UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

| ☐ |

Preliminary

Information Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☒ |

Definitive

Information Statement |

NORDICUS

PARTNERS CORPORATION

(Name

of Registrant as Specified in its Charter)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

(1)

Title of each class of securities to which transaction applies: ______________

(2)

Aggregate number of securities to which transaction applies: _____________

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0.11 (set forth the amount on which the

filing fee is calculated and state how it was determined): ________________

(4)

Proposed maximum aggregate value of transaction: ___________________

(5)

Total fee paid: ___________________________

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

(1)

Amount Previously Paid: _______________________________

(2)

Form, Schedule or Registration Statement No.: ______________

(3)

Filing Party: __________________________________________

(4)

Date Filed: ____________________________________________

NORDICUS

PARTNERS CORPORATION

280

South Beverly Dr., Suite 505

Beverly

Hills, CA 90212

INFORMATION

STATEMENT PURSUANT TO SECTION 14(c) OF THE

SECURITIES

EXCHANGE ACT OF 1934 AND REGULATION 14C THEREUNDER

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE

REQUESTED NOT TO SEND US A PROXY

October

7, 2024

To

the Stockholders of Nordicus Partners Corporation:

This

Information Statement is furnished to holders of Common Shares, $.001 par value (the “Common Stock”) of Nordicus Partners

Corporation (“we,” “us” or the “Company”) as of October 4, 2024 (the

“Record Date”). The purpose of the Information Statement is to notify the Company’s stockholders that, on June

7, 2024, the Company’s board of directors (the “Board”) took action by written consent to approve the matters

listed below and, on June 7, 2024, in lieu of a meeting of the Company’s stockholders, and pursuant to Section 228 of the

Delaware General Corporation Law, GK Partners ApS, Reddington Partners LLC, Alteral Therapeutics ApS and JE Pitzner Holding ApS (collectively

referred to as the “Voting Stockholders”), as the holders of 78.3% of our voting securities, approved, by written

consent, the following matters:

| |

1. |

To

amend the Company’s certificate of incorporation to implement a one-for-ten (1-for-10) reverse split of the Company’s

Common Stock (the “Reverse Split”); |

| |

2. |

To

adopt the Nordicus Partners Corporation 2024 Stock Incentive Plan consisting of up to 7,000,000 shares of Common Stock for issuance

in connection with awards thereunder (the “2024 Plan Adoption”). |

On

June 7, 2024, the Board of Directors of the Company approved the Reverse Split and the 2024 Plan Adoption, subject to stockholder

approval. The Voting Stockholders approved the Reverse Split and the 2024 Plan Adoption by written consent in lieu of a meeting on June

7, 2024. Accordingly, your consent is not required and is not being solicited in connection with the approval of the Reverse Split

or the 2024 Plan Adoption. No action is required by you. Pursuant to Rule 14c-2 under the Securities Exchange Act of 1934, as amended,

we are required to distribute this information statement describing the actions listed above to our stockholders of record on October

4, 2024. Further, these actions will not be effective until a date at least 20 days after the date that the information statement

is filed and delivered to our stockholders of record. The Amendments will become effective when we file the Certificate of Amendment

with the Secretary of State of the State of Delaware after this Information Statement is effective.

The

actions will not become effective before the date which is 20 days after this Information Statement was first mailed to stockholders.

This Information Statement is being mailed on or about October 10, 2024 to stockholders of record on the Record Date.

THIS

IS FOR YOUR INFORMATION ONLY. YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO THIS INFORMATION STATEMENT. THIS IS NOT A NOTICE OF A MEETING

OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

| |

By

order of the Board of Directors |

| |

|

| |

/s/

Henrik Rouf |

| |

Henrik

Rouf |

| |

Chief

Executive Officer |

NORDICUS

PARTNERS CORPORATION

280

South Beverly Dr., Suite 505

Beverly

Hills, CA 90212

INFORMATION

STATEMENT PURSUANT TO SECTION 14(c)

OF

THE SECURITIES EXCHANGE ACT OF 1934

This

Information Statement (the “Information Statement”) is being mailed on or about October 10, 2024 to the holders

of record at the close of business on October 4, 2024 (the “Record Date”), of the Common Stock of Nordicus

Partners Corporation, a Delaware corporation (“we,” “us” or the “Company”),

in connection with an action taken by written consent of holders of a majority of our Common Stock in lieu of a meeting to approve the

following matters:

| |

1. |

To

amend the Company’s certificate of incorporation to implement a one-for-ten (1-for-10) reverse split of the Company’s

Common Stock (the “Reverse Split”); |

| |

2. |

To

adopt the Nordicus Partners Corporation 2024 Stock Incentive Plan consisting of up to 7,000,000 shares of Common Stock for issuance

in connection with awards thereunder (the “2024 Plan Adoption”). |

The

members of the Board of Directors (the “Board”) and stockholders owning 38,475,261 shares of our issued and outstanding

Common Stock (the “Voting Stockholders”) have executed a written consent approving the Reverse Split and the 2024

Plan Adoption. The Voting Stockholders held of record on the Record Date approximately 78.3 % of the total issued and outstanding Common

Stock of the Company, which was sufficient to approve the proposed Reverse Split and the 2024 Plan Adoption. Dissenting stockholders

do not have any statutory appraisal rights as a result of the action taken. The Board does not intend to solicit any proxies or consents

from any other stockholders in connection with this action. All necessary corporate approvals have been obtained, and this Information

Statement is furnished solely to advise stockholders of the actions taken by written consent.

The

Delaware General Corporation Law generally provides that any action required or permitted to be taken at a meeting of the stockholders

may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a

majority of the voting power, except that if a different proportion of voting power is required for such an action at a meeting, then

that proportion of written consents is required. In order to eliminate the costs and management time involved in obtaining proxies and

in order to effect the above actions as early as possible in order to accomplish the purposes of the Company as herein described, the

Board consented to the utilization of, and did in fact obtain, the written consent of the Voting Stockholders who collectively own shares

representing a majority of our Common Stock.

This

Information Statement is being distributed pursuant to the requirements of Section 14(c) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), to the Company’s stockholders of record on the Record Date. The corporate action described

herein will be effective 20 days (the “20-day Period”) after the mailing of this Information Statement. The 20-day

Period is expected to conclude on or about October 30, 2024.

The

entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians,

fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Common Stock held of record

by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

FORWARD

LOOKING STATEMENTS

This

Information Statement and other reports that the Company files with the U.S. Securities and Exchange Commission (the “SEC”)

contain forward-looking statements about the Company’s business containing the words “believes,” “anticipates,”

“expects” and words of similar import. These forward-looking statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or performance to be materially different from the results or performance anticipated or

implied by such forward-looking statements. Given these uncertainties, stockholders are cautioned not to place undue reliance on forward-looking

statements. Except as specified in SEC regulations, the Company has no duty to publicly release information that updates the forward-looking

statements contained in this Information Statement. An investment in the Company involves numerous risks and uncertainties, including

those described elsewhere in this Information Statement. Additional risks will be disclosed from time-to-time in future SEC filings.

VOTE

REQUIRED TO APPROVE THE AMENDMENT

As

of the Record Date, there were 49,132,248 shares of Common Stock issued and outstanding. Each share of Common Stock is entitled to one

vote. For the approval of the Reverse Split and the 2024 Plan Adoption, the affirmative vote of a majority of the shares of Common Stock

outstanding and entitled to vote at the Record Date, or 24,566,125 shares, was required for approval.

