UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

ANNUAL REPORT

PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

☒ ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended |

December 31, 2023 |

or

☐ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number

|

001-12103

|

| |

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

Peoples Financial Corporation Employee Stock Ownership Plan

Howard and Lameuse Avenues

Biloxi, Mississippi 39533

| |

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

Peoples Financial Corporation

Howard and Lameuse Avenues

Biloxi, Mississippi 39533

Peoples Financial Corporation Employee Stock Ownership Plan

Table of Contents

| |

Page

|

|

Reports of Independent Registered Public Accounting Firm

|

3-5

|

| |

|

|

Financial Statements:

|

|

| |

|

|

Statements of Net Assets Available for Benefits

|

6

|

| |

|

|

Statement of Changes in Net Assets Available for Benefits

|

7

|

| |

|

|

Notes to Financial Statements

|

8-13

|

| |

|

|

Supplemental Schedule:

|

|

| |

|

|

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

|

14

|

| |

|

|

Signatures

|

16

|

|

Exhibits Index

|

15

|

|

|

EisnerAmper LLP

8550 United Plaza Blvd.

Suite 1001

Baton Rouge, LA 70809

T 225.922.4600

F 225.922.4611

www.eisneramper.com

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Administrator, Participants and Beneficiaries

of the Peoples Financial Corporation Employee Stock Ownership Plan

Opinion on the Financial Statements

We have audited the accompanying statement of net assets available for benefits of Peoples Financial Corporation Employee Stock Ownership Plan (the "Plan") as of December 31, 2023, and the related statement of changes in net assets available for benefits for the year then ended, and the related notes (collectively referred to as the “financial statements”).

In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and the changes in net assets available for benefits for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan's internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

“EisnerAmper” is the brand name under which EisnerAmper LLP and Eisner Advisory Group LLC and its subsidiary entities provide professional services. EisnerAmper LLP and Eisner Advisory Group LLC are independently owned firms that practice in an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations and professional standards. EisnerAmper LLP is a licensed CPA firm that provides attest services, and Eisner Advisory Group LLC and its subsidiary entities provide tax and business consulting services. Eisner Advisory Group LLC and its subsidiary entities are not licensed CPA firms.

Supplemental Information

The supplemental information in the accompanying schedule of schedule of assets (held at end of year) as of December 31, 2023 has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ EisnerAmper LLP

We have served as the Plan’s auditor since 2024.

EISNERAMPER LLP

Baton Rouge, Louisiana

July 10, 2024

|

10000 Innovation Drive

Suite 250

Milwaukee, WI 53226

|

414 431 9300

wipfli.com

|

Report of Independent Registered Public Accounting Firm

To the Trustees, Plan Administrator and Plan Participants

Peoples Financial Corporation Employee Stock Ownership Plan

Opinion on the Financial Statements

We have audited the accompanying statement of net assets available for benefits of the Peoples Financial Corporation Employee Stock Ownership Plan (the “Plan”) as of December 31, 2022, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2022, in conformity with accounting principles generally accepted in the United States.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures to respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provide a reasonable basis for our opinion.

/s/ Wipfli LLP

We have served as the Plan’s auditor from 2007 to 2022.

June 27, 2023

Atlanta, Georgia

|

Peoples Financial Corporation Employee Stock Ownership Plan

|

|

Statements of Net Assets Available for Benefits

|

| |

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

12,505 |

|

|

$ |

12,120 |

|

| |

|

|

|

|

|

|

|

|

|

Peoples Financial Corporation common stock

|

|

|

3,240,152 |

|

|

|

3,116,942 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

3,252,657 |

|

|

|

3,129,062 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$ |

3,252,657 |

|

|

$ |

3,129,062 |

|

See Accompanying Notes to Financial Statements.

|

Peoples Financial Corporation Employee Stock Ownership Plan

|

|

Statement of Changes in Net Assets Available for Benefits

|

|

For the Year Ended December 31, 2023

|

|

Additions to net assets

|

|

|

|

|

|

Net appreciation in fair value of Peoples Financial

|

|

|

|

|

|

Corporation common stock

|

|

$ |

102,881 |

|

|

Dividend income

|

|

|

113,073 |

|

|

Other income

|

|

|

630 |

|

|

Total additions to net assets

|

|

|

216,584 |

|

| |

|

|

|

|

|

Deductions from net assets

|

|

|

|

|

|

Distributions paid to participants

|

|

|

92,561 |

|

|

Other expense

|

|

|

428 |

|

|

Total deductions

|

|

|

92,989 |

|

| |

|

|

|

|

|

Change in net assets available for benefits

|

|

|

123,595 |

|

| |

|

|

|

|

|

Net assets available for benefits, beginning of year

|

|

|

3,129,062 |

|

| |

|

|

|

|

|

Net assets available for benefits, end of year

|

|

$ |

3,252,657 |

|

See Accompanying Notes to Financial Statements.

