Mediobanca's Profit Rises; Bad Loan Provisions Fall

05 August 2016 - 6:50PM

Dow Jones News

MILAN—Mediobanca SpA said net profit in its fiscal fourth

quarter rose by nearly a third, helped by higher trading income and

lower provisions for bad loans.

The bank said Friday it has proposed a dividend payment of €0.27

a share, up 8% from the amount it paid for the previous fiscal

year.

Net profit for the quarter totaled €162 million ($180 million),

up from €124 million in the same period a year earlier. Revenue was

little changed at €528 million. Net profit for the fiscal year

increased 3% to €605 million.

In June, the bank completed a strategic plan launched three

years ago aimed at boosting its profitability by selling its vast

portfolio of stakes in pre-eminent Italian companies, and investing

the proceeds in its corporate and investment banking divisions and

retail and wealth-management units.

To this end, the bank agreed last year to buy a 51% stake in

London-based asset manager Cairn Capital from Royal Bank of

Scotland and other institutional investors, and it acquired

Barclays PLC's Italian retail business.

It has sold stakes in companies worth €1.5 billion, generating

€500 million in gains. The bank aims to launch a new plan in the

fall of this year, likely in November.

"We'll continue with our [investment] disposal policy in the

next years," said Chief Executive Alberto Nagel.

The results of the bank come at a time of heightened concerns

about the solidity of the Italian banking system and market

turbulence.

Investors have been dumping Italian banks' shares since the

beginning of the year, fretting about their high levels of bad

loans and low profitability. The country's lenders have lost more

than half of their market value since the beginning of the year.

Mediobanca shares have fallen about 36%.

This week, tensions on local banks intensified after a health

check of banks carried out by the European Banking Authority showed

that Banca Monte dei Paschi di Siena SpA—Italy's third largest bank

by assets—was the least resilient to economic downturns. At the

same time, the country's largest bank UniCredit SpA fared the worst

among banks considered systemically important.

On Friday, Monte dei Paschi unveiled a plan aimed at solving

once and for all its bad loan problems, which have dogged the

lender for years. It said it would sell €27.7 billion in gross bad

loans, or its entire portfolio of most toxic problematic loans, to

a government orchestrated fund called Atlante and other investors.

In parallel, it plans to launch a sale of fresh shares worth up to

€5 billion.

Mediobanca will be a global coordinator in Monte dei Paschi's

share sale. Mr. Nagel said Mediobanca is also willing to invest

together with other players in Atlante, which has roughly just €1.7

billion of firepower at the moment, after rescuing two small

Italian banks.

"The [Monte dei Paschi] transaction is courageous," said Mr.

Nagel. "It is the first time a large bank tackles radically the

problem of nonperforming loans."

He added that Italian banks are trading at very low prices and

that banks undergoing a restructuring, like Monte dei Paschi, can

be an interesting investment.

The bank said net interest income for its fourth fiscal quarter

stood at €301 million, from €303 million in the same period a year

earlier. Its trading income for the period grew 40% to €36 million,

while provisions for losses on bad loans dropped 18% to €100

million.

Mr. Nagel said he is positive about the outlook for the rest of

the year.

"Despite market turbulence there are opportunities," said Mr.

Nagel. "We see it from the good pipeline we have in our advisory

and equity capital markets businesses."

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

August 05, 2016 04:35 ET (08:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

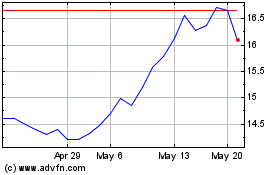

Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Historical Stock Chart

From Jan 2025 to Feb 2025

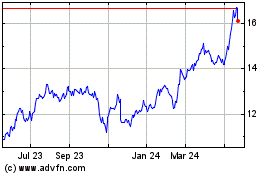

Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Historical Stock Chart

From Feb 2024 to Feb 2025