Energizer Resources Well-Positioned To Be Major Supplier of a Critical Material In Short Supply

18 August 2014 - 9:58PM

InvestorsHub NewsWire

TORONTO, ONTARIO, Aug. 18, 2014 (UPTICK Newswire) -- UPTICK Newswire discovers a

world-class graphite project in Energizer Resources, Inc.

(OTCQX:ENZR, TSX:EGZ), a mine development and mineral

exploration company based in Toronto, Canada, that is rapidly

developing its flagship Molo Flake Graphite Project in southern

Madagascar to mine production.

There are currently over 200 daily applications that depend upon

flake graphite. Incremental demand will be created by a number of

green initiatives, including lithium ion batteries, fuel cells,

solar energy, semi-conductors, and nuclear energy. Industry

analysts say many of these applications have the potential to

consume more graphite than all current uses combined. In fact, the

average electric car uses approximately 100 pounds of flake

graphite per vehicle.

Flake graphite is the most coveted form of graphite because it can

be used in any application and commands the most premium price.

China, who produces over 75% of the world's graphite, is in urgent

supply of flake graphite for their own domestic markets and this

has created supply concerns for the rest of the world. With limited

exploration and potential development projects on the horizon,

Energizer Resources and its Molo project are well positioned to

supply both traditional and rapidly growing high-tech and

clean-tech markets with the high quality and high purity,

large-flake graphite that is in strong demand.

The Molo project is monstrous in size, ranked as one of the largest

flaked graphite deposits globally, and possesses almost unlimited

expansion capability. The Molo deposit comes with the assurance of

the highest mining standard issued from the Canadian government:

NI43-101. In fact, Energizer Resources released an economically

robust Preliminary Economic Assessment Study of the Molo site in

February 2013, verifying to the market it has the potential to be a

profitable and low cost producer. Based on this Study, Energizer

has now initiated a Full Feasibility Study - the last stage

required to qualify the project for mine financing by chartered

banks. The feasibility study is on track to be completed and

released to the market by the fourth quarter of 2014. Energizer

also completed a pilot plant, sending multiple-ton samples of

finished graphite concentrate for the purposes of evaluation to

leading steel, lithium-ion battery and consumer electronics

companies who repre sent the world's largest buyers of

graphite.

All results to date by the evaluating companies have been extremely

positive, confirming through 3rd-party validation that Energizer's

graphite is of superior quality and meets all the criteria for the

largest demand markets for graphite both today and in the future.

As a result, Energizer now has a senior management team stationed

in Asia to continue advanced meetings with several of these

world-leading companies regarding off-take and strategic alliances

in order to ensure a seamless process to market - with the bonus of

their Project being relatively close to these key Asian customers:

Japan, China, Korea and India.

Energizer Resources'current intuitional investors are impressive.

JP Morgan, along with two of Canada's largest investment banks,

Dundee Resources and Power Corporation's Investors Group, are its

largest shareholders. Energizer has also partnered up with Africa's

leading mine engineering and construction firm, DRA Global, who

have already been contracted to build and operate the mine,

providing Energizer with a de-risked and turn-key solution for mine

operation.

To the general public, both graphite's surging demand and

Energizer's Molo Graphite Project remain largely unrecognized. Many

know that graphite is in pencils, and as widely recognized as this

particular application may be, today it accounts for a small

fraction of the worldwide graphite demand. It is the steel industry

that accounts for over 50% of worldwide graphite demand, and this

well-established industrial demand for graphite has been growing at

approximately 5% throughout the current decade due to ongoing

industrialization in China, India, and other emerging markets.

Based on the steel market alone, annual graphite demand is expected

to increase from 1.1 million metric tons to 1.5 million metric tons

by the year 2020, which reflects a growth potential of almost 50%.

But what has been causing industry analysts lately to call graphite

"black gold" is its use in batteries. Now the second largest demand

driver for graphite at approximately 26%, lithium-ion batterie s

are poised to overtake the steel industry in the next 5 years as

the top consumption market for flake graphite. Why? The answer is

electric vehicles (EVs).

Few outside of the industry are aware of this fact; that a

lithium-ion battery contains about 11 times more graphite than it

does lithium. And it is this fact that has global buyers of

graphite in a panic, and current producers of graphite in a frenzy

when it comes to the potential demand for graphite from EVs.

Every Tesla Model S has about 100 lbs of flake graphite in its

battery. Tesla Motor Company's intent to produce the world's total

lithium-ion production in one plant in the USA came closer to

reality last month when it partnered with Panasonic to fund its

"Gigafactory". At capacity, it would consume the entire amount of

flake graphite used in the world today for batteries. This demand

would requiresix brand new graphite mines to be brought

online. And that's just for Tesla alone.

