EUROPE MARKETS: Europe Stocks Approach Seven-month High On U.S., China Optimism

24 July 2019 - 2:43AM

Dow Jones News

By Steve Goldstein, MarketWatch

European stocks on Wednesday rose to nearly a seven-month high,

helped by optimism over U.S.-China trade talks and an agreement for

increased spending in the world's largest economy.

Up about 16% for the year, the Stoxx 600 rose 1% to 391.54, its

sixth gain in the last eight sessions.

The FTSE 100 advanced 0.6% to 7,556.86, with the

well-anticipated election of Boris Johnson to lead the U.K.

Conservatives having little impact on stocks during the day.

The German DAX jumped 1.6% to a two-week high of 12,490.74,

France's CAC 40 gained 0.9% to 5,618.16, and Italy's FTSE MIB rose

1% to 21,954.66.

What's moving markets

Europe stocks got a bid from the successful resolution of the

looming debt ceiling issue in the U.S. The deal reached by Treasury

Secretary Steven Mnuchin and House Speaker Nancy Pelosi

(http://www.marketwatch.com/story/trump-says-compromise-deal-on-budget-debt-ceiling-reached-2019-07-22)

will lift federal spending for the next two years, and push back

the debt ceiling issue until 2021. The deal still needs to be

approved by the U.S. Congress and signed by President Donald Trump

to go into effect.

Also helping was a report in The South China Morning Post that a

U.S. delegation led by U.S. Trade Representative Robert Lighthizer

and Treasury Secretary Steven Mnuchin

(https://www.scmp.com/economy/china-economy/article/3019604/us-trade-war-negotiators-likely-visit-china-next-week-first)

is likely to visit Beijing next week, for the first face-to-face

meetings since the G20. An in-person meeting between Lighthizer,

Mnuchin and Vice-Premier Liu He, who leads China's negotiation

team, would be seen as a positive step towards reducing trade

tensions, the report said.

Active stocks

Daimler shares (DAI.XE) rallied over 4% in Frankfurt as the

Mercedes maker said Beijing Automotive Group Co. has taken a 5%

equity interest. The two companies already are partners in

China.

Auto parts maker Faurecia (EO.FR) jumped 11% after reiterating

targets. The company's first-half profit rose 1%.

Norsk Hydro (NHY.OS) climbed 7% in Oslo as the aluminum giant

said its underlying earnings before interest and tax slumped 68% to

875 million Norwegian kronor in the second quarter. A previously

disclosed cyber attack will cost the company between 250 millio

nand 300 million kronor. The stock is still down 17% for the

year.

Computer peripheral maker Logitech (LOGN.EB) (LOGN.EB) jumped 5%

in Swiss trade after confirming 2020 targets for sales growth and

operating income.

(END) Dow Jones Newswires

July 23, 2019 12:28 ET (16:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

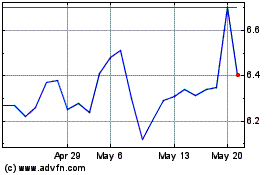

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Feb 2025 to Mar 2025

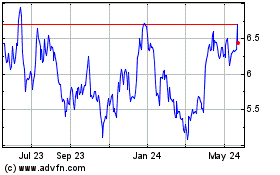

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Mar 2024 to Mar 2025