Peoples Financial Corporation Employee Stock Ownership Plan

Notes to Financial Statements

NOTE A – DESCRIPTION OF PLAN

The following description of the Peoples Financial Corporation and its subsidiaries (the “Company”) Employee Stock Ownership Plan (the “Plan”) provides only general information. Participants should refer to the plan agreement for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan covering all employees of the Company who are age 21 or older and employed in a position requiring the completion of at least 1,000 hours of service per plan year. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA). The Plan was amended on April 5, 2019. As a result of the amendment, the Plan was frozen effective January 1, 2019. No eligible employee shall become a participant and no contributions shall accrue.

Participant Accounts

A separate Company Stock Account and Other Investments Account, which is vested at 100%, will reflect each participant’s interest.

Company Stock Account – This account is credited annually with the employee’s allocable share of Company stock purchased and paid for by the trust or contributed in kind to the trust, and with any stock dividends on Company stock allocated to the employee’s Company Stock Account.

Other Investments Account – This account is credited or debited annually with the employee’s share of net income or loss of the Trust, with any forfeitures of common stock, with any cash dividends on Company stock allocated to the employee’s Company Stock Account, with the employee’s allocable share of the employer contributions in cash and with any forfeitures from Other Investment Accounts.

Investment Funds

The Trustee will invest employer contributions primarily in Company stock.

Put Option

Under Federal income tax regulations, the Company stock that is held by the Plan and its participants and is not readily tradeable on an established securities market, or is subject to trading limitations, includes a put option. The put option is a participant’s right to require the employer to repurchase the Company stock distributed to such participant under a fair valuation formula. The put price is representative of the fair market value of the stock.

A participant can exercise the right to “put” the Company Stock to the Company by submitting written notification to the Plan Administrator during the first sixty days after the stock is distributed by the Plan. If a participant does not exercise the right in the sixty-day period, the participant may do so during the sixty-day period commencing on June 1 of the year following the year in which the participant receives the stock distribution by submitting written notification to the Plan Administrator. If the participant elects a lump sum distribution of Company Stock and then exercises the “put” right, the Company may elect to pay for the stock in equal installments over a period of up to five years, with adequate security and a reasonable rate of interest. If the participant elects installment distributions and exercises the “put” right, the Company must pay the participant for the Company Stock distribution within thirty days after the exercise of the “put” right.

Any stock distributed to a participant cannot ordinarily be transferred to anyone else without first giving the Company and the Plan the opportunity to buy the stock at its fair market value, as determined by an independent appraiser.

Diversifications

Diversification is offered to participants close to retirement so that they may have the opportunity to move part of the value of their investment in Company stock into investments which are more diversified. Participants who are at least age 55 with at least 10 years of participation in the Plan may elect to diversify a portion of their account. Diversification is offered to each eligible participant over a six-year period. The qualified participant may choose to receive this diversification distribution as a direct rollover to a traditional IRA or eligible employer plan or the diversification distribution may be paid directly to the qualified participant. In each of the first five years, a participant may diversify up to 25% of the number of post-1986 shares allocated to his or her account, less any shares previously diversified. In the sixth year, the percentage changes to 50%.

Payment of Benefits

Upon retirement (as defined), death or disablement, a participant is entitled to receive 100% of his or her account balance paid in cash in a lump sum distribution or may be paid in equal installments over a period of up to five years not later than the close of the plan year following the plan year or termination. When the Plan was frozen as of January 1, 2019, all participants became 100% vested.

Payment of the participants vested ESOP account will commence not later than the close of the sixth Plan year following the Plan year in which a participant terminates employment.

Minimum Distribution Requirements

Payment of the participants benefits must commence not later than April 1 of the calendar year following the calendar year in which the participant attains age 70½ (age 72 if born after July 1, 1949) if more than 5% owner of the Company, even if still employed. If not a more than 5% owner, the commencement of the distribution of benefits will be deferred until retirement. Once minimum distributions are required to commence, they are also required in subsequent years. The failure to timely commence or receive any minimum required distribution can result in a 50% penalty tax.

