Filed

pursuant to Rule 424(b)(5)

Registration No. 333-252523

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated February 3, 2021)

Up

to $45,000,000 of Shares of Common Stock

SunHydrogen,

Inc.

This

prospectus supplement relates to the issuance and sale of up to $45,000,000 in shares of our common stock to GHS Investments, LLC (“GHS”),

an “accredited investor” as defined by Rule 501(a) of Regulation D under the Securities Act of 1933, as amended (the “Securities

Act”), under a purchase agreement entered into on November 17, 2022 (the “Purchase Agreement”). GHS is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act.

The

shares offered consist of shares of our common stock that we may sell from time to time, at our sole discretion, to GHS over the next

fourteen months in accordance with the Purchase Agreement. See “Purchase Agreement with GHS Investments, LLC” on page S-2

of this prospectus for a description of the Purchase Agreement.

Our

common stock trades on the OTC Pink under the symbol, “HYSR.” On November 18, 2022, the last reported sales price of our

common stock on the OTC Pink was $0.028 per share.

Investing

in our securities involves a high degree of risk. Please see “Risk Factors” on page S-4 of this prospectus supplement for

a discussion of important risks that you should consider before making an investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

The

date of this prospectus supplement is November 22, 2022

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the U.S. Securities and

Exchange Commission, or SEC, utilizing a “shelf” registration process and relate to the offering of our common stock. Before

buying any of the common stock that we are offering, we urge you to carefully read this prospectus supplement and the accompanying prospectus,

together with the information incorporated by reference as described under the heading “Incorporation of Certain Information by

Reference” in this prospectus supplement. These documents contain important information that you should consider when making your

investment decision.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also

adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein or therein.

The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are

referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus

supplement, on the one hand, and the information contained in any document incorporated by reference into this prospectus supplement

that was filed with the U.S. Securities and Exchange Commission (the “SEC”), before the date of this prospectus supplement,

on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent

with a statement in another document having a later date—for example, a document incorporated by reference into this prospectus

supplement—the statement in the document having the later date modifies or supersedes the earlier statement.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein or in the accompanying prospectus were made solely for the benefit of the parties to such agreement,

including, in some cases, for the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus.

We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We are not making an offer to sell or seeking an offer to buy our common stock under this prospectus

in any jurisdiction where the offer or sale is not permitted. Persons outside the United States who come into possession of this prospectus

must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus

outside the United States. Furthermore, you should not consider this prospectus to be an offer or solicitation relating to the securities

if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover

of this prospectus, or that the information contained in any document incorporated by reference is accurate as of any date other than

the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

Our business, financial condition, results of operations and prospects may have changed since those dates. It is important for you to

read and consider all information contained in this prospectus supplement, the accompanying prospectus, and the documents incorporated

by reference herein and therein, in their entirety, before making an investment decision. You should also read and consider the information

in the documents to which we have referred you in the section entitled “Incorporation of Certain Information by Reference”

in this prospectus supplement.

In

this prospectus supplement and the accompanying prospectus, unless the context otherwise requires, references to “SunHydrogen,”

the “Company,” “we,” “our,” or “us,” refer to SunHydrogen, Inc. unless the context suggests

otherwise.

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein contain or incorporate

forward-looking statements. These forward-looking statements reflect management’s beliefs and assumptions. In addition, these forward-looking

statements reflect management’s current views with respect to future events or our financial performance, and involve certain known

and unknown risks, uncertainties and other factors, including those identified below, which may cause our or our industry’s actual

or future results, levels of activity, performance or achievements to differ materially from those expressed or implied by any forward-looking

statements or from historical results. Forward-looking statements include information concerning our possible or assumed future results

of operations and statements preceded by, followed by, or that include the words “may,” “will,” “could,”

“would,” “should,” “believe,” “expect,” “plan,” “anticipate,”

“intend,” “estimate,” “predict,” “potential” or similar expressions.

Forward-looking

statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might

not even anticipate. Although we believe that the expectations reflected in the forward-looking statements are based upon reasonable

assumptions at the time made, we can give no assurance that the expectations will be achieved. Future events and actual results, financial

and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place

undue reliance on these forward-looking statements.

The

factors described under “Risk Factors” in this prospectus supplement and in any documents incorporated by reference herein,

and other factors could cause our or our industry’s future results to differ materially from historical results or those anticipated

or expressed in any of our forward-looking statements. We operate in a continually changing business environment, and new risk factors

emerge from time to time. Other unknown or unpredictable factors also could have material adverse effects on our future results, performance

or achievements. We cannot assure you that projected results or events will be achieved or will occur.

You

should read this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein

completely and with the understanding that our actual future results may be materially different from what we expect. Any forward-looking

statement speaks only as of the date of this prospectus supplement. We do not assume any obligation to update any forward-looking statements,

whether as a result of new information, future events or otherwise, except as may be required by law.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights certain information about this offering and selected information contained elsewhere in or incorporated by reference

into this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information

that you should consider before deciding whether to invest in our shares of common stock. You should carefully read this entire prospectus

supplement and accompanying prospectus, including the information incorporated herein and therein, including the “Risk Factors”

section contained in this prospectus supplement and the other documents incorporated by reference into this prospectus supplement.

Overview

At

SunHydrogen, we are developing a breakthrough, low-cost technology to make renewable hydrogen using sunlight and any source of water,

including seawater and wastewater. The only byproduct of hydrogen fuel is pure water, unlike hydrocarbon fuels such as oil, coal and

natural gas that release carbon dioxide and other contaminants into the atmosphere when used. By optimizing the science of water electrolysis

at the nano-level, our low-cost nanoparticles mimic photosynthesis to efficiently use sunlight to separate hydrogen from water, ultimately

producing environmentally friendly renewable hydrogen. Using our low-cost method to produce renewable hydrogen, we intend to enable a

world of distributed hydrogen production for renewable electricity and hydrogen fuel cell vehicles.

