UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC. 20549

FORM 10-K

(Mark One)

| x | Annual report pursuant

to Section 13 or 15 (d) of the Securities Exchange Act of 1934

For the fiscal year ended July 31, 2015 |

OR

| ¨ | Transition

report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ____________________ to ____________________ |

Commission File Number 000-13176

|

| NON-INVASIVE MONITORING SYSTEMS, INC. |

| |

(Exact name of registrant as specified

in its charter) |

| Florida |

|

59-2007840 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| 4400 Biscayne Blvd., Suite 180, Miami, Florida, 33137 |

(Address of principal executive offices) (Zip Code)

|

Registrant’s telephone number, including area code: (305) 575-4200

|

Securities registered pursuant to Section 12(b) of the Exchange Act: None

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

|

| Common stock, $0.01 par value per share |

| (Title of Class) |

Indicate by check mark

whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark whether the registrant

is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for

the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 month (or for such shorter

period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of

delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment

to this Form 10-K.

Yes x No ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

Large accelerated filer ¨ Accelerated

filer ¨ Non-accelerated filer ¨ Smaller

reporting company x

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

The aggregate market value of the voting

and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity,

as of September 25, 2015 was: $9.2 million.

As of October 17, 2015 there were 79,007,423

shares of common stock, $0.01 par value outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None

Non-Invasive

Monitoring Systems, INC.

TABLE OF

CONTENTS FOR FORM 10-K

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This Annual Report

on Form 10-K contains, in addition to historical information, certain forward-looking statements about our expectations, beliefs

or intentions regarding, among other things, our product development and commercialization efforts, business, financial condition,

results of operations, strategies or prospects. You can identify forward-looking statements by the fact that these statements

do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected

events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that

have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results

to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause

our actual activities or results to differ materially from the activities and results described in forward-looking statements.

These factors include those set forth below as well as those contained in “Item 1A - Risk Factors” of this Annual

Report on Form 10-K and our other filings with the Securities and Exchange Commission (“SEC”). We do not undertake

any obligation to update forward-looking statements, except as required by applicable law. These forward-looking statements reflect

our views only as of the date they are made with respect to future events and financial performance.

Risks and uncertainties,

the occurrence of which could adversely affect our business, include the following:

| · | We

have a history of operating losses, we do not expect to become profitable in the near

future and absent a significant increase in revenue or additional equity or debt financing,

we may be unable to continue as a going concern. |

| · | We

will require additional funding, which may not be available to us on acceptable terms,

or at all. |

| · | We

terminated the Product and Supply Agreement with Sing Lin and may potentially be obligated

to pay amounts under the agreement. |

| · | We

rely on third parties to manufacture and supply our products, and we presently have no

agreement with any third party to manufacture and supply our products. |

| · | The

continued worldwide economic crisis and concurrent market instability may materially

and adversely affect the demand for our products, as well as our ability to obtain credit

or secure funds through sales of our stock, which may materially and adversely affect

our business, financial condition and ability to fund our operations. |

| · | Healthcare

policy changes, including reforms to the U.S. healthcare system, may have a material

adverse effect on us. |

| · | Our

Exer-Rest device does not have a unique Medicare Reimbursement CPT Code. |

| · | The

terms of clearances or approvals and ongoing regulation of our products may limit how

we manufacture and market our products, which could materially impair our ability to

generate anticipated revenues. |

| · | Our

competitors may develop and market products that are more effective, safer or less expensive

than our products, negatively impacting our commercial opportunities. |

| · | If

we are unable to obtain and enforce patent protection for our products, our business

could be materially harmed. |

| · | If

we are unable to protect the confidentiality of our proprietary information and know-how,

the value of our technology and products could be adversely affected. |

| · | Our

commercial success depends significantly on our ability to operate without infringing

the patents and other proprietary rights of third parties. |

| · | If

we become involved in patent litigation or other proceedings related to a determination

of rights, we could incur substantial costs and expenses, substantial liability for damages

or be required to stop our product development and commercialization efforts. |

| · | Failure

to obtain regulatory approval outside the United States will prevent us from marketing

our products abroad. |

| · | Non-U.S.

governments often impose strict price controls, which may adversely affect our future

profitability. |

| · | Our

business is subject to economic, political, regulatory and other risks associated with

international operations. |

| · | We

do not anticipate paying dividends on our common stock in the foreseeable future. |

| · | Because

our common stock is a “penny stock,” it may be more difficult for investors

to sell shares of our Common Stock, and the market price of our common stock may be adversely

affected. |

| · | Our

stock price has been volatile and there may not be an active, liquid trading market for

our common stock. |

| · | Our

quarterly results of operations will fluctuate, and these fluctuations could cause our

stock price to decline. |

| · | Shareholders

may experience dilution of ownership interests because of the future issuance of additional

shares of our common stock and our preferred stock. |

* * * * *

PART

I

General

Non-Invasive Monitoring

Systems, Inc. (together with its consolidated subsidiaries, the “Company,” “NIMS,” “we,” “us”

or “our”) was incorporated under the laws of the State of Florida on July 16, 1980. The Company’s offices are

located at 4400 Biscayne Boulevard, Miami, Florida, 33137 and its telephone number is (305) 575-4200. The Company’s

primary business is the research, development, manufacture and marketing of a line of motorized, non-invasive, whole body, periodic

acceleration platforms, which are intended as aids to increase local circulation and temporary relief of minor aches and pains,

produce local muscle relaxation and reduce morning stiffness. Our current products are derivatives of our original acceleration

platform, the AT-101 (described below), and are intended for use in homes, wellness and fitness centers, healthcare providers

offices and clinics, nursing homes, assisted living facilities, sports facilities and hospitals.

Company Overview

Prior to 2002, our

primary business was the development of computer-assisted, non-invasive diagnostic monitoring devices and related software designed

to detect abnormal respiratory, cardiac and other medical conditions from sensors placed externally on the body’s surface.

We assigned our patents for these ambulatory monitoring devices in 1999 to the SensorMedics Division of ViaSys (which is now a

unit of CareFusion Corporation (“SensorMedics”), and to privately-held VivoMetrics, Inc. (“VivoMetrics”),

both of which are required to pay us royalties on sales of these products. SensorMedics indicated they will discontinue licensed

product sales after current inventory is depleted. We believe SensorMedics inventory is depleted and, therefore, do not expect

any further royalty revenue from SensorMedics. VivoMetrics ceased operations in July 2009 and filed for Chapter 11 bankruptcy

protection in October 2009. Pursuant to VivoMetrics’ approved bankruptcy plan of reorganization, our license with VivoMetrics

was assigned to another company; however, there can be no assurance as to the future amount of royalty revenue, if any, that we

may derive from this license or from our existing license with SensorMedics. We periodically contact the current owner of the

license for progress updates.

