Current Report Filing (8-k)

22 March 2019 - 4:27AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

March 21, 2019

Commission file number:

1-03319

|

Mineral Mountain Mining & Milling Company

|

|

(Exact name of registrant as specified in its charter)

|

|

Idaho

|

|

82-0144710

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification Number)

|

Mineral Mountain Mining & Milling Company

13 Bow Circle, Suite 170

Hilton Head, South Carolina 29928

(917) 587-8153

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

_______________________________________________

(Former name and former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

Item 3.03

|

Material Modification to Rights of Security Holders.

|

On March 21, 2019, we filed a Certificate of Designation amending our Articles of Incorporation and designating the rights and restrictions of 1 share of our Series B Super Voting Preferred Stock, par value $0.10 per share, pursuant to resolutions approved by our Board of Directors on November 5, 2018.

Our authorized capital stock consists of 10,000,000 shares of preferred stock, par value $.10 per share. As of November 5, 2018 we had no shares of preferred stock issued and outstanding. On November 5, 2018, the Board of Directors authorized the issuance to our CEO, Mr. Sheldon Karasik, one share of a Series B Super Voting Preferred Voting Stock with a 51% voting designation. The holder of our Series B Super Voting Preferred Stock is immediately and automatically entitled to vote together with the holders of our common stock upon all matters that may be submitted to holders of our common stock for a vote, and on all such matters, the share of Series B Super Voting Preferred Stock shall be entitled to that number of votes equal to 51% of the total number of votes that all issued and outstanding shares of common stock and all other securities of the Company are entitled to, as of any such date of determination, on a fully diluted basis. This does not affect the authority of matters that must be approved by the Board of Directors. Filing the Certificate of Designation with the Secretary of State of Idaho on March 21, 2019 comprises an amendment to the Company’s Articles of Incorporation.

In the event of any liquidation, dissolution or winding up of our company, the assets available for distribution to our stockholders will be distributed among the holder of our Series B Super Voting Preferred Stock and the holders of our common stock on a share by share basis with no special preferences to the Series B Super Voting Preferred Share other than it has senior rank to the common shares. The holder of our Series B Super Voting Preferred Stock is not entitled to dividends in the event that we pay cash or other dividends in property to holders of outstanding shares of our common stock.

On March 21, 2019, we issued to Sheldon Karasik, our Chief Executive Officer, President and Chairman of the Board, the one share of our Series B Super Voting Preferred Stock in exchange for $0.16. The per share price of our Super Voting Preferred Stock issued to Mr. Karasik was based on the per share closing price ($0.16) of our common stock as of November 5, 2018, the date the issuance was approved by our Board of Directors. We issued the aforementioned shares in a private placement, exempt from the registration requirements of the Securities Act of 1993, as amended, to Mr. Karasik, an accredited investor.

Except for the transactions above and any previously disclosed transactions with Mr. Karasik, none of our company nor its subsidiaries had any material relationship with Mr. Karasik.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

The disclosures set forth in Item 3.03 above are incorporated in this Item 5.03.

The disclosures set forth in Item 3.03 above are incorporated in this Item 8.01.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Mineral Mountain Mining & Milling Company

|

|

|

|

|

|

|

Dated: March 21, 2019

|

By:

|

/s/ Sheldon Karasik

|

|

|

|

|

Sheldon Karasik

|

|

|

|

|

Chief Executive Officer (Principal Executive Officer)

|

|

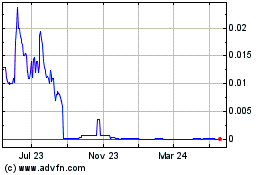

Quad M Solutions (CE) (USOTC:MMMM)

Historical Stock Chart

From Nov 2024 to Dec 2024

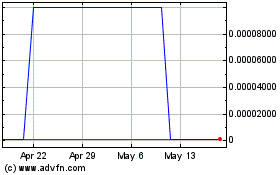

Quad M Solutions (CE) (USOTC:MMMM)

Historical Stock Chart

From Dec 2023 to Dec 2024