTSE Straits Times

Index added 0.6%.

Overnight, Federal Reserve Chairwoman Janet Yellen said an

interest-rate increase could happen "relatively soon." Her comments

come amid upbeat data, with the number of Americans applying for

first-time unemployment benefits falling to its lowest level since

November 1973.

Meanwhile, U.S. consumer prices increased in October from a year

earlier at the fastest rate in two years. According to CME Group's

FedWatch tool, the likelihood of an interest-rate rise at the Fed's

meeting in December is now higher than 90%.

"It's all [about] Yellen's speech," said Tareck Horchani, deputy

head of Asian-Pacific sales trading at Saxo Markets. "All of this

pushed the dollar higher…and dollar-yen exploded."

The dollar gained further strength in early Asia trade Friday,

pushing it beyond the ¥ 110 mark for the first time in five months.

The yen was recently down 0.3% against the greenback, at ¥ 110.40

to the dollar.

In Japan, exporters caught an updraft from the favorable

currency winds as their goods became cheaper to ship around the

globe. Chip maker Renesas Electronics was up 6.6%, auto maker

Suzuki Motor rose 3.4% and electronics giant Sharp added 1.7%.

Across the region, financial stocks got a further boost as

investors continued their bets that a Donald Trump presidency could

see looser banking regulations and higher interest rates. The

S&P/ASX 200 financials subindex in Australia was 0.3% higher,

while Japan's Topix bank subindex increased 0.7%.

However, shares in Asian emerging markets faced further selling

pressure, with analysts expecting more declines given that rate

increases will likely spur a flight of capital back to the U.S., as

investors search for higher yields.

In Indonesia, the Jakarta Composite Index was last down 0.5%,

while the FTSE Bursa Malaysia Index was off 0.3%.

"I expect the broad selloff to continue in emerging markets in

Asia because I feel if the rates in the U.S. are really going to go

up, there is no point putting your money in risky countries," said

Mr. Horchani.

Elsewhere, oil prices slumped as hopes that members of the

Organization of the Petroleum Exporting Countries could reach a

deal to cut output at their Nov. 30 meeting took a dive.

"The market is lowering expectations regarding the OPEC talk and

oil prices dropped back down," said Alex Wijaya, a sales trader at

CMC Markets, in a note.

Brent crude, the global price benchmark, was last down 1% at

$46.05 a barrel in Asian trade. Shares in oil producers across Asia

felt the pinch. Australia's Santos Ltd. fell 1.0%, while Japanese

oil and gas explorer Inpex Corp. slipped 1.1%. In Hong Kong, oil

major PetroChina Co. declined 1.2%.

Kosaku Narioka contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

November 17, 2016 22:45 ET (03:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

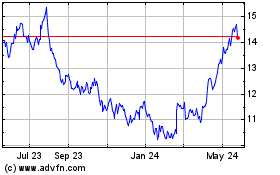

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

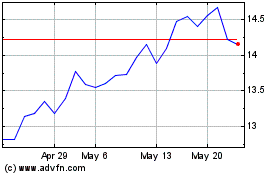

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024