Recent

Developments

On

November 11, 2022, the Company entered into a subscription agreement with TECO 2030 ASA, a public limited company incorporated in Norway

(“TECO”). Pursuant to the subscription agreement, the Company purchased (i) 13,443,875 new shares of TECO for aggregate consideration

of $7 million, and (ii) convertible bonds of TECO for a subscription amount of $3 million. The issuance of the convertible bonds is through

a Tap Issue Addendum to TECO’s secured convertible bond agreement dated June 1, 2022, pursuant to which Nordic Trustee AS is acting

as the Security Agent on behalf of the bond holders. The Convertible Bonds mature on June 1, 2025, bear interest at the rate of 8% per

year paid quarterly in arrears and are convertible into shares of TECO at a rate of NOK 5.0868.

The

subscription agreement also provides for the nomination by the Company of a director to serve on the Board of Directors of TECO, subject

to such appointment being approved by TECO’s extraordinary general meeting.

Simultaneously

with entry into the subscription agreement, the Company and TECO entered into a side letter pursuant to which the parties indicated their

intention to explore a potential business combination of the parties and to thereafter seek to list the shares of the combined company

on a U.S. stock exchange.

Corporate

Information

We

were incorporated in the State of Nevada on February 18, 2009. Our principal executive offices are located at 10 E. Yanonali, Suite 36,

Santa Barbara, CA 93101. Our telephone number is (805) 966-6566. We maintain an Internet website at www.sunhydrogen.com. The information

contained on, connected to or that can be accessed via our website is not part of this prospectus. We have included our website address

in this prospectus as an inactive textual reference only and not as an active hyperlink.

THE

OFFERING

The

following summary is qualified in its entirety by, and should be read together with, the more detailed information and financial statements

and related notes thereto appearing elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus.

Before you decide to invest in our securities, you should read the entire prospectus supplement and the accompanying prospectus carefully,

including the risk factors and the financial statements and related notes included or incorporated by reference in this prospectus supplement

and the accompanying prospectus.

| Issuer

|

|

SunHydrogen,

Inc. |

| |

|

|

| Common

Stock offered |

|

Up

to $45,000,000 of shares of our common stock that we may sell from time to time, at our sole discretion, to GHS over the next year

in accordance with the Purchase Agreement. |

| |

|

|

| Common

stock outstanding before the offering |

|

4,393,682,998

shares |

| |

|

|

| Use

of proceeds |

|

We

intend to use net proceeds of this offering to accelerate the development of our breakthrough nanoparticle hydrogen generation technology,

as well as for working capital and general corporate purposes, including strategic investments in complimentary technology companies

related to production, utilization, storage, and transportation of hydrogen. See “Use of Proceeds.” |

| |

|

|

| Risk

factors |

|

Investing

in our common stock involves a high degree of risk. You should read the description of risks set forth in the “Risk Factors”

section of this prospectus supplement or incorporated by reference in this prospectus supplement for a discussion of factors to consider

before deciding to purchase our securities. |

| |

|

|

| OTC

Pink stock symbol |

|

HYSR

|

The

number of shares of common stock outstanding before this offering is based on 4,393,682,998 shares of our common stock outstanding as

of November 4, 2022. Unless we specifically state otherwise, the share information in this prospectus supplement excludes:

| |

● |

156,031,859

shares of common stock issuable upon the exercise of outstanding stock options as of November 4, 2022 at a weighted average exercise

price of $0.01; |

| |

● |

shares

of common stock issuable upon conversion of convertible notes in the aggregate amount of approximately $759,347 as of November 4,

2022, which are convertible into shares of common stock at variable conversion prices; |

| |

● |

94,895,239

shares of common stock issuable upon exercise of warrants with exercise prices ranging from

$0.0938 - $0.13125 per share; and |

| |

● |

284,210,526

shares of common stock issuable upon conversion of 2,700 shares of Series C Preferred Stock outstanding as of November 4, 2022. |

Purchase

Agreement with GHS Investments, LLC

On

November 17, 2022, we entered into the Purchase Agreement with GHS, which provides that, upon the terms and subject to the conditions

and limitations set forth therein, we have the right to sell to GHS up to $45,000,000 of shares of our common stock at our discretion

as described below.

The

Company has the right, in its sole discretion, subject to the conditions and limitations in the Purchase Agreement, to direct GHS, by

delivery of a purchase notice from time to time (a “Purchase Notice”) to purchase (each, a “Purchase”) over the

fourteen month term of the Purchase Agreement, a minimum of $100,000 and up to a maximum of $2,000,000 (the “Purchase Amount”)

of shares of common stock (the “Purchase Shares”) for each Purchase Notice, provided that the parties may agree to waive

such limitation. The number of Purchase Shares we will issue under each Purchase will be equal to 112.5% of the Purchase Amount sold

under such Purchase, divided by the Purchase Price per share (as defined under the Purchase Agreement). The “Purchase Price”

is defined as 90% of the lowest end-of-day volume weighted average price of the common stock for the five consecutive business days immediately

preceding the purchase date, including the purchase date. The Company may not deliver more than one Purchase Notice to GHS every five

business days except as the parties may otherwise agree.

The

Purchase Agreement prohibits us from directing GHS to purchase any shares of common stock if those shares, when aggregated with all other

shares of our common stock then beneficially owned by GHS and its affiliates, would result in GHS and its affiliates having beneficial

ownership, at any single point in time, of more than 4.99% of the then total outstanding shares of our common stock.

There

are no trading volume requirements or restrictions under the Purchase Agreement. We will control the timing and amount of any sales of

our common stock to GHS.