In 2002, we began

focusing on the research, development, manufacturing, marketing and sales of non-invasive, motorized, whole body periodic acceleration

(“WBPA”) platforms. These therapeutic acceleration platforms are intended as aids to temporarily increase local circulation

for temporary relief of minor aches and pains, produce local muscle relaxation and reduce morning stiffness. Our first such platform,

the AT-101, was initially registered with the United States Food and Drug Administration (the “FDA”) as a Class 1

(exempt) powered exercise device and was sold to physicians and their patients. In January 2005, the FDA disagreed with our device

classification, and requested that we cease commercial sales and marketing of the AT-101 until we received clearance from the

FDA to market the device following submission of a 510(k) application incorporating appropriate clinical trial data. Accordingly,

we ceased our commercial sales and marketing of therapeutic platforms in 2005, but continued to receive royalty revenue from sales

of diagnostic monitoring hardware and software by SensorMedics and VivoMetrics during that time.

In January 2005,

we began development of a less costly and more efficient second generation version of the AT-101, the Exer-Rest®

(now designated the Exer-Rest AT). In January 2008, we received ISO 13485 certification for Canada, the United Kingdom and Europe

from SGS United Kingdom Ltd., the world’s leading verification and certification body. ISO 13485 certification is recognized

and accepted worldwide as a sign of design and manufacturing quality for medical devices. In addition to our ISO certification,

the Exer-Rest AT acceleration therapeutic platform (Class IIa) was awarded CE0120 certification, which requires several safety-related

conformity tests, including clinical assessment for safety and effectiveness. The CE0120 certification is often referred to as

a “passport” that allows manufacturers from anywhere in the world to sell their goods throughout the European market,

as well as in many other countries. Prior to obtaining FDA registration for the sale of our therapeutic acceleration platforms

in the United States, we marketed and sold the Exer-Rest AT platforms in the United Kingdom, Canada, Europe, India and Latin America.

We entered into a

product development and supply agreement with Sing Lin Technology Co., Ltd. (“Sing Lin”) of Taichung, Taiwan on September

4, 2007. Under this agreement, Sing Lin began manufacturing the third generation versions of our patented Exer-Rest motorized

platforms (designated the Exer-Rest AT3800 and the Exer-Rest AT4700). We filed a 510(k) premarket notification submission with

the FDA in October 2008 for approval to market the Exer-Rest line of platforms in the United States. The submission included 23

investigational and clinical studies on the vasodilatation properties of WBPA, as well as a controlled, four week clinical trial

in a group of patients with chronic aches and pains carried out at the Center of Clinical Epidemiology and Biostatistics at the

University of Pennsylvania Medical School. The submission supported Exer-Rest safety and efficacy for the intended uses

as an aid to temporarily increase local circulation, to provide temporary relief of minor aches and pains and to provide local

muscle relaxation. The FDA informed us in January 2009 that the full Exer-Rest line of products would be registered as Class I

(Exempt) Medical Devices as described in the Company’s 510(k) premarket notification submission, at which time we commenced

marketing the Exer-Rest in the United States. In June 2009, the FDA notified us that the additional intended use of the Exer-Rest

as an aid to reduce morning stiffness would be added to the Exer-Rest’s FDA registration. We market and sell our Exer-Rest

devices in the United States, Canada, the UK, Europe, India, Mexico, the Middle East, the Far East and Latin America. Prior to

the termination of our development and supply agreement with them, Sing Lin marketed and sold the Exer-Rest exclusively in certain

Asian markets.

Market Opportunities

More than thirty

peer reviewed scientific publications attest to the benefits of WBPA in animal and human research investigations. According to

those studies, the application of this WBPA technology provides objective benefits in patients with angina pectoris and increases

the blood supply to the heart muscle in both healthy individuals and patients with heart disease. These findings are not claimed

as an intended use of the device for marketing purposes, but demonstrate a potential mechanism for its benefits. We believe the

market for our products is driven by, among other factors:

| · | the

increasing number of elderly persons reporting chronic ailments; |

| · | an

increased awareness of the benefits of exercise, particularly as a form of prevention; |

| · | an

increasing portion of the population that is incapable of performing traditional exercise;

and |

| · | the

expanding body of research connecting the body’s reduction of inflammation and

improved transmission of neural impulses. |

Our products are

designed for use by people who are unable or unwilling to exercise or for whom exercise is contraindicated. We market the Exer-Rest

line of platforms for the intended uses of temporarily increasing local circulation, temporarily relieving minor aches and pains,

providing local muscle relaxation and as an aid to reduce morning stiffness. These symptoms are frequently reported by individuals

with chronic cardiovascular, neurological or musculoskeletal conditions, although we do not claim that the Exer-Rest is intended

to treat these conditions.

Products

Whole Body Periodic Acceleration (“WBPA”) Therapeutic

Devices

The original AT-101

was a comfortable gurney-styled device that provided movement of a platform repetitively in a head-to-foot motion at a rapid pace.

Sales of the AT-101 commenced in October 2002 in Japan and in February 2003 in the United States. QTM Incorporated (“QTM”),

an FDA registered manufacturer located in Oldsmar, Florida, manufactured the device, which was built in accordance with ISO and

current Good Manufacturing Practices. As discussed above, we ceased manufacturing and selling the AT-101 in the United States

in January 2005 as we began development of the Exer-Rest AT. We continued selling our existing inventory of AT-101 devices overseas

until the Exer-Rest AT became available in October 2007, at which time we discontinued marketing of the AT-101.

The Exer-Rest AT

is based upon the design and concept of the AT-101, but has the dimensions and appearance of a commercial extra long twin bed.

The Exer-Rest AT, which was also manufactured by QTM until we stopped production in July 2009, weighs about half as much as the

AT-101, has a much more efficient and less costly drive mechanism, has a much lower selling price than did the AT-101 and is designed

such that the user can utilize and operate it without assistance. The wired hand held controller provides digital values for speed,

travel and time, rather than analog values for speed and arbitrary force values as in the AT-101. Sales of the Exer-Rest AT began

outside the United States in October 2007 and in the United States in February 2009. We discontinued manufacturing of the Exer-Rest

AT in July 2009, and we expect to utilize our remaining inventory of these units primarily for research purposes.

The Exer-Rest AT3800

and Exer-Rest AT4700, which were manufactured for us by Sing Lin prior to the termination of our agreement with them, are next

generation versions of the Exer-Rest AT and further advance the acceleration therapeutic platform technology. The AT3800 (38”

wide) and AT4700 (47” wide) models combine improved drive technology for quieter operation, a more comfortable “memory-foam”

mattress, more convenient operation with a multi-function wireless remote and a more streamlined look to improve the WBPA experience.

Sales of the Exer-Rest AT3800 and Exer-Rest AT4700 platforms began outside the United States in October 2008, and U.S. sales commenced

in February 2009.

