VW Forecasts Higher Sales, Earnings in 2017 -- Update

14 March 2017 - 10:01PM

Dow Jones News

By William Boston

WOLFSBURG, Germany--Volkswagen AG, struggling to shoulder the

costs of its emissions-cheating scandal, on Tuesday forecast higher

sales and earnings in 2017 as it detailed its return to profit last

year following its worst-ever loss in the wake of the diesel

crisis.

The German car maker faces a tough challenge convincing

investors that it is putting the diesel crisis behind it and is on

track to deliver strong earnings in the years ahead after racking

up more than $25 billion in fines, penalties and compensation in

the U.S. to settle criminal and civil litigation related to the

diesel scandal.

The company recently reported net profit of 5.14 billion euros

for last year, after a record loss of EUR1.6 billion for 2015.

Volkswagen generated revenue of EUR217.3 billion last year, an

increase of nearly 2%. The company sold 10.4 million vehicles in

2016, overtaking Toyota Motor Corp. as the world's largest auto

maker by sales.

"2016 did not turn out to be the nightmare year that many

predicted for Volkswagen," Chief Executive Matthias Muller told

reporters. "Even though much work lies ahead of us, Volkswagen is

back on track."

Volkswagen last week pleaded guilty to criminal charges for

rigging diesel-powered vehicles to cheat on government emissions

tests, capping the final significant U.S. legal settlement expected

in a long-running deception that hammered the German auto company's

reputation and finances.

For the new year, Volkswagen forecast a 4% increase in sales

revenue, moderately higher vehicle sales, and a pretax return on

sales of between 6% and 7%.

The outlook for 2017 was neither as detailed nor as robust as

investors had hoped, causing Volkswagen's widely traded non-voting

preference shares to slip 0.9% to EUR142.85 in early trading on the

Frankfurt Stock Exchange.

Mr. Mueller, after taking the helm in September 2015, launched a

major restructuring of the company in a bid to put more

decision-making power in the hands of brand managers and regional

organizations and increase profits.

The biggest challenge has been restructuring the Volkswagen

namesake brand, the company's core passenger-car business. Efforts

to boost productivity and earnings have been bogged down in

internal power struggles between the brand's management and the

powerful IG Metall trade union, which controls half the seats on

Volkswagen's 20-member supervisory board.

VW-brand operating profit fell 11% to EUR1.9 billion last

year.

"In times where most other car companies are improving

efficiency and shaping the industry, VW needs to be very mindful

not to waste any more time with internal power struggles," said

Arndt Ellinghorst, auto analyst at Evercore ISI, a London-based

brokerage. "Volkswagen's shareholders, employees and customers

desperately need a success story."

Although the Volkswagen passenger-car business is the company's

biggest division, the lion's share of profits come from its luxury

brand Audi and sports-car maker Porsche.

Porsche remained robust in 2016, reporting a nearly 14% increase

in earnings to EUR3.9 billion.

But Audi is struggling. New car sales edged up slightly last

year, but earnings slipped nearly 6% to EUR4.85 billion.

Write to William Boston at William.Boston@wsj.com

(END) Dow Jones Newswires

March 14, 2017 06:46 ET (10:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

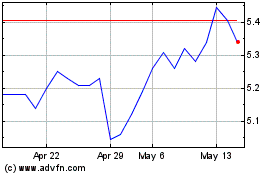

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

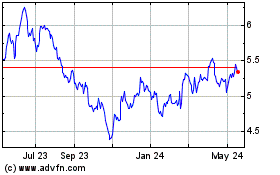

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jul 2023 to Jul 2024