Events

of default under the Purchase Agreement include the following:

| ● | the

effectiveness of the registration statement for the Purchase Shares lapses for any reason

or is unavailable for the issuance to or resale by GHS of the Purchase Shares; |

| |

● |

the

suspension of our common stock from trading for a period of two business days; |

| |

● |

the

delisting of the Company’s common stock from the OTC Pink; provided, however, that the common stock is not immediately thereafter

trading on the Nasdaq Capital Market, New York Stock Exchange, the Nasdaq Global Market, the Nasdaq Global Select Market, the NYSE

American, or the OTCQX or OTCQB (or any nationally recognized successor to any of the foregoing); |

| |

● |

the

failure for any reason by the transfer agent to issue Purchase Shares to GHS within three business days after the applicable date

on which GHS is entitled to receive such Purchase Shares; |

| |

● |

any

breach of the representations and warranties or covenants contained in the Purchase Agreement if such breach would reasonably be

expected to have a material adverse effect and such breach is not cured within five business days; |

| |

● |

insolvency

or bankruptcy proceedings are commenced by or against us, as more fully described in the Purchase Agreement; or |

| |

● |

if

at any time we are not eligible to transfer our common stock electronically via DWAC. |

So

long as an event of default (all of which are outside the control of GHS) has occurred and is continuing, the Company may not deliver

to GHS any Purchase Notice.

This

offering will terminate on the date that all shares offered by this prospectus supplement have been sold or, if earlier, the expiration

or termination of the Purchase Agreement. We have the right to terminate the Purchase Agreement at any time. In the event of bankruptcy

proceedings by or against us, the Purchase Agreement will automatically terminate without action of any party.

The

above description of the Purchase Agreement is qualified in its entirety by reference to the Purchase Agreement, which is incorporated

by reference into this prospectus supplement.

GHS

was also the purchaser under a securities purchase agreement with the Company dated September 21, 2020 and February 3, 2021.

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. Prior to making a decision about investing in our common stock, you should

carefully consider the risk factors described below and the risk factors discussed in the section entitled “Risk Factors”

contained in our most recent Annual Report on Form 10-K, and our other filings with the SEC and incorporated by reference in this prospectus

supplement, together with all of the other information contained in this prospectus supplement. Our business, financial condition and

results of operations could be materially and adversely affected as a result of these risks. This could cause the trading price of our

common stock to decline, resulting in a loss of all or part of your investment.

Risks

Related to this Offering

We

will have broad discretion in the use of the net proceeds from this offering and we may use the net proceeds in a manner that does not

increase the value of your investment.

We

currently intend to use the net proceeds from this offering to accelerate the development of our breakthrough nanoparticle hydrogen generation

technology, as well as for working capital and general corporate purposes including strategic investments in complimentary technology

companies related to production, utilization, storage, and transportation of hydrogen. See “Use of Proceeds.” However, we

have not determined the specific allocation of the net proceeds among these potential uses. Our management will have broad discretion

over the use and investment of the net proceeds from this offering, and, accordingly, investors in this offering will need to rely upon

the judgment of our management with respect to the use of proceeds, with only limited information concerning our specific intentions.

We may use the net proceeds in ways that do not improve our operating results or increase the value of your investment.

You

may experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase in the offering.

In addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to

you.

The

offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding as of September

30, 2022. Assuming that we sell an aggregate of 2,008,928,572 shares of our common stock for aggregate gross proceeds of $45,000,000,

and after deducting estimated aggregate offering expenses payable by us, you will experience immediate dilution of approximately $0.011

per share, representing the difference between our as adjusted net tangible book value per share as of September 30, 2022 after giving

effect to this offering and the assumed effective offering price. See the section titled “Dilution” below for a more detailed

illustration of the dilution you would incur if you participate in this offering.

USE

OF PROCEEDS

We

estimate the net proceeds to us from this offering will be approximately $44.1 million, after deducting placement agent fees and estimated

offering expenses payable by us. We intend to use the net proceeds from the sale of the securities offered by this prospectus to accelerate

the development of our breakthrough nanoparticle hydrogen generation technology, as well as for working capital and general corporate

purposes including strategic investments in complimentary technology companies related to production, utilization, storage, and transportation

of hydrogen. In addition we may use proceeds of the offering to redeem shares of common stock of the Company (and/or options to purchase

shares of common stock of the Company) held by officers, directors, employees and/or consultants of the Company, in the amount of up

to $3.0 million to aid the company in key personnel retention and reduce dilution.

Until

we use the net proceeds of this offering for the above purposes, we intend to invest the funds in short-term, investment grade, interest-bearing

securities. We cannot predict whether the proceeds invested will yield a favorable return. We have not yet determined the amount or timing

of the expenditures for the categories listed above, and these expenditures may vary significantly depending on a variety of factors.

As a result, we will retain broad discretion over the use of the net proceeds from this offering.

DILUTION

If

you purchase shares of our common stock in this offering, your interest will be diluted to the extent of the difference between the offering

price per share and the pro forma as adjusted net tangible book value per share of our common stock after this offering. We calculate

net tangible book value per share by dividing our net tangible assets (tangible assets less total liabilities) by the number of shares

of our common stock issued and outstanding as of September 30, 2022.

Our

historical net tangible book value at September 30, 2022 was approximately $23.7 million, or $0.006 per share.

After

giving effect to the sale of an assumed 2,008,928,572 shares of our common stock for aggregate gross proceeds of $45,000,000 (assuming

the sale of the maximum offering amount, and based on a number of shares equal to 112.5% of $45,000,000 divided by 90% of the closing

price of our common stock of $0.028 on November 18, 2022, for an effective assumed offering price per share of $0.022 in this offering,

and after deducting estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of September 30,

2022 would have been approximately $67.8 million, or approximately $0.011 per share of our common stock. This represents an immediate

increase in net tangible book value of $0.005 per share of our common stock to our existing stockholders and an immediate dilution in

net tangible book value of approximately $0.011 per share of our common stock to new investors. The following table illustrates per share

dilution:

| Assumed

effective offering price per share | |

$ | 0.022 | |

| Net

tangible book value per share as of September 30, 2022 | |

$ | 0.006 | |

| Increase

in net tangible book value per share attributable to this offering | |

$ | 0.005 | |

| As

adjusted net tangible book value per share as of September 30, 2022, after giving effect to this offering | |

$ | 0.011 | |

| Dilution

per share to new investors purchasing shares in this offering | |

$ | 0.011 | |

The

table above assumes for illustrative purposes that we sell an aggregate of 2,008,928,572 shares of common stock for aggregate gross proceeds

of $45,000,000. The shares sold in this offering may be sold from time to time at various prices. This information is supplied for illustrative

purposes only.