LifeShirt®

The

LifeShirt is a patented Wearable Physiological Computer that incorporates transducers, electrodes and sensors into a sleeveless

garment. These sensors transmit vital and physiological signs to a miniaturized, battery-powered, electronic module which saves

the raw waveforms and digital data to the compact flash memory of a Personal Digital Assistant (“PDA”) attached to

the LifeShirt. Users of the LifeShirt can enter symptoms (with intensity), mood and medication information directly into the PDA

for integration with the physiologic information collected by the LifeShirt garment. The flash memory can then be removed from

the LifeShirt and the data uploaded and converted into minute-by-minute median trends of more than 30 physical and emotional signs

of health and disease. Vital and physiological signs can therefore be obtained non-invasively, continuously, cheaply and reliably

with the comfortably worn LifeShirt garment system while resting, exercising, working or sleeping. The LifeShirt was sold exclusively

by VivoMetrics, but has not been marketed since VivoMetrics ceased operations in July 2009. Pursuant to VivoMetrics’ approved

bankruptcy plan of reorganization, our license with VivoMetrics was assigned to another company; however, there can be no assurance

as to the future amount of LifeShirt sales, if any, that may result from this license. We periodically contact the current owner

of the license for progress updates.

Intellectual Property

We currently hold

five United States patents with respect to both overall design and specific features of our present and proposed products, with

corresponding foreign patents issued or pending in multiple jurisdictions. No assurance can be given as to the scope of protection

afforded by any patent issued, whether patents will be issued with respect to any pending or future patent application, that patents

issued will not be designed around, infringed or successfully challenged by others, that we will have sufficient resources to

enforce any proprietary protection afforded by our patents or that our technology will not infringe on patents held by others.

We believe that in the event our patent protection is materially impaired, a material adverse effect on our present and proposed

business could result. The following table lists our patents, along with their expiration dates (each of which is 20 years from

the filing date):

| US Patent |

|

Inventors |

|

Title |

|

Expiration Date |

| 7,404,221 |

|

Sackner, Marvin A. |

|

Reciprocating movement platform for the external addition of pulses to the fluid channels of a subject |

|

August 4, 2028 |

| |

|

|

|

|

|

|

| 7,228,576 |

|

Inman, D. Michael;

Sackner, Marvin A. |

|

Reciprocating movement platform for the addition of pulses of the fluid channels of a subject |

|

June 12, 2027 |

| |

|

|

|

|

|

|

| 7,111,346 |

|

Inman, D. Michael;

Sackner, Marvin A. |

|

Reciprocating movement platform for the addition of pulses of the fluid channels of a subject |

|

May 15, 2023 |

| |

|

|

|

|

|

|

| 7,090,648 |

|

Sackner, Marvin A.;

Inman, D. Michael |

|

External addition of pulses to fluid channels of body to release or suppress endothelial mediators and to determine effectiveness

of such intervention |

|

September 28, 2021 |

| |

|

|

|

|

|

|

| 6,155,976 |

|

Sackner, Marvin A.;

Inman, D. Michael;

Meichner, William J. |

|

Reciprocating movement platform for shifting subject to and fro in headwards-footwards direction |

|

May 24, 2019 |

With respect to our

present and potential product line, we have six trademarks and trade names which are registered in the United States and in several

foreign countries, including our principal trademark, “Exer-Rest”.

Research and Development

Our strategy is to

develop a portfolio of non-invasive products through a combination of internal development and collaborations with external partners.

We have also sponsored or monitored research investigating the effectiveness of WBPA in chronic heart failure, mild traumatic

brain injury, acute myocardial infarction, Parkinson’s disease, peripheral vascular disease and lymphedema.

Competition

We compete with several

entities that market, sell or distribute therapeutic devices that are registered with the FDA as powered exercise devices, or

therapeutic vibrators. These include Power Plate of North America, Vibraflex and CERAGEM International, Inc., all of which

are larger than we are, have longer operating histories and have financial and personnel resources far greater than ours. We believe

that we essentially compete with such competitors based upon the uniqueness of our products and our product differentiation on

the basis of intended uses and operation.

Government Regulation of our Medical

Device Development and Distribution Activities

Healthcare is heavily

regulated by the federal government and by state and local governments. The federal laws and regulations affecting healthcare

change constantly thereby increasing the uncertainty and risk associated with any healthcare-related venture.

The federal government

regulates healthcare through various agencies, including but not limited to the following: (i) the FDA which administers the federal

Food, Drug, and Cosmetic Act (“FD&C Act”), as well as other relevant laws; (ii) the Centers for Medicare &

Medicaid Services (“CMS”) which administers the Medicare and Medicaid programs; (iii) the Office of Inspector General

(“OIG”), which enforces various laws aimed at curtailing fraudulent or abusive practices including, by way of example,

the Anti-Kickback statute, the Physician Self Referral Law, commonly referred to as the Stark Law, the Anti-Inducement Law, the

Civil Money Penalty Law, and the laws that authorize the OIG to exclude health care providers and others from participating in

federal healthcare programs; and (iv) the Office of Civil Rights which administers the privacy aspects of the Health Insurance

Portability and Accountability Act of 1996 (“HIPAA”). All of the aforementioned are agencies within the Department

of Health and Human Services (“HHS”). Healthcare is also provided or regulated, as the case may be, by the Department

of Defense through its TriCare program, the Department of Veterans Affairs, especially through the Veterans Health Care Act of

1992, Public Health Service within HHS under the Public Health Service Act, the Department of Justice through the Federal False

Claims Act and various criminal statutes, and state governments under the Medicaid program and their internal laws regulating

all healthcare activities.

FDA Regulation of the Design,

Manufacture and Distribution of Medical Devices

The testing, manufacture,

distribution, advertising and marketing of medical devices are subject to extensive regulation by federal, state and local governmental

authorities in the United States, including the FDA, and by similar agencies in other countries. Any product that we develop must

receive all relevant regulatory clearances or approvals, as the case may be, before it may be marketed in a particular country.

Under United States law, a “medical device” (“device”) is an article, which, among other things, is intended

for use in the diagnosis of disease or other conditions, or in the cure, mitigation, treatment or prevention of disease, in man

or other animals. See FD&C Act § 201(h). Substantially all of our products are classified as medical devices and subject

to regulation by numerous agencies and legislative bodies, including the FDA and its foreign counterparts.

As a company that

manufactures medical devices, we are required to register with the FDA. As a result, we and any entity that manufactures products

on our behalf will be subject to periodic inspection by the FDA for compliance with the FDA’s Quality System Regulation

requirements and other regulations. In the European Community, we will be required to maintain certain International Organization

for Standardization (“ISO”) certifications in order to sell products and we or our manufacturers undergo periodic

inspections by notified bodies to obtain and maintain these certifications. These regulations require us or our manufacturers

to manufacture products and maintain documents in a prescribed manner with respect to design, manufacturing, testing and control

activities. Further, we are required to comply with various FDA and other agency requirements for labeling and promotion. The

Medical Device Reporting regulations require that we provide information to the FDA whenever there is evidence to reasonably suggest

that a device may have caused or contributed to a death or serious injury or, if a malfunction were to occur, could cause or contribute

to a death or serious injury. In addition, the FDA prohibits us from promoting a medical device for unapproved indications.