Energizer Resources' management team has consistently completed key

project milestones as it progresses its Molo Project to mine

development and is uniquely positioned to capitalize on both the

current demand and future potential of graphite. While the Molo is

one of the largest graphite deposits on the planet, it sits in less

than 1 of over 200 miles of continuous graphite mineralization

confirmed on Energizer's property in Madagascar. Energizers' Molo

deposit has the size and economics to make it a significant barrier

to entry in the graphite space, while being one of the most

undervalued companies in the industry.

The stars are aligning for Energizer to supply one of the most

innovative materials of our time - applicable in everything from

EVs to energy storage to safe nuclear applications. The Molo

Graphite Project represents one vital source of supply of a

critical material and an undeniable opportunity for investors.

Energizer Resources trades on the OTCQX under the symbol "ENZR"

and on the Toronto Stock Exchange (TSX) under the symbol "EGZ".

About Energizer Resources

Energizer Resources is an American-domiciled mineral exploration

and mine development company based in Toronto, Canada, that is

developing its 100%-owned, flagship Molo Graphite Project in

southern Madagascar.

The Molo Graphite Project is one of the largest known crystalline

flake graphite deposits in the world. The Molo Project hosts a NI

43-101 compliant indicated mineral resource of 84.04 million metric

tons grading 6.36%C and an inferred resource grading 6.29% C of

crystalline flake graphite.

Energizer has initiated a Full Feasibility Study, with results to

be released to the market by Q4 2014. Results of the Company's

recently completed pilot plant operation confirmed that 43.5% of

the Molo deposit is classified as the premium-priced large and

extra-large flake, with an average purity level in excess of 97%C

achieved through standard flotation alone. The Company is targeting

production in Q2/Q3 of 2016.

Safe Harbor: This release may contain forward-looking statements

that may involve a number of risks and uncertainties. Actual

events or results could differ materially from expectations and

projections set out herein.

The National Instrument 43-101 ("NI 43-101") compliant technical

report, titled "Molo Graphite Project Fotadrevo Province of

Toliara, Madagascar Preliminary Economic Assessment Technical

Report Update and dated April 12, 2013, was prepared

by DRA Mineral Projects Pty Ltd and authored by John

Hancox, Pri.Sc.Nat, Desmond Subramani, Pri.Sc.Nat, Dave Thompson

and Glenn Bezuidenhout, all Qualified Persons as defined by NI

43-101, and independent of Energizer Resources for the purposes of

NI 43-101 requirements. The Technical Report is available on SEDAR

at www.sedar.com and on the Company's website

at www.energizerresources.com

The above resource estimates, or mention thereof, were

calculated in accordance with NI 43-101 as required by Canadian

securities regulatory authorities. For United States reporting

purposes, Industry Guide 7 (under the Securities Exchange Act of

1934), as interpreted by the Staff of the SEC, applies different

standards in order to classify mineralization as a reserve. Among

other things, the terms "measured", "indicated" and "inferred"

mineral resources are required pursuant to National Instrument

43-101, the U.S. Securities and Exchange Commission does not

recognize such terms. Canadian standards differ significantly from

the requirements of the U.S. Securities and Exchange Commission,

and mineral resource information contained herein is not comparable

to similar information regarding mineral reserves disclosed in

accordance with the requirements of the U.S. Securities and

Exchange Commission.

Mineral resources are not mineral reserves and do not have

demonstrated economic viability. The mineral resource estimates in

this press release include inferred resources that are normally

considered too speculative geologically to have economic

considerations applied to them that would enable them to be

categorized as mineral reserves. There is also no certainty that

the inferred mineral resource will be converted to the measured and

indicated mineral resource categories through further drilling, or

into a mineral reserve once economic considerations are

applied.U.S. investors should understand that "inferred" mineral

resources have a great amount of uncertainty as to their existence

and great uncertainty as to their economic and legal feasibility.

In addition, investors are cautioned not to assume that any part or

all of the Company's mineral resources constitute or will be

converted into reserves. Cautionary Statement: Neither TSX

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Exchange) accepts responsibility

for the adequacy or accuracy of this release.

CONTACT:

Brent Nykoliation

Senior Vice President

Corporate Development

+1.416.364.4911

bnykoliation@energizerresources.com

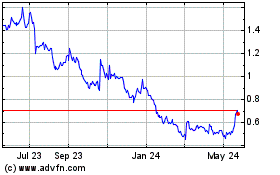

Nextsource Materials (QB) (USOTC:NSRCF)

Historical Stock Chart

From Jan 2025 to Feb 2025

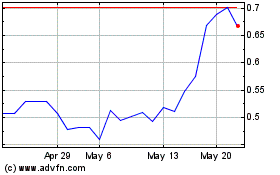

Nextsource Materials (QB) (USOTC:NSRCF)

Historical Stock Chart

From Feb 2024 to Feb 2025