UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

December 21, 2023

Date of report (Date of earliest event reported)

NUVERA COMMUNICATIONS, INC.

(Exact name of registrant as specified in its charter)

| Minnesota | 0-3024 | 41-0440990 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

27 North Minnesota Street

New Ulm, MN 56073

(Address of principal executive offices, including zip code)

(507) 354-4111

(Registrant's telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: None

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§230.12b-2 of this chapter).

Emerging growth company Yes £

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

1

Item 1.01. Entry Into a Material Definitive Agreement.

On December 21, 2023, Nuvera Communications, Inc. (“Nuvera” or the “Company”), the Guarantors (as defined below), CoBank, ACB (“CoBank”), in its capacities (i) as administrative agent under the Credit Agreement dated July 15, 2022, as amended, (“Amended Credit Agreement”), (ii) as the Swing Line Lender, (iii) as the sole Issuing Lender, and (iv) as a Lender, and each other Lender and Voting Participant party to the Amended Credit Agreement entered into the Third Amendment to Amended Credit Agreement (“Third Amendment”).

Under the Third Amendment, the Revolving Commitment under the Amended Credit Agreement was increased from $30.0 million to $40.0 million and the Company’s operating subsidiaries listed below agreed to extend their previous guarantees, security interests and mortgages to cover the increased amount of the Revolving Commitment. The foregoing description of the Third Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Third Amendment, which is attached to this report as Exhibit 10.1 and incorporated by reference into this Item 1.01.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above in Item 1.01 of this Current Form on Form 8-K is incorporated by reference into this Item 2.03.

Item 5.03. Amendment to Articles of Incorporation or Bylaws; Changes in Fiscal Year

On December 21, 2023, the Board of Directors of Nuvera amended Section 2.5 of the Company’s Bylaws to set 60 days as the maximum time between record date and meeting date for regular and special meetings of shareholders. This corresponds to the maximum allowable time allowed under Minnesota law. A copy of the Nuvera Bylaws as amended effective December 21, 2023 is filed as Exhibit 3.2 to this Form 8-K.

Item 7.01. Regulation FD Disclosure

As previously disclosed, the Company will continue to evaluate costs and spending across its organization. The Company may, in the future, seek additional financing to continue to fund its fiber expansion plans and meet current and future liquidity needs.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| Exhibit No. | Description |

| 10.1 | Third Amendment dated December 21, 2023, by and among Nuvera Communications, Inc., Nuvera subsidiaries as Guarantors, CoBank ACB in its capacity as administrative agent, as Swing Line Lender, as sole Issuing Lender and as a Lender, and each other Lender and Voting Participant party to the Amended Credit Agreement. |

| | |

| 3.2 | Nuvera Communications, Inc. Bylaws as amended December 21, 2023 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: December 21, 2023 | Nuvera Communications, Inc. |

| | |

| | By: | /s/Curtis Kawlewski |

| | | Curtis Kawlewski |

| | Its: | Chief Financial Officer |

3

false

--12-31

0000071557

0000071557

2023-12-21

2023-12-21

EXHIBIT 3.2

BYLAWS

OF

NUVERA COMMUNICATIONS, INC.

(As Amended December 21, 2023)

ARTICLE 1.

OFFICES

1.1) Offices. The address of the registered office of the corporation shall be designated in the Articles of Incorporation, as amended from time to time. The principal executive office of the corporation is currently located at 27 North Minnesota Street, New Ulm, Minnesota, 56073, and the corporation may have offices at such other places within or without the State of Minnesota as the Board of Directors shall from time to time determine or the business of the corporation requires.

ARTICLE 2.

MEETINGS OF SHAREHOLDERS

2.1) Annual Meeting. The annual meeting of the shareholders of this corporation shall be held each year on such date, time, and place as is determined by the Board of Directors. At the annual meeting, the shareholders, voting as provided in the Articles of Incorporation and these Bylaws, shall elect qualified successors for directors whose terms have expired or are due to expire within six (6) months after the date of the meeting, and shall transact such other business as shall come before the meeting.

2.2) Special Meetings. Special meetings of the shareholders entitled to vote may be called at any time by a majority of the directors, or shareholders holding fifty percent (50%) or more of the voting power of all shares entitled to vote who shall demand such special meeting by giving written notice of demand to the chief executive officer specifying the purposes of the meeting.

2.3) Meetings Held Upon Shareholder Demand. Within thirty (30) days after receipt by the chief executive officer of a demand from shareholders entitled to call a special meeting of shareholders, the Board of Directors shall cause such meeting to be called and held on notice no later than ninety (90) days after receipt of such demand. If the Board of Directors fails to cause such a meeting to be called and held, the shareholders making the demand may call the meeting by giving notice as provided in Section 2.5 hereof at the expense of the corporation.

2.4) Place of Meetings. Meetings of the shareholders will be held in the City of New Ulm, State of Minnesota, or at such other place as is designated by the Board of Directors, except that a special meeting called by or at the demand of the shareholders will be held in the county where the principal executive office of the corporation is located.