The

information above is based on 4,271,749,146 shares of our common stock outstanding as of September 30, 2022, and excludes, as of

that date:

| ● | 157,965,711

shares of common stock issuable upon the exercise of outstanding stock options at a weighted

average exercise price of $0.01; |

| ● | shares

of common stock issuable upon conversion of convertible notes in the aggregate amount of

approximately $827,500, which are convertible into shares of common stock at variable conversion

prices; |

| ● | 94,895,239

shares of common stock issuable upon exercise of warrants with a weighted average exercise price of $0.11; and |

| ● | 284,210,526,shares

of common stock issuable upon conversion of 2,700 shares of Series C Preferred Stock outstanding. |

To

the extent that outstanding options or warrants are exercised, or we issue other shares, investors purchasing shares in this offering

could experience further dilution. In addition, to the extent that we raise additional capital through the sale of equity or debt securities,

the issuance of those securities could result in further dilution to our stockholders.

DESCRIPTION

OF SECURITIES OFFERED

This

prospectus relates to the offer and sale of up to $45,000,000 of shares of our common stock. See “Description of Common Stock”

in the accompanying base prospectus for a description of our common stock.

PLAN

OF DISTRIBUTION

We

are filing this prospectus supplement to cover the offer and sale of up to $45,000,000 of shares of our common stock, which we may

sell from time to time in our sole discretion to GHS over the next fourteen months, subject to the conditions and limitations in the

Purchase Agreement.

We

entered into the Purchase Agreement with GHS on November 17, 2022. The Purchase Agreement provides that, upon the terms and subject to

the conditions set forth therein, GHS is committed to purchase an aggregate of up to $45,000,000 of shares of our common stock over the

fourteen month term of the Purchase Agreement. See “The Offering—Purchase Agreement with GHS Investments, LLC.” GHS is an

“underwriter” within the meaning of Section 2(a)(11) of the Securities Act.

The

Company has the right, in its sole discretion, subject to the conditions and limitations in the Purchase Agreement, to direct GHS, by

delivery of a purchase notice from time to time (a “Purchase Notice”) to purchase (each, a “Purchase”) over the

fourteen month term of the Purchase Agreement, a minimum of $100,000 and up to a maximum of $2,000,000 (the “Purchase Amount”)

of shares of common stock (the “Purchase Shares”) for each Purchase Notice, provided that the parties may agree to waive

such limitation. The number of Purchase Shares we will issue under each Purchase will be equal to 112.5% of the Purchase Amount sold

under such Purchase, divided by the Purchase Price per share (as defined under the Purchase Agreement). The “Purchase Price”

is defined as 90% of the lowest end-of-day volume weighted average price of the common stock for the five consecutive business days immediately

preceding the purchase date, including the purchase date. The Company may not deliver more than one Purchase Notice to GHS every five

business days unless, except as the parties may otherwise agree

We

will pay a fee of 2% of the aggregate gross proceeds we receive from sales of our common stock to GHS under the Purchase Agreement to

Icon Capital Group, LLC (“Icon” or “Placement Agent”), pursuant to a placement agent agreement between us and

Icon.

We

have agreed to indemnify the Placement Agent against certain liabilities, including liabilities under the Securities Act, and liabilities

arising from breaches and representations and warranties.

The

Placement Agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions

received by it and any profit realized on the resale of the securities sold by them while acting as principal might be deemed to be underwriting

discounts or commissions under the Securities Act. As an underwriter, the Placement Agent would be required to comply with the requirements

of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and

Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of securities by the Placement

Agent acting as principal. Under these rules and regulations, the Placement Agent:

| ● | may

not engage in any stabilization activity in connection with our securities; and |

| ● | may

not bid for or purchase any of our securities or attempt to induce any person to purchase

any of our securities, other than as permitted under the Exchange Act, until it has completed

its participation in the distribution. |

We

estimate our total expenses for this offering, assuming we sell the maximum offering amount of $45,000,000, will be approximately $940,000.

This

offering will terminate on the date that all shares offered by this prospectus supplement have been sold or, if earlier, the expiration

or termination of the Purchase Agreement. We have the right to terminate the Purchase Agreement at any time. In the event of bankruptcy

proceedings by or against us, the Purchase Agreement will automatically terminate without action of any party.

LEGAL

MATTERS

Sichenzia

Ross Ference LLP, New York, New York, will pass upon the validity of the securities offered by this prospectus supplement.

EXPERTS

The

financial statements of SunHydrogen, Inc. as of and for the years ended June 30, 2022 and June 30, 2021 appearing in SunHydrogen, Inc.’s

Annual Report on Form 10-K for the year ended June 30, 2022, have been audited by M&K CPAS, PLLC as set forth in its report thereon,

included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon

such report given on the authority of such firm as experts in accounting and auditing.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

We

file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission, or the

SEC. These documents are available to the public from the SEC’s website at www.sec.gov.

This

prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 relating to the common stock offered

by this prospectus supplement and the accompanying prospectus, which has been filed with the SEC. This prospectus supplement and the

accompanying prospectus do not contain all of the information set forth in the registration statement and the exhibits and schedules

thereto, certain parts of which are omitted in accordance with the rules and regulations of the SEC. Statements contained in this prospectus

supplement and the accompanying prospectus as to the contents of any contract or other document referred to are not necessarily complete

and in each instance reference is made to the copy of that contract or other document filed as an exhibit to the registration statement.

For further information about us and the common stock offered by this prospectus supplement and the accompanying prospectus we refer

you to the registration statement and the exhibits and schedules which may be obtained as described above.