CONSENTING

STOCKHOLDERS

On

June 7, 2024, the Board unanimously adopted resolutions declaring the advisability of, and recommending that stockholders approve,

the Reverse Split and the 2024 Plan Adoption. In connection with the adoption of this resolution, the Board elected to seek the written

consent of the holders of a majority of the Company’s issued and outstanding shares of Common Stock in order to reduce the costs

and implement the proposals in a timely manner.

On

June 7, 2024, the following Voting Stockholders, who collectively own 38,475,261 shares of the Company’s issued and outstanding

Common Stock (approximately 78.3%), consented in writing to the proposed Reverse Split:

| Shareholder Name | |

No. of Shares | | |

% of Outstanding | |

| GK Partners ApS | |

| 22,352,106 | | |

| 45.5 | % |

| Reddington Partners LLC | |

| 585,018 | | |

| 1.2 | % |

| Alteral Therapeutics ApS | |

| 12,652,279 | | |

| 25.8 | % |

| JE Pitzner Holding Aps | |

| 2,885,858 | | |

| 5.9 | % |

Under

Section 14(c) of the Exchange Act, the transactions cannot become effective until the expiration of the 20-day Period.

The

Company is not seeking written consent from any of our other stockholders, and stockholders other than the Voting Stockholders will not

be given an opportunity to vote with respect to the Reverse Split.

MATTER

1

APPROVAL

EFFECTING A 1-FOR-10 SHARE REVERSE SPLIT

OF

OUR OUTSTANDING COMMON STOCK

General

Our

Board has unanimously approved a proposal to effect a one-for-ten reverse stock split of the Company’s outstanding Common Stock.

The Voting Stockholders have also approved this Reverse Split.

The

corporate action provides for the combination of our presently issued and outstanding shares of Common Stock into a smaller number of

shares of identical Common Stock. This is known as a “reverse stock split.” Under the proposal, each ten shares of our presently

issued and outstanding Common Stock as of the close of business on the effective date of the approved director’s resolution will

be converted automatically into one share of our post-Reverse Split Common Stock.

Each

stockholder will hold the same percentage of our outstanding Common Stock immediately following the Reverse Split as he or she did immediately

prior to the Reverse Split. The Reverse Split does not change the number of authorized shares of Common Stock.

Reasons

for the Reverse Split

The

primary purposes of the Reverse Split are to:

| |

● |

increase

the per share price of our Common Stock; and |

| |

|

|

| |

● |

provide

the Company with the flexibility to issue additional shares to facilitate future stock acquisitions and financings. |

The

reduction in the number of issued and outstanding shares of Common Stock to result from the Reverse Split is expected to increase the

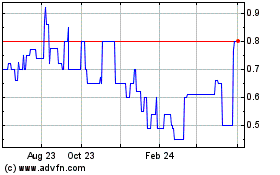

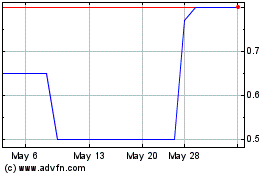

market price of the Common Stock to a level above the current market trading price.

While

the Board believes that the shares of Common Stock will trade at higher prices than those which have prevailed in the recent past, there

can be no assurance that such increase in the trading price will occur or, if it does occur, that it will equal or exceed the direct

arithmetical result of the Reverse Split because there are numerous factors and contingencies which could affect our market price.

Our

Common Stock is currently quoted on the OTC Markets Group, Inc. OTCQB Market under the symbol “NORD.” A higher per share

price for the Common Stock may enable the Company to meet minimum bid price criteria for initial listing of the Common Stock on a national

securities exchange at such time as we implement our future business plans.

Because

trading of our Common Stock is conducted in the over-the-counter market, an investor could find it more difficult to dispose of, or to

obtain accurate quotations as to the market value of, the Common Stock. In addition, because the Common Stock is not listed on a national

securities exchange and presently trades at less than $5.00 per share, trading in our Common Stock is subject to the requirements of

certain rules promulgated under the Exchange Act, which require additional disclosure by brokers or dealers in connection with any trades

involving a stock defined as a “penny stock.” Because our Common Stock is presently classified as a “penny stock,”

prior to effectuating any transaction in our Common Stock, a broker or dealer is required to make a suitability determination as to the

proposed purchaser of our Common Stock and to receive a written agreement, meeting certain requirements. The additional burdens imposed

upon brokers or dealers by such requirements could discourage brokers or dealers from effecting transactions in our Common Stock, which

could limit the market liquidity of our Common Stock and the ability of investors to trade our Common Stock.

The

Board believes that the Reverse Split also could result in a broader market for our Common Stock than the current market. Many institutional

investors are unwilling or unable due to investment restrictions to invest in companies whose stock trades at less than $5.00 per share.

Many Investment Advisors are subject to internal restrictions on their ability to recommend stocks trading at less than $5.00 per share

because of a general presumption that such stocks may be highly speculative. In addition, stocks trading at less than $5.00 per share

may not be marginable under the internal policies of some investment firms. The Reverse Split is anticipated to result in a price increase

for our Common Stock relieving, to some extent, the effect of such limitations on the market for our Common Stock. Additionally, brokerage

commissions on the sale of lower priced stocks often represent a higher percentage of the sales price than commissions on relatively

higher priced stocks. The expected increase in trading price may also encourage interest and trading in our Common Stock and possibly

promote greater liquidity for our stockholders. We also believe that the current per share price of our Common Stock has or may have

a negative effect on our ability to use our Common Stock in connection with possible future transactions such as financings, strategic

alliances, acquisitions and other uses not presently determinable.

Furthermore,

as a result of the Reverse Split, there will be a reduction in the number of shares of Common Stock issued and outstanding; however,

the number of shares authorized will remain the same. The reduced number of issued and outstanding number of shares may, in the view

of the board, attract new investment partners to assist with the development of Company initiatives and business plans. For the above

reasons, the Board believes that the Reverse Split is in the best interests of the Company and the stockholders. However, there

can be no assurances that the Reverse Split will have the desired consequences.

Effects

of the Reverse Split

The

Reverse Split will be effected and will be effective upon a date on or after the expiration of the 20-day Period after the mailing of

this Information Statement. The 20-day Period is expected to conclude on or about October 30, 2024. However, the actual timing

will be determined by our management based upon their evaluation as to when effecting the Reverse Split will be most advantageous to

the Company and our stockholders.

We

reserve the right to forego or postpone effecting the Reverse Split if we determine that action to be in the best interests of the Company

and the stockholders. We are currently authorized to issue 50,000,000 shares of Common Stock, of which 49,132,248 shares were issued

and outstanding at the close of business on the Record Date. An additional 7,000,000 authorized and unissued shares are reserved for

issuance under the Company’s 2017 Non-Qualified Equity Incentive Plan. Adoption of the Reverse Split will reduce the shares of

Common Stock outstanding on the record date but will not affect the number of authorized shares of Common Stock. The Reverse Split also

will have no effect on the par value of the Common Stock.

The

effect of the Reverse Split upon holders of Common Stock will be that the total number of shares of our Common Stock held by each stockholder

will be automatically converted into the number of whole shares of Common Stock equal to the number of shares of Common Stock owned immediately

prior to the Reverse Split divided by ten. Each of our stockholders will continue to own shares of Common Stock and will continue to

share in the assets and future growth of the Company as a stockholder. In addition, the Reverse Split will increase the number of our

stockholders who own odd lots (less than 100 shares). Stockholders who hold odd lots typically will experience an increase in the cost

of selling their shares, as well as possible greater difficulty in effecting such sales. Consequently, there can be no assurance that

the Reverse Split will achieve the desired results that have been outlined above.