The Board of Directors may determine that shareholders not physically present in person or by proxy at a shareholder meeting may, by means of remote communication, participate in a regular or special shareholder meeting held at a designated place. The Board of Directors also may determine that a regular or special meeting of the shareholders will not be held at a physical place, but instead solely by means of remote communication, so long as the corporation implements reasonable measures to provide that each shareholder participating by means of remote communication has a reasonable opportunity to participate in the meeting in accordance with the provisions of Section 302A.436, subdivision 5, of the Minnesota Business Corporation Act (the “MBCA”) as amended from time to time), or any successor statute. Participation by means of remote communication constitutes presence at the meeting.

1

2.5) Notice of Meetings.

(a) Written Notice. Except as otherwise specified in Section 2.6 or required by law, a written notice setting out the place, date and hour of the annual or special meeting shall be given to each holder of shares entitled to vote not less than ten (10) days nor more than sixty (60) days prior to the date of the meeting. Notice of any special meeting shall state the purpose or purposes of the proposed meeting, and the business transacted at all special meetings shall be confined to the purposes stated in the notice. The Board of Directors may fix in advance a date not exceeding sixty (60) days preceding the date of any meeting of shareholders as a record date for the determination of the shareholders entitled to notice of and to vote at such meeting.

(b) Electronic Notice. Notwithstanding the written notice requirement in Subsection 2.5 (a) above, notice of meeting may be given to a shareholder by means of electronic communication if the requirements of MBCA Section 302A.436, subdivision 5, as amended from time to time, are met. Notice to a shareholder is also effectively given if the notice is addressed to the shareholder or a group of shareholders in a manner permitted by the rules and regulations under the Securities Exchange Act of 1934, as amended, so long as the corporation has first received the written or implied consent required by those rules and regulations.

2.6) Waiver of Notice. Notice of any regular or special meeting may be waived by any shareholder either before, at or after such meeting and may be given in writing, orally, by authenticated electronic communication, or by attendance. A shareholder, by attendance at any meeting of shareholders, including attendance by means of remote communication, will be deemed to have waived notice of this meeting, except where the shareholder objects at the beginning of the meeting to the transaction of business because the meeting is not lawfully called or convened, or objects before a vote on an item of business because the item may not lawfully be considered at that meeting and does not participate in the consideration of the item at that meeting.

2.7) Quorum and Adjourned Meeting. The holders of thirty-five percent (35%) of the voting power of shares entitled to vote at a meeting, represented either in person or by proxy, shall constitute a quorum for the transaction of business at any regular or special meeting of shareholders. If a quorum is present when a duly called or held meeting is convened, the shareholders present may continue to transact business until adjournment, even though the withdrawal of a number of shareholders originally present leaves less than the proportion or number otherwise required for a quorum.

2.8) Voting. At each meeting of the shareholders, every shareholder having the right to vote shall be entitled to vote in person, by proxy duly appointed by an instrument in writing subscribed by such shareholder or, if determined by the Board of Directors, by means of remote communication. Each shareholder shall have one (1) vote for each share having voting power standing in each shareholder’s name on the books of the corporation except as may be otherwise provided in the terms of the share or as may be required to provide for cumulative voting. A complete list of shareholders entitled to vote at the meeting arranged in alphabetical order and the number of voting shares held by each shall be prepared by the Secretary who shall have charge of the stock ledger and the list shall be available at least ten (10) days before the meeting and be open to the examination of any shareholder. The vote for directors or the vote upon any question before the meeting as determined by the Secretary shall be by ballot. All elections for directors shall be decided by a plurality of the voting power of the shares present and entitled to vote on the election of directors at a meeting at which a quorum is present, unless otherwise provided in the Articles of Incorporation. All questions shall be decided by a majority vote of the number of shares entitled to vote and represented at any meeting at which there is a quorum except in such cases as shall otherwise be required by statute or the Articles of Incorporation.

2

ARTICLE 3.

DIRECTORS

3.1) General Powers. The business and affairs of the corporation shall be managed by or under the direction of a Board of Directors.

3.2) Number, Term and Qualifications. The Board of Directors shall consist of no fewer than seven (7) but no more than nine (9) members, based on need as determined by the Board. The directors shall be elected at the annual meeting of shareholders of the corporation. Each director shall be elected to office for a term of three (3) years and shall continue to serve until the director’s successor has been duly elected and qualified.

3.3) Vacancies. Vacancies on the Board of Directors may be filled by the affirmative vote of a majority of the remaining members of the Board, though less than a quorum; provided, that newly created directorships resulting from an increase in the authorized number of directors shall be filled by the affirmative vote of a majority of the directors serving at the time of such increase. Persons so elected shall be directors until their successors are elected by the shareholders, who shall make such election at the next annual meeting of shareholders to fill the unexpired term.

3.4) Quorum and Voting. A majority of the directors currently holding office shall constitute a quorum for the transaction of business. In the absence of a quorum, a majority of the directors present may adjourn a meeting from time to time until a quorum is present. If a quorum is present when a duly called or held meeting is convened, the directors present may continue to transact business until adjournment even though the withdrawal of a number of directors originally present leaves less than the proportion or number otherwise required for a quorum. Except as otherwise required by law or the Articles of Incorporation, the acts of a majority of the directors present at a meeting at which a quorum is present shall be the acts of the Board of Directors.

