Norsk Hydro Sees Aluminum Demand Growth in 2019, But Warns on Trade Issues

29 November 2018 - 7:13PM

Dow Jones News

By Dominic Chopping

Norwegian aluminum and energy company Norsk Hydro ASA (NHY.OS)

said Thursday it expects global demand for primary aluminum to grow

by 2% to 3% in 2019 and to continue growing at that rate over the

next 10 years, but warned that trade sanctions and tariffs are

impacting global flows of aluminum.

In slides accompanying its capital markets day presentation,

Norsk Hydro said the following factors are all impacting flows:

U.S. duties on aluminum imports, sanctions against Russia's United

Co. Rusal PLC (0486.HK), Indian duties on imports, and Chinese

limitations on scrap imports--which is leaving more scrap in North

America and Europe.

Chief Executive Svein Richard Brandtzaeg said that due to the

long-running production problems at its Alunorte alumina refinery

in Brazil, the company won't be able to deliver on its efficiency

program that targeted improvements of 3.0 billion Norwegian kroner

($349.3 million) over a four-year period until end 2019.

The company said that in the short-term it is working hard to

resume full operations at Alunorte, following nine months of

running at 50% production.

"We are aiming to establish a common platform with authorities

and the court system to have an aligned way forward towards full

production, utilizing the best available technology," Norsk Hydro

said.

Total capital expenditure is estimated to average NOK6.5 billion

to NOK7.0 billion between 2018 and 2021. The total capital

expenditure estimate for 2019 is NOK10 billion to NOK10.5

billion.

Write to Dominic Chopping at dominic.chopping@wsj.com;

@domchopping @WSJNordics

(END) Dow Jones Newswires

November 29, 2018 02:58 ET (07:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

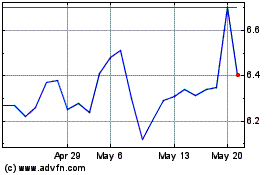

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Nov 2024 to Dec 2024

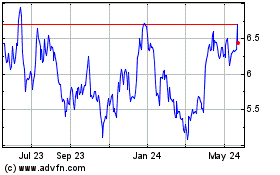

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Norsk Hydro ASA (QX) (OTCMarkets): 0 recent articles

More Norsk Hydro Asa (QX) News Articles