Voting Rights

Each participant is entitled to exercise voting rights attributable to the shares allocated to his or her account and is notified by the Trustee prior to the time that such rights are to be exercised. The Trustee, however, shall vote any allocated shares for which instructions have not been given by a participant. The Trustee is required to vote any unallocated shares. Any investment for which no instructions are received by the Trustee within such time specified by notice and, unless otherwise required by applicable law, any shares which are not allocated to Participants’ accounts shall be voted by the Trustee in the same proportion that the shares for which instructions are received and voted.

NOTE B – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The financial statements of the Plan are prepared using the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

Investments

The Plan’s investment in Company stock is recorded at fair value as determined by a third-party valuation specialist. Purchases and sales of securities are recorded on a trade-date basis. Realized gains and losses from security transactions are reported on the average cost method. Interest income is recorded on the accrual basis and dividends are recorded on the ex-dividend date. Net appreciation in the fair value of investments includes the Plan’s gains and losses on investments bought and sold as well as held during the Plan year.

Benefit Payments

Benefit payments to participants are recorded when paid.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

NOTE C - INVESTMENTS

Financial assets and liabilities reported at fair value at each reporting date are classified and disclosed in one of the following categories: Level 1 – Quoted market prices in active markets for identical assets or liabilities, Level 2 – Observable market-based inputs or unobservable inputs that are corroborated by market data, or Level 3 – Unobservable inputs that are not corroborated by market data.

The asset's or liability's fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement as of the reporting date.

The balances of the Plan’s investment in Peoples Financial Corporation common stock, which are measured at fair value on a recurring basis, by level within the fair value hierarchy as of December 31, 2023 and 2022, respectively, are as follows:

| |

|

Total Assets at

|

|

|

Fair Value Measurements Using

|

|

| |

|

Fair Value

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023

|

|

$ |

3,240,152 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

3,240,152 |

|

|

December 31, 2022

|

|

$ |

3,116,942 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

3,116,942 |

|

The Plan’s investment in Peoples Financial Corporation common stock was determined by a third-party valuation specialist using key inputs from the Plan sponsor and other publicly available information. The specialist used a combined value using the asset based, income and market approaches which are in accordance with the Uniform Standards of Professional Appraisal Practice of the Appraisal Foundation and in accordance with the Principles of Appraisal Practice and Code of Ethics of the American Society of Appraisers, ASA Business Valuation Standards.

The following table presents a summary of changes in the fair value of the Plan’s investment in Peoples Financial Corporation common stock which is measured using Level 3 inputs:

| |

|

For the Year

|

|

|

For the Year

|

|

| |

|

Ended

|

|

|

Ended

|

|

| |

|

December 31, 2023

|

|

|

December 31, 2022

|

|

|

Balance, beginning of period

|

|

$ |

3,116,942 |

|

|

$ |

3,343,369 |

|

| |

|

|

|

|

|

|

|

|

|

Purchases

|

|

|

113,073 |

|

|

|

41,798 |

|

| |

|

|

|

|

|

|

|

|

|

Sales and distributions

|

|

|

(92,744 |

) |

|

|

(166,449 |

) |

| |

|

|

|

|

|

|

|

|

|

Net change in fair value

|

|

|

102,881 |

|

|

|

(101,776 |

) |

| |

|

|

|

|

|

|

|

|

|

Balance, end of period

|

|

$ |

3,240,152 |

|

|

$ |

3,116,942 |

|

NOTE D – COST OF PLAN ADMINISTRATION

The Company absorbs the cost of plan administration.

NOTE E – PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the plan to terminate the Plan subject to the provisions of ERISA.

No eligible employee shall become a Participant, no Participant shall be eligible to further participate in the Plan and no contributions shall accrue as of the date specified January 1, 2019, at which time the Plan was frozen.

NOTE F – TAX STATUS

The Company received a favorable determination letter dated June 6, 2013, from the Internal Revenue Service (“IRS”) under which the Plan qualifies for favorable tax treatment under Sections 401(a) and 4975(e)(7) of the Internal Revenue Code and, therefore, is exempt from federal income taxes under provisions of Section 501(a).

As a result of the Plan’s amendments in 2015, the Company filed an application with the IRS requesting determination concerning the qualification of the Plan. The IRS has notified the Company that it would not review this off-cycle request and that we should rely on the 2013 determination letter.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2023, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

NOTE G – ADMINISTRATION OF PLAN ASSETS

The Plan’s assets consist primarily of Peoples Financial Corporation voting common shares and cash in a money market fund held and managed by the Trustee.

Company contributions are held and managed by the Trustee, which invests cash received, interest and dividend income and makes distributions to participants. A third-party administrator handles the recordkeeping and administrative reports.

Certain administrative functions are performed by officers or employees of the Company. No such officer or employee receives compensation from the Plan.

NOTE H – PARTY-IN-INTEREST TRANSACTIONS

Common stock of the Company, the Plan sponsor, is the only investment of the Plan. The shares held by the Plan at December 31, 2023 and 2022 had a fair value of $3,240,152 and $3,116,942, respectively. The Plan purchased $113,073 (8,457 shares) and sold and distributed $92,744 (7,408 shares) of the Plan sponsor’s common stock during the year ended December 31, 2023.

Members of management of the Plan sponsor are participants in the Plan; however, there are no transactions with these individuals other than their participation in the Plan. The Asset Management & Trust Division of The Peoples Bank, Biloxi, Mississippi, a wholly owned subsidiary of the Plan sponsor, serves as the Trustee of the Plan.

NOTE H – ECONOMIC DEPENDENCY

The Plan is dependent on the Company to fund the liquidity needs of the Plan.

NOTE I – CONCENTRATION OF MARKET RISK

The Plan has invested a significant portion of its assets in Company common stock. This investment in the Company’s common stock approximates 99% of the Plan’s net assets available for benefits as of December 31, 2023. As a result of the concentration, any significant reduction in the market value of the stock could adversely affect individual participant accounts and the net assets of the Plan.

NOTE J – NOTICE OF LATE FILING

The Form 11-K for the Peoples Financial Corporation Employee Stock Ownership Plan for the period ended December 31, 2023, filed an extension under Rule 12b-25. The administrator of the Plan requires additional time to fully develop the financial information necessary to provide complete disclosure in its Form 11-K and to finalize the materials necessary to complete the audit of the Plan.

Peoples Financial Corporation Employee Stock Ownership Plan

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

EIN: 64-0709834 Plan 002

December 31, 2023

|

(A)

|

|

Identity of issuer, borrower,

lessor or similar party (B)

|

Description of investment including maturity date,

rate of interest, collateral, par or maturity date (C)

|

|

Cost (D)

|

|

|

Current Value (E)

|

|

| |

|

|

Cash

|

|

$ |

12,505 |

|

|

$ |

12,505 |

|

|

*

|

|

Peoples Financial Corporation

|

Common stock - 216,010 shares

|

|

|

2,441,839 |

|

|

|

3,240,152 |

|

| |

|

|

Total

|

|

$ |

2,454,344 |

|

|

$ |

3,252,657 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| * |

|

represents party-in-interest

|

|

|

|

|

|

|

|

|

|

See Accompanying Report of Independent Registered Public Accounting Firm.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned thereunto duly authorized.

Peoples Financial Corporation Employee Stock Ownership Plan

Name of Plan

/s/ Daniel A. Bass

______________________________________________

The Asset Management and Trust Division of

The Peoples Bank, Biloxi, Mississippi; Trustee

By: Daniel A. Bass, Vice-President/Trust Officer,

The Peoples Bank, Biloxi, Mississippi

July 10, 2024

Date

Exhibit 23.1:

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement of Peoples Financial Corporation on Form S 8 No. 333-144181 of our report dated July 10, 2024, on our audit of the financial statements of Peoples Financial Corporation Employee Stock Ownership Plan as of December 31, 2023, and for the year then ended and supplemental schedule as of December 31, 2023, which report is included in this Annual Report on Form 11-K to be filed on or about July 10, 2024.

/s/ EisnerAmper LLP

EISNERAMPER LLP

Baton Rouge, Louisiana July 10, 2024

Exhibit 23.2:

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement (No. 333-144181) on Form S-8 of Peoples Financial Corporation of our report dated June 27, 2023, relating to the financial statements and supplement schedule of Peoples Financial Corporation Employee Stock Ownership Plan, appearing in this Annual Report on Form 11-K of Peoples Financial Corporation Employee Stock Ownership Plan for the year ended December 31, 2023.

/s/ Wipfli LLP

Wipfli LLP

Atlanta, Georgia

July 10, 2024

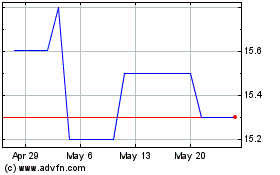

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Nov 2023 to Nov 2024