3.5) Board Meetings; Place and Notice.

(a) Regular Meetings. A regular meeting of the Board of Directors shall be held without notice other than by this Bylaw immediately after the annual meeting of shareholders. Meetings of the Board of Directors may be held from time to time at any place within or without the State of Minnesota that the Board of Directors may designate or by any means described in section 3.6 below. In the absence of designation by the Board of Directors, Board meetings shall be held at the principal executive office of the corporation, except as may be otherwise unanimously agreed orally, in writing, or by attendance. The Board of Directors shall also schedule regular meetings at such time and place as the Board may provide by resolution. Once a meeting schedule is adopted by the Board, or if the date and time of a Board meeting has been announced at a previous meeting, no notice is required.

3

(b) Special Meetings. Special meetings of the Board of Directors may be called jointly by the President and Secretary or by any five (5) members of the Board by giving written notice thereof to each member of the Board at least three (3) days prior to the time set for such meeting. The attendance of any director at a special meeting shall constitute a waiver of notice of such meeting except in the case a director attends a meeting for the express purpose of objecting to the transaction of any business because the meeting was not lawfully called or convened.

3.6) Board Meetings Held Solely by Means of Remote Communication. Any meeting among directors may be conducted solely by one or more means of remote communication through which all of the directors may participate with each other during the meeting, if the notice is given of the meeting as required by Section 3.5 above, and if the number of directors participating in the meeting is sufficient to constitute a quorum at a meeting. Participation in a meeting by that means constitutes presence at the meeting.

3.7) Waiver of Notice. A director may waive notice of any meeting before, at or after the meeting, in writing, orally or by attendance. Attendance at a meeting by a director is a waiver of notice of that meeting unless the director objects at the beginning of the meeting to the transaction of business because the meeting is not lawfully called or convened and does not participate thereafter in the meeting.

3.8) Absent Directors. A director may give advance written consent or opposition to a proposal to be acted on at a Board meeting. If the director is not present at the meeting, consent or opposition to a proposal does not constitute presence for purposes of determining the existence of a quorum, but consent or opposition shall be counted as a vote in favor of or against the proposal and shall be entered in the minutes of the meeting, if the proposal acted on at the meeting is substantially the same or has substantially the same effect as the proposal to which the director has consented or objected.

3.9) Compensation. Directors who are not salaried officers of the corporation shall receive such fixed sum and expenses per meeting attended or such fixed annual sum or both as shall be determined from time to time by resolution of the Board of Directors. Nothing herein contained shall be construed to preclude any director from serving this corporation in any other capacity and receiving proper compensation therefor.

3.10) Action Without Meeting. Any action of the Board of Directors or any committee of the Board that may be taken at a meeting thereof may be taken without a meeting if authorized by a written action signed or consented to by authenticated electronic communication, by the number of directors that would be required to take the same action at a meeting of the Board at which all directors were present, or by the number of members of such committee that would be required to take the same action at a meeting of the committee at which all of the committee members were present, as the case may be.

4

3.11) Committees. The Board of Directors may, by resolution approved by affirmative vote of a majority of the Board, establish committees having the authority of the Board in the management of the business of the corporation only to the extent provided in the resolution. Each such committee shall consist of two or more natural persons, at least one of whom must be a director, confirmed by the affirmative vote of a majority of the directors present, and shall be subject at all times to the direction and control of the Board. A majority of the members of a committee present at a meeting shall constitute a quorum for the transaction of business. Committee meetings may be held solely by means of remote communication and committee members may participate in meetings by means of remote communication to the same extent as permitted for meetings of the Board of Directors.

ARTICLE 4.

OFFICERS

4.1) Number and Designation. The corporation shall have one or more natural persons exercising the functions of the offices of chief executive officer and chief financial officer. The Board of Directors may elect or appoint such other officers or agents as it deems necessary for the operation and management of the corporation including, but not limited to, a Chairman of the Board, a President, one or more Vice Presidents, a Chief Financial Officer, a Chief Operating Officer, a Secretary and a Treasurer. Any of the offices or functions of those offices may be held by the same person.

4.2) Election, Term of Office and Qualification. At the first meeting of the Board following each election of directors, the Board shall elect officers, who shall hold office until the next election of officers or until their successors are elected or appointed and qualify; provided, however, that any officer may be removed with or without cause by the affirmative vote of a majority of the Board of Directors present (without prejudice, however, to any contract rights of such officer).

4.3) Resignation. Any officer may resign at any time by giving written notice to the corporation. The resignation is effective when notice is given to the corporation, unless a later date is specified in the notice, and acceptance of the resignation shall not be necessary to make it effective.

4.4) Vacancies in Office. If there be a vacancy in any office of the corporation, by reason of death, resignation, removal or otherwise, such vacancy may, or in the case of a vacancy in the office of chief executive officer or chief financial officer shall, be filled for the unexpired term by the Board of Directors.

