UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-QSB/A

(Amendment No.1)

[ X ] Quarterly Report pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

For the period ended May 31, 2007

[ ] Transition Report pursuant to 13 or 15(d) of the Securities Exchange Act

of 1934

For the transition period to

Commission File Number 333-139773

K-9 Concepts, Inc.

___________________________________________________

(Exact name of Small Business Issuer as specified in its charter)

Nevada Pending

(State or other jurisdiction of (IRS Employer Identification No.)

incorporation or organization)

6250 King's Lynn Street

Vancouver, British Columbia, Canada V5S 4V5

(Address of principal executive offices) (Postal or Zip Code)

Issuer's telephone number, including area code: 604-618-2888

N/A

(Former name, former address and former fiscal year, if changed since last

report)

Check whether the issuer (1) filed all reports required to be filed by Section

13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the issuer was required to file such

reports), and (2) has been subject to such filing requirements for the past 90

days

Yes [ X ] No [ ]

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act).

Yes [] No [ X ]

State the number of shares outstanding of each of the issuer's classes of

common stock, as of the latest practicable date: 6,400,000 shares of common

stock with par value of $0.001 per share outstanding as of July 16, 2007.

EXPLANATORY REASON FOR AMEMENDMENT:

The Company has never been a "Shell" status and the box was checked wrongly. The Box "NO" is now properly checked.

<PAGE>

K-9 CONCEPTS, INC.

(A development stage Company)

FINANCIAL STATEMENTS

May 31, 2007

BALANCE SHEETS

STATEMENT OF OPERATIONS

STATEMENT OF CASH FLOWS

NOTES TO THE FINANCIAL STATEMENTS

<PAGE>

<TABLE>

<CAPTION>

K-9 CONCEPTS, INC.

A DEVELOPMENT STAGE COMPANY

BALANCE SHEET

(EXPRESSED IN US DOLLARS)

<S>

May 31, August

2007 31, 2006

<C> ASSETS (Unaudited) (Audited)

CURRENT ASSETS <C> <C>

Cash

$ 8,945 $ 16,826

Account receivable 96 96

Total Assets 9,041 16,922

STOCKHOLDERS' EQUITY

STOCKHOLDERS' EQUITY

Common stock(Note 3)

Authorized

75,000,000, par value $0.001 per share

Issued and outstanding:

6,400,000 common shares

(August 31, 2006 - 6,400,000 common shares 6,400

6,400

Additional paid in capital 27,100 22,600

Deficit accumulated during the

development stage (24,459) (12,078)

TOTAL STOCKHOLDERS' EQUITY 9,041 16,922

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 9,041 $ 16,922

The accompanying notes are an integral part of these financial statements.

<PAGE>

<TABLE>

<CAPTION>

K-9 CONCEPTS, INC.

A DEVELOPMENT STAGE COMPANY

STATEMENT OF OPERATIONS

(EXPRESSED IN US DOLLARS)

(UNAUDITED)

<S>

Three Three Nine Nine August 25,

Months Months Months Months 2005 (Date

Ended Ended Ended Ended of Inception)

May 31, May 31, May 31 May 31 to May 31,

2007 2006 2007 2006 2007

<C> <C> <C> <C> <C>

<C>

Bank charges $ 20 $ 18 $ 107 $ 80 $ 331

Filing and transfer

agent fees 5,000 - 5,750 - 5,750

Management fees 1,500 1,500 4,500 1,500 7,500

Marketing - - 1,626 1,626

Professional fees 2,000 - 2,000 - 6,348

Travel and entertainment - - 24 240 2,904

Loss for the period $ (8,520) $ 1,518 $(12,381) $ 3,446 $ 24,459

BASIC AND DILUTED

LOSS PER SHARE $ (0.00) $(0.00) $ (0.00) $(0.00)

WEIGHTED AVERAGE NUMBER OF

SHARES OUTSTANDING 6,400,000 6,271,111 6,400,000 4,739,927

The accompanying notes are an integral part of these financial statements.

