Asian Shares Lifted by Record Wall Street Close

08 December 2016 - 4:00PM

Dow Jones News

Asian equity markets were firmly higher on Thursday, propelled

by another record close on Wall Street and expectations that the

European Central Bank will extend its monetary-stimulus

measures.

Australia's S&P/ASX 200 rose 1.3%, while the Nikkei Stock

Average gained 0.8% and Korea's Kospi added 1%. Hong Kong's Hang

Seng Index was up 0.6%, after briefly reclaiming the 23,000-point

mark, and the Shanghai Composite Index rose 0.1%.

Asia's stock gains came as major U.S. indexes logged their

biggest one-day rally since the November elections, with a 1.6%

gain in the Dow Jones Industrial Average and a 1.3% rise in S&P

500 sending both to fresh closing highs.

While there was no specific trigger for the U.S. rally, market

participants speculated that large orders in stock futures placed

by computer programs may have accelerated buying.

"Despite a lack of triggering data, animal spirits were evident

in overnight trading," said Michael McCarthy, chief market

strategist at CMC Markets.

In Asia, gains in commodities stocks helped drive the

S&P/ASX 200 to become the best performing Asia-Pacific market

so far on Thursday. This followed a surge in iron-ore prices, which

tracked the movement of steel prices, to a more-than two-year high.

Chinese rebar steel futures had surged nearly 7% on Wednesday.

Among individual resource stocks, Rio Tinto was last up 3.8%,

while Fortescue Metals rose 3.3% and BHP Billiton added 1.9%.

In Japan, industrial and financial stocks were leading gains,

with equipment maker SMC surging 4.1% and casualty insurer Sompo

Holdings rising 3%.

Shares of electronics maker Sharp surged 9.3%, making it the

best-performing large-cap Japanese stock, with analysts noting that

recent comments by Chief Executive Tai Jeng-wu have raised

expectations that the troubled electronics maker is on a firm path

to recovery.

Meanwhile, the Korean market was up despite the prospect of

early elections in Asia's fourth-largest economy. South Korean

President Park Geun-hye is widely expected to be impeached by

lawmakers on Friday, amid the country's biggest political scandal

in a generation.

Looking ahead, investors will be closely watching the European

Central Bank's meeting later Thursday. Most investors and analysts

expect at least a six-month extension to the bank's monthly

purchase of 80 billion euros ($86 billion) of assets. The ECB will

also likely ease its bond-purchase criteria to get around the

"running out of bunds" problem, analysts said.

"An extension would be good for risk assets globally," said Bill

Bowler, an equity sales trader for Asian equities at Forsyth Barr

Asia.

Most Asia-Pacific government bonds strengthened Thursday ahead

of the ECB decision, with Australia's 10-year debt yield falling

6.3 basis points to bid at 2.743% and New Zealand's 10-year debt

yield down 5 basis points to bid at 3.20%, according to Thomson

Reuters. Yields fall as bond prices rise.

Rhiannon Hoyle, Kosaku Narioka, Jonathan Cheng, Carol Chan,

Akane Otani and Sam Goldfarb contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

December 07, 2016 23:45 ET (04:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

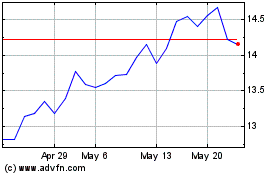

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

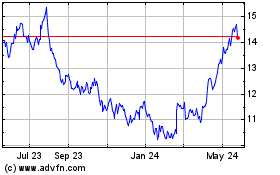

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024