4.5) Delegation. Unless prohibited by a resolution approved by the affirmative vote of a majority of the directors present, an officer elected or appointed by the Board may delegate in writing some or all of the duties and powers of such officer to other persons.

5

ARTICLE 5.

INDEMNIFICATION

5.1) Indemnification. Each director and officer of the corporation now and hereafter serving as such shall be indemnified by the corporation against any and all claims and liabilities to which he or she has or shall become subject by reason of serving or having served as such director or officer, or by reason of any action alleged to have been taken, omitted or neglected by him or her as such director; and the corporation shall promptly reimburse each person for all legal expenses reasonably incurred by him or her in connection with any such claim or liability, provided the director or officer acted in good faith in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. Moreover, the corporation shall indemnify such persons, for such expenses and liabilities, in such manner, under such circumstances, and to such extent, as permitted by Minnesota Statutes, Section 302A.521, as now enacted or hereafter amended. The right of indemnification hereinabove provided shall not be exclusive of any rights to which any director or officer of the corporation may otherwise be entitled by law.

ARTICLE 6.

SHARES AND THEIR TRANSFER

6.1) Stock Shares. The shares of stock of the corporation shall be represented by certificates, or shall be uncertificated shares that may be evidenced by a book entry system maintained by the registrar of such stock, or combination of both. To the extent that shares are represented by certificates, such certificates whenever authorized by the Board, shall be in such form as shall be approved by the Board. The certificates representing shares of stock of each class shall be signed by, or in the name of, the corporation by the President, and by the Secretary or any assistant secretary or the Treasurer or any assistant treasurer of the corporation, which may be a facsimile thereof. Any or all of such signatures may be facsimiles if countersigned by a transfer agent or registrar. Although any officer, transfer agent or registrar whose manual or facsimile signature is affixed to such certificate ceases to be such officer, transfer agent or registrar before such certificate has been issued, it may nevertheless be issued by the corporation with the same effect as if such officer, transfer agent or registrar were still such at the date of its issue.

6.2) Stock Record. As used in these Bylaws, the term “shareholder” shall mean the person, firm or corporation in whose name outstanding shares of capital stock of the corporation are currently registered on the stock record books of the corporation. The corporation shall keep, at its principal executive office or at another place or places within the United States determined by the Board, a share register not more than one year old containing the names and addresses of the shareholders and the number and classes of shares held by each shareholder. The corporation shall also keep at its principal executive office or at another place or places within the United States determined by the Board, a record of the dates on which certificates representing shares were issued.

6.3) Transfer of Shares. Transfer of shares on the books of the corporation may be authorized only by the shareholder named in the certificate (or the shareholder’s legal representative or duly authorized attorney-in-fact) and upon surrender for cancellation of the certificate or certificates for such shares. The shareholder in whose name shares of stock stand on the books of the corporation shall be deemed the owner thereof for all purposes as regards the corporation; provided, that when any transfer of shares shall be made as collateral security and not absolutely, such fact, if known to the corporation or to the transfer agent, shall be so expressed in the entry of transfer; and provided, further, that the Board of Directors may establish a procedure whereby a shareholder may certify that all or a portion of the shares registered in the name of the shareholder are held for the account of one or more beneficial owners.

6

6.4) Lost Certificates. Any shareholder claiming a certificate of stock to be lost or destroyed shall make an affidavit or affirmation of that fact in such form as the Board of Directors may require, and shall, if the directors so require, give the corporation a bond of indemnity in form and with one or more sureties satisfactory to the Board of at least double the value, as determined by the Board, of the stock represented by such certificate in order to indemnify the corporation against any claim that may be made against it on account of the alleged loss or destruction of such certificate, whereupon a new certificate may be issued in the same tenor and for the same number of shares as the one alleged to have been destroyed or lost.

ARTICLE 7.

GENERAL PROVISIONS

7.1) Record Dates. In order to determine the shareholders entitled to notice of and to vote at a meeting, or entitled to receive payment of a dividend or other distribution, the Board of Directors may fix a record date which shall not be more than sixty (60) days preceding the date of such meeting or distribution. In the absence of action by the Board, the record date for determining shareholders entitled to notice of and to vote at a meeting shall be at the close of business on the day preceding the day on which notice is given, and the record date for determining shareholders entitled to receive a distribution shall be at the close of business on the day on which the Board of Directors authorizes such distribution.

7.2) Distributions; Acquisitions of Shares. Subject to the provisions of law, the Board of Directors may authorize the acquisition of the corporation’s shares and may authorize distributions whenever and in such amounts as, in its opinion, the condition of the affairs of the corporation shall render it advisable.

7.3) Fiscal Year. The fiscal year of the corporation shall be established by the Board of Directors.

7.4) Seal. The corporation shall have such corporate seal or no corporate seal as the Board of Directors shall from time to time determine.

7.5) Securities of Other Corporations.