The

Reverse Split will be effected on a certificate-by-certificate basis, and any fractional shares resulting from such combination shall

be rounded up to the nearest whole share on a certificate-by-certificate basis. Each stockholder’s percentage ownership interest

in the Company and proportional voting power will not change as a result of the Reverse Split. The rights and privileges of the holders

of shares of Common Stock will be substantially unaffected by the Reverse Split, except with respect to any such rounding of fractional

shares.

As

soon as practicable after the expiration of the 20-day Period, we will cause a letter of transmittal to be forwarded to each holder of

record of shares of our Common Stock outstanding as of such date. The letter of transmittal will contain instructions for the surrender

of certificates representing shares of pre-Reverse Split Common Stock to our transfer agent in exchange for certificates representing

the number of whole shares of post-Reverse Split Common Stock into which the shares of pre-Reverse Split common stock have been converted

as a result of the Reverse Split.

Certificates

should not be sent to us or the transfer agent before receipt of such letter of transmittal from us.

Until

a stockholder forwards a completed letter of transmittal, together with certificates representing such stockholder’s shares of

pre-Reverse Split Common Stock to the transfer agent and receives in return a certificate representing shares of post-Reverse Split Common

Stock, such stockholder’s pre-Reverse Split Common Stock shall be deemed equal to the number of whole shares of post-Reverse Split

Common Stock to which such stockholder is entitled as a result of the Reverse Split.

Certain

Federal Income Tax Considerations

The

following discussion describes certain material federal income tax considerations relating to the Reverse Split. This discussion is based

upon the Internal Revenue Code, existing and proposed regulations thereunder, legislative history, judicial decisions and current administrative

rulings and practices, all as amended and in effect on the date hereof. Any of these authorities could be repealed, overruled or modified

at any time. Any such change could be retroactive and, accordingly, could cause the tax consequences to vary substantially from the consequences

described herein. No ruling from the Internal Revenue Service (the “IRS”) with respect to the matters discussed herein

has been requested, and there is no assurance that the IRS would agree with the conclusions set forth in this discussion.

This

discussion may not address certain federal income tax consequences that may be relevant to particular stockholders in light of their

personal circumstances or to stockholders who may be subject to special treatment under the federal income tax laws. This discussion

also does not address any tax consequences under state, local or foreign laws.

STOCKHOLDERS

ARE URGED TO CONSULT THEIR TAX ADVISORS AS TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT FOR THEM, INCLUDING THE APPLICABILITY

OF ANY STATE, LOCAL OR FOREIGN TAX LAWS, CHANGES IN APPLICABLE TAX LAWS AND ANY PENDING OR PROPOSED LEGISLATION.

The

Reverse Split is intended to be a tax-free recapitalization to the Company and its stockholders, except for those stockholders whose

number of shares are rounded up in lieu of receiving a fractional share. Stockholders will not recognize any gain or loss for federal

income tax purposes as a result of the Reverse Split, except for those stockholders whose number of shares are rounded up in lieu of

receiving a fractional share. The holding period for shares of Common Stock after the Reverse Split will include the holding period of

shares of Common Stock before the Reverse Split, provided that such shares of Common Stock are held as a capital asset at the effective

time of the Amendment. The adjusted basis of the shares of Common Stock after the Reverse Split will be the same as the adjusted basis

of the shares of Common Stock before the Reverse Split, excluding the basis of fractional shares.

A

stockholder whose number of shares are rounded up in lieu of receiving a fractional share generally may recognize gain in an amount not

to exceed the excess of the fair market value of such fractional share over the fair market value of the fractional share to which the

stockholder was otherwise entitled.

MATTER

2

2024

PLAN ADOPTION

General

On

June 7, 2024, the Board and the Voting Stockholders approved the Nordicus Partners Corporation 2024 Stock Incentive Plan (the

“2024 Plan”) for the Company in the form attached hereto as Annex A. Stockholder approval of the 2024 Plan

enables the Company to make awards that qualify as performance-based compensation that is exempt from the deduction limitation set forth

under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Subject to certain exceptions,

Section 162(m) generally limits the corporate income tax deductions to $1,000,000 annually for compensation paid to each of the Chief

Executive Officer and the other three highest paid executive officers of the Company required to be reported under the proxy disclosure

rules.

The

amount and nature of any proposed awards under the 2024 Plan have not yet been determined, although the 2024 Plan permits grants

of stock options, restricted stock or units, unrestricted stock, deferred stock and performance awards. Our Board believes that the 2024

Plan will be an important factor in attracting, retaining and motivating employees, consultants, and directors of the Company and its

affiliates. Our Board believes that the Company needs the flexibility both to have an ongoing reserve of Common Stock available for future

equity-based awards, and to make future awards in a variety of forms.

Set

forth below is a summary of the material terms of the 2024 Plan, but this summary is qualified in its entirety by reference to the full

text of the 2024 Plan, a copy of which is included as Annex A to this Information Statement. Capitalized terms used in this summary

and not otherwise defined herein will have the meanings ascribed to such terms in the 2024 Plan.

Administration

of the 2024 Plan. The Compensation Committee (the “Committee”) of our Board, or in the absence of a committee,

the Board, has such powers and authorities related to the administration of the 2024 Plan as are consistent with our corporate governance

documents and applicable law. The Committee, if one is established, will be comprised of directors who (i) qualify as “outside

directors” within the meaning of Section 162(m) of the Code, (ii) meet such other requirements as may be established from time

to time by the SEC for plans intended to qualify for exemption under Rule 16b-3 (or its successor) under the Exchange Act and (iii) comply

with the independence requirements of the stock exchange on which our common stock may be listed. The Committee will interpret the 2024

Plan, establish and modify administrative rules, impose such conditions and restrictions on awards as it determines appropriate, and

make all factual determinations with respect to and take such steps in connection with the 2024 Plan and awards granted under it as it

may deem necessary or advisable. The Committee may delegate certain of its powers or responsibilities to a subcommittee of the Committee

or designated officers or employees of the Company. In addition, the full Board generally may exercise any of the powers and authority

of the Committee under the 2024 Plan.

Number

of Authorized Shares and Award Limits. The initial number of shares of our Common Stock reserved for issuance in connection with

awards under the 2024 Plan is 7,000,000. The shares to be offered under the 2024 Plan shall be authorized and unissued Common Stock,

or issued Common Stock that shall have been reacquired by the Company. Any shares covered by an award that are forfeited, expired, cancelled,

settled in cash or otherwise terminated without delivery of shares to the grantee, will be available for future grants under the 2024

Plan. Further, shares surrendered to or withheld by us in payment or satisfaction of the exercise price of an award or any tax withholding

obligation with respect to an award will be available for the grant of new awards. In addition, shares issued with respect to awards

assumed by us in connection with any merger, acquisition or related transaction will not reduce the total number of shares available

for issuance under the 2024 Plan. The number and class of shares available under the 2024 Plan and subject to outstanding awards, as

well as the award limits described above, may be equitably adjusted by the Committee in the event of various changes in the capitalization

of the Company.

Eligibility

and Participation. Eligibility to participate in the 2024 Plan is limited to such employees, non-employee directors and consultants

of the Company, or of any affiliate, as the Committee may determine and designate from time to time. At this time the Company has three

directors, no employees and no consultants eligible for grants.

Type

of Awards. The following types of awards are available for grant under the 2024 Plan: incentive stock options (“ISOs”),

non-qualified stock options (“NSOs”), restricted stock, restricted stock units, performance awards, other stock-based

awards or cash-based incentive awards.