The

SEC allows us to “incorporate by reference” the information contained in documents that we file with them, which means that

we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered

to be part of this prospectus supplement and the accompanying prospectus. Information in the accompanying prospectus supersedes information

incorporated by reference that we filed with the SEC before the date of the prospectus, and information in this prospectus supplement

supersedes information incorporated by reference that we filed with the SEC before the date of this prospectus supplement, while information

that we file later with the SEC will automatically update and supersede the information in this prospectus supplement and the accompanying

prospectus or incorporated by reference. We incorporate by reference the documents listed below and any future filings we will make with

the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the time that all securities covered by this prospectus

supplement have been sold; provided, however, that we are not incorporating any information furnished under any of Item 2.02 or Item

7.01 of any current report on Form 8-K:

| ● | our

Annual Report on Form 10-K for the year ended June 30, 2022 filed with the SEC on October 7, 2022; |

| ● | our

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022 filed with the SEC on November 7, 2022; |

| ● | the

description of our common stock contained in our Registration Statement on Form 8-A filed with the SEC on June 14, 2011 (File No. 000-54437),

including any amendment or report filed for the purpose of updating such description. |

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by reference.

You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: Timothy Young, 10 E. Yanonali, Suite

36, Santa Barbara, CA 93101, (805) 966-6566.

This

prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference” into this

prospectus the information that we file with them, which means that we can disclose important information to you by referring you to

those documents. The information incorporated by reference is considered to be part of this prospectus, and information that we file

later with the SEC will automatically update and supersede this information. The following documents are incorporated by reference and

made a part of this prospectus:

All

documents that we file with the SEC pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act subsequent to the date of this

registration statement and prior to the filing of a post-effective amendment to this registration statement that indicates that all securities

offered under this prospectus have been sold, or that deregisters all securities then remaining unsold, will be deemed to be incorporated

in this registration statement by reference and to be a part hereof from the date of filing of such documents.. Nothing in this prospectus

shall be deemed to incorporate information furnished but not filed with the SEC (including without limitation, information furnished

under Item 2.02 or Item 7.01 of Form 8-K, and any exhibits relating to such information).

Any

statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus shall

be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in the applicable

prospectus supplement or in any other subsequently filed document which also is or is deemed to be incorporated by reference modifies

or supersedes the statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute

a part of this prospectus.

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by reference.

You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: Timothy Young, 10 E. Yanonali, Suite

36, Santa Barbara, CA 93101, (805) 966-6566.

PROSPECTUS

$100,000,000

SunHydrogen,

Inc.

Common

Stock

Preferred

Stock

Warrants

Units

We

may from time to time, in one or more offerings at prices and on terms that we will determine at the time of each offering, sell

common stock, preferred stock, warrants, or a combination of these securities, or units, for an aggregate initial offering price

of up to $100,000,000. This prospectus describes the general manner in which our securities may be offered using this prospectus.

Each time we offer and sell securities, we will provide you with a prospectus supplement that will contain specific information

about the terms of that offering. Any prospectus supplement may also add, update, or change information contained in this prospectus.

You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed

to be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

This

prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

Our

common stock is currently traded on the OTC Pink under the symbol “HYSR.” On January 27, 2021, the last reported sales

price for our common stock was $0.191 per share. The prospectus supplement will contain information, where applicable, as to any

other listing of the securities on the OTC Pink or any other securities market or exchange covered by the prospectus supplement.

The

securities offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 2, in

addition to Risk Factors contained in the applicable prospectus supplement.

Neither

the Securities and Exchange Commission nor any State securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We

may offer the securities directly or through agents or to or through underwriters or dealers. If any agents or underwriters are

involved in the sale of the securities their names, and any applicable purchase price, fee, commission or discount arrangement

between or among them, will be set forth, or will be calculable from the information set forth, in an accompanying prospectus

supplement. We can sell the securities through agents, underwriters or dealers only with delivery of a prospectus supplement describing

the method and terms of the offering of such securities. See “Plan of Distribution.”

This

prospectus is dated February 3, 2021

Table

of Contents

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We

have not authorized anyone to provide you with information different from that contained or incorporated by reference into this

prospectus. If any person does provide you with information that differs from what is contained or incorporated by reference in

this prospectus, you should not rely on it. No dealer, salesperson or other person is authorized to give any information or to

represent anything not contained in this prospectus. You should assume that the information contained in this prospectus or any

prospectus supplement is accurate only as of the date on the front of the document and that any information contained in any document

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not an offer to

sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf”

registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus

in one of more offerings up to a total dollar amount of proceeds of $100,000,000. This prospectus describes the general manner

in which our securities may be offered by this prospectus. Each time we sell securities, we will provide a prospectus supplement

that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change

information contained in this prospectus or in documents incorporated by reference in this prospectus. The prospectus supplement

that contains specific information about the terms of the securities being offered may also include a discussion of certain U.S.

Federal income tax consequences and any risk factors or other special considerations applicable to those securities. To the extent

that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus or in documents

incorporated by reference in this prospectus, you should rely on the information in the prospectus supplement. You should carefully

read both this prospectus and any prospectus supplement together with the additional information described under “Where

You Can Find More Information” before buying any securities in this offering.

The

terms “SunHydrogen,” the “Company,” “we,” “our” or “us” in this prospectus

refer to SunHydrogen, Inc., unless the context suggests otherwise.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements.

These forward-looking statements involve risks and uncertainties, including statements regarding our capital needs, business strategy

and expectations. Any statements that are not of historical fact may be deemed to be forward-looking statements. In some cases

you can identify forward-looking statements by terminology such as “may,” “will,” “should,”

“expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,”

“predict,” “potential,” or “continue”, the negative of the terms or other comparable terminology.

Actual events or results may differ materially from the anticipated results or other expectations expressed in the forward-looking

statements. In evaluating these statements, you should consider various factors, including the risks set forth under “Risk

Factors” herein and in the documents incorporated herein by reference. These factors may cause our actual results to differ

materially from any forward-looking statements. We disclaim any obligation to publicly update these statements, or disclose any

difference between actual results and those reflected in these statements, except as may be required under applicable law.

ABOUT

SUNHYDROGEN

At

SunHydrogen, our goal is to replace fossil fuels with clean renewable hydrogen.

We

refer to our technology as the SunHydrogenH2Generator which is comprised of the following components:

1.

