Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

09 January 2024 - 9:12AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-256888

Dated: January 8, 2024

Pricing Term Sheet

National Grid plc

U.S.$750,000,000 5.418% Notes due 2034

Pricing Term Sheet

|

|

|

| Issuer: |

|

National Grid plc |

|

|

| Type: |

|

SEC-registered |

|

|

| Ratings*: |

|

Baa2 (Moody’s) / BBB (S&P) / BBB (Fitch) |

|

|

| Size: |

|

$750,000,000 |

|

|

| Maturity: |

|

January 11, 2034 |

|

|

| Coupon: |

|

5.418% |

|

|

| Price: |

|

100% of face amount |

|

|

| Yield to maturity: |

|

5.418% |

|

|

| Spread to Benchmark Treasury: |

|

+142 bps |

|

|

| Benchmark Treasury: |

|

UST 4.500% due November 15, 2033 |

|

|

| Benchmark Treasury Price and Yield: |

|

104-01+, 3.998% |

|

|

| Day Count: |

|

30/360 |

|

|

| Day Count Convention: |

|

Following, unadjusted |

|

|

| Interest Payment Dates: |

|

January 11 and July 11, commencing July 11, 2024 |

|

|

| Record Dates: |

|

The 15th calendar day preceding each interest payment date, whether or not such day is a business day |

|

|

| Optional redemption: |

|

Prior to October 11, 2033 (the date that is three months prior to the Maturity Date) callable at any time at redemption price equal to

the greater of (i) 100% of the principal amount and (ii) discount rate equal to the Treasury Rate plus 25 basis points

On or after October 11, 2033, callable at par |

|

|

| Tax Redemption: |

|

100% |

|

|

| Restructuring Put: |

|

101% |

|

|

| Settlement**: |

|

T+3; January 11, 2024 |

|

|

| Underwriting Discount: |

|

0.400% |

|

|

| Net Proceeds to Issuer (after underwriting discount but before expenses): |

|

$747,000,000 |

|

|

| CUSIP: |

|

636274 AF9 |

|

|

| ISIN: |

|

US636274AF94 |

|

|

|

| Denominations: |

|

$2,000 and integral multiples of $1,000 in excess thereof |

|

|

| Bookrunners: |

|

BNP Paribas Securities Corp., Citigroup Global Markets Inc., Mizuho Securities USA LLC and Morgan Stanley & Co. LLC |

|

|

| Co-managers: |

|

HSBC Securities (USA) Inc., ICBC Standard Bank Plc, ING Financial Markets LLC, NatWest Markets Securities Inc., Santander US Capital Markets LLC and SG Americas Securities, LLC |

| *) |

A securities rating is not a recommendation to buy, sell or hold securities and may be revised or withdrawn

at any time. |

| **) |

The issuer expects that delivery of the Notes will be made to investors on or about January 11, 2024

(such settlement being referred to as “T+3”). Under Rule 15c6-1 under the Exchange Act, trades in the secondary market are required to settle in two business days, unless the parties to any such

trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes prior to two business days before the delivery of the Notes hereunder may be required, by virtue of the fact that the Notes initially settle in T+3, to specify an

alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to their date of delivery hereunder should consult their advisors. |

No PRIIPs or UK PRIIPs key information document (KID) has been prepared as not available to retail in EEA or UK.

Capitalized terms used but not defined in this term sheet have the meanings set forth in the base prospectus as supplemented by the preliminary prospectus

supplement.

ICBC Standard Bank Plc is restricted in its U.S. securities dealings under the United States Bank Holding Company Act and may not

underwrite, subscribe, agree to purchase or procure purchasers to purchase notes that are offered or sold in the United States. Accordingly, ICBC Standard Bank Plc shall not be obligated to, and shall not, underwrite, subscribe, agree to purchase or

procure purchasers to purchase notes that may be offered or sold by other underwriters in the United States. ICBC Standard Bank Plc shall offer and sell the Notes constituting part of its allotment solely outside the United States.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on

the SEC website at www.sec.gov. Alternatively, you may obtain a copy of the base prospectus and the preliminary prospectus supplement by calling toll-free BNP Paribas Securities Corp. at 1-800-854-5674, Citigroup Global Markets Inc. at

1-800-831-9146, Mizuho Securities USA LLC at 1-866-271-7403 or Morgan Stanley & Co. LLC at 1-866-718-1649.

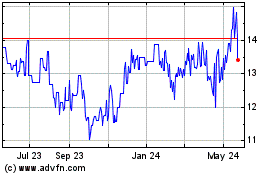

National Grid (PK) (USOTC:NGGTF)

Historical Stock Chart

From Jan 2025 to Mar 2025

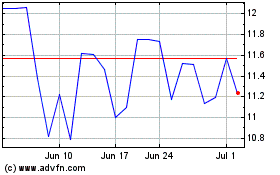

National Grid (PK) (USOTC:NGGTF)

Historical Stock Chart

From Feb 2024 to Mar 2025