The FDA in the course

of enforcing the FD&C Act may subject a company to various sanctions for violating FDA regulations or provisions of the Act,

including requiring recalls, issuing Warning Letters, seeking to impose civil money penalties, seizing devices that the agency

believes are non-compliant, seeking to enjoin distribution of a specific type of device or other product, seeking to revoke a

clearance or approval, seeking disgorgement of profits and seeking to criminally prosecute a company and its officers and other

responsible parties.

In March 2011, we

received a warning letter from the FDA regarding our promotion of the Exer-Rest. We addressed the FDA’s concerns by revising

our marketing material and website content. On October 28, 2011, we received a FDA Form 483 with three observations related to

our marketing material and certain protocols. As a result of those observations, the FDA recommended we voluntarily recall our

marketing materials from the US market. We have complied with the FDA recommendation and in August 2012, the FDA notified NIMS

that they have reviewed our actions and concluded that the voluntary recall has been completed.

Third-Party Payments, Especially

payments by Medicare and Medicaid

| A. | Medicare and

Medicaid Coverage |

Because of the projected

patient population that could potentially benefit from our devices is elderly, Medicare could be a potential source of reimbursement.

Medicare is a federal program that provides certain hospital and medical insurance benefits to persons age 65 and over, certain

disabled persons, persons with end-stage renal disease and those suffering from Lou Gehrig’s Disease. In contrast, Medicaid

is a medical assistance program jointly funded by federal and state governments and administered by each state pursuant to which

benefits are available to certain indigent patients. The Medicare and Medicaid statutory framework is subject to administrative

rulings, interpretations and discretion that affect the amount and timing of reimbursement made under Medicare and Medicaid.

Medicare reimburses

for medical devices in a variety of ways depending on where and how the device is used. However, Medicare only provides reimbursement

if CMS, either directly or through one of its contracts, determines that the device should be covered and that the use of the

device is consistent with the coverage criteria. A coverage determination can be made at the local level (“Local Coverage

Determination”) by the Medicare administrative contractor (formerly called carriers and fiscal intermediaries), a private

contractor that processes and pays claims on behalf of CMS for the geographic area where the services were rendered, or at the

national level by CMS through a National Coverage Determination. There are statutory provisions intended to facilitate coverage

determinations for new technologies under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (“MMA”)

§§ 731 and 942. Coverage presupposes that the device has been cleared or approved by the FDA and, further, that the

coverage will be no broader than the FDA approved intended uses of the device (i.e., the device’s label) as cleared or approved

by the FDA, but coverage can be narrower. In that regard, a narrow Medicare coverage determination may undermine the commercial

viability of a device. It is unclear whether the therapies and treatments that would use our primary products would be covered

under Local or National Coverage Determinations.

Seeking to modify

a coverage determination, whether local or national, is a time-consuming, expensive and highly uncertain proposition, especially

for a new technology, and inconsistent local determinations are possible. On average, according to an industry report, Medicare

coverage determinations for medical devices lag 15 months to five years or more behind FDA approval for respective devices. Moreover,

Medicaid programs and private insurers are frequently influenced by Medicare coverage determinations. Our inability to obtain

a favorable coverage determination may adversely affect our ability to market our products and thus, the commercial viability

of our products.

We do not have Medicare

or any other third-party reimbursement programs specific for our product. Even if Medicare and other third-party payor programs

cover the procedures that use our devices, the level of reimbursement may not be sufficient for commercial success. The Medicare

reimbursement levels for covered procedures are determined annually through three sets of rulemakings, one for outpatient departments

of hospitals under the Outpatient Prospective Payment System (“OPPS”), another for the inpatient departments of hospitals

under the Inpatient Perspective Payment System (“IPPS”), and a third for procedures in physicians’ offices under

the Resource-Based Relative Value Scales (“RBRVS”) (the Medicare fee schedule). If the use of a device is covered

by Medicare, a physician’s ability to bill a Medicare patient more than the Medicare allowable amount is significantly constrained

by the rules limiting balance billing. For covered services in a physician’s office, Medicare normally pays 80% of the Medicare

allowable amount and the beneficiary pays the remaining 20%, assuming that the beneficiary has met his or her annual Medicare

deductible and is not also a Medicaid beneficiary. For services performed in an outpatient department of a hospital, the patient’s

co-payment under Medicare may exceed 20%, depending on the service and depending on whether CMS has set the co-payment at greater

than 20%. If a device is used as part of an in-patient procedure, the hospital where the procedure is performed is reimbursed

under the IPPS. In general, IPPS provides a single payment to the hospital based on the diagnosis at discharge and devices are

not separately reimbursed under IPPS.

Usually, Medicaid

pays less than Medicare, assuming that the state covers the service. In addition, private payors, including managed care payors,

increasingly are demanding discounted fee structures and the assumption by healthcare providers of all or a portion of the financial

risk. Efforts to impose greater discounts and more stringent cost controls upon healthcare providers by private and public payors

are expected to continue.

Significant limits

on the scope of services covered or on reimbursement rates and fees on those services that are covered could have a material adverse

effect on our ability to commercialize our devices and therefore, on our liquidity and financial condition.

State and Federal Security

and Privacy Regulations

The privacy and security

regulations under the Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology

for Economic and Clinical Health Act of 2009 (the “HITECH Act” and collectively, the “HIPAA”), establish

comprehensive federal standards with respect to the uses and disclosures of protected health information, or PHI, by health plans

and health care providers, in addition to setting standards to protect the confidentiality, integrity and availability of electronic

PHI. The regulations establish a complex regulatory framework on a variety of subjects, including:

| · | the

circumstances under which uses and disclosures of PHI are permitted or required without

a specific authorization by the patient, including but not limited to treatment purposes,

to obtain payments for services and health care operations activities; |

| · | a

patient’s rights to access, amend and receive an accounting of certain disclosures

of PHI; |

| · | the

content of notices of privacy practices for PHI; and |

| · | administrative,

technical and physical safeguards required of entities that use or receive PHI electronically. |

The final “omnibus”

rule implementing the HITECH Act took effect on March 26, 2013. The rule is broad in scope, but certain provisions are particularly

significant in light of our business operations. For example, the final “omnibus” rule implementing the HITECH Act:

| · | Makes

clear that situations involving impermissible access, acquisition, use or disclosure

of protected health information are now presumed to be a breach unless the covered entity

or business associate is able to demonstrate that there is a low probability that the

information has been compromised; |

| · | Defines

the term “business associate” to include subcontractors and agents that receive,

create, maintain or transmit protected health information on behalf of the business associate; |

| · | Establishes

new parameters for covered entities and business associates on uses and disclosures of

PHI for fundraising and marketing; and |

| · | Establishes

clear restrictions on the sale of PHI without patient authorization. |

The privacy and security

regulations provide for significant fines and other penalties for wrongful use or disclosure of PHI, including potential civil

and criminal fines and penalties.

