Bear of the Day: Southern Copper (SCCO) - Bear of the Day

05 July 2013 - 6:28PM

Zacks

Global markets are once again reeling thanks to a number of

political issues. Emerging markets are under pressure thanks to a

variety of protests, while developed markets in Europe are facing

uncertainty thanks to more debt concerns.

This trend has led to devastating consequences for a variety of

commodity producers, as the dollar has strengthened against a

number of global currencies. Plus, many key markets such as China

could see reduced demand levels in the months ahead, further adding

to commodity producers’ woes.

In particular, gold and silver miners have seen weakness in this

environment, falling by well over 45%, as represented by the

Gold Mining ETF (GDX), since the start of 2013.

Yet, while many investors have been laser-focused on the precious

metal market, there has also been significant weakness in the base

metal world as well.

Companies in this space have been hit hard by the same issues of

a strong dollar and sluggish international demand, and could thus

be ones to avoid as well. One firm in particular that could

struggle in this environment is Southern Copper

(SCCO).

Southern Copper in Focus

SCCO is a major U.S.-based producer of copper in key Latin

American countries, but especially in Peru and Mexico. The firm

mines over one billion pounds of copper—for the last full

year—while it smelts and refines a similar amount as well.

The company saw soaring stock prices for much of 2012, although

the firm did see extreme price volatility. However, the stock has

since cratered in 2013, falling by about 30% in the first half of

the year.

This slump has been largely due to two key factors; the weak

outlook for copper, and the low earnings growth projections for the

firm by analysts. In fact, current projections are looking for a

year-over-year earnings contraction of 20% for the full year

period, with similar double digit contractions for the current

quarter and next quarter periods too.

Analysts have also taken down their estimates of the

company in recent weeks, as not a single estimate has gone higher

in the past 90 days. The current year earnings consensus is now

just $2.04/share, a far cry from the $2.63/share that analysts were

expecting 90 days ago.

Thanks to this trend, SCCO has earned itself a Zacks Rank #5

(Strong Sell), suggesting that it will underperform in the near

term. And with the sluggish outlook for copper for the rest of

2013, it seems like it will be difficult for SCCO to break out of

its slump and push higher, especially considering the falling

earnings expectations.

Better Plays?

It is hard to find a good play in the Zacks Industry of Mining

non-Ferrous metals, as the industry currently has a rank of 247 out

of 261. In fact, in our five mining industries, there are only two

#1 Ranked stocks; Brigus Gold (BRD) and

Impala (IMPUY).

Both of these are in struggling industries, but they have proven

to be best-in-class thanks to improving earnings estimates. Plus,

both have seen their ranks surge from holds (or worse) up to strong

buy territory, suggesting either of these names might be better

picks than the struggling SCCO at this time.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

BRIGUS GOLD CP (BRD): Free Stock Analysis Report

MKT VEC-GOLD MI (GDX): ETF Research Reports

IMPALA ADR (IMPUY): Get Free Report

SOUTHERN COPPER (SCCO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

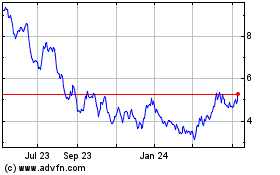

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Oct 2024 to Nov 2024

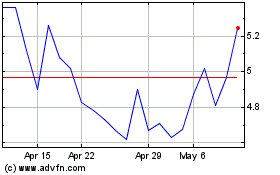

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Nov 2023 to Nov 2024