<PAGE>

<TABLE>

<CAPTION>

K-9 CONCEPTS, INC.

A DEVELOPMENT STAGE COMPANY

STATEMENT OF CASH FLOWS

(EXPRESSED IN US DOLLARS)

(UNAUDITED)

<S>

Nine Nine

Months Months

Ended Ended August 25, 2005

May 31, May 31, (Date of Inception)

2007 2006 May 31, 2007

<C> <C> <C> <C>

CASH FLOWS FROM

OPERATING

ACTIVITIES

Net loss $ (12,381) $ - $ (24,459)

Non-cash item:

Donated services 4,500 - 7,500

Changes in non-cash

operating working

capital item:

Other receivable - - (96)

Net cash (used in)

operating activiites (7,881) - (17,055)

Cash Flows From Financing

Activities

Issuance of common

shares - - 26,000

Net cash provided by

financing activities - - 26,000

Increase (decrease) in

Cash (7,881) - 8,945

Cash, Beginning 16,826 - -

Cash, Ending $ 8,945 $ - $ 8,945

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

CASH PAID DURING THE PERIOD FOR:

Interest $ - $ - $ -

Income taxes $ - $ - $ -

</TABLE>

The accompanying notes are an integral part of these financial statements.

<PAGE>

K-9 CONCEPTS, INC.

A DEVELOPMENT STAGE COMPANY

NOTES TO FINANCIAL STATEMENTS

MAY 31, 2007

(EXPRESSED IN US DOLLARS)

(UNAUDITED)

NOTE 1. BASIS OF PRESENTATION

Unaudited Interim Financial Statements

The accompanying unaudited interim financial statements have been

prepared in accordance with United States generally accepted accounting

principles for interim financial information and with the instructions

pertaining to Form 10-QSB of Regulation S-B. They may not include all

information and footnotes required by United States generally accepted

accounting principles for complete financial statements. HOwever, except

as disclosed herein, there have been no material changes in the

information disclosed in the notes to the financial statements for the

year ended August 31, 2006, included in the Company's Form 10-KSB filed

with the Securities and Exchange Commission. These unaudited interim

financial statements should be read in conjunction with the audited

financial statements included in the Form 10-KSB. In the opinion of

Management, all adjustments, considered necessary for fair presentation,

consisting solely of normal recurring adjustments, have been made.

Operating results for nin months ended May 31, 2007 are not necessarily

indicative of the results that may be expected for the year ending

August 31, 2007

Going Concern

The accompanying financial statements have been prepared assuming the

Company will continue as a going concern. As of May 31, 2007, the

Company has a working capital of $9,041, has not yet acheived profitable

operations and has accumulated a deficite of $24,459 since inception. Its

ability to continue as a going concern is dependent upon the ability of

the Company to obtain the necessary financing to meet its obligations and

pay its liabilities arising from normal business operations when they

come due. The outcome of these matters cannot be predicted with any

certainty at this time and raise substantial doubt that the Company will

be able to continue as a going concern. These financial statements do

not include any adjustments to the amounts and classification of assets

and liabilities a that may be necessary should the Company be unable to

contintue as a going concern. Management believes that the Company has

adequate funds to carry on operations for the upcoming fiscal year.

NOTE 2.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

These financial statements have been prepared in accordance with

generally accepted accounting principles in the United States of America

("US GAAP").

USE OF ESTIMATES

The preparation of financial statements in conformity with US GAAP

requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities at the dates of the financial statements and the

reported amounts of revenues and expenses during the reporting periods.

Actual results could differ from these estimates.

ORGANIZATIONAL AND START-UP COSTS

Costs of start-up activities, including organizational costs, are

expensed as incurred

<PAGE>

K-9 CONCEPTS, INC.