(a) Voting Securities Held by the Corporation. Unless otherwise ordered by the Board of Directors, the chief executive officer shall have full power and authority on behalf of the corporation (i) to attend and to vote at any meeting of security holders of other companies in which the corporation may hold securities; (ii) to execute any proxy for such meeting on behalf of the corporation; and (iii) to execute a written action in lieu of a meeting of such other company on behalf of this corporation. At such meeting, by such proxy or by such writing in lieu of meeting, the chief executive officer shall possess and may exercise any and all rights and powers incident to the ownership of such securities that the corporation might have possessed and exercised if it had been present. The Board of Directors may from time to time confer like powers upon any other person or persons.

7

(b) Purchase and Sale of Securities. Unless otherwise ordered by the Board of Directors, the chief executive officer shall have full power and authority on behalf of the corporation to purchase, sell, transfer or encumber securities of any other company owned by the corporation which represent not more than 10% of the outstanding securities of such issue, and may execute and deliver such documents as may be necessary to effectuate such purchase, sale, transfer or encumbrance. The Board of Directors may from time to time confer like powers upon any other person or persons. Notwithstanding the foregoing, the chief executive officer shall have no such power or authority to purchase, sell, transfer, or encumber the shares of stock of any wholly-owned subsidiary of the corporation without the approval of the Board of Directors.

Section 7.6). Exclusive Forum for Internal Corporate Claims. The sole and exclusive forum for (i) any claim that is based upon a violation of a duty under the laws of the State of Minnesota by a current or former director, officer or shareholder in such capacity; (ii) any derivative action or proceeding brought on behalf of the corporation; or (iii) any action asserting a claim arising under any provision of the Minnesota Business Corporation Act or the corporation’s articles or bylaws will be the federal courts (where jurisdiction exists) and state courts located in Hennepin County, Minnesota. Any person or entity purchasing or otherwise acquiring an interest in shares of capital stock of the corporation is deemed to have notice of and consented to the provisions of this bylaw.

ARTICLE 8.

AMENDMENT OF BYLAWS

8.1) Amendments. Unless the Articles of Incorporation or these Bylaws provide otherwise, these Bylaws may be altered, amended, added to or repealed by the affirmative vote of a majority of the members of the Board of Directors. Such authority in the Board of Directors is subject to the power of the shareholders to change or repeal such Bylaws, and the Board of Directors shall not make or alter any Bylaws fixing a quorum for meetings of shareholders, prescribing procedures for removing directors or filling vacancies on the Board, or fixing the number of directors or their classifications, qualifications or terms of office, but the Board may adopt or amend a Bylaw to increase the number of directors.

8

EXHIBIT 10.1

THIRD AMENDMENT TO CREDIT AGREEMENT

This THIRD AMENDMENT TO CREDIT AGREEMENT (this “Amendment”) is made and entered into as of December 21, 2023, by and among NUVERA COMMUNICATIONS, INC., a Minnesota corporation (the “Borrower”), the Guarantors party hereto, COBANK, ACB (“CoBank”), in its capacity as administrative agent under the Existing Credit Agreement (as defined below; CoBank, in such capacity, the “Administrative Agent”) as the Swing Line Lender, as the sole Issuing Lender and as a Lender, and each other Lender and Voting Participant party to the Existing Credit Agreement (as defined below; collectively, the “Existing Lenders”).

RECITALS

WHEREAS, the Borrower, the guarantors party thereto from time to time (collectively, the “Guarantors” and, together with the Borrower, the “Loan Parties”), the Lenders party thereto from time to time and the Administrative Agent have entered into that certain Credit Agreement, dated as of July 15, 2022 (as the same has been and may be further amended, restated, or otherwise modified from time to time prior to the date hereof, the “Existing Credit Agreement”);

WHEREAS, the Borrower has requested that (i) certain of the financial institutions set forth on Schedule 1 hereto (the “Increasing Lenders”) provide an increase to the Revolving Commitment in an amount equal to $10,000,000 (the “Revolving Increase”) and (ii) the other Revolving Lenders consent to the Revolving Increase;

WHEREAS, the Administrative Agent, the Existing Lenders, the Increasing Lenders and the Loan Parties have hereby agreed to the following amendments to the Existing Credit Agreement on the terms and subject to the conditions set forth herein (the Existing Credit Agreement, as so modified and amended, the “Amended Credit Agreement”);

NOW, THEREFORE, in consideration of the premises set forth herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Certain Definitions; Interpretation.

(a) Defined terms used but not otherwise defined herein shall have the meanings when used herein as set forth in the Amended Credit Agreement (as defined below).

(b) The rules of construction set forth in Sections 1.2 through 1.7 of the Amended Credit Agreement shall apply to this Amendment.

2. Amendments to Existing Credit Agreement. Subject to the satisfaction (or waiver) of the conditions set forth in Section 4 hereof, the Existing Credit Agreement is hereby amended by:

1

(a) adding the following definitions to Section 1.1 thereof in alphabetical order as follow:

“Third Amendment” means that certain Third Amendment to Credit Agreement, by and among the Administrative Agent, the Lenders party thereto, the Voting Participants party thereto, the Issuing Lender, the Swing Line Lender, the Borrower, and the other Loan Parties thereto, dated as of the Third Amendment Effective Date.

“Third Amendment Effective Date” means December 21, 2023.

(b) amending the definition of “Revolving Commitment” set forth in Section 1.1 thereof by amending and restating the last sentence thereof to read as follows:

“As of the Third Amendment Effective Date, the aggregate amount of the Revolving Commitments of all Revolving Lenders is $40,000,000.”

3. Representations and Warranties of the Loan Parties. Each Loan Party represents and warrants to the Administrative Agent, the Issuing Lender, the Swing Line Lender and the Lenders that, as of the Effective Date, after giving effect to this Amendment:

(a) the representations and warranties of the Loan Parties set forth in Article V of the Amended Credit Agreement and in the other Loan Documents are true and correct, except such representations and warranties that are not qualified by reference to materiality or a Material Adverse Change are true and correct in all material respects, after giving effect to this Amendment, as though made on and as of the date hereof (except for any such representation and warranty that by its terms is made only as of an earlier date, which representation and warranty shall remain true and correct in all material respects as of such earlier date);

(b) each Loan Party has taken all necessary limited liability company, corporate and other action to authorize the execution, delivery and performance of this Amendment and each of the other Loan Documents to which it is a party;

(c) this Amendment is the legally valid and binding obligation of each Loan Party hereto, enforceable against such Person in accordance with its terms, subject only to limitations on enforceability imposed by (y) applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting creditors’ rights generally, and (z) general equitable principles;

(d) no event has occurred and is continuing, or would result from the transactions contemplated by this Amendment, that constitutes a Default or an Event of Default;

(e) no Loan Party has received written notice and no Authorized Officer of any Loan Party or any Subsidiary of a Loan Party has knowledge of any action, suit, proceeding or investigation pending against or threatened in writing against any Loan Party or any Subsidiary of any Loan Party or any of their respective properties, including the Licenses, in any court or before any arbitrator of any kind or before or by any other Governmental Authority (including the FCC and any applicable PUC) that would reasonably be expected to result in a Material Adverse Effect; and

(f) all material governmental and third-party consents, subordinations and waivers, as applicable, required to effectuate the transactions contemplated hereby a have been obtained and are in full force and effect, including any required material permits and authorizations of all applicable Governmental Authorities, including the FCC and all applicable PUCs.

4. Conditions to Effectiveness. The effectiveness of this Amendment and the amendments set forth herein are subject to the satisfaction of the following conditions (the date upon which such conditions are satisfied, the “Effective Date”):

(a) Amendment Documents. The Administrative Agent shall have received duly authorized and executed copies of each of the following in form and substance satisfactory to the Administrative Agent and, if applicable, its counsel, in each case signed by an Authorized Officer of each applicable Loan Party and by each other Person party thereto:

(i) this Amendment;

(ii) all Notes requested by the Lenders; and

(iii) all other documents and instruments required by the Amended Credit Agreement or this Amendment in connection with the execution, delivery and performance of this Amendment by each Loan Party.

(b) Closing Certificates. The Administrative Agent shall have received duly authorized and executed copies of each of the following in form and substance satisfactory to the Administrative Agent and, if applicable, its counsel:

(i) a certificate of the Borrower on behalf of itself and the other Loan Parties signed by an Authorized Officer of the Borrower, dated as of the Third Amendment Effective Date stating that (A) the representations and warranties of the Loan Parties set forth in Article V of the Amended Credit Agreement and in the other Loan Documents are true and correct, except such representations and warranties that are not qualified by reference to materiality or a Material Adverse Change are true and correct in all material respects, after giving effect to this Amendment, as though made on and as of the date hereof (except for any such representation and warranty that by its terms is made only as of an earlier date, which representation and warranty shall remain true and correct in all material respects as of such earlier date), (B) no Default or Event of Default exists or is continuing as of the Third Amendment Effective Date, or will result from the transactions contemplated by this Amendment, (C) all Governmental Authority authorizations required with respect to the execution, delivery or performance of this Amendment by the Loan Parties have been received, (D) since December 31, 2022, there has occurred no Material Adverse Effect and (E) each of the Loan Parties has satisfied each of the other closing conditions required to be satisfied by it hereunder;

(ii) a certificate dated as of the Third Amendment Effective Date and signed by the Secretary or an Assistant Secretary of each of the Loan Parties, certifying as appropriate as to: (A) all corporate or limited liability company action taken by each Loan Party in connection with the authorization of this Amendment and the Revolving Increase; (B) the names of the Authorized Officers authorized to sign the Loan Documents on behalf of each Loan Party and their true signatures; and (C) certifying that there have been no changes to its Organizational Documents since last delivered to the Administrative Agent on the Closing Date, together with certificates from the appropriate state officials as to the continued existence and good standing or existence (as applicable) of each Loan Party in each state where organized; and

3

(iii) a Solvency Certificate, duly executed by an Authorized Officer of the Borrower.

(c) Representations and Warranties. The representations and warranties of the Loan Parties set forth in Section 3of this Amendment, in Article V of the Amended Credit Agreement and in the other Loan Documents shall be true and correct, except such representations and warranties that are not qualified by reference to materiality or a Material Adverse Change shall be true and correct in all material respects, after giving effect to this Amendment, as though made on and as of the date hereof (except for any such representation and warranty that by its terms is made only as of an earlier date, which representation and warranty shall remain true and correct in all material respects as of such earlier date).

(d) No Material Adverse Effect. Since December 31, 2022, there shall not have occurred any Material Adverse Effect.

(e) Defaults and Events of Default. After giving effect to this Amendment, no event shall have occurred and shall be continuing, or would result from, the transactions contemplated by this Amendment that constitutes a Default or an Event of Default.

(f) Governmental Approvals. The Administrative Agent shall have received evidence that all material governmental (including, without limitation, all FCC and applicable PUC) authorizations, consents and waivers which are required with respect to the execution, delivery or performance of this Amendment and the Revolving Increase and the other transactions contemplated thereby shall have been obtained or made and shall be final orders and in full force and effect.

(g) Payment of Fees. The Borrower shall have paid (i) the fees described in that certain fee letter, dated as of the Third Amendment Effective Date, between the Borrower and the Increasing Lender and (ii) all other fees and expenses related to this Amendment and the other Loan Documents payable on or before the Third Amendment Effective Date as required by this Amendment or any other Loan Document.

5. Reaffirmation of Security Interest. Each of the Borrower and each Guarantor hereby acknowledges its receipt of a copy of this Amendment and its review of the terms and conditions hereof and consents to the terms and conditions of this Amendment and the transactions contemplated thereby. Each of the Borrower and each Guarantor, as applicable, (a) affirms and confirms its guarantees, pledges, grants and other undertakings under the Amended Credit Agreement and the other Loan Documents to which it is a party and (b) agrees that (i) each Loan Document, as modified by this Amendment, to which it is a party shall continue to be in full force and effect and (ii) all guarantees, pledges, grants and other undertakings thereunder, as modified by this Amendment, shall continue to be in full force and effect and shall accrue to the benefit of the Secured Parties, including the Administrative Agent.

6. Release. Although each of the Administrative Agent and the Lenders regards its conduct as proper and does not believe that any of the Loan Parties have any claim, right, cause of action, offset or defense against the Administrative Agent, any Lender, or any of their respective affiliates or participants in connection with the execution, delivery, performance and administration of, or the transactions contemplated by, the Existing Credit Agreement, the other Loan Documents or this Amendment, the Administrative Agent, the Lenders and the Loan Parties, as an inducement to enter into this Amendment and as consideration therefor, agree to eliminate any possibility that any past conduct, conditions, acts, omissions, events, circumstances or matters of any kind whatsoever could impair or otherwise affect any rights, interests, contracts or remedies of the Administrative Agent, any Lender, any of their respective affiliates or any participant. Therefore, each Loan Party unconditionally, freely, voluntarily and, after consultation with counsel and becoming fully and adequately informed as to the relevant facts, circumstances and consequences, jointly and severally releases, waives and forever discharges the Administrative Agent, each Lender, and each of their respective affiliates and participants from and against (a) any and all liabilities, indebtedness and obligations, of any kind whatsoever, (b) any legal, equitable or other obligations of any kind whatsoever and (c) all other claims, rights, causes of action, counterclaims or defenses of any kind whatsoever, in contract or in tort, at Law or in equity, whether known or unknown, direct or derivative, which each Loan Party, or any predecessor, successor or assign thereof might otherwise have against the Administrative Agent, any Lender, or any of their respective affiliates or participants on account of any conduct, condition, act, omission, event, contract, liability, obligation, demand, covenant, promise, indebtedness, claim, right, cause of action, suit, damage, defense, circumstance or matter of any kind whatsoever which, in the case of clauses (a) through (c), arise from or relate to any actions which any such Person has or may have taken or omitted to take in connection with, or otherwise arise from, relate to or are in connection with, the Existing Credit Agreement or the other Loan Documents, that existed, arose or occurred at any time prior to the effectiveness of this Amendment; provided, that, the foregoing releases and waivers shall not apply to any claims arising from the gross negligence or willful misconduct of the Administrative Agent, such Lender or any such affiliate or participants.

7. Expenses; Indemnity; Damage Waiver. Section 11.3 of the Amended Credit Agreement is hereby incorporated, mutatis mutandis, by reference as if such section was set forth in full herein.

8. Miscellaneous.

(a) Counterparts; Integrations; Effectiveness.

(i) This Amendment may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. This Amendment, the Amended Credit Agreement and the other Loan Documents, and any separate letter agreements with respect to fees payable to the Administrative Agent, constitute the entire contract among the parties relating to the subject matter hereof and supersede any and all previous agreements and understandings, oral or written, relating to the subject matter hereof. Except as provided in Section 5, this Amendment shall become effective when it shall have been executed by the Administrative Agent and when the Administrative Agent shall have received counterparts hereof that, when taken together, bear the signatures of each of the other parties hereto. Delivery of an executed counterpart of a signature page of this Amendment by facsimile or in electronic (i.e., “pdf” or “tif”) format shall be effective as delivery of a manually executed counterpart of this Amendment.