Stock

Options and Other Awards

Grant

of Options. The Committee may award ISOs and NSOs (collectively referred to as “Options”) to grantees. The exercise

price per share of an Option will be at least 100% of the fair market value per share of our stock underlying the award on the grant

date. The Committee will determine the terms and conditions (including any performance requirements) under which an Option will become

exercisable and will include such information in the award agreement.

Special

Limitations on ISOs. In the case of a grant of an Option intended to qualify as an ISO to a grantee who owns more than ten percent

of the total combined voting power of all classes of our outstanding stock (a “Ten Percent Stockholder”), the exercise

price of the Option will not be less than 110% of the fair market value of a share of our stock on the grant date. Additionally, an Option

will constitute an ISO only (i) if the grantee is an employee of the Company or a subsidiary of the Company, (ii) to the extent such

Option is specifically designated as an ISO in the related award agreement, and (iii) to the extent that the aggregate fair market value

(determined at the time the option is granted) of the shares of stock with respect to which all ISOs held by such grantee become exercisable

for the first time during any calendar year (under the 2024 Plan and all other plans of the grantee’s employer and its affiliates)

does not exceed $100,000.

Exercise

of Options. An Option may be exercised by the delivery to us of written notice of exercise and payment in full of the exercise price

(plus the amount of any taxes which we may be required to withhold). If not exercised, Options will expire at such time as the Committee

determines. However, no Option may be exercised more than ten years from the date of grant, or in the case of an ISO held by a Ten Percent

Stockholder, not more than five years from the date of grant.

Restricted

Stock and Restricted Stock Units. The Committee may award to a participant shares of Common Stock subject to specified restrictions

(“restricted stock”). The Committee also may award to a participant-restricted stock units representing the right

to receive shares of Common Stock in the future. Shares of restricted stock and restricted stock units are subject to forfeiture if the

participant does not meet certain conditions such as continued employment over a specified period and/or the attainment of specified

performance targets over such period. The Committee will determine the terms and conditions (including any performance requirements)

for each award of restricted stock or restricted stock units and will include such information in the award agreement.

Effect

of Certain Transactions. In the event of a change in control of the Company, outstanding awards under the 2024 Plan may be subject

to accelerated vesting or settlement as provided in the individual award agreements. Upon the occurrence of certain corporate transactions,

which may include a change in control, outstanding awards generally will be subject to the terms of the agreement entered into in connection

with the transaction, which may provide for the assumption or substitution of awards by the surviving corporation or its parent or subsidiary,

for accelerated vesting and accelerated expiration, or for settlement in cash or cash equivalents.

Nontransferability

of Awards. Generally, during the lifetime of a grantee, only the grantee may exercise rights under the 2024 Plan and no award will

be assignable or transferable other than by will or laws of descent and distribution. If authorized in the award agreement, a grantee

may transfer, not for value, all or part of an NSO to certain family members (including trusts and foundations for their benefit). Neither

restricted stock nor restricted stock units may be sold, transferred, assigned, pledged or otherwise encumbered or disposed of during

the restricted period or prior to the satisfaction of any other restrictions prescribed by the Committee.

Amendment

and Termination. Subject to applicable laws and stock exchange listing standards requiring shareholder approval under certain circumstances,

our Board of Directors may, at any time, amend or terminate the 2024 Plan, provided that no such action may be taken that adversely affects

any rights or obligations with respect to any awards previously made under the 2024 Plan without the consent of the applicable participants.

New

Plan Benefits. All grants of awards under the 2024 Plan will be discretionary and, therefore, the benefits and amounts that will

be received under the 2024 Plan are not determinable.

Federal

Income Tax Consequences. The following is a summary of the general federal income tax consequences to the Company and to U.S. taxpayers

of awards to be granted under the 2024 Plan. Tax consequences for any particular individual or under state or non-U.S. tax laws may be

different.

NSOs.

No taxable income is reportable when a NSO is granted. Upon exercise, generally, the recipient will have ordinary income equal to the

fair market value of the underlying shares of stock on the exercise date minus the exercise price. Any gain or loss upon the disposition

of the stock received upon exercise will be capital gain or loss to the recipient if the appropriate holding period under federal tax

law is met for such treatment.

ISOs.

No taxable income is reportable when an ISO is granted or exercised (except for grantees who are subject to the alternative minimum tax,

who may be required to recognize income in the year in which the ISO is exercised). If the recipient exercises the ISO and then sells

the underlying shares of stock more than two years after the grant date and more than one year after the exercise date, the excess of

the sale price over the exercise price will be taxed as long-term capital gain or loss. If the recipient exercises the ISO and sells

the shares before the end of the two- or one-year holding periods, he or she generally will have ordinary income at the time of the sale

equal to the fair market value of the shares on the exercise date (or the sale price, if less) minus the exercise price of the ISO.

Restricted

Stock and Restricted Stock Units. A recipient of restricted stock or restricted stock units will not have taxable income upon the

grant unless, in the case of restricted stock, he or she elects to be taxed at that time. Instead, he or she will have ordinary income

at the time of vesting equal to the fair market value on the vesting date of the shares (or cash) received minus any amount paid for

the shares.

Performance

Awards, Other Stock-Based Awards and Cash-Based Incentive Awards. Typically, a recipient will not have taxable income upon the grant

of a performance awards, any other stock-based awards or any cash-based incentive awards. Subsequently, when the conditions and requirements

for the grants have been satisfied and the payment determined, any cash received and the fair market value of any common stock received

will constitute ordinary income to the recipient.

Tax

Effect for the Company. We generally will receive a tax deduction for any ordinary income recognized by a grantee in respect of an

award under the 2024 Plan (for example, upon the exercise of a NSO). In the case of ISOs that meet the holding period requirements described

above, the grantee will not recognize ordinary income; therefore, we will not receive a deduction.

SECURITY

OWNERSHIP OF

CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth the ownership, as of October 4, 2024, of our Common Stock by each person known by us to be the beneficial

owner of more than 5% of our outstanding Common Stock, each of our directors and executive officers; and all of our directors and executive

officers as a group. The information presented below regarding beneficial ownership of our Common Stock has been presented in accordance

with the rules of the SEC and is not necessarily indicative of ownership for any other purpose. This table is based upon information

derived from our stock records. Unless otherwise indicated in the footnotes to this table and subject to community property laws where

applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares

indicated as beneficially owned. Except as set forth below, applicable percentages are based upon 49,659,276 shares of Common

Stock outstanding as of October 4, 2024.

| Class | |

Name and Address of Beneficial Owner | |

Amount and

Nature of

Beneficial

Ownership | | |

Percentage of

Class | |

| Common Stock | |

GK Partners ApS

Dyrehavevej 3B

DK-2930 Klampenborg, Denmark | |

| 27,779,551 | (1) | |

| 55.9 | % |

| Common Stock | |

Alteral Therapeutics ApS

Mesterlodden 3 A, First Floor

DK-2820 Gentofte, Denmark | |

| 12,652,279 | | |

| 25.5 | % |

| Common Stock | |

JE Pitzner Holding ApS

Pilevej 4,

DK-4180 Sorø, Denmark | |

| 2,885,858 | | |

| 5.8 | % |

| Common Stock | |

Henrik Rouf, Chief Executive Officer

7950 West Sunset Boulevard – Suite 629

Los Angeles, CA 90046 | |

| 585,018 | (2) | |

| 1.2 | % |

| Common Stock | |

Bennett J. Yankowitz

Director and Chief Financial Officer

280 South Beverly Dr., Suite 505

Beverly Hills, CA 90212 | |

| 250,000 | (3) | |

| 0.5 | % |

| Common Stock | |

Christian Hill-Madsen

Mesterlodden 3a

2820 Gentofte

Denmark | |

| 125,000 | (4) | |

| 0.2 | % |

| Common Stock | |

Current executive officers and directors as a group | |

| 960,018 | | |

| 1.9 | % |

| (1) |

Includes

5,325,000 shares issuable upon exercise of warrants at a price of $1.00 per share. |

| |

|

| (2) |

Consists

of 578,618 shares owned directly by Reddington

Partners LLC, over which Mr. Rouf possesses sole power to vote and dispose and 6,400 shares owned in Mr. Rouf’s name. |

| |

|

| (3) |

Consists

of shares issuable upon exercise of warrants at a price of $1.00 per share. |

| |

|

| (4) |

Held

through Life Science Power House ApS, which is wholly owned by Mr. Hill-Madsen. |

In

addition, the following table sets forth the position of Cede & Co. as of October 4, 2024:

| Class | |

Name and Address | |

Amount and

Nature of

Beneficial

Ownership | | |

Percentage of

Class | |

| Common Stock | |

Cede & Co.