A DEVELOPMENT STAGE COMPANY

NOTES TO FINANCIAL STATEMENTS

MAY 31, 2007

(EXPRESSED IN US DOLLARS)

(UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT'D)

DEVELOPMENT STAGE COMPANY

The Company is in the development stage. Since its formation, the Company

has not yet realized any revenues from its planned operations.

FOREIGN CURRENCY TRANSLATION

The reporting currency of the Company is the United States Dollar;

functional currency of the Company is the U.S. Dollar. The accounts of

other currencies are translated into US Dollars on the following basis:

Monetary assets and liabilities are translated at the current rate of

exchange.

The weighted average exchange rate for the period is used to translate

revenue, expenses, and gains or losses from the functional currency to

the reporting currency.

The gain or loss on the foreign currency financial statements is reported

as a separate component of stockholders' equity and not recognized in net

income. Gains or losses on remeasurement from the recording currency are

recognized in current net income.

Gains or losses from foreign currency transactions are recognized in

current net income.

Fixed assets are measured at historical exchange rates that existed at

the time of the transaction.

Depreciation is measured at historical exchange rates that existed at the

time the underlying related asset was acquired.

The effect of exchange rate changes on cash balances is reported in the

statement of cash flows as a separate part of the reconciliation of

change in cash and cash equivalents during the period.

FINANCIAL INSTRUMENTS

As defined in Financial Accounting Standards Board ("FASB") No. 107, the

company estimates whether the fair value of all financial instruments

differ materially from the aggregate carrying values of its financial

instruments recorded in the accompanying balance sheet, which need to be

disclosed. The estimated fair values of amounts have been determined by

the Company using available market information and appropriate valuation

methodologies. Considerable judgment is required in interpreting market

data to develop the estimates of fair value, and accordingly, the

estimates are not necessarily indicative of the amounts that the Company

could realize in a current market exchange.

<PAGE>

K-9 CONCEPTS, INC.

A DEVELOPMENT STAGE COMPANY

NOTES TO FINANCIAL STATEMENTS

MAY 31, 2007

(EXPRESSED IN US DOLLARS)

(UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT'D)

FINANCIAL INSTRUMENTS (CONT'D)

The company's financial instruments consist of cash and accounts payable

and accrued liabilities. Unless otherwise noted, it is management's

opinion that the company is not exposed to significant interest, currency

or credit risks arising from these financial instruments. The fair value

of these financial instruments approximate their carrying values.

INCOME TAXES

The Company has adopted Statements of Financial Accounting Standards

("SFAS") No. 109 - "Accounting for Income Taxes". SFAS No. 109 requires

the use of the asset and liability method of accounting of income taxes.

Under the asset and liability method of SFAS No. 109, deferred tax assets

and liabilities are recognized for the future tax consequences

attributable to temporary differences between the financial statements

carrying amounts of existing assets and liabilities and their respective

tax bases. Deferred tax assets and liabilities are measured using enacted

tax rates expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled.

LOSS PER SHARE

In accordance with SFAS No. 128 - "Earnings Per Share", the basic loss

per common share is computed by dividing net loss available to common

stockholders by the weighted average number of common shares outstanding.

Diluted loss per common share is computed similar to basic loss per

common share except that the denominator is increased to include the

number of additional common shares that would have been outstanding if

the potential common shares had been issued and if the additional common

shares were dilutive. At May 31, 2007, the Company had no dilutive stock

equivalents, accordingly diluted loss per share has not been presented.

<PAGE>

K-9 CONCEPTS, INC.

A DEVELOPMENT STAGE COMPANY

NOTES TO FINANCIAL STATEMENTS

MAY 31, 2007

(EXPRESSED IN US DOLLARS)

(UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT'D)

STOCK-BASED COMPENSATION

The Company accounts for equity instruments issued in exchange for the

receipt of goods or services from other than employees in accordance with

SFAS No. 123 and the conclusions reached by the Emerging Issues Task

Force ("EITF") in Issue No. 96-18 ("EITF 96-18"). Costs are measured at

the estimated fair market value of the consideration received or the

estimated fair value of the equity instruments issued, whichever is more

reliably measurable. The value of equity instruments issued for

consideration other than employee services is determined on the earliest

of a performance commitment or completion of performance by the provider

of goods or services as defined by EITF 96-18.

