Italian Lenders' Results Show Suffering Continues -- 2nd Update

10 February 2017 - 7:36AM

Dow Jones News

By Giovanni Legorano

ROME -- Full-year results from Italy's largest banks reflect the

deep wounds the country's financial system continues to suffer,

showing how long the road to recovery is for Italian lenders.

In the past week, four of the country's largest banks posted a

patchy set of numbers for the last three months of 2016.

This is the first set of results for major banks since the

Italian government stepped in to bail out Banca Monte dei Paschi di

Siena SpA in December, after the lender failed to secure EUR5

billion ($5.35 billion) from private investors to stay afloat. The

Italian government set up a EUR20 billion rescue fund in December

that will also be available to other ailing banks, should they need

it.

Analysts and bankers hailed the move as a great leap forward in

shoring up the financial system. However, several Italian banks are

still grappling -- and will likely continue to -- with high costs

and decreasing revenue.

"I am positive [on the government move] as a solution for the

banks' problems of capital," said Alberto Nagel, Mediobanca SpA's

chief executive. "But issues on Italian banks' profitability will

remain."

One of the main drags on local lenders' profitability is the

massive amount of bad loans still sitting on their balance sheets,

which requires provisions for potential losses quarter after

quarter.

The most toxic bad loans, or so-called sofferenze, where a

debtor is deemed insolvent, stood at EUR200 billion in December,

roughly the same level as for the same month of 2015 and 1% higher

than in November.

Rock-bottom interest rates continue to take a heavy toll on

Italian banks, as they are predominantly commercial lenders and

make most of their revenue from lending.

To make matters worse, Italy has been in and out of recessions

in the past 10 years, while losing around a quarter of its

industrial production.

This past year, lenders' results -- including those of the

strongest banks such as Mediobanca and Intesa Sanpaolo SpA -- also

have been dented by one-off contributions to rescue funds set up to

help weaker lenders. The situation is a sign of how results of

Italian banks are still under pressure due to the fragility of the

whole system.

On Thursday, UniCredit SpA, Italy's largest bank by assets,

posted a jumbo loss of EUR13.6 billion for the last quarter,

largely due to billions of provisions for losses on soured loans.

Meanwhile, a EUR13 billion share sale launched on Monday to shore

up its finances continues.

The share sale is guaranteed by a pool of banks that agreed to

buy any unsold shares and it is slated to be completed by March

10.

Mr. Nagel said that UniCredit's rights issue is another event,

which, coupled with the government's fund, is set to stabilize the

system during the first half of this year.

However, UniCredit's revenue shows how lenders are still heavily

under pressure. Its net interest income -- the difference between

what lenders earn from loans and pay for deposits, and a key profit

driver for retail banks -- dropped by 13% in the fourth quarter,

compared with the same period a year earlier and by 7% from the

previous quarter.

Its fees declined by 5% from a year earlier and total revenue by

11%. The bank also took a charge of EUR1 billion, mainly due to the

write-down of its stake in a backstop fund for banks Atlante, and

other stakes.

Meanwhile, Italy's second-largest lender Intesa said last week

that without one-off contributions to a national resolution fund

for banks and other funds, as well as a write-down of its stake in

Atlante, its net profit for the fourth quarter would have been

EUR1.15 billion, instead of EUR776 million.

On Thursday, Monte dei Paschi posted a EUR2.53 billion net loss

for the fourth quarter, hit by declining net interest and fees

income and EUR2.46 billion in provisions for bad loans.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

February 09, 2017 15:21 ET (20:21 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

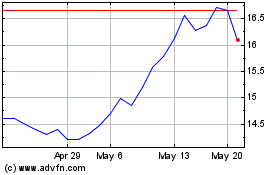

Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

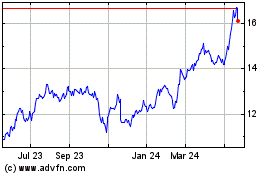

Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Historical Stock Chart

From Dec 2023 to Dec 2024