Anti-Kickback Laws, Physician

Self-Referral Laws, False Claims Act, Civil Monetary Penalties

We are also subject

to various federal, state, and international laws pertaining to health care “fraud and abuse,” including anti-kickback

laws and false claims laws. The federal Anti-Kickback Statute prohibits anyone from knowingly and willfully soliciting,

receiving, offering, or paying any remuneration with the intent to refer, or to arrange for the referral or order of, services

or items payable under a federal health care program, including the purchase or prescription of a particular drug or the use of

a service or device. Recognizing that the Anti-Kickback Statute is broad and may technically prohibit many innocuous or

beneficial arrangements, Congress authorized the U.S. Department of Health and Human Services Office of Inspector General, or

OIG, to issue a series of regulations, known as “safe harbors.” These safe harbors set forth requirements that, if

met in their entirety, will assure health care providers and other parties that they will not be prosecuted under the Anti-Kickback

Statute. The failure of a transaction or arrangement to fit precisely within one or more safe harbors does not necessarily mean

that it is illegal, or that prosecution will be pursued. However, conduct and business arrangements that do not fully satisfy

each applicable safe harbor may result in increased scrutiny by government enforcement authorities, such as the OIG.

Violations of the

Anti-Kickback Statute are punishable by the imposition of criminal fines, civil money penalties, treble damages, and/or exclusion

from participation in federal health care programs. Many states have also enacted similar anti-kickback laws. The

Anti-Kickback Statute and similar state laws and regulations are expansive. If the government were to allege against or

convict us of violating these laws, there could be a material adverse effect on our business, results of operations, financial

condition, and our stock price. Even an unsuccessful challenge could cause adverse publicity and be costly to respond to,

which could have a materially adverse effect on our business, results of operations and financial condition. We will consult

counsel concerning the potential application of these and other laws to our business and our sales, marketing and other activities

and will make good faith efforts to comply with them. However, given the broad reach of federal and state anti-kickback

laws and the increasing attention given by law enforcement authorities, we are unable to predict whether any of our activities

will be challenged or deemed to violate these laws.

We are also subject

to the physician self-referral laws, commonly referred to as the Stark law, which is a strict liability statute that generally

prohibits physicians from referring Medicare patients to providers of “designated health services,” with whom the

physician or the physician’s immediate family member has an ownership interest or compensation arrangement, unless an applicable

exception applies. Moreover, many states have adopted or are considering adopting similar laws, some of which extend beyond the

scope of the Stark law to prohibit the payment or receipt of remuneration for the prohibited referral of patients for designated

healthcare services and physician self-referrals, regardless of the source of the payment for the patient’s care. If it

is determined that certain of our practices or operations violate the Stark law or similar statutes, we could become subject to

civil and criminal penalties, including exclusion from the Medicare programs and loss of government reimbursement. The imposition

of any such penalties could harm our business.

Another development

affecting the health care industry is the increased use of the federal civil False Claims Act and, in particular, actions brought

pursuant to the False Claims Act’s “whistleblower” or “qui tam” provisions. The False Claims Act,

as amended by the Fraud Enforcement and Recovery Act of 2009 and the Patient Protection and Affordable Care Act of 2010, imposes

liability on any person or entity who, among other things, knowingly presents, or causes to be presented, a false or fraudulent

claim for payment by a federal health care program. The qui tam provisions of the False Claims Act allow a private individual

to bring actions on behalf of the federal government alleging that the defendant has submitted a false claim to the federal government,

and to share in any monetary recovery. In recent years, the number of suits brought by private individuals has increased dramatically.

In addition, various states have enacted false claim laws analogous to the False Claims Act. Many of these state laws apply where

a claim is submitted to any third-party payor and not merely a federal health care program. When an entity is determined to have

violated the False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus

civil penalties for each separate false claim. There are many potential bases for liability under the False Claims Act. Liability

arises, primarily, when an entity knowingly submits, or causes another to submit, a false claim for reimbursement to the federal

government. The False Claims Act has been used to assert liability on the basis of inadequate care, kickbacks and other improper

referrals, improper use of Medicare numbers when detailing the provider of services, and allegations as to misrepresentations

with respect to the services rendered. Our activities relating to the sale and marketing of our products may be subject to scrutiny

under these laws. We are unable to predict whether we would be subject to actions under the False Claims Act or a similar state

law, or the impact of such actions. However, the costs of defending such claims, as well as any sanctions imposed, could significantly

adversely affect our financial performance.

Federal law prohibits

any entity from offering or transferring to a Medicare or Medicaid beneficiary any remuneration that the entity knows or should

know is likely to influence the beneficiary’s selection of a particular provider, practitioner or supplier of Medicare or

Medicaid payable items or services, including waivers of copayments and deductible amounts (or any part thereof) and transfers

of items or services for free or for other than fair market value. Entities found in violation may be liable for civil monetary

penalties of up to $10,000 for each wrongful act. Although we believe that our sales and marketing practices are in material compliance

with all applicable federal and state laws and regulations, relevant regulatory authorities may disagree and violation of these

laws, or, our exclusion from such programs as Medicaid and other governmental programs as a result of a violation of such laws,

could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Manufacturing

We have no commercial

manufacturing facilities, and we do not intend to build commercial manufacturing facilities of our own in the foreseeable future.

All of our manufacturing had been performed by Sing Lin, Genemax Medical Products Industry Corp (“Genemax”), QTM and

other FDA registered contract manufacturers. Genemax manufactured our product under the management of Sing Lin. All of our contract

manufacturers and their manufacturing facilities must comply with FDA regulations, current quality system regulations (referred

to as QSRs), which include current good manufacturing practices, or cGMPs, and to the extent laboratory analysis is involved,

current good laboratory practices, or cGLPs. We notified Sing Lin in June 2010 that we were terminating our manufacturing agreement

with them, which termination was effective September 2010. As a result, we currently have no supplier contracted to manufacture

our products, and Sing Lin and its suppliers are currently in possession of the tooling required to manufacture our products.

If we are unable to enter into a new agreement for the manufacture and supply of our devices, whether with Sing Lin or another

supplier, or if we are not able to timely regain possession or remanufacture the tooling, we may not be able to procure additional

inventory on a timely basis, in the quantities we require or at all. We estimate that our existing inventory of Exer-Rest products

will, at a minimum, be sufficient to meet demand through the end of the 2016 fiscal year.

Sales & Marketing

Our limited sales

efforts are currently focused on hospitals, cardiac rehabilitation clinics, physical therapy centers, senior living communities

and other healthcare providers, as well as their patients, professional athletes and other individuals through our management.

In addition to our limited sales efforts, we continue to explore potential distributor and independent sale representative networks

in the US, Canada and abroad. There can be no assurance that we will be able to enter into additional distribution and representation

agreements on terms acceptable to us or at all, or that our sales and distribution network will generate significant sales.

Employees

The Company currently

does not have full time employees. Our administrative, accounting and legal functions are contracted on a part-time basis.

Our future operating

results may vary substantially from anticipated results due to a number of factors, many of which are beyond our control. The

following discussion highlights some of these factors and the possible impact of these factors on our future results of operations.

If any of the following events actually occurs, our business, financial condition or results of operations could be materially

harmed. In that case, the value of our common stock could decline substantially.