P.O. Box 222

Bowling Green Station

New York, NY 10274 | |

| 4,874,446 | | |

| 9.8 | % |

DISSENTER’S

RIGHTS OF APPRAISAL

The

Stockholders do not have any rights of appraisal based upon these action by the Board and Voting Stockholders.

ADDITIONAL

INFORMATION

The

Company files annual, quarterly and current reports and other information with the SEC under the Exchange Act. You may obtain copies

of this information by mail from the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may

obtain information on the operation of the public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet

website that contains reports and other information about issuers that file electronically with the SEC. The address of that website

is www.sec.gov.

WRITTEN

CONSENT OF THE CONSENTING STOCKHOLDERS WHO COLLECTIVELY OWN SHARES REPRESENTING A MAJORITY OF OUR COMMON STOCK HAVE CONSENTED TO AND

EFFECTING THE REVERSE STOCK SPLIT. NO FURTHER VOTES OR PROXIES ARE NEEDED AND NONE ARE REQUESTED. THE BOARD IS NOT REQUESTING A PROXY

FROM YOU AND YOU ARE REQUESTED NOT TO SEND A PROXY.

| October

7, 2024 |

BY

ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

/s/

Henrik Rouf |

| |

Henrik

Rouf, Chief Executive Officer |

Annex

A

Nordicus

Partners Corporation

2024

Stock Incentive Plan

1.

Establishment, Purpose and Types of Awards

Nordicus

Partners Corporation, a Delaware corporation (the “Company”), hereby establishes the Nordicus Partners Corporation 2024 Stock

Incentive Plan (the “Plan”). The purpose of the Plan is to promote the long-term growth and profitability of the Company

by (i) providing key people with incentives to improve stockholder value and to contribute to the growth and financial success of the

Company, and (ii) enabling the Company to attract, retain and reward the best-available persons.

The

Plan permits the granting of stock Options (including incentive stock options qualifying under Code Section 422 and nonqualified stock

options), Stock Appreciation Rights, restricted or unrestricted Stock Awards, Restricted Stock Units, Performance Awards, other stock-based

awards, or any combination of the foregoing.

2.

Definitions

Under

this Plan, except where the context otherwise indicates, the following definitions apply:

2.1

“Administrator” shall mean the committee or committees as may be appointed by the Board from time to time to administer

the Plan, or if no such committee is appointed, the Board itself. For purposes of establishing and certifying the achievement of Performance

Goals pursuant to Code Section 162(m), any such committee shall consist of three or more persons, each of whom, unless otherwise determined

by the Board, is (i) an “outside director” within the meaning of Code Section 162(m), (ii) a “nonemployee director”

within the meaning of Rule 16b-3 and (iii) satisfies the requirements of the New York Stock Exchange for independent directors.

2.2

“Affiliate” shall mean any entity, whether now or hereafter existing, which controls, is controlled by, or is under

common control with, the Company (including, but not limited to, joint ventures, limited liability companies, and partnerships). For

this purpose, “control” shall mean ownership of 50% or more of the total combined voting power or value of all classes of

stock or interests of the entity.

2.3

“Award” shall mean any stock Option, Stock Appreciation Right, Stock Award, Restricted Stock Unit, Performance Award,

or other stock-based award.

2.4

“Board” shall mean the Board of Directors of the Company.

2.5

“Change in Control” shall mean the occurrence of one or more of the change in ownership or control events set forth

in Treasury Regulation Section 1.409A-3(i)(5).

2.6

“Code” shall mean the Internal Revenue Code of 1986, as amended, and any regulations promulgated thereunder.

2.7

“Common Stock” shall mean shares of common stock of the Company, par value $.001 per share.

2.8

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

2.9

“Fair Market Value” So long as the Common Stock is registered under Section 12(b) or (g) of the Exchange Act, “Fair

Market Value” shall mean, as applicable, (i) either the closing price or the average of the high and low sale price on the

relevant date, as determined in the Administrator’s discretion, quoted on the New York Stock Exchange, the American Stock Exchange,

or the Nasdaq National Market; (ii) the last sale price on the relevant date quoted on the Nasdaq National Market; (iii) the average

of the high bid and low asked prices on the relevant date quoted on the FINRA OTC Bulletin Board or by the National Quotation Bureau,

Inc. or a comparable service as determined in the Administrator’s discretion; or (iv) if the Common Stock is not quoted by any

of the above, the average of the closing bid and asked prices on the relevant date furnished by a professional market maker for the Common

Stock, or by such other source, selected by the Administrator. If no public trading of the Common Stock occurs on the relevant date,

then Fair Market Value shall be determined as of the next preceding date on which trading of the Common Stock does occur. In the event

that the Common Stock is not registered under Section 12(b) or (g) of the Exchange Act, Fair Market Value shall mean, with respect to

a share of the Company’s Common Stock for any purpose on a particular date, the value determined by the Administrator in good faith;

provided that for purpose of any Option or any Award that is deferred compensation subject to Code Section 409A, such value shall be

determined reasonably in a manner that satisfies Code Section 409A.

2.10

“Grant Agreement” shall mean a written document memorializing the terms and conditions of an Award granted pursuant

to the Plan and shall incorporate the terms of the Plan.

2.11

“Incentive Stock Option” shall mean an Option that is an “incentive stock option” within the meaning of

Code Section 422, or any successor provision, and that is designated by the Administrator as an Incentive Stock Option.

2.12

“Nonqualified Stock Option” means an Option other than an Incentive Stock Option.

2.13

“Option” means the right to purchase a stated number of shares of Common Stock at a stated price for a stated period

of time, granted pursuant to Section 7.

2.14

“Parent” shall mean a corporation, whether now or hereafter existing, within the meaning of the definition of “parent

corporation” provided in Code Section 424(e), or any successor thereto.

2.15

“Participant” shall mean an employee, officer, director or consultant of the Company, or of any Affiliate of the Company

to whom an Award is granted pursuant to the Plan, or upon the death of the Participant, his or her successors, heirs, executors, and

administrators, as the case may be.

2.16

“Performance Awards” shall mean an Award of a number of shares or units granted to a Participant pursuant to Section

11 that is paid out based on the achievement of stated performance criteria or Performance Goals during a stated period of time.

