Plateau Minerals Issues Operational Update

05 February 2011 - 4:41AM

Marketwired

Plateau Mineral Development, Inc. ("Plateau Metals") (PINKSHEETS:

PMDP) is pleased to provide an operational update on the progress

accomplished in the implementation of its recently announced

enhanced business plan and new strategic direction.

On December 14th, 2010, the Company Plateau announced all

unprofitable natural gas operations or opportunities were divested

and in their place the Company has acquired various precious metal

production, shipping, surety, and arbitrage operations.

The Company now reports the following progress:

1. Private change of control of the Company completed resulting in complete

change of Officers and Directors

2. Adoption of new business operations consisting of the following key

components:

a. Precious metal international shipping and arbitrage

b. Risk surety services for trans-shipping and precious metals exchange

and arbitrage

c. Acquisition and development of precious metal production properties

d. Online international marketplace operations for direct purchase,

sale, ownership and storage of smaller quantity precious metals

3. New website outlining new operations at www.plateaumetals.com

4. To accommodate its operations and services across multiple international

time zones, the Company has opened temporary offices in New York and

London, UK

a. 80 Broad Street 5th Floor New York City 10004 United States 917-463-

3364

b. 81 Oxford St London W1D 2EU United Kingdom 44 (0)203 371 7122

5. Signed a three year Gold Trans-shipment and Transaction Handling

agreement valued at $25,000,000 per annum; shipments of which have

already commenced

6. Completing revised Disclosure document and Financial Statements that

reflect the new structure in order to bring the Company to 'current

information' reporting status with the OTC Disclosure service. The

current delay resulting from incomplete prior records and new operation

additions, the project is nearing completion

7. Commenced due diligence on a number of complementary business

opportunities, including on-line precious metal trading and precious

metal recycling and recovery, both of which would expand the Company's

operations and services, thereby increasing revenue potential and

shareholder value.

8. Filing of the Company's complete financials was originally anticipated

for 30 Jan 2011. Complete financials will be posted on or before 15

February as new operational additions are completed.

9. Preliminary financials will be posted to the company's web site before

official filing of final documents with the OTC Disclosure Service.

The increased demand for all precious metals, particularly gold,

is supported by the recent World Gold Council (WGC) complete Third

Quarter Gold Market Outlook that reports increased 2010 worldwide

demand across all sectors. Demand is seen coming from the jewelry

sector, as well as from institutions, including central banks, and

a jump in industrial demand "on the back of renewed growth in the

electronics industry, due to the majority of semi-conductors being

wired by gold."

This growing demand is expected to continue to grow through 2011

and beyond which has already placed the Company's broad range of

Precious Metal services in high demand and additional agreements

and business unit activations are anticipated. The Company believes

the G7 governments, with the USA as the leader, will continue to

debase their currencies thereby further pushing gold and silver

back into the forefront as inflationary safe-havens and

value-storage.

The Company will continue to provide regular updates regarding

progress on the implementation of its new business model.

About Plateau Plateau Metals provides

precious metal shipping, access to production, transaction

underwriting, and related services. Plateau operates across the

world through its agents and offers service to multiple

jurisdictions. Plateau offers complete solutions to buyers and

sellers of precious metals that include storage, shipping, and

transaction underwriting and arbitrage.

Plateau also acquires, develops, integrates and operates

strategically aligned precious metal assets in worldwide markets

where expansion is planned through additional investments to

support organic growth; thereby providing significant revenue, and

equity growth.

The company's operations and services are distributed across

multiple international time zones with executives and agents

located in client-appropriate locales. The company's website is

www.plateaumetals.com.

Safe Harbor Statement: This information

includes certain "forward-looking statements." The forward-looking

statements reflect the beliefs, expectations, objectives and goals

of the Company management with respect to future events and

financial performance. They are based on assumptions and estimates,

which are believed reasonable at the time such statements are made.

However, actual results could differ materially from anticipated

results. Important factors that may impact actual results include

but are not limited to commodity prices, political developments,

legal decisions, market and economic conditions, industry

competition, the weather, changes in financial markets and changing

legislation and regulations. Matters discussed in this press

release may contain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. When used

in this press release, the words "anticipate," "believe,"

"estimate," "may," "intend," "expect" and similar expressions

identify such forward-looking statements. Actual results,

performance or achievements could differ materially from those

contemplated, expressed or implied by the forward-looking

statements contained herein. These forward-looking statements are

based largely on the expectations of the Company and are subject to

a number of risks and uncertainties. These include but are not

limited to risks and uncertainties associated with the impact of

economic, competitive and other factors affecting the Company and

its operations, markets, product, and distributor performance, the

impact on the national and local economies resulting from terrorist

actions, and U.S. actions subsequently; and other factors detailed

in reports filed by the Company. Forward-looking statements are

intended to qualify for the safe harbor provisions of Section 21E

of the Securities and Exchange Act of 1934, as amended.

CONTACT: Plateau Metals Investor Relations New York:

1.917.463.3364 London: +(44) (0)20 337 17122 Fax: +(44) (0)208 338

0655 info@plateaumetals.com

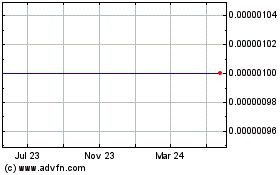

Plateau Mineral Developm... (CE) (USOTC:PMDP)

Historical Stock Chart

From Oct 2024 to Nov 2024

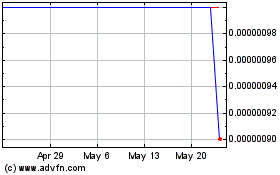

Plateau Mineral Developm... (CE) (USOTC:PMDP)

Historical Stock Chart

From Nov 2023 to Nov 2024