Risks Relating to Our Business.

We have a history of operating losses,

we do not expect to become profitable in the near future and absent a significant increase in revenue or additional equity or

debt financing, we may be unable to continue as a going concern.

Our consolidated

financial statements for the years ended July 31, 2015 and 2014 were prepared on a “going concern” basis; however

substantial doubt exists about our ability to continue as a going concern as a result of recurring losses and an accumulated deficit.

We are not profitable and have been incurring material losses. Our net losses for our fiscal years ended July 31, 2015 and 2014

were $0.4 and $0.4 million respectively. As of July 31, 2015, we had an accumulated deficit of $24.7 million. Although we have

obtained regulatory clearance to market our principal products in the US and abroad, there can be no assurance that our products

will achieve market acceptance. Market acceptance of our products may depend upon, among other things: the timing of market introduction

of competitive products; the safety and efficacy of our products; and the potential advantage or disadvantages of alternative

treatments. If our products fail to achieve market acceptance, we may not be able to generate significant revenues or be profitable.

Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Absent a significant

increase in revenue or additional equity or debt financing, we will be unable to continue as a going concern, and you may lose

all of your investment in us.

We will require additional funding,

which may not be available to us on acceptable terms, or at all.

We will need to raise

additional capital in order for us to continue as a going concern. We have reached our borrowing limit under our existing $1.0

million secured credit facility. In addition, we borrowed $425,000 in promissory notes of $175,000 from Frost Gamma Investments

Trust between September 2011 and August 2015 and $50,000 from an unrelated third party in September 2011, $50,000 from Hsu Gamma

Investments, L.P. in May 2012 and $150,000 from Jane Hsiao, the Company’s Chairman of the Board and Interim Chief Executive

Officer, between February 2013 and February 2015. Until we can generate a sufficient amount of product revenue to finance our

cash requirements, which we may never do, we will need to finance future cash needs primarily through public or private equity

offerings, debt financings or strategic collaborations. We do not know whether additional funding will be available on acceptable

terms, or at all. We cannot assure you that we could obtain such approval. If we are not able to secure additional funding when

needed, we may have to delay, reduce the scope of or eliminate our research and development programs and operations. To the extent

that we raise additional funds by issuing equity securities, our shareholders may experience significant dilution, and debt financing,

if available, may require that we agree to covenants that restrict our operations. To the extent that we raise additional funds

through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our products or grant licenses

on terms that may not be favorable to us.

We terminated the Product and Supply

Agreement with Sing Lin and may potentially be obligated to pay amounts under the agreement.

The now-terminated

product and supply agreement with Sing Lin contained obligations to purchase approximately $2.6 million of Exer-Rest units within

one year of acceptance of the final product, and an additional $4.1 million and $8.8 million of products in the second and third

years following acceptance of the final product, respectively. Under the product and supply agreement, we were required to pay

a portion of the product purchase price at the time production orders were placed, with the balance due upon delivery. Through

July 31, 2015, we paid Sing Lin $1.7 million in connection with orders placed through that date, with the last payment being made

in July 2009. As of the filing date we had not placed orders sufficient to satisfy the first-year or second-year minimum purchase

obligations under the agreement. We notified Sing Lin in June 2010 that we were terminating the agreement effective September

2010, and Sing Lin in July 2010 demanded that we place orders sufficient to fulfill the three year purchase obligations under

the agreement. As of October 23, 2015 Sing Lin has not followed up on its July 2010 demand. There can be no assurance that Sing

Lin will not attempt to enforce its rights under the product and supply agreement, or pursue other available remedies. If Sing

Lin seeks to enforce remedies against us, any such remedies could have a material adverse effect on our business, liquidity and

results of operations.

We rely on third parties to manufacture

and supply our products, and we presently have no agreement with any third party to manufacture and supply our products.

We do not own or

operate manufacturing facilities for clinical or commercial production of our products. We have only have limited experience in

medical device manufacturing, and we lack the resources and the capability to manufacture any of our products on a commercial

scale. We expect to depend on third-party contract manufacturers for the foreseeable future. Our ability to replace an existing

manufacturer may be difficult because the number of potential manufacturers is limited, and the FDA must approve any replacement

manufacturer before it can begin manufacturing our product. It may be difficult or impossible for us to identify and engage a

replacement manufacturer on acceptable terms in a timely manner, or at all.

We entered into an

agreement with Sing Lin to, among other things, manufacture all of our acceleration therapeutic platforms. We notified Sing Lin

in June 2010 that we were terminating the agreement, which termination was effective September 2010. As a result, we do not currently

have a supplier contracted to manufacture our products, and Sing Lin and its suppliers are currently in possession of the tooling

required to manufacture our products. If we are unable to enter into a new agreement for the manufacture and supply of our devices,

whether with Sing Lin or another supplier, or if we are not able to timely regain possession or remanufacture the tooling, we

may not be able to procure additional inventory on a timely basis, in the quantities we require or at all, which would have a

material adverse effect on our business, liquidity and results of operations.

The current worldwide economic condition

and concurrent market instability may materially and adversely affect the demand for our products, as well as our ability to obtain

credit or secure funds through sales of our stock, which may materially and adversely affect our business, financial condition

and ability to fund our operations.

The current worldwide

economic condition may reduce the demand for new and innovative medical devices, resulting in delayed market acceptance of our

products. Such a delay could have a material adverse impact on our business, expected cash flows, results of operations and financial

condition.

Additionally, we

have funded our operations to date primarily through private sales of our common stock and preferred stock and through borrowings

under credit facilities available to us from shareholders and other individuals. The current economic conditions and instability

in the world’s equity and credit markets may materially adversely affect our ability to sell additional shares of our stock

and/or borrow cash. There can be no assurance that we will be able to raise additional working capital on acceptable terms or

at all, which may materially adversely affect our ability to continue our operations.

Medicare legislation

and future legislative or regulatory reform of the health care system may affect our ability to sell our products profitably.

In the United States,

there have been a number of legislative and regulatory initiatives, at both the federal and state government levels, to change

the healthcare system in ways that, if approved, could affect our ability to sell our products and provide our laboratory services

profitably. While many of the proposed policy changes require congressional approval to implement, we cannot assure you

that reimbursement payments under governmental and private third party payor programs will remain at levels comparable to present

levels or will be sufficient to cover the costs allocable to patients eligible for reimbursement under these programs. Any

changes that lower reimbursement rates under Medicare, Medicaid or private payor programs could negatively affect our business.