2.17

“Performance Goals” shall mean the objectives established by the Administrator in its sole discretion with respect

to any performance-based Awards that relate to one or more business criteria within the meaning of Code Section 162(m). Performance Goals

may include or be based upon, without limitation: sales; gross revenue; gross margins; internal rate of return; cost; ratio of debt to

debt plus equity; profit before tax; earnings before interest and taxes; earnings before interest, taxes, depreciation, and amortization;

earnings per share; operating earnings; economic value added; ratio of operating earnings to capital spending; cash flow; free cash flow;

net operating profit; net income; net earnings; net sales or net sales growth; price of Common Stock; return on capital, net assets,

equity, or shareholders’ equity; segment income; market share; productivity ratios; expense targets; working capital targets; or

total return to shareholders. Performance Goals may (a) be used to measure the performance of the Company as a whole or any Subsidiary,

business unit or segment of the Company, (b) include or exclude (or be adjusted to include or exclude) extraordinary items, the impact

of charges for restructurings, discontinued operations and other unusual and non-recurring items, and the cumulative effects of tax or

accounting changes, each as defined by generally accepted accounting principles and as identified in the financial statements, notes

to the financial statements, management’s discussion and analysis or other Securities and Exchange Commission filings, and/or (c)

reflect absolute entity performance or a relative comparison of entity performance to the performance of a peer group, index, or other

external measure, in each case as determined by the Administrator in its sole discretion.

2.18

“Restricted Stock Units” shall mean an Award granted to a Participant pursuant to Section 10, denominated in units,

providing a Participant the right to receive payment at a future date after the lapse of restrictions or achievement of performance criteria

or Performance Goals or other conditions determined by the Administrator.

2.19

“Stock Appreciation Right” or “SAR” shall mean the right to receive an amount calculated as provided in

a grant pursuant to Section 8.

2.20

“Stock Award” shall mean an Award of restricted or unrestricted Common Stock granted to a Participant pursuant to

Section 9 and the other provisions of the Plan.

2.21

“Subsidiary” and “subsidiaries” shall mean only a corporation or corporations, whether now or hereafter

existing, within the meaning of the definition of “subsidiary corporation” provided in Code Section 424(f), or any successor

thereto.

2.22

“Ten Percent Owner” means a person who owns or is deemed within the meaning of Section 422(b)(6) of the Code to own,

stock possessing more than 10% of the total combined voting power of all classes of stock of the Company (or any Parent or Subsidiary

of the Company). Whether a person is a Ten Percent Owner shall be determined with respect to an Option based on the facts existing immediately

prior to the grant date of the Option.

3.

Administration

3.1

Administration of the Plan. The Plan shall be administered by the Board or the Administrator.

3.2

Powers of the Administrator. The Administrator shall have all the powers vested in it by the terms of the Plan, such powers to

include authority, in its sole and absolute discretion, to grant Awards under the Plan, prescribe Grant Agreements evidencing such Awards

and establish programs for granting Awards.

The

Administrator shall have full power and authority to take all other actions necessary to carry out the purpose and intent of the Plan,

including, but not limited to, the authority to: (i) determine the eligible persons to whom, and the time or times at which Awards shall

be granted; (ii) determine the types of Awards to be granted; (iii) determine the number of shares to be covered by or used for reference

purposes for each Award; (iv) impose such terms, limitations, restrictions and conditions upon any such Award as the Administrator shall

deem appropriate; (v) modify, amend, extend or renew outstanding Awards, or accept the surrender of outstanding Awards and substitute

new Awards (provided however, that, except as provided in Section 14.4 of the Plan, any modification that would materially adversely

affect any outstanding Award shall not be made without the consent of the holder); (vi) accelerate or otherwise change the time in which

an Award may be exercised or becomes payable and to waive or accelerate the lapse, in whole or in part, of any restriction or condition

with respect to such Award, including, but not limited to, any restriction or condition with respect to the vesting or exercisability

of an Award following termination of any grantee’s employment or other relationship with the Company (vii) establish objectives

and conditions, including Performance Goals, if any, for earning Awards and determining whether Awards will be paid after the end of

a performance period, (viii) make adjustments in the Performance Goals in recognition of unusual or nonrecurring events affecting the

Company or the financial statements of the Company, or in response to changes in applicable laws, regulations, or accounting principles,

and (ix) provide for forfeiture of outstanding Awards and recapture of realized gains and other realized value in such events as determined

by the Administrator, which include, but are not limited to, a breach of restrictive covenants or an intentional or negligent misstatement

of financial records.

The

Administrator shall have full power and authority, in its sole and absolute discretion, to administer and interpret the Plan and to adopt

and interpret such rules, regulations, agreements, guidelines and instruments for the administration of the Plan and for the conduct

of its business as the Administrator deems necessary or advisable.

3.3

Non-Uniform Determinations. The Administrator’s determinations under the Plan (including without limitation, determinations

of the persons to receive Awards, the form, amount and timing of such Awards, the terms and provisions of such Awards and the Grant Agreements

evidencing such Awards) need not be uniform and may be made by the Administrator selectively among persons who receive, or are eligible

to receive, Awards under the Plan, whether or not such persons are similarly situated.

3.4

Limited Liability. To the maximum extent permitted by law, no member of the Administrator shall be liable for any action taken

or decision made in good faith relating to the Plan or any Award thereunder.

3.5

Indemnification. To the maximum extent permitted by law and by the Company’s charter and by-laws, the members of the Administrator

shall be indemnified by the Company in respect of all their activities under the Plan.

3.6

Effect of Administrator’s Decision. All actions taken and decisions and determinations made by the Administrator on all

matters relating to the Plan pursuant to the powers vested in it hereunder shall be in the Administrator’s sole and absolute discretion

and shall be conclusive and binding on all parties concerned, including the Company, its stockholders, any Participants in the Plan and

any other employee, consultant, or director of the Company, and their respective successors in interest.

4.

Shares Available for the Plan

4.1

Shares Available for Awards. Subject to adjustments as provided in Section 14.4 of the Plan, the shares of Common Stock that may

be issued with respect to Awards granted under the Plan shall not exceed an aggregate of 7,000,000 shares of Common Stock. The Company

shall reserve such number of shares for Awards under the Plan, subject to adjustments as provided in Section 14.4 of the Plan. The maximum

number of shares of Common Stock under the Plan that may be issued as Incentive Stock Options shall be 7,000,000 shares. Shares may be

authorized but unissued Common Stock or authorized and issued Common Stock held in the Company’s treasury. If any Award, or portion

of an Award, under the Plan expires or terminates unexercised, becomes unexercisable or is forfeited or otherwise terminated, surrendered

or canceled as to any shares, or if any shares of Common Stock are surrendered to the Company in connection with any Award (whether or

not such surrendered shares were acquired pursuant to any Award), the shares subject to such Award and the surrendered shares shall thereafter

be available for further Awards under the Plan; provided, however, that any such shares that are surrendered to the Company in connection

with any Award or that are otherwise forfeited after issuance shall not be available for purchase pursuant to Incentive Stock Options.

Shares under substitute awards pursuant to Section 14.4 for grants made under a plan of an acquired business entity shall not reduce

the maximum number of shares that may be issued under the Plan.

4.2

Performance-Based Award Limitation. Awards that are designed to comply with the performance-based exception from the tax deductibility

limitation of Code Section 162(m) shall be subject to the following rules:

(a)

The number of shares of Common Stock that may be granted in the form of Options in a single fiscal year to a Participant may not exceed

2,000,000, as adjusted pursuant to Section 14.4.

(b)

The number of shares of Common Stock that may be granted in the form of SARs in a single fiscal year to a Participant may not exceed

2,000,000, as adjusted pursuant to Section 14.4.

(c)

The number of shares of Common Stock that may be granted in the form of restricted Stock Awards in a single fiscal year to a Participant

may not exceed 2,000,000, as adjusted pursuant to Section 14.4.