The Company has also adopted the provisions of the FASB Interpretation

No.44, Accounting for Certain Transactions Involving Stock Compensation -

An Interpretation of Accounting Principals Board ("APB") Opinion No. 25

("FIN 44"), which provides guidance as to certain applications of APB 25.

The Company has not adopted a stock option plan and has not granted any

stock options. Accordingly, no stock-based compensation has been recorded

to date.

NOTE 3.COMMON STOCK

In October 2005, the Company subscribed 2,000,000 shares of common stock

at a price of @0.001 per share for total proceeds of $2,000.

In November 2005, the Company subscribed 4,000,000 shares of common stock

at a price of $0.001 per share for total proceeds of $4,000.

In March 2006, the Company subscribed 400,000 shares of common stock at a

price of $0.05 per share for total proceeds of $20,000.

The total number of common authorized that may be issued by the Company

is 75,000,000 shares of common stock with a par value of one-tenth of one

cent ($0.001) per share. No other class of shares is authorized.

During the period from August 25, 2005 (inception) to August 31, 2006,

the Company subscribed 6,400,000 common shares for total cash proceeds of

$26,000.

At May 31, 2007, there were no outstanding stock options or warrants.

<PAGE>

K-9 CONCEPTS, INC.

A DEVELOPMENT STAGE COMPANY

NOTES TO FINANCIAL STATEMENTS

MAY 31, 2007

(EXPRESSED IN US DOLLARS)

(UNAUDITED)

NOTE 3.COMMON STOCK (CONT'D)

COMMON SHARES

The common shares of the Company are all of the same class.

ADDITIONAL PAID-IN CAPITAL

The excess of proceeds received for shares of common stock over their par

value of $0.001, less share issue costs, is credited to additional paid-in

capital.

NOTE 4. RELATED PARTY TRANSACTIONS

The Company recognized donated services by directors of the Company for

2007management fees, valued at $500 per month, totaling $4,500 for the

period from September 1, 2006 to May 31, 2007 and $3,000 for the period

from March 1, 2006 to August 31, 2006. These transactions were recorded

at the exchange amount which is the amount agreed to by the related

parties.

NOTE 5. INCOME TAXES

At May 31, 2007, the Company has accumulated non-capital losses

totaling $24,459, which are available to reduce taxable income in

future taxation years. These losses expire beginning 2027. The

potential benefit of those losses, if any, has not been recorded in the

financial statements as these losses are not likely to be realized.

<PAGE>

FORWARD-LOOKING STATEMENTS

This Form 10-QSB includes "forward-looking statements" within the meaning of

the"safe-harbor" provisions of the Private Securities Litigation Reform Act of

1995. Such statements are based on management's current expectations and are

subject to a number of factors and uncertainties that could cause actual

results to differ materially from those described in the forward-looking

statements.

All statements other than historical facts included in this Form, including

without limitation, statements under "Plan of Operation", regarding our

financial position, business strategy, and plans and objectives of management

for the future operations, are forward-looking statements.

Although we believe that the expectations reflected in such forward-looking

statements are reasonable, it can give no assurance that such expectations will

prove to have been correct. Important factors that could cause actual results

to differ materially from our expectations include, but are not limited to,

market conditions, competition and the ability to successfully complete

financing.

ITEM 2. PLAN OF OPERATION

The success of our business plan depends heavily on the strength of national

and local new residential construction, home improvement and remodelling

markets. Future downturns in new residential construction and home improvement

activity may result in intense price competition among building materials

suppliers, which may adversely affect our intended business.