On March 23, 2010,

President Obama signed into law both the Patient Protection and Affordable Care Act (the “Affordable Care Act”) and

the reconciliation law known as Health Care and Education Affordability Reconciliation Act (the “Reconciliation Act”)

and, combined we refer to both Acts as the “2010 Health Care Reform Legislation.” The Supreme Court of the United

States upheld fundamental aspects of the 2010 Health Care Reform Legislation in June 2012 and again in June 2015. Specifically,

the Supreme Court upheld the individual mandate that included changes regarding the extension of medical benefits to those who

currently lack insurance coverage, and affirmed that subsidies are available to participants enrolled in both state and federally

created health care exchanges. Extending coverage to a large population could substantially change the structure of the

health insurance system and the methodology for reimbursing medical services, drugs and devices. These structural changes could

entail modifications to the existing system of third-party payors and government programs, such as Medicare and Medicaid, the

creation of a government-sponsored healthcare insurance source, or some combination of both, as well as other changes. Additionally,

restructuring the coverage of medical care in the United States could impact the reimbursement for diagnostic tests. If

reimbursement for our diagnostic tests is substantially less than we or our clinical laboratory customers expect, or rebate obligations

associated with them are substantially increased, our business could be materially and adversely impacted.

Beyond coverage and

reimbursement changes, the 2010 Health Care Reform Legislation subjects manufacturers of medical devices to an excise tax

of 2.3% on certain U.S. sales of medical devices in January 2013. This excise tax will likely increase our expenses in the future.

Further, the 2010

Health Care Reform Legislation includes the Physician Payments Sunshine Act, which, in conjunction with its implementing regulations,

requires manufacturers of certain drugs, biologics, and devices that are covered by Medicare and Medicaid to record all transfers

of value to physicians and teaching hospitals starting on August 1, 2013 and to begin reporting the same for public disclosure

to the Centers for Medicare and Medicaid Services by March 31, 2014. Several other states and a number of countries worldwide

have adopted or are considering the adoption of similar transparency laws. The failure to report appropriate data may result

in civil or criminal fines and/or penalties.

Regulations under

the 2010 Health Care Reform Legislation are expected to continue being drafted, released and finalized throughout the next several

years. Pending the promulgation of these regulations, we are unable to fully evaluate the impact of the 2010 Health Care

Reform Legislation.

Our Exer-Rest device

does not have a unique Medicare Reimbursement CPT Code.

The procedures using

our Exer-Rest device technology are new, and the existing Current Procedural Terminology (CPT) codes do not accurately describe

the Whole Body Periodic Acceleration (WBPA) therapy. Medicare and other third-party payors recognize that there may be procedures

performed by physicians or other qualified health care professionals where a number of specific code numbers could be, and have

been, designated for reporting unlisted procedures. We provide a Standard Operating Procedure for the healthcare professional

to submit WBPA therapy as an unlisted procedure using a paper claim submission. However, depending on the Medicare intermediary,

Medicare submissions using unlisted codes may not be reimbursed fully or at all. If Medicare and/or third-party payors elect not

to “cover” WBPA as a qualified unlisted procedure or if a new reimbursement code is not established, it may weaken

demand for our product among healthcare providers, which could have a material adverse effect on the results of our operations

and financial position.

The terms of clearances or approvals

and ongoing regulation of our products may limit how we manufacture and market our products, which could materially impair our

ability to generate anticipated revenues.

Once regulatory clearance

or approval has been granted, the cleared or approved product and its manufacturer are subject to continual review. Any cleared

or approved product may only be promoted for its indicated uses. Accordingly, it is possible that our products may be cleared

or approved for fewer or more limited uses than we request or that clearance or approval may be granted contingent on the performance

of costly post-marketing clinical trials. In addition, if the FDA or other non-U.S. regulatory authorities clear or approve our

products, the labeling, packaging, adverse event reporting, storage, advertising and promotion for the products will be subject

to extensive regulatory requirements. It is possible that the FDA or other non-U.S. regulatory authorities may not approve the

labeling claims necessary or desirable for the successful commercialization of our products. Further, regulatory agencies must

approve our manufacturing facilities before they can be used to manufacture our products, and these facilities are subject to

ongoing regulatory inspection. If we fail to comply with the regulatory requirements of the FDA and other non-U.S. regulatory

authorities, or if previously unknown problems with our products, manufacturers or manufacturing processes are discovered, FDA

may seek to revoke our clearance or clearances, or may hold that a previously exempt device is subject to premarket notification

and clearance and may not be marketed until such clearance issues. We could also be subject to administrative or judicially imposed

sanctions. FDA may also conclude that a previously exempt or cleared device is subject to full FDA approval and that marketing

must cease until the device is approved. FDA approval is time-consuming, extraordinarily expensive and highly uncertain.

In addition, the

FDA and other non-U.S. regulatory authorities may change their policies and additional regulations may be enacted that could prevent

or delay regulatory clearance or approval of our products. We cannot predict the likelihood, nature or extent of government regulation

that may arise from future legislation or administrative action, either in the United States or abroad. If we are not able to

maintain regulatory compliance, we would likely not be permitted to market our products and we may not achieve or sustain profitability.

Our competitors may develop and market

products that are more effective, safer or less expensive than our products, negatively impacting our commercial opportunities.

The life sciences

industry is highly competitive, and we face significant competition from many medical device companies that are researching and

marketing products designed to address the same ailments we are endeavoring to address. The medical devices that we have developed

or are developing will compete with other medical devices that currently exist or are being developed. Products we may develop

in the future are also likely to face competition from other medical devices and therapies. Many of our competitors have significantly

greater financial, manufacturing, marketing and product development resources than we do. If our competitors market products that

are more effective, safer, easier to use or less expensive than our products, or that reach the market sooner than our products,

we may not achieve commercial success. In addition, the medical device industry is characterized by rapid technological change.

It may be difficult for us to stay abreast of the rapid changes in each technology. If we fail to stay at the forefront of technological

change, then we may be unable to compete effectively. Technological advances or products developed by our competitors may render

our technologies or products obsolete or less competitive. Any of the foregoing may have a material adverse effect on our business,

liquidity and results of operations.

If we are unable to obtain and enforce

patent protection for our products, our business could be materially harmed.

We currently hold

five United States patents with respect to overall design and specific features of our present and proposed products and have

submitted applications with respect to four foreign patents. The issuance of a patent does not guarantee that it is valid or enforceable.

Any patents we have obtained, or obtain in the future, may be challenged, invalidated, unenforceable or circumvented. Moreover,

the United States Patent and Trademark Office (the “USPTO”) may commence interference proceedings involving our patents

or patent applications. Any challenge to, finding of unenforceability or invalidation or circumvention of, our patents or patent

applications would be costly, would require significant time and attention of our management and could have a material adverse

effect on our business.

Our pending patent

applications may not result in issued patents. The patent position of medical device companies, including us, is generally uncertain

and involves complex legal and factual considerations. The standards that the USPTO and its foreign counterparts use to grant

patents are not always applied predictably or uniformly and can change. There is also no uniform, worldwide policy regarding the

subject matter and scope of claims granted or allowable in medical device patents. Accordingly, we do not know the degree of future

protection for our proprietary rights or the breadth of claims that will be allowed in any patents issued to us or to others.

If we are unable to protect the confidentiality

of our proprietary information and know-how, the value of our technology and products could be adversely affected.

