Shenzhen-Hong Kong Trading Link Gets Off to Slow Start

05 December 2016 - 7:30PM

Dow Jones News

HONG KONG—The opening of a trading link between the Hong Kong

and Shenzhen stock markets met with a muted response from

investors.

At the midday trading break Monday, investors based outside

China had piled around 1.6 billion yuan ($230.5 million) into the

Shenzhen market—home to some of the country's fastest-growing

companies in sectors like technology, pharmaceuticals and consumer

goods—while Chinese investors had put some 521 million yuan ($75.1

million) into Hong Kong stocks. Those totals represent 12% and 5%,

respectively, of the daily limits for the link known as Stock

Connect.

The Shenzhen Composite Index was off 0.8%; Hong Kong's benchmark

Hang Seng Index, off 0.3%.

The underwhelming activity comes despite a monthslong buildup,

as the opening coincided with a number of events that weighed on

global markets during Asian trading hours. Italy's prime minister

resigned after losing a key referendum vote, while U.S.

President-elect Donald Trump criticized China's currency and trade

policies via Twitter.

Investors were also shaken by harsh criticism over the weekend

from China's top securities regulator Liu Shiyu of the practice of

using borrowed funds to build big stakes in companies, which he

called "barbaric" and "industrial robbery."

The latest Stock Connect allows global investors to trade 881

shares listed in Shenzhen and opens more Hong Kong stocks to

mainland Chinese investors. Analysts say the Shenzhen market's

wealth of companies in faster-growing parts of economy could in

time make it more attractive to foreign investors than the Shanghai

market, dominated more by less dynamic state-owned enterprises such

as banks and oil companies.

"There are definitely a few companies that trade in Shenzhen

that people have liked for a while but didn't have easy access to

before," said Joshua Crabb, head of Asian equities at Old Mutual

Global Investors. "It's very natural to see these stocks starting

to gain from some institutional attention." The Shenzhen market is

dominated by retail investors, a factor cited in its well-earned

reputation for volatility.

In Hong Kong, an opening ceremony for the new Stock Connect was

more restrained than the one for a similar link with Shanghai two

years ago, as was investor response. On that earlier launch day,

around two-thirds of the daily quota for Shanghai shares was used

up in the first 45 minutes of trading.

For much of this year, more money has flowed "southbound"

through the linkâ "from Shanghai into Hong Kongâ "than the other

way.

Among the Shenzhen-traded companies analysts point to are

Hikvision, a video-surveillance provider, Wanda Cinema Line, the

world's biggest movie-theater operator, and Gree, a leading

home-appliances maker. Monday's big winners, though, were

lesser-known companies, with video-display maker Shenzhen Silkroad

Digital Vision Co. Ltd. and cable maker Nanjing Quanxin Cable

Technology both rising by 10%, the daily limit allowed on the

exchange.

Some long-term investors seem to have "already done their

homework" on Shenzhen, said Nicole Yuen, vice chairman and head of

equities for Greater China at Credit Suisse, adding, though, that

she expects only gradual growth in northbound trading volume

through the link.

"It will not be abrupt," she said.

Yifan Xie in Shanghai and Gregor Stuart Hunter in Hong Kong

contributed to this article.

(END) Dow Jones Newswires

December 05, 2016 03:15 ET (08:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

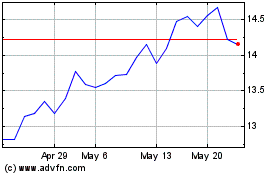

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2024 to Jan 2025

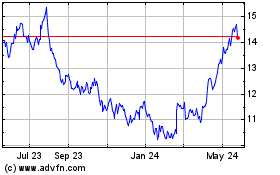

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Jan 2024 to Jan 2025