The building products distribution industry is subject to cyclical market

pressures and most impacted by changes in the demand for new homes and in

general economic conditions that impact the level of home improvements. Our

business success depends on anticipating changes in consumer preferences and on

successful new product and process development and product re-launches in

response to such changes. Consumer preferences for our products shift due to a

variety of factors that affect discretionary spending, including changes in

demographic and social trends and downturn in general economic conditions.

The building materials distribution industry is extremely fragmented and

competitive. Our competition varies by product line, customer classification

and geographic market. The principal competitive factors in our industry are

pricing and availability of product, service and delivery capabilities, ability

to assist with problem-solving, customer relationships, geographic coverage and

breadth of product offerings. We compete with many local, regional and

national building materials distributors and dealers.

Separate showers and baths have also become de rigueur in many households and

increasingly a major component in the Personal Healthcare industry segment.

Showers have morphed into vertical spas and the use of multiple shower heads is

also growing in popularity, often with multiple sprays for each head.

We are positioning ourselves to take advantage of current market and industry

trends for the Personal Healthcare segment; including an increased emphasis on

a personal health care lifestyle and an increased emphasis on spending time at

home or "cocooning". Consumers in this industry segment wish to remain active

and seek personal health care products to maintain a high quality of life.

These "baby boomers" typically have more discretionary income, which are more

likely spent on home remodelling projects (including projects to improve their

pools and spas).

We intend to develop our retail network by initially focusing our marketing

efforts on larger chain stores that sell various types of shower heads, such as

Home Depot. These businesses sell more shower heads, have a greater budget for

in-stock inventory and tend to purchase a more diverse assortment of shower

heads. In 2007, we anticipate expanding our retail network to include small to

medium size retail businesses whose businesses focus is limited to the sale of

bathroom accessories. Any relationship we arrange with retailers for the

wholesale distribution of our shower heads will be non-exclusive. Accordingly,

we will compete with other shower head vendors for positioning of our products

in retail space.

Even if we are able to receive an order commitment, some larger chains will

only pay cash on delivery and will not advance deposits against orders. Such a

policy may place a financial burden on us and, as a result, we may not be able

to deliver the order. Other retailers may only pay us 30 or 60 days after

delivery, creating an additional financial burden.

We intend to retain one full-time sales person in the next six months, as well

as an additional full-time sales person in the six months thereafter. These

individuals will be independent contractors compensated solely in the form of

commission based upon bamboo flooring sales they arrange. We expect to pay each

sales person 12% to 15% of the net profit we realize from such sales.

We therefore expect to incur the following costs in the next 12 months in

connection with our business operations:

Marketing costs: $20,000

General administrative costs: $10,000

Total: $30,000

In addition, we anticipate spending an additional $10,000 on administrative

fees. Total expenditures over the next 12 months are therefore expected to be

$40,000.

While we have sufficient funds on hand to commence business operations, our

cash reserves are not sufficient to meet our obligations for the next twelve-

month period. As a result, we will need to seek additional funding in the near

future. We currently do not have a specific plan of how we will obtain such

funding; however, we anticipate that additional funding will be in the form of

equity financing from the sale of our common stock.

We may also seek to obtain short-term loans from our directors, although no

such arrangement has been made. At this time, we cannot provide investors with

any assurance that we will be able to raise sufficient funding from the sale of

our common stock or through a loan from our directors to meet our obligations

over the next twelve months. We do not have any arrangements in place for any

future equity financing.

If we are unable to raise the required financing, we will be delayed in

conducting our business plan.

Our ability to generate sufficient cash to support our operations will be based

upon our sales staff's ability to generate bamboo flooring sales. We expect to

accomplish this by securing a significant number of agreements with large and

small retailers and by retaining suitable salespersons with experience in the

retail sales sector.

RESULTS OF OPERATIONS FOR PERIOD ENDING MAY 31, 2007

We did not earn any revenues in the nine-month period ended May 31, 2007.

During the same period, we incurred operating expenses of $12,381 consisting

of management fees of $4,500, filing and transfer agent fees of $5,750,

professional fees of $2,000, travel and promotion costs of $24, and bank

charges of $107.