(d)

The number of Restricted Stock Units that may be granted in a single fiscal year to a Participant may not exceed 2,000,000, as adjusted

pursuant to Section 14.4.

(e)

The number of shares of Common Stock that may be granted as Performance Award shares in a single fiscal year to a Participant may not

exceed 2,000,000 as adjusted pursuant to Section 14.4.

(f)

The maximum amount that may be paid to a Participant for Performance Award units granted in a single fiscal year to the Participant may

not exceed $1,000,000.

5.

Participation

Participation

in the Plan shall be open to all employees, officers, directors, and consultants of the Company, or of any Affiliate of the Company,

as may be selected by the Administrator from time to time. However, only employees of the Company, and of any Parent or Subsidiary of

the Company, shall be eligible for the grant of an Incentive Stock Option. The grant of an Award at any time to any person shall not

entitle that person to a grant of an Award at any future time.

6.

Awards

Awards

that may be granted under the Plan consist of Options, Stock Appreciation Rights, Stock Awards, Restricted Stock Units, Performance Awards

and other stock-based awards. The Administrator, in its sole discretion, establishes the terms of all Awards granted under the Plan.

Awards may be granted individually or in tandem with other types of Awards. All Awards are subject to the terms and conditions provided

in the Grant Agreement. If there is any inconsistency between the terms of the Plan and a Grant Agreement, the terms of the Plan shall

control unless the Grant Agreement explicitly states that an exception to the Plan is being made. By accepting an Award, a Participant

agrees that the Award shall be subject to all of the terms and provisions of the Plan and the applicable Grant Agreement.

7.

Stock Options

7.1

Terms and Grant Agreement. Subject to the terms of the Plan, Options may be granted to Participants at any time as determined

by the Administrator. The Administrator shall determine, and the Grant Agreement shall reflect, the following for each Option granted:

(a)

the number of shares subject to each Option;

(b)

duration of the Option (provided that no Option shall have an expiration date later than the the 10th anniversary of the date of grant

and no Incentive Stock Option that is granted to any Participant who is a Ten Percent Owner shall have an expiration date later than

the fifth anniversary of the date of grant);

(c)

vesting requirements that specify a vesting period;

(d)

whether the Option is an Incentive Stock Option or a Nonqualified Stock Option; provided, however, no Option shall be an Incentive Stock

Option unless so designated by the Administrator at the time of grant or in the Grant Agreement evidencing such Option;

(e)

the exercise price for each Option, which, except with respect to substitute awards complying with Code Section 424 and regulations thereunder,

shall not be less than the Fair Market Value on the date of the grant (with respect to Incentive Stock Options, 110% of the Fair Market

Value on the date of grant for any Participant who is a Ten Percent Owner);

(f)

the permissible method(s) of payment of the exercise price;

(g)

the rights of the Participant upon termination of employment or service as a director; and

(h)

any other terms or conditions established by the Administrator.

7.2

Exercise of Options. Options shall be exercisable at such times and subject to such restrictions and conditions as the Administrator,

in its sole discretion, deems appropriate, which need not be the same for all Participants.

An

Option shall be exercised by delivering written notice as specified in the Grant Agreement on the form of notice provided by the Company.

Options may be exercised in whole or in part. The exercise price of any Option shall be payable to the Company in full, in cash or in

cash equivalent approved by the Adminstrator, by tendering (if permitted by the Adminstrator) previously acquired Common having an aggregate

Fair Market Value at the time of exercise equal to the total Option exercise price (provided that the tendered Common Stock must have

been held by the Participant for any period required by the Adminstrator), or by any other means that the Adminstrator determines to

be consistent with the Plan’s purpose and applicable law. For a Participant who is subject to Section 16 of the Exchange Act, the

Company may require that the method of payment comply with Section 16 and the rules and regulations thereunder. Any payment in shares

of Common Stock, if permitted, shall be made by delivering the shares to the secretary of the Company, duly endorsed in blank or accompanied

by stock powers duly executed in blank, together with any other documents and evidence as the secretary shall require (or delivering

a certification or attestation of ownership of such Common Stock, if permitted by the Adminstrator).

Certificates

for shares of Common Stock purchased upon the exercise of an Option shall be issued in the name of or for the account of the Participant

or other person entitled to receive the shares and delivered to the Participant or other person as soon as practicable following the

effective date on which the Option is exercised.

7.3

Incentive Stock Options. Notwithstanding anything in the Plan to the contrary, no term of the Plan relating to Incentive Stock

Options shall be interpreted, amended, or altered, nor shall any discretion or authority granted under the Plan be exercised so as to

disqualify the Plan under Code Section 422, or, without the consent of any affected Participant, to cause any Incentive Stock Option

previously granted to fail to qualify for the federal income tax treatment afforded under Code Section 421. An Option shall be considered

to be an Incentive Stock Option only to the extent that the number of shares of Common Stock for which the Option first becomes exercisable

in a calendar year do not have an aggregate Fair Market Value (as of the date of the grant of the Option) in excess of the “current

limit.” The current limit for any optionee for any calendar year shall be $100,000 minus the aggregate Fair Market Value at the

date of grant of the number of shares of Common Stock available for purchase for the first time in the same year under each other incentive

option previously granted to the optionee under all other plans of the Company and Affiliates. Any Common Stock which would cause the

foregoing limit to be violated shall be deemed to have been granted under a separate Nonqualified Stock Option, otherwise identical in

its terms to those of the Incentive Stock Option. The current limit will be calculated according to the chronological order in which

the Options were granted.

7.4

Reduction in Price or Reissuance. In no event shall the Administrator cancel any outstanding Option for the purpose of (i) providing

a replacement award under this or another Company plan, or (ii) cashing out an Option, unless such cash-out occurs in conjunction with

a Change in Control. Additionally, in no event shall the Administrator, without first receiving shareholder approval, (a) cancel any

outstanding Option for the purpose of reissuing the Option to the Participant at a lower exercise price or (b) reduce the exercise price

of a previously issued Option.

7.5

Notification of Disqualifying Disposition. If any Participant shall make any disposition of shares issued pursuant to the exercise

of an Incentive Stock Option under the circumstances described in Code Section 421(b) (relating to certain disqualifying dispositions),

such Participant shall notify the Company of such disposition within ten (10) calendar days thereof.

8.

Stock Appreciation Rights

8.1

Terms and Agreement. Subject to the terms of the Plan, Stock Appreciation Rights may be granted to Participants at any time as

determined by the Administrator. The grant price of the SAR shall be at least equal to one hundred percent (100%) of the Fair Market

Value of Stock as determined on the date of the grant, except with respect to substitute awards complying with Code Section 424 and regulations

thereunder. The Administrator shall determine, and the Grant Agreement shall reflect, the following for each SAR granted:

(a)

the number of shares subject to each SAR;

(b)

whether the SAR is a Related SAR or a Freestanding SAR (as defined below);

(c)

the duration of the SAR (provided however, that no SAR shall have an expiration date later than the date after the 10th anniversary

of the date of grant);

(d)

vesting requirements;

(e)

rights of the Participant upon termination of employment or service as a director; and

(f)

any other terms or conditions established by the Administrator.

8.2

Related and Freestanding SARs. A Stock Appreciation Right may be granted in connection with an Option, either at the time of grant

or at any time thereafter during the term of the Option (a “Related SAR”) or may be granted unrelated to an Option (a “Freestanding

SAR”).