The Generator Housing - Novel device design is the first of its type to safely separate oxygen and hydrogen in the water splitting

process without sacrificing efficiency. This device houses the water, the solar particles/cells and is designed with inlets and

outlets for water and gasses. Utilizing a special membrane for separating the oxygen side from the hydrogen side, proton transport

is increased which is the key to safely increasing solar-to-hydrogen efficiency. Our design can be scaled up and manufactured

for commercial use.

2.

The NanoParticle or Solar Cell - Our patented nanoparticle consists of thousands of tiny solar cells that are electrodeposited

into one tiny structure to provide the charge that splits the water molecule when the sun excites the electron. In the process

of optimizing our nanoparticles to be efficient and only use earth abundant materials (an ongoing process), we experimented with

commercially available triple junction silicon solar cells to perform tests with our generator housing and other components. Through

this experimentation, our discovery leads us to believe that we can bring a system to market utilizing these readily available

cells while our nanoparticles are still being optimized. These solar cells also absorb the sunlight and produce the necessary

charge for splitting the water molecule into hydrogen and oxygen.

3.

Oxygen Evolution Catalyst - This proprietary catalyst developed at the University of Iowa lab is uniformly applied onto the solar

cell or nanoparticle and efficiently oxidize water molecule to generate oxygen gas. The oxygen evolution catalyst must be robust

to withstand the long operating hours of the hydrogen generation device to ensure long lifetime. It must be stable in alkaline,

neutral and acidic environments.

4.

Hydrogen Evolution Catalyst - Necessary for collecting electrons to reduce protons for generating hydrogen gas, we have successfully

integrated a low-cost hydrogen catalyst into our generator system successfully coating a triple junction solar cell with a catalyst

comprised primarily of ruthenium, carbon and nitrogen that can function as well as platinum, the current catalyst used for hydrogen

production, but at one twentieth of the cost.

5.

Coating Technologies - Two major coating technologies were developed to protect the nanoparticles and solar cells from photocorrosion

under water. A transparent conducive coating to protect our nanoparticles and solar cells from photo corrosion and efficiently

transfer charges to catalysts for oxygen and hydrogen evolution reactions. A polymer combination that protects the triple junction

solar cells from any corrosive water environments for long lifetime of the hydrogen generation device.

6.

A concentrator equal to two suns - This inexpensive Fresnel lens concentrator to increase sunlight to equal two suns reduces our

necessary footprint for a 1000 KG per day system.

Our

business and commercialization plan calls for two generations of our panels or generators. The first generation utilizes readily

available commercial solar cells, coated with a stability polymer and catalysts and inserted into our proprietary panels to efficiently

and safely split water into hydrogen and oxygen to produce very pure and green hydrogen that can be piped off the panel, pressurized,

and stored for use in a fuel cell to power anything electric.

The

second generation of our panels will feature a nanoparticle based technology where billions of autonomous solar cells are electrodeposited

onto porous alumina sheets and manufactured in a roll to roll process and inserted into our proprietary panels. For this generation,

we have received multiple patents and it is estimated that it will produce hydrogen for less than $4 per kilogram before pressurization.

Our

principal executive offices are located at 10 E. Yanonali, Suite 36, Santa Barbara, CA 93101. Our telephone number is (805) 966-6566.

We maintain an Internet website at www.sunhydrogen.com. The information contained on, connected to or that can be accessed via

our website is not part of this prospectus. We have included our website address in this prospectus as an inactive textual reference

only and not as an active hyperlink.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks,

uncertainties and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent

quarterly reports on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated

by reference into this prospectus.

Our

business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely

affected by these risks. For more information about our SEC filings, please see “Where You Can Find More Information”.

USE

OF PROCEEDS

Unless

otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus

for general corporate purposes, including working capital.

DESCRIPTION

OF COMMON STOCK

General

We

are authorized to issue 5,000,000,000 shares of common stock, $0.001 par value per share.

Holders

of the Company’s common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders

of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for

the election of directors can elect all of the directors to our board of directors. Holders of the Company’s common stock

representing a majority of the voting power of the Company’s common stock issued, outstanding and entitled to vote, represented

in person or by proxy, are necessary to constitute a quorum at any meeting of stockholders. A vote by the holders of a majority

of the Company’s outstanding shares is required to effectuate certain fundamental corporate changes such as a liquidation,

merger or an amendment to the Company’s articles of incorporation

Subject

to the rights of preferred stockholders (if any), holders of the Company’s common stock are entitled to share in all dividends

that the Board of Directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution

or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities

and after providing for each class of stock, if any, having preference over the common stock. The Company’s common stock

has no pre-emptive rights, no conversion rights, and there are no redemption provisions applicable to the Company’s common

stock.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Worldwide Stock Transfer, LLC.

Listing

Our

common stock is currently traded on the OTC Pink under the symbol “HYSR”.

DESCRIPTION

OF PREFERRED STOCK

We

are authorized to issue up to 5,000,000 shares of preferred stock, par value $0.001 per share, from time to time, in one or more

series. We do not have any outstanding shares of preferred stock.

Our

articles of incorporation authorizes our board of directors to issue preferred stock from time to time with such designations,

preferences, conversion or other rights, voting powers, restrictions, dividends or limitations as to dividends or other distributions,

qualifications or terms or conditions of redemption as shall be determined by the board of directors for each class or series

of stock. Preferred stock is available for possible future financings or acquisitions and for general corporate purposes without

further authorization of stockholders unless such authorization is required by applicable law, or any securities exchange or market

on which our stock is then listed or admitted to trading.

Our

board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect

the voting power or other rights of the holders of common stock. The issuance of preferred stock, while providing flexibility

in connection with possible acquisitions and other corporate purposes could, under some circumstances, have the effect of delaying,

deferring or preventing a change-in-control of the Company.

A

prospectus supplement relating to any series of preferred stock being offered will include specific terms relating to the offering.

