Plateau Minerals Leverages Financing and Surety Anticipating Continuing Increase in Demand for Gold Bullion Caused by Mideast Un

19 March 2011 - 2:11AM

Marketwired

Plateau Mineral Development, Inc ("Plateau Metals") (PINKSHEETS:

PMDP) announced today it is preparing to increase its capacity in

all operations to meet the rising world demand for 'physical gold'

and other precious metals.

The continuing and widespread unrest in the Mideast and North

Africa has been a driving force for investors, looking for a safe

haven, to demand physical possession, mainly in the form of

bullion.

This demand positively affects all aspects of the Company's

operations including shipping, refining, storage and surety, which

operate on an international basis.

The Company's recent $60 million Formal Financial Guarantee and

Commitment, together with the worldwide resources enable it to meet

the expected growth across all its operations.

The Company had recently announced a substantial volume increase

in its Purchase, Shipping Refining and Resale business and expects

to make further growth announcements in the near future.

The recent World Gold Council (WGC) Third Quarter Gold Market

Outlook had reported increased 2010 worldwide demand across all

sectors, including "jewellery, institutions including central

banks, and a jump in industrial demand "on the back of renewed

growth in the electronics industry, due to the majority of

semi-conductors being wired by gold."

Reports worldwide for 2011 are even more favourable citing:

- "Skyrocketing demand for gold in China" evidenced by imports of

gold which are on track for a 500% annual increase.

- Chinese regulators have approved the first mutual fund to

invest in gold-backed ETFs.

- "Bar hoarding" is on the rise, too, increasing 44% over 2009 as

investors increasingly take physical delivery of their

merchandise,

- Net retail investments continue to grow, keeping pace with last

year's 60% increase

- level of buying also driven by central banks, mostly in the

Middle East and Asia

- Russia absorbed a full 63% of its own 2009 production, Iran

announced that it is converting $45 billion into a mix of euros and

gold and a smaller (unnamed) Mideast nation has indicated that it

is converting 200,000 barrels per day of oil production into gold,

the annualized equivalent of 140 tons of gold yearly at the current

oil-to-gold ratio.

About Plateau

Plateau Metals provides precious metal shipping, access to

production, transaction underwriting, and related services. Plateau

operates across the world through its agents and offers service to

multiple jurisdictions. Plateau offers complete solutions to buyers

and sellers of precious metals that include storage, shipping, and

transaction underwriting and arbitrage.

Plateau also acquires, develops, integrates and operates

strategically aligned precious metal assets in worldwide markets

where expansion is planned through additional investments to

support organic growth; thereby providing significant revenue, and

equity growth.

The company's operations are distributed across multiple

international time zones with executives and agents located in

client-appropriate locales. The company's website is

www.plateaumetals.com.

Safe Harbor Statement:

This information includes certain "forward-looking statements."

The forward-looking statements reflect the beliefs, expectations,

objectives and goals of the Company management with respect to

future events and financial performance. They are based on

assumptions and estimates, which are believed reasonable at the

time such statements are made. However, actual results could differ

materially from anticipated results. Important factors that may

impact actual results include but are not limited to commodity

prices, political developments, legal decisions, market and

economic conditions, industry competition, the weather, changes in

financial markets and changing legislation and regulations. Matters

discussed in this press release may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. When used in this press release, the words

"anticipate," "believe," "estimate," "may," "intend," "expect" and

similar expressions identify such forward-looking statements.

Actual results, performance or achievements could differ materially

from those contemplated, expressed or implied by the

forward-looking statements contained herein. These forward-looking

statements are based largely on the expectations of the Company and

are subject to a number of risks and uncertainties. These include

but are not limited to risks and uncertainties associated with the

impact of economic, competitive and other factors affecting the

Company and its operations, markets, product, and distributor

performance, the impact on the national and local economies

resulting from terrorist actions, and U.S. actions subsequently;

and other factors detailed in reports filed by the Company.

Forward-looking statements are intended to qualify for the safe

harbor provisions of Section 21E of the Securities and Exchange Act

of 1934, as amended.

CONTACT: Plateau Metals Investor Relations New York:

1.917.463.3364 London: +(44) (0)20 337 17122 Fax: +(44) (0)208 338

0655 info@plateaumetals.com

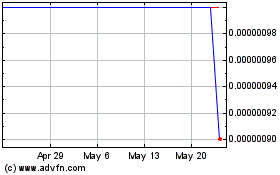

Plateau Mineral Developm... (CE) (USOTC:PMDP)

Historical Stock Chart

From Oct 2024 to Nov 2024

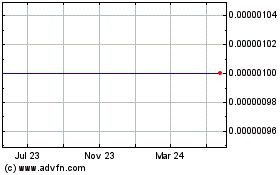

Plateau Mineral Developm... (CE) (USOTC:PMDP)

Historical Stock Chart

From Nov 2023 to Nov 2024