8.3

Surrender of Option. A Related SAR shall require the holder, upon exercise, to surrender the Option with respect to the number

of shares as to which the SAR is exercised, in order to receive payment. The Option will, to the extent surrendered, cease to be exercisable.

8.4

Reduction in Number of Shares Subject to Related SARs. For Related SARs, the number of shares subject to the SAR shall not exceed

the number of shares subject to the Option. For example, if the SAR covers the same number of shares as the Option, the exercise of a

portion of the Option shall reduce the number of shares subject to the SAR to the number of shares remaining under the Option. If the

Related SAR covers fewer shares than the Option, the exercise of a portion of the Option shall reduce the number of shares subject to

the SAR to the extent necessary so that the number of remaining shares subject to the SAR is not more than the remaining shares under

the Option.

8.5

Exercisability. Subject to Section 8.7 and to any rules and restrictions imposed by the Administrator, a Related SAR will be exercisable

at the time or times, and only to the extent, that the Option is exercisable and will not be transferable except to the extent that the

Option is transferable. A Freestanding SAR will be exercisable as determined by the Administrator but in no event after 10 years from

the date of grant.

8.6

Payment. Upon the exercise of a Stock Appreciation Right, the holder will be entitled to receive payment of an amount determined

by multiplying:

(a)

The excess of the Fair Market Value on the date of exercise over the Fair Market Value on the date of grant, by

(b)

The number of shares with respect to which the SAR is being exercised.

The

Administrator may limit the amount payable upon exercise of a Stock Appreciation Right. Any limitation must be determined as of the date

of grant and noted on the Grant Agreement evidencing the grant.

Payment

may be made in cash, Common Stock, or a combination of cash and Common Stock, in the Administrator’s sole discretion. No fractional

shares shall be used for such payment and the Administrator shall determine whether cash shall be given in lieu of such fractional shares

or whether such fractional shares shall be eliminated.

8.7

Reduction in Price or Reissuance. In no event shall the Administrator cancel any outstanding Stock Appreciation Right for the

purpose of (i) providing a replacement award under this or another Company plan, or (ii) cashing out a Stock Appreciation Right, unless

such cash-out occurs in conjunction with a change in control. Additionally, in no event shall the Administrator, without first receiving

shareholder approval, (a) cancel any outstanding Stock Appreciation Right for the purpose of reissuing the Stock Appreciation Right to

the Participant at a lower exercise price or (b) reduce the exercise price of a previously issued Stock Appreciation Right.

8.8

Additional Terms. The Administrator may impose additional conditions or limitations on the exercise of a Stock Appreciation Right

as it may deem necessary or desirable to secure for holders the benefits of Rule 16b-3, or any successor provision, or as it may otherwise

deem advisable.

9.

Stock Awards

9.1

Terms and Agreement. Subject to the terms of the Plan, shares of restricted or unrestricted Common Stock may be granted to Participants

at any time as determined by the Administrator. The Administrator shall determine, and the Grant Agreement shall reflect, the following

for the Stock Awards granted:

(a)

the number of shares of granted;

(b)

the purchase price, if any, to be paid by the Participant for each share of Common Stock;

(c)

the restriction period established, if any;

(d)

any requirements with respect to elections under Code Section 83(b);

(e)

rights of the Participant upon termination of employment or service as a director; and

(f)

any other terms or conditions established by the Administrator.

9.2

Restriction Period. At the time of the grant of the Stock Award, the Administrator may establish a restriction period for the

shares granted, which may be time-based, based on the achievement of specified Performance Goals, a combination of time- and Performance

Goal-based, or based on any other criteria the Administrator deems appropriate. The Administrator may divide the shares into classes

and assign a different restriction period for each class. The Administrator may impose additional conditions or restrictions upon the

vesting of the Stock Award as it deems fit in its sole discretion. If all applicable conditions are satisfied, then upon the termination

of the restriction period with respect to a share of restricted Common Stock, the share shall vest and the restrictions shall lapse.

To the extent required to ensure that a Performance Goal-based Award of the Stock Award to an executive officer is deductible by the

Company pursuant to Code Section 162(m), any such Award shall vest only upon the Administrator’s determination that the Performance

Goals applicable to the Award have been attained.

9.3

Restrictions on Transfer Prior to Vesting. Prior to the vesting of a restricted Stock Award, the Participant may not sell, assign,

pledge, hypothecate, transfer, or otherwise encumber the Stock Award. Upon any attempt to transfer rights in a share of restricted Common

Stock, the share and all related rights shall immediately be forfeited by the Participant. Upon the vesting of a restricted Stock Award,

the transfer restrictions of this section shall lapse with respect to that share.

9.4

Rights as a Shareholder. Except for the restrictions set forth here and unless otherwise determined by the Administrator, the

Participant shall have all the rights of a shareholder with respect to shares of a Stock Award, including but not limited to the right

to vote and the right to receive dividends, provided that the Administrator, in its sole discretion, may require that any dividends paid

on shares of a restricted Stock Award be held in escrow until all restrictions on the shares have lapsed.

9.5

Section 83(b) Election. The Administrator may provide in the Grant Agreement that the Award is conditioned upon the Participant

making or not making an election under Code Section 83(b). If the Participant makes an election pursuant to Code Section 83(b), the Participant

shall be required to file a copy of the election with the Company within ten (10) calendar days.

10.

Restricted Stock Units

10.1

Terms and Agreement. Subject to the terms of the Plan, Restricted Stock Units may be granted to Participants at any time as determined

by the Administrator. The Administrator shall determine, and the Grant Agreement shall reflect, the following for the Restricted Stock

Units granted:

(a)

the number of Restricted Stock Units awarded;

(b)

the purchase price, if any, to be paid by the Participant for each Restricted Stock Unit;

(c)

the restriction period established, if any;

(d)

whether dividend equivalents will be credited with respect to Restricted Stock Units, and, if so, any accrual, forfeiture or payout restrictions

on the dividend equivalents;

(e)

rights of the Participant upon termination of employment or service as a director; and

(f)

any other terms or conditions established by the Administrator.

To

the extent a Restricted Stock Unit Award constitutes “deferred compensation” within the meaning of Code Section 409A, the

Administrator shall establish Grant Agreement terms and provisions that comply with Code Section 409A and regulations thereunder.

10.2

Restriction Period. At the time of the grant of Restricted Stock Units, the Administrator may establish a restriction period,

which may be time-based, based on the achievement of specified Performance Goals, a combination of time- and Performance Goal-based,

or based on any other criteria the Administrator deems appropriate. The Administrator may divide the awarded Restricted Stock Units into

classes and assign a different restriction period for each class. The Administrator may impose any additional conditions or restrictions

upon the vesting of the Restricted Stock Units as it deems fit in its sole discretion. If all applicable conditions are satisfied, then

upon the termination of the restriction period with respect to a Restricted Stock Unit, the Unit shall vest. To the extent required to

ensure that a Performance Goal-based Award of Restricted Stock Units to an executive officer is deductible by the Company pursuant to

Code Section 162(m), any such Award shall become vested only upon the Administrator’s determination that the Performance Goals

applicable to the Award, if any, have been attained.

10.3

Payment. Upon vesting of a Restricted Stock Unit, the Participant shall be entitled to receive payment of an amount equal to the

Fair Market Value of one share of Stock. Payment may be made in cash, Stock, or a combination of cash and Stock, in the Administrator’s

sole discretion.

11.

Performance Awards

11.1

Terms and Agreement. Subject to the terms of the Plan, Performance Awards may be granted to Participants at any time as determined

by the Administrator. The Administrator shall determine, and the Grant Agreement shall reflect, the following for the Performance Awards

granted: