SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13G

(Rule

13d-102)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO

RULE 13d-1(b), (c), AND (d) AND AMENDMENTS THERETO FILED

PURSUANT

TO RULE 13d-2(b)

(AMENDMENT

NO. 2)*

Nuvera

Communications, Inc.

(Name

of Issuer)

Common

Stock, $1.66 par value

(Title

of Class of Securities)

67075V100

(CUSIP

Number)

December

31, 2023

(Date

of Event Which Requires Filing of This Statement)

Check

the appropriate box to designate the rule pursuant to which this Schedule is filed:

| * | The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided

in a prior cover page. |

The

information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

CUSIP NO. 67075V100 |

13G |

Page

2 of

8 Pages |

| 1 |

NAMES

OF REPORTING PERSONS S.S. OR

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS

Magnolia

Capital Fund, LP |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

[ ]

(b)

[ ] |

| 3 |

SEC

USE ONLY

|

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

5 |

SOLE

VOTING POWER

345,907 |

|

| 6 |

SHARED

VOTING POWER

0 |

|

| 7 |

SOLE

DISPOSITIVE POWER

345,907 |

|

| 8 |

SHARED

DISPOSITIVE POWER

0 |

|

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

345,907

|

|

| 10 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW 9 EXCLUDES CERTAIN SHARES

|

[ ]

|

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

6.7% |

|

| 12 |

TYPE

OF REPORTING PERSON

PN |

|

| |

|

|

|

|

|

CUSIP NO. 67075V100 |

13G |

Page

3 of

8 Pages |

| 1 |

NAMES

OF REPORTING PERSONS S.S. OR

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS

The

Magnolia Group, LLC

|

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

[ ]

(b)

[ ] |

| 3 |

SEC

USE ONLY

|

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Nebraska |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

5 |

SOLE

VOTING POWER

345,907

|

|

| 6 |

SHARED

VOTING POWER

0

|

|

| 7 |

SOLE

DISPOSITIVE POWER

345,907 |

|

| 8 |

SHARED

DISPOSITIVE POWER

0 |

|

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

345,907 |

|

| 10 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW 9 EXCLUDES CERTAIN SHARES

|

[ ]

|

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

6.7% |

|

| 12 |

TYPE

OF REPORTING PERSON

IA |

|

| |

|

|

|

|

|

CUSIP NO. 67075V100 |

13G |

Page

4 of

8 Pages |

| 1 |

NAMES

OF REPORTING PERSONS S.S. OR

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS

Adam

K. Peterson |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

[ ]

(b)

[ ] |

| 3 |

SEC

USE ONLY

|

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

5 |

SOLE

VOTING POWER

345,907 |

|

| 6 |

SHARED

VOTING POWER

0

|

|

| 7 |

SOLE

DISPOSITIVE POWER

345,907

|

|

| 8 |

SHARED

DISPOSITIVE POWER

0

|

|

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

345,907

|

|

| 10 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW 9 EXCLUDES CERTAIN SHARES

|

[ ]

|

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

6.7% |

|

| 12 |

TYPE

OF REPORTING PERSON

IN

|

|

| |

|

|

|

|

|

CUSIP NO. 67075V100 |

13G |

Page

5 of

8 Pages |

| Item 1. | (a) | Name

of Issuer: |

Nuvera

Communications, Inc.

| (b) | Address

of Issuer’s Principal Executive Offices: |

27

North Minnesota Street

New

Ulm, Minnesota 56073

| Item 2. | (a) | Name

of Person Filing: |

This

Schedule 13G is being filed by Magnolia Capital Fund, LP (“MCF”), The Magnolia Group, LLC (“TMG”), a registered

investment adviser, and Adam K. Peterson (each a “Reporting Person” and, collectively, the “Reporting Persons”)

with respect to shares of common stock, $1.66 par value of the Issuer (the “Common Stock”) owned directly by MCF.

TMG

is the general partner of MCF. Mr. Peterson is the managing member of TMG. TMG and Mr. Peterson may each exercise voting and dispositive

power over the Common Stock held by MCF and, as a result, may be deemed to be indirect beneficial owners of shares of Common Stock

held by MCF. TMG and Mr. Peterson disclaim beneficial ownership of the Common Stock.

| (b) | Address

of Principal Business Office or, if None, Residence: |

1601

Dodge Street, Suite 3300

Omaha,

Nebraska 68102

MCF

is a Delaware limited partnership. TMG is a Nebraska limited liability company and registered investment adviser. Mr. Peterson

is a U.S. citizen.

| (d) | Title

of Class of Securities: |

Common

Stock, $1.66 par value

67075V100

| Item

3. | If

This Statement is Filed Pursuant to Rule 13d-1(b), or 13d-2(b) or (c), Check Whether

the Person Filing is a: |

| (a) | [ ] | Broker

or dealer registered under Section 15 of the Exchange Act. |

| (b) | [ ] | Bank

as defined in Section 3(a)(6) of the Exchange Act. |

| (c) | [ ] | Insurance

company as defined in Section 3(a)(19) of the Exchange Act. |

| (d) | [ ] | Investment

company registered under Section 8 of the Investment Company Act. |

| (e) | [X] | An

investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E); |

| (f) | [ ] | An

employee benefit plan or endowment fund in accordance with Rule 13d-1(b)(1)(ii)(F); |

|

CUSIP NO. 67075V100 |

13G |

Page

6 of

8 Pages |

| (g) | [ ] | A

parent holding company or control person in accordance with Rule 13d-1(b)(1)(ii)(G); |

| (h) | [ ] | A

savings association as defined in Section 3(b) of the Federal Deposit Insurance Act; |

| (i) | [ ] | A

church plan that is excluded from the definition of an investment company under Section

3(c)(14) of the Investment Company Act; |

| (j) | [ ] | Group,

in accordance with Rule 13d-1(b)(1)(ii)(J). |

| (a) | Amount

beneficially owned: |

Mr.

Peterson may be deemed the beneficial owner of 345,907 shares of Common Stock held for the account of MCF.

TMG

may be deemed the beneficial owner of 345,907 shares of Common Stock held for the account of MCF.

MCF

may be deemed the beneficial owner of 345,907 shares of Common Stock that it holds.

The

information set forth in Rows 5 through 11 of the cover page for each Reporting Person is hereby incorporated into this Item 4(b)

for each such Reporting Person. The percentages reported herein have been determined by dividing the number of shares of Common

Stock beneficially owned by each of the Reporting Persons by 5,126,581 the number of shares of Common Stock outstanding as of

November 14, 2023, as reported on the 10-Q filed by the Issuer on November 14, 2023, with the Securities and Exchange Commission.

| (c) | Number

of shares as to which the person has: |

The

information set forth in Rows 5 through 11 of the cover page for each Reporting Person is hereby incorporated by reference

into this Item 4(c) for each such Reporting Person.

| Item

5. | Ownership

of Five Percent or Less of a Class. |

If

this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial

owner of more than five percent of the class of securities, check the following. [ ]

| Item

6. | Ownership

of More than Five Percent on Behalf of Another Person. |

Not

applicable.

| Item

7. | Identification

and Classification of the Subsidiary Which Acquired the Security Being Reported on by

the Parent Holding Company or Control Person. |

Not

applicable

|

CUSIP NO. 67075V100 |

13G |

Page

7 of

8 Pages |

| Item

8. | Identification

and Classification of Members of the Group. |

Not

applicable

| Item

9. | Notice

of Dissolution of Group. |

Not

applicable

|

CUSIP NO. 67075V100 |

13G |

Page

8 of

8 Pages |

By

signing below I certify that, to the best of my knowledge and belief, the securities referred to above were not acquired and are

not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were

not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect.

Signature

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

| |

Magnolia Capital Fund, LP |

|

| |

|

|

|

| |

By: |

The Magnolia Group, LLC General Partner |

|

| |

|

|

|

| |

By: |

/s/ Adam K. Peterson |

|

| |

Name: |

Adam K. Peterson |

|

| |

Title: |

Manager |

|

| |

|

|

|

| |

Date: |

February 14, 2024 |

|

| |

|

|

| |

The Magnolia Group, LLC |

|

| |

|

|

|

| |

By: |

The Magnolia Group, LLC |

|

| |

|

|

|

| |

By: |

/s/ Adam K. Peterson |

|

| |

Name: |

Adam K. Peterson |

|

| |

Title: |

Manager |

|

| |

|

|

|

| |

Date: |

February 14, 2024 |

|

| |

|

|

| |

Adam K. Peterson |

|

| |

|

|

|

| |

By: |

/s/ Adam K. Peterson |

|

| |

Name: |

Adam K. Peterson |

|

| |

|

|

|

| |

Date: |

February 14, 2024 |

|

EXHIBIT

INDEX TO SCHEDULE 13G

EXHIBIT

1

Joint

Filing Agreement, dated as of February 14, 2024, by and between Magnolia Capital Fund, LP, The Magnolia Group, LLC, and Adam K.

Peterson.

EXHIBIT

1

JOINT

FILING AGREEMENT

Pursuant

to Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, the undersigned agree, as of February 14, 2024, that only one statement

containing the information required by Schedule 13G, and each amendment thereto, need be filed with respect to the ownership by

each of the undersigned of shares of Common Stock of Nuvera Communications, Inc., and such statement to which this Joint Filing

Agreement is attached as Exhibit 1 is filed on behalf of each of the undersigned.

Dated:

February 14, 2024

Magnolia

Capital Fund, LP

| By: |

The Magnolia Group, LLC |

|

| |

General Partner |

|

| |

|

|

| By: |

/s/ Adam K. Peterson |

|

| |

Adam K. Peterson, Manager |

|

| |

|

|

| The Magnolia Group, LLC |

|

| |

|

|

| By: |

/s/ Adam K. Peterson |

|

| |

Adam K. Peterson, Manager |

|

| |

|

|

| By: |

/s/ Adam K. Peterson |

|

| |

Adam K. Peterson |

|

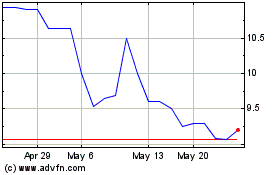

Nuvera Communications (QB) (USOTC:NUVR)

Historical Stock Chart

From Nov 2024 to Dec 2024

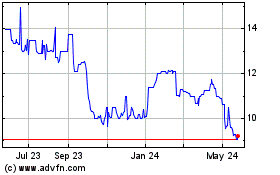

Nuvera Communications (QB) (USOTC:NUVR)

Historical Stock Chart

From Dec 2023 to Dec 2024