<PAGE>

At May 31, 2007, we had assets of $9,041 consisting of $8,945 in cash and $96

in accounts receivable. We did not have any liabilities as of May 31, 2007.

We have not attained profitable operations and are dependent upon obtaining

financing to pursue exploration activities. For these reasons our auditors

believe that there is substantial doubt that we will be able to continue as a

going concern.

ITEM 3 CONTROLS AND PROCEDURES

EVALUATION OF DISCLOSURE CONTROLS

We evaluated the effectiveness of our disclosure controls and procedures as

of May 31, 2007. This evaluation was conducted by Albert Au, our chief

executive officer and Jeanne Mok, our principal accounting officer.

Disclosure controls are controls and other procedures that are designed

to ensure that information that we are required to disclose in the reports we

file pursuant to the Securities Exchange Act of 1934 is recorded,

processed, summarized and reported.

LIMITATIONS ON THE EFFECTIVE OF CONTROLS

Our management does not expect that our disclosure controls or our

internal controls over financial reporting will prevent all error and fraud.

A control system, no matter how well conceived and operated, can provide only

reasonable, but no absolute, assurance that the objectives of a control

system are met. Further, any control system reflects limitations on

resources, and the benefits of a control system must be considered relative to

its costs. These limitations also include the realities that judgments in

decision-making can be faulty and that breakdowns can occur because of simple

error or mistake. Additionally, controls can be circumvented by the

individual acts of some persons, by collusion of two or more people or

by management override of a control. A design of a control system is

also based upon certain assumptions about potential future conditions; over

time, controls may become inadequate because of changes in conditions,

or the degree of compliance with the policies or procedures may deteriorate.

Because of the inherent limitations in a cost- effective control system,

misstatements due to error or fraud may occur and may not be detected.

CONCLUSIONS

Based upon their evaluation of our controls, Albert Au, our chief

executive officer and Jeanne Mok, our principal accounting officer, have

concluded that, subject to the limitations noted above, the disclosure

controls are effective providing reasonable assurance that material

information relating to us is made known to management on a timely basis

during the period when our reports are being prepared. There were no changes

in our internal controls that occurred during the quarter covered by this

report that have materially affected, or are reasonably likely to materially

affect our internal controls.

PART II- OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

The Company is not a party to any pending legal proceeding. Management is

not aware of any threatened litigation, claims or assessments.

ITEM 2. CHANGES IN SECURITIES

None.

<PAGE>

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS AND REPORT ON FORM 8-K

31.1 Certification pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

31.2 Certification pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

32.1 Certification pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

32.2 Certification pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

We did not file any current reports on Form 8-K during the period.

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused

this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

July 16, 2007

K-9 Concepts, Inc.

/s/ Albert Au

------------------------------

Albert Au, President

=============================================================

AMENDMENT SIGNATURE

Resubmitted: December 1, 2015

Now Called Predictive Technology Group, Inc. (f.k.a Global Enterprises Group, Inc.)(f.k.a Global Housing Group, Inc.)

In accordance with the requirements of the Exchange Act, the registrant caused this amended report to be signed on its behalf by the undersigned, thereunto duly

authorized.

By: Merle Ferguson

/s/ Merle Ferguson

Chairman

December 1, 2015

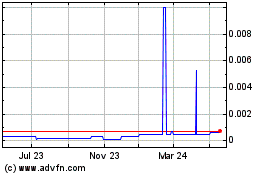

Predictive Technology (CE) (USOTC:PRED)

Historical Stock Chart

From Dec 2024 to Jan 2025

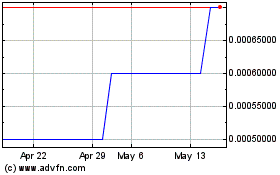

Predictive Technology (CE) (USOTC:PRED)

Historical Stock Chart

From Jan 2024 to Jan 2025