In addition to patent

protection, we also rely on other proprietary rights, including protection of trade secrets, know-how and confidential and proprietary

information. Adequate remedies may not exist in the event of unauthorized use or disclosure of our confidential information. The

disclosure of our trade secrets would impair our competitive position and may materially harm our business, financial condition

and results of operations. To the extent that our employees, consultants or contractors use technology or know-how owned by third

parties in their work for us, disputes may arise between us and those third parties as to the rights in related inventions.

Our commercial success depends significantly

on our ability to operate without infringing the patents and other proprietary rights of third parties.

Other entities may

have or obtain patents or proprietary rights that could limit our ability to manufacture, use, sell, offer for sale or import

products or impair our competitive position. In addition, to the extent that a third party develops new technology that covers

our products, we may be required to obtain licenses to that technology, which licenses may not be available or may not be available

on commercially reasonable terms, if at all. If licenses are not available to us on acceptable terms, we will not be able to market

the affected products or conduct the desired activities, unless we challenge the validity, enforceability or infringement of the

third party patent or circumvent the third party patent, which would be costly and would require significant time and attention

of our management. Third parties may have or obtain valid and enforceable patents or proprietary rights that could block us from

developing products using our technology. Our failure to obtain a license to any technology that we require may materially harm

our business, financial condition and results of operations.

If we become involved in patent litigation

or other proceedings related to a determination of rights, we could incur substantial costs and expenses, substantial liability

for damages or be required to stop our product development and commercialization efforts any of which could materially adversely

affect our liquidity, business prospects and results of operations.

Third parties may

sue us for infringing their patent rights. Likewise, we may need to resort to litigation to enforce a patent issued or licensed

to us or to determine the scope and validity of proprietary rights of others. In addition, a third party may claim that we have

improperly obtained or used its confidential or proprietary information. The cost to us of any litigation or other proceeding

relating to intellectual property rights, even if resolved in our favor, could be substantial, and the litigation would divert

our management’s efforts. Some of our competitors may be able to sustain the costs of complex patent litigation more effectively

than we can because they have substantially greater resources. Uncertainties resulting from the initiation and continuation of

any litigation could limit our ability to continue our operations.

If any parties successfully

claim that our creation or use of proprietary technologies infringes upon their intellectual property rights, we might be forced

to pay damages, potentially including treble damages, if we are found to have willfully infringed on such parties’ patent

rights. In addition to any damages we might have to pay, a court could require us to stop the infringing activity or obtain a

license. Any license required under any patent may not be made available on commercially acceptable terms, if at all. In addition,

such licenses are likely to be non-exclusive and, therefore, our competitors may have access to the same technology licensed to

us. If we fail to obtain a required license and are unable to design around a patent, we may be unable to effectively market some

of our technology and products, which could limit our ability to generate revenues or achieve profitability and possibly prevent

us from generating revenue sufficient to sustain our operations.

Failure to obtain regulatory approval

outside the United States will prevent us from marketing our products abroad.

We intend to market

certain of our products in non-U.S. markets. In order to market our existing and future products in the European Union and many

other non-U.S. jurisdictions, we must obtain separate regulatory approvals. We have had limited interactions with non-U.S. regulatory

authorities, the approval procedures vary among countries and can involve additional testing, and the time required to obtain

approval may differ from that required to obtain FDA approval. Approval or clearance by the FDA does not ensure approval by regulatory

authorities in other countries, and approval by one or more non-U.S. regulatory authorities does not ensure approval by regulatory

authorities in other countries or by the FDA. The non-U.S. regulatory approval process may include all of the risks associated

with obtaining FDA approval or clearance. We may not obtain non-U.S. regulatory approvals on a timely basis, if at all. We may

not be able to file for non-U.S. regulatory approvals and may not receive necessary approvals to commercialize our future product

candidates in any market.

Non-U.S. governments often impose strict

price controls, which may adversely affect our future profitability.

We have obtained

approval to market certain of our products in one or more non-U.S. jurisdictions, which subjects us to rules and regulations in

those jurisdictions relating to our products. In some countries, particularly countries of the European Union, each of which has

developed its own rules and regulations, some pricing is subject to governmental control. In these countries, pricing negotiations

with governmental authorities can take considerable time after the receipt of marketing approval for a medical device candidate.

To obtain reimbursement or pricing approval in some countries, we may be required to conduct a clinical trial that compares the

cost-effectiveness of our existing and future product candidates to other available products. If reimbursement of our future product

candidates is unavailable or limited in scope or amount, or if pricing is set at unsatisfactory levels, we may be unable to achieve

or sustain profitability.

Our business is subject to economic,

political, regulatory and other risks associated with international operations.

Our business is subject to risks associated

with conducting business internationally, in part due to some of our suppliers historically being located outside the United States.

Accordingly, our future results could be harmed by a variety of factors, including:

| · | difficulties

in compliance with non-U.S. laws and regulations; |

| · | changes

in non-U.S. regulations and customs; |

| · | changes

in non-U.S. currency exchange rates and currency controls; |

| · | changes

in a specific country’s or region’s political or economic environment; |

| · | trade

protection measures, import or export licensing requirements or other restrictive actions

by U.S. or non-U.S. governments; |

| · | negative

consequences from changes in tax laws; and |

| · | difficulties

associated with staffing and managing foreign operations, including differing labor relations. |

Risks Relating to Our Stock.

We do not anticipate paying dividends

on our common stock in the foreseeable future.

We have not declared

and paid cash dividends on our common stock in the past, and we do not anticipate paying any cash dividends in the foreseeable

future. We intend to retain all of our earnings, if any, for the foreseeable future to finance the operation and expansion of

our business. Additionally, our current credit facility prohibits us from paying dividends on our capital stock at any time during

which we have outstanding borrowings thereunder. As a result, you may only receive a return on your investment in our common stock

if the market price of our common stock increases and you sell your shares.

Because our common stock is a “penny

stock,” it may be more difficult for investors to sell shares of our common stock, and the market price of our common stock

may be adversely affected.

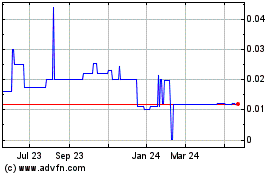

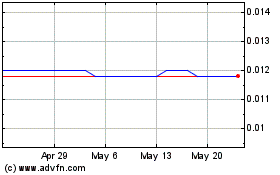

Our common stock,

which trades on the OTCBB, is a “penny stock” since, among other things, the stock price is below $5.00 per share,

it is not listed on a national securities exchange, and it has not met certain net tangible asset or average revenue requirements.

Broker-dealers who sell penny stocks must provide purchasers of these stocks with a standardized risk-disclosure document prepared

by the SEC. This document provides information about penny stocks and the nature and level of risks involved in investing in the

penny-stock market. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information regarding

broker and salesperson compensation, make a written determination that the penny stock is a suitable investment for the purchaser

and obtain the purchaser’s written agreement to the purchase. Broker-dealers must also provide customers that hold penny

stock in their accounts with such broker-dealer a monthly statement containing price and market information relating to the penny

stock. If a penny stock is sold to an investor in violation of the penny stock rules, the investor may be able to cancel its purchase