5

(ii) The words “execution,” “signed,” “signature,” and words of like import in this Amendment shall be deemed to include electronic signatures or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, or any similar state laws based on the Uniform Electronic Transactions Act. This Amendment and the other Loan Documents constitute the entire contract among the parties relating to the subject matter hereof and supersede any and all previous agreements and understandings, oral or written, relating to the subject matter hereof.

(b) Successors and Assigns. The provisions of this Amendment shall be binding upon, and inure to the benefit of, the parties hereto and their respective successors and assigns permitted by the Amended Credit Agreement, except that neither the Borrower nor any other Loan Party may assign or otherwise transfer any of its rights or obligations hereunder without the prior written consent of the Administrative Agent and each Lender and no Lender may assign or otherwise transfer any of its rights or obligations hereunder except as permitted under the Amended Credit Agreement.

(c) Governing Law. This Amendment and any claims, controversy, dispute or cause of action (whether in contract or tort or otherwise) based upon, arising out of or relating to this Amendment and the transactions contemplated hereby and thereby shall be governed by, and construed in accordance with, the law of the State of Colorado. Section 11.10 of the Amended Credit Agreement regarding governing law, submission to jurisdiction, waiver of venue, service of process and waiver of jury trial is hereby incorporated, mutatis mutandis, by reference as if such section was set forth in full herein.

(d) Severability. The provisions of this Amendment are intended to be severable. If any provision of this Amendment shall be held invalid or unenforceable in whole or in part in any jurisdiction, such provision shall, as to such jurisdiction, be ineffective to the extent of such invalidity or unenforceability without in any manner affecting the validity or enforceability thereof in any other jurisdiction or the remaining provisions hereof in any jurisdiction.

(e) Headings. The headings of this Amendment are included for convenience and shall not affect the interpretation of this Amendment.

(f) Loan Document. This Amendment is a Loan Document and subject to the terms of the Amended Credit Agreement.

(g) Effect on the Existing Credit Agreement and other Loan Documents. Except as specifically modified by this Amendment, the Existing Credit Agreement and the other Loan Documents shall remain in full force and effect and are hereby ratified and confirmed and this Amendment shall not be considered a novation. Other than as specifically set forth in Section 3, the execution, delivery and performance of this Amendment shall not constitute a waiver of any provision of, or operate as a waiver of any right, power or remedy of the Administrative Agent or any Lender under, the Existing Credit Agreement or any of the other Loan Documents.

[Remainder of page intentionally left blank.]

IN WITNESS WHEREOF, each of the parties hereto has caused this Amendment to be executed by such party, or to be executed by a duly authorized officer of such party, as of the date first above written.

BORROWER:

NUVERA COMMUNICATIONS, INC., as Borrower

By: /s/ Glenn H. Zerbe

Name: Glenn H. Zerbe

Title: Chief Executive Officer and President

GUARANTORS:

PEOPLES TELEPHONE COMPANY

WESTERN TELEPHONE COMPANY

HUTCHINSON TELEPHONE COMPANY

HUTCHINSON TELECOMMUNICATIONS, INC.

HUTCHINSON CELLULAR, INC.

TECH TRENDS, INC.

SLEEPY EYE TELEPHONE COMPANY

SCOTT-RICE TELEPHONE CO., each as Guarantor

By: /s/ Glenn H. Zerbe

Name: Glenn H. Zerbe

Title: Chief Executive Officer and President

COBANK, ACB, as a Lender, the Administrative Agent and the Swing Line Lender

By: /s/ Lennie Blakeslee_____________________

Lennie Blakeslee

Managing Director

GREENSTONE FARM CREDIT SERVICES, FLCA, as a Voting Participant pursuant to the provisions of Section 11.7 of the Existing Credit Agreement

By: /s/ _

Name:

Title:

FEDERAL AGRICULTURAL MORTGAGE CORPORATION, as a Voting Participant pursuant to the provisions of Section 11.7 of the Existing Credit Agreement

By: /s/ _

Name:

Title:

AGCOUNTRY FARM CREDIT SERVICES, FLCA, as a Voting Participant pursuant to the provisions of Section 11.7 of the Existing Credit Agreement

By: /s/ _

Name:

Title:

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

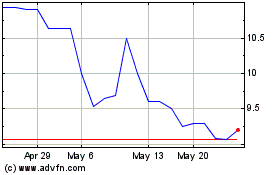

Nuvera Communications (QB) (USOTC:NUVR)

Historical Stock Chart

From Apr 2024 to May 2024

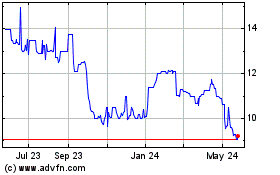

Nuvera Communications (QB) (USOTC:NUVR)

Historical Stock Chart

From May 2023 to May 2024