Such prospectus supplement will include:

| ● | the

title and stated or par value of the preferred stock; |

| |

● |

the

number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred

stock; |

| |

● |

the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the preferred stock; |

| |

● |

whether

dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock shall

accumulate; |

| |

● |

the

provisions for a sinking fund, if any, for the preferred stock; |

| |

● |

any

voting rights of the preferred stock; |

| |

● |

the

provisions for redemption, if applicable, of the preferred stock; |

| |

● |

any

listing of the preferred stock on any securities exchange; |

| |

● |

the

terms and conditions, if applicable, upon which the preferred stock will be convertible into our common stock, including the

conversion price or the manner of calculating the conversion price and conversion period; |

| |

● |

if

appropriate, a discussion of Federal income tax consequences applicable to the preferred stock; and |

| |

● |

any

other specific terms, preferences, rights, limitations or restrictions of the preferred stock. |

The

terms, if any, on which the preferred stock may be convertible into or exchangeable for our common stock will also be stated in

the preferred stock prospectus supplement. The terms will include provisions as to whether conversion or exchange is mandatory,

at the option of the holder or at our option, and may include provisions pursuant to which the number of shares of our common

stock to be received by the holders of preferred stock would be subject to adjustment.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of preferred stock or common stock. Warrants may be issued independently or together with

any preferred stock or common stock, and may be attached to or separate from any offered securities. Each series of warrants will

be issued under a separate warrant agreement to be entered into between a warrant agent specified in the agreement and us. The

warrant agent will act solely as our agent in connection with the warrants of that series and will not assume any obligation or

relationship of agency or trust for or with any holders or beneficial owners of warrants. This summary of some provisions of the

warrants is not complete. You should refer to the warrant agreement, including the forms of warrant certificate representing the

warrants, relating to the specific warrants being offered for the complete terms of the warrant agreement and the warrants. The

warrant agreement, together with the terms of the warrant certificate and warrants, will be filed with the SEC in connection with

the offering of the specific warrants.

The

applicable prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this

prospectus is being delivered:

| |

● |

the

title of the warrants; |

| |

● |

the

aggregate number of the warrants; |

| |

● |

the

price or prices at which the warrants will be issued; |

| |

● |

the

designation, amount and terms of the offered securities purchasable upon exercise of the warrants; |

| |

● |

if

applicable, the date on and after which the warrants and the offered securities purchasable upon exercise of the warrants

will be separately transferable; |

| |

● |

the

terms of the securities purchasable upon exercise of such warrants and the procedures and conditions relating to the exercise

of such warrants; |

| |

● |

any

provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price

of the warrants; |

| |

● |

the

price or prices at which and currency or currencies in which the offered securities purchasable upon exercise of the warrants

may be purchased; |

| |

● |

the

date on which the right to exercise the warrants shall commence and the date on which the right shall expire; |

| |

● |

the

minimum or maximum amount of the warrants that may be exercised at any one time; |

| |

● |

information

with respect to book-entry procedures, if any; |

| |

● |

if

appropriate, a discussion of Federal income tax consequences; and |

| |

● |

any

other material terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of

the warrants. |

Warrants

for the purchase of common stock or preferred stock will be offered and exercisable for U.S. dollars only. Warrants will be issued

in registered form only.

Upon

receipt of payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant

agent or any other office indicated in the applicable prospectus supplement, we will, as soon as practicable, forward the purchased

securities. If less than all of the warrants represented by the warrant certificate are exercised, a new warrant certificate will

be issued for the remaining warrants.

Prior

to the exercise of any warrants to purchase preferred stock or common stock, holders of the warrants will not have any of the

rights of holders of the common stock or preferred stock purchasable upon exercise, including in the case of warrants for the

purchase of common stock or preferred stock, the right to vote or to receive any payments of dividends on the preferred stock

or common stock purchasable upon exercise.

DESCRIPTION

OF UNITS

As

specified in the applicable prospectus supplement, we may issue units consisting of shares of common stock, shares of preferred

stock or warrants or any combination of such securities.

The

applicable prospectus supplement will specify the following terms of any units in respect of which this prospectus is being delivered:

| |

● |

the

terms of the units and of any of the common stock, preferred stock and warrants comprising the units, including whether and

under what circumstances the securities comprising the units may be traded separately; |

| |

● |

a

description of the terms of any unit agreement governing the units; and |

| |

● |

a

description of the provisions for the payment, settlement, transfer or exchange of the units. |

PLAN

OF DISTRIBUTION

We

may sell the securities offered through this prospectus (i) to or through underwriters or dealers, (ii) directly to

purchasers, including our affiliates, (iii) through agents, or (iv) through a combination of any these methods. The securities

may be distributed at a fixed price or prices, which may be changed, market prices prevailing at the time of sale, prices related

to the prevailing market prices, or negotiated prices. The prospectus supplement will include the following information:

| |

● |

the

terms of the offering; |

| |

● |

the

names of any underwriters or agents; |

| |

● |

the

name or names of any managing underwriter or underwriters; |

| |

● |

the

purchase price of the securities; |

| |

● |

any

over-allotment options under which underwriters may purchase additional securities from us; |

| |

● |

the

net proceeds from the sale of the securities; |

| |

● |

any

delayed delivery arrangements; |

| |

● |

any

underwriting discounts, commissions and other items constituting underwriters’ compensation; |

| |

● |

any

initial public offering price; |

| |

● |

any

discounts or concessions allowed or reallowed or paid to dealers; |

| |

● |

any

commissions paid to agents; and |

| |

● |

any

securities exchange or market on which the securities may be listed. |

Sale

Through Underwriters or Dealers

Only

underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement.

If

underwriters are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting,

purchase, security lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one

or more transactions, including negotiated transactions. Underwriters may sell the securities in order to facilitate transactions

in any of our other securities (described in this prospectus or otherwise), including other public or private transactions and

short sales. Underwriters may offer securities to the public either through underwriting syndicates represented by one or more

managing underwriters or directly by one or more firms acting as underwriters. Unless otherwise indicated in the prospectus supplement,

the obligations of the underwriters to purchase the securities will be subject to certain conditions, and the underwriters will

be obligated to purchase all the offered securities if they purchase any of them. The underwriters may change from time to time

any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers.

