Q.E.P. Co., Inc. Completes Acquisition of ArborCraft Floors and Simultaneously Expands Its Credit Facilities

15 February 2010 - 5:31PM

Q.E.P. CO., INC. (Pink Sheets:QEPC) (the "Company") today announced

that on Friday, February 12, 2010, it completed the acquisition of

substantially all of the assets and the assumption of certain

liabilities of ArborCraft, LLC.

ArborCraft, formerly Harris-Tarkett, was founded in 1898 as The

Harris Manufacturing Company and has evolved into a leading North

American hardwood flooring manufacturer. ArborCraft produces a

broad line of hardwood flooring including prefinished engineered

plank, prefinished solid flooring and unfinished parquet along with

related moldings and accessories sold under the Tarkett®, Genesis

and Harris® brands. The ArborCraft operations employ

approximately 190 people in three facilities located on

approximately 67 acres in Johnson City, Tennessee, and Montpelier,

Indiana. The facilities include over 500,000 square feet of

manufacturing and drying space in addition to a 192,000 square foot

lumber yard.

Mr. Lewis Gould, Chairman of the Company's Board of Directors,

commented: "We are very pleased to report to our shareholders the

completion of this important acquisition. The acquisition will be a

key component of the Company's strategy to become a 'full line

supplier' to the flooring industry. Q.E.P., under various brand

names, supplies adhesives, underlayment, tools, chemicals and now

flooring in this strategy."

ArborCraft had 2009 net sales of approximately $27.8 million.

Consideration for the transaction included approximately $6.2

million of cash, subject to a post-closing working capital

adjustment, and the issuance of a subordinated term note to the

seller of approximately $3.8 million, which consideration is

substantially equivalent to the fair value of the net assets

acquired.

In connection with the acquisition, the Company amended its

domestic asset based loan agreement to increase its revolving

credit facility from $27 million to $34 million, establish a $6.0

million term loan and extend the maturity of the loan agreement to

May 2013. The interest rate applicable to the revolving credit

facility was amended to a range of Libor plus 2.75% to 3.75% for

advances with fixed maturities and to a range of the Base Rate plus

1.75% to 2.75% for all other advances. The term loan bears interest

equal to, at the option of the Company, the Libor rate or Base Rate

interest rates applicable to the revolving credit facility plus

0.25%, has a term that varies with the term of the loan agreement,

and requires quarterly payments of principal of approximately $0.2

million with a balloon payment upon maturity. There were no changes

to the financial covenants included in the loan agreement. Prior to

completion of the ArborCraft transaction, the Company had borrowed

approximately $11.7 million under its domestic revolving credit

facility and approximately $11.0 million was available for future

borrowings.

The subordinated term note issued to the seller matures in May

2013, requires quarterly payments of principal of approximately

$0.3 million and bears interest at 6.75% per annum. The note

is fully subordinated to the Company's domestic asset based loan

agreement and is collateralized by certain property, plant and

equipment and intangible assets acquired in the ArborCraft

transaction.

Q.E.P. Co., Inc., founded in 1979, is a leading worldwide

manufacturer, marketer and distributor of a comprehensive line of

hardwood flooring, flooring installation tools, adhesives and

flooring related products targeted at the professional

installer as well as the do-it-yourselfer. Under brand names

including QEP®, ROBERTS®, Capitol®, Vitrex®, PRCI®, BRUTUS® and

Elastiment®, and now including Tarkett®, Genesis and Harris®, the

Company markets over 3,000 flooring and flooring related

products. In addition to a complete hardwood flooring line,

Q.E.P. products are used primarily for surface preparation and

installation of wood, laminate, ceramic tile, carpet and vinyl

flooring. The Company sells its products to home improvement retail

centers and specialty distribution outlets in 50 states and

throughout the world.

This press release contains forward-looking statements,

including statements regarding the expected benefits resulting from

the acquisition, our strategic plans and the fair value of net

assets acquired, that involve risks and uncertainties. These

statements are not guarantees of future performance and actual

results could differ materially from our current expectations.

CONTACT: Q.E.P. Co., Inc.

Richard A. Brooke, Senior Vice President and

Chief Financial Officer

561-994-5550

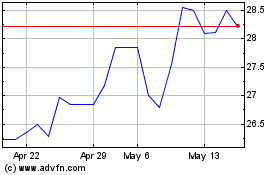

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

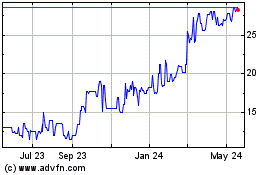

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025