Current Report Filing (8-k)

14 October 2017 - 12:51AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported)

MODERN MOBILITY AIDS INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

333-168983

|

27-4677038

|

(State

or other jurisdiction of incorporation)

|

|

(IRS

Employer Identification No.)

|

|

First Canadian Place

Suite 350

Toronto, Ontario

Canda

|

|

M5X 1C1

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

(416) 890 4820

Registrant’s

telephone number, including area code

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☒

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

☒

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

__________

SECTION 1. REGISTRANT’S BUSINESS AND OPERATIONS

Item 1.01. Entry Into a Material Definitive Agreement

On

October 11, 2017, the Board of Directors of Modern Mobility Aids,

Inc., a Nevada corporation (the “Company”) authorized

the execution of that certain letter of intent (the “Letter

of Intent”) among the Company, 2539296 Ontario Limited, a

corporation organized under the laws of the Province of Ontario

(“2539296 Ontario”) and Marble Mining Company Inc., a

corporation organized under the laws of Province of Ontario

(“Marble Mining), which provides for the acquisition of

2539296 Ontario and Marble Mining.

In

accordance with the terms and provisions of the Letter of Intent,

MDRM Group (Canada) Ltd., a Canadian subsidiary of the Company

(“MDRM”) shall: (i) acquire all of the total issued and

outstanding shares of common stock from the shareholders of 2539296

Ontario for consideration of $500,000 in cash, the issuance of

257,460 shares of common stock of MDRM (which will be exchangeable

into 257,460,494 shares of the Company) and 500,000 shares of

preferred stock of the Company (which will have voting rights of

200 to one); and (ii) acquire all of the total issued and

outstanding shares of common stock from the shareholders of Marble

Mining for consideration of the issuance of 273,552 shares of

common stock of MDRM (which will be exchangeable into 547,103,549

shares of common stock of the Company). In addition, MDRM may make

the following purchases: (i) 1,050,000 shares of common stock of

Marble Mining for $2,000,000 on or before November 30, 2017; and

(ii) 1,050,000,000 shares of common stock of Marble Mining for

$4,000,000 on or before March 31, 2018.

In

accordance with further terms and provisions of the Letter of

Intent: (i) certain key employees of 2539296 and Marble Mining

shall enter into employment contracts with MDRM for not more than a

three year period providing for salary and benefits; (ii) a first

draft of a share purchase agreement shall be provided on or before

October 16, 2017; (iii) the respective board of directors of and

majority shareholders of 2539296 Ontario and Marble Mining shall

have approved the share purchase agreements; (iv) MDRM shall have

received audited financial statements for all prior fiscal years

since inception of 2539296 Ontario and Marble Mining, respectively;

and (v) MDRM shall have conducted its legal, environmental,

business and financial due diligence reviews of 2539296 Ontario and

Marble Mining, respectively.

In is

anticipated that the parties will negotiate in good faith with an

intent to execute a definitive share purchase agreement on or

before October 31, 2017.

The

foregoing is a summary description of the terms and conditions of

the Letter of Intent and does not purport to be complete and is

qualified in its entirety by reference to the Letter of Intent,

which is filed as Exhibit 10.1 to this Current Report on Form 8-K

and incorporated by reference herein.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item

9.01

Financial

Statements and Exhibits

(a) Financial Statements of Business Acquired.

Not

applicable.

(b) Pro forma Financial Information

.

Not

applicable.

(c) Shell Company Transaction.

Not

applicable.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly

authorized.

|

|

MODERN MOBILITY AIDS, INC.

|

|

DATE:

October 12, 2017

|

/s/

Tito

DiMarco

|

|

|

Name: Tito DiMarco

Title: President/Chief Executive Officer

|

__________

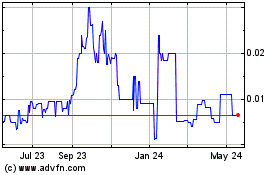

Modern Mobility Aids (PK) (USOTC:MDRM)

Historical Stock Chart

From Dec 2024 to Jan 2025

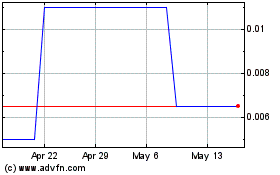

Modern Mobility Aids (PK) (USOTC:MDRM)

Historical Stock Chart

From Jan 2024 to Jan 2025