If

dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals.

They may then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus

supplement will include the names of the dealers and the terms of the transaction.

Direct

Sales and Sales Through Agents

We

may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such

securities may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved

in the offer or sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated

in the prospectus supplement, any agent will agree to use its reasonable best efforts to solicit purchases for the period of its

appointment.

We

may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning

of the Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus

supplement.

Delayed

Delivery Contracts

If

the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of

institutions to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide

for payment and delivery on a specified date in the future. The contracts would be subject only to those conditions described

in the prospectus supplement. The applicable prospectus supplement will describe the commission payable for solicitation of those

contracts.

Continuous

Offering Program

Without

limiting the generality of the foregoing, we may enter into a continuous offering program equity distribution agreement with a

broker-dealer, under which we may offer and sell shares of our common stock from time to time through a broker-dealer as our sales

agent. If we enter into such a program, sales of the shares of common stock, if any, will be made by means of ordinary brokers’

transactions on the OTC Pink or other market on which are shares may then trade at market prices, block transactions and such

other transactions as agreed upon by us and the broker-dealer. Under the terms of such a program, we also may sell shares of common

stock to the broker-dealer, as principal for its own account at a price agreed upon at the time of sale. If we sell shares of

common stock to such broker-dealer as principal, we will enter into a separate terms agreement with such broker-dealer, and we

will describe this agreement in a separate prospectus supplement or pricing supplement.

Market

Making, Stabilization and Other Transactions

Unless

the applicable prospectus supplement states otherwise, other than our common stock, all securities we offer under this prospectus

will be a new issue and will have no established trading market. We may elect to list offered securities on an exchange or in

the over-the-counter market. Any underwriters that we use in the sale of offered securities may make a market in such securities,

but may discontinue such market making at any time without notice. Therefore, we cannot assure you that the securities will have

a liquid trading market.

Any

underwriter may also engage in stabilizing transactions, syndicate covering transactions and penalty bids in accordance with Rule 104

under the Securities Exchange Act. Stabilizing transactions involve bids to purchase the underlying security in the open market

for the purpose of pegging, fixing or maintaining the price of the securities. Syndicate covering transactions involve purchases

of the securities in the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty

bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the

syndicate member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions,

syndicate covering transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence

of the transactions. The underwriters may, if they commence these transactions, discontinue them at any time.

General

Information

Agents,

underwriters, and dealers may be entitled, under agreements entered into with us, to indemnification by us against certain liabilities,

including liabilities under the Securities Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of,

engage in transactions with or perform services for us, in the ordinary course of business.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference LLP,

New York, New York.

EXPERTS

The

financial statements of SunHydrogen, Inc. as of and for the year ended June 30, 2020 appearing in SunHydrogen, Inc.’s Annual

Report on Form 10-K for the year ended June 30, 2020, have been audited by M&K CPAS, PLLC, as set forth in its report thereon,

included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance

upon such report given on the authority of such firm as experts in accounting and auditing.

The

financial statements of SunHydrogen, Inc. as of and for the year ended June 30, 2019 appearing in SunHydrogen, Inc.’s Annual

Report on Form 10-K for the year ended June 30, 2020, have been audited by Liggett & Webb, P.A., as set forth in its report

thereon, included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference

in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, along with other information with the SEC. The SEC maintains an Internet site that

contains reports, proxy and information statements, and other information regarding issuers that file electronically with the

SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

This

prospectus is part of a registration statement on Form S-3 that we filed with the SEC to register the securities offered hereby

under the Securities Act of 1933, as amended. This prospectus does not contain all of the information included in the registration

statement, including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration

statement from the SEC’s internet site.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

This

prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference”

into this prospectus the information that we file with them, which means that we can disclose important information to you by

referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information

that we file later with the SEC will automatically update and supersede this information. The following documents are incorporated

by reference and made a part of this prospectus:

| |

● |

our

Annual Report on Form 10-K for the year ended June 30, 2020 filed with the SEC on September 23, 2020; |

| |

● |

our

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020 filed with the SEC on November 16, 2020; |

| |

● |

our

Current Reports on Form 8-K filed with the SEC on July 31, 2020, August 7, 2020, September 23, 2020, December 3, 2020, December 8, 2020, December 11, 2020, December 29, 2020 and January 27, 2021; and |

| |

● |

the

description of our common stock contained in the our Registration Statement on Form 8-A filed with the SEC on June 14, 2011

(File No. 000-54437), including any amendment or report filed for the purpose of updating such description. |

All

documents that we file with the SEC pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act subsequent to the date

of this registration statement and prior to the filing of a post-effective amendment to this registration statement that indicates

that all securities offered under this prospectus have been sold, or that deregisters all securities then remaining unsold, will

be deemed to be incorporated in this registration statement by reference and to be a part hereof from the date of filing of such

documents.. Nothing in this prospectus shall be deemed to incorporate information furnished but not filed with the SEC (including

without limitation, information furnished under Item 2.02 or Item 7.01 of Form 8-K, and any exhibits relating to such information).

Any

statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus

shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or

in the applicable prospectus supplement or in any other subsequently filed document which also is or is deemed to be incorporated

by reference modifies or supersedes the statement. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this prospectus.

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by

reference. You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: Timothy Young,

10 E. Yanonali, Suite 36, Santa Barbara, CA 93101, (805) 966-6566.

Up

to $45,000,000 of Shares of Common Stock

PROSPECTUS

SUPPLEMENT

November

22, 2022

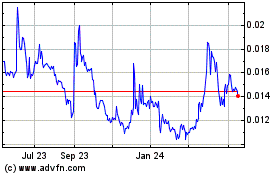

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Nov 2024 to Dec 2024

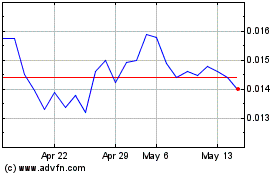

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Dec 2023 to Dec 2024