UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 22, 2014

|

| | |

______________________RBC Life Sciences, Inc.______________________ (Exact name of registrant as specified in its charter) |

_______NEVADA_______ (State or other jurisdiction of incorporation) | _______000-50417_________ (Commission File Number) | _______91-2015186________ (IRS Employer Identification No.) |

2301 CROWN COURT, IRVING, TEXAS (Address of principal executive offices) | ____________75038_____________ (Zip Code) |

Registrant's telephone number, including area code __________972-893-4000______________ |

__________________________N/A____________________________ (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

[ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement.

On August 22, 2014, the Company entered into a two-year exclusive distributorship agreement effective as of August 1, 2014 (the “Agreement”) with Coral Club International, Inc., a Canadian corporation (“CCI”). This Agreement replaces a ten-year exclusive distributorship agreement between the parties ( the "Former Agreement") that automatically renewed for a one-year term following expiration of the initial term on July 1, 2014. CCI is the Company’s principal licensee and accounted for virtually all of the Company’s licensees’ net sales in the six months ended June 30, 2014 and 2013, respectively. The President of CCI is a former member of the Company’s Board of Directors and beneficially owns approximately 18% of the Company’s common stock.

Pursuant to the Agreement, CCI’s exclusive territory includes Russia and other countries located primarily in Europe and Central Asia, which represents an expansion of the territory set forth in the Former Agreement. In consideration of the rights granted to CCI under the Agreement, CCI is required to purchase certain minimum amounts of products from the Company each year, which minimum amounts are consistent with the Former Agreement.

Under the Former Agreement, CCI was required to pay the Company a monthly royalty calculated as a percentage of its sales of the Company's products. Under the Agreement, in lieu of a royalty, the prices at which products are sold to CCI were marked up as of the effective date of the Agreement to include the royalty so that no additional royalty will be due upon the sale of the Company's products by CCI. To affect the transition of royalty calculations under the Former Agreement and the Agreement, the Company will recognize on a one-time basis royalty revenue of approximately $476,000 in the third quarter of 2014.

The foregoing description of the material terms of the Agreement is subject to, and qualified in its entirety by reference to, the Agreement that is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

| |

10.1 | Exclusive Distributorship Agreement between the Company and Coral Club International, Inc. made as of August 1, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 28, 2014

|

|

RBC Life Sciences, Inc. |

|

By: /s/ Steven E. Brown |

Name: Steven E. Brown |

Title: President and Chief Financial Officer |

Exhibit Index

|

| |

Exhibit Number | Description |

10.1 | Exclusive Distributorship Agreement between the Company and Coral Club International, Inc. made as of August 1, 2014. |

EXHIBIT 10.1

EXCLUSIVE AGREEMENT

This agreement (the “Agreement”) is made as of the 1st day of August, 2014, by and between RBC Life Sciences, Inc., a Nevada corporation with offices at 2301 Crown Court, Irving, Texas, 75038, USA, (“RBC” or “Supplier”), and Coral Club International Inc., an Ontario corporation, with offices at 255 Duncan Mill Road, Suite 806, Toronto, ON, M3B 3H9, Canada (“CCI” or “Purchaser”).

WHEREAS, RBC and CCI entered into an Exclusive Distributorship Agreement dated the 14th day of July, 2004 (the “Former Agreement”), and the parties hereto desire to enter into a new Agreement that supersedes and replaces in all respects the Former Agreement except as otherwise set forth herein;

WHEREAS, RBC manufactures, and has manufactured for itself, a line of quality health, nutritional dietary supplement and personal care products (collectively, “Products”) which are also for sale to the Purchaser; under the RBC brand or under the CCI brand;

WHEREAS, CCI is a corporation of Ontario, Canada, with the power to carry on business as contemplated by this Agreement;

WHEREAS, CCI desires to promote, market, and sell the Products subject to the terms and conditions of this Agreement;

WHEREAS, the parties hereto desire to establish, among other things, the terms and conditions under which orders will be placed by CCI and accepted and filled by RBC.

NOW, THEREFORE, in consideration of the premises stated above and subject to the terms and conditions contained herein, the parties agree as follows:

I. TERRITORY

A. As used herein, “CCI’s Exclusive Territory” shall be comprised of the countries in regions as outlined below:

1. Region A: The countries of the former USSR, commonly known as the Former Soviet Union: Armenia, Azerbaijan, Belarus, Estonia, Georgia, Kazakhstan, Kyrgyzstan, Latvia, Lithuania, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine, and Uzbekistan.

2. Region B: Europe comprising the following countries: Albania, Andorra, Austria, Belgium, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Liechtenstein, Luxembourg, Macedonia, Malta, Monaco, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, and United Kingdom.

2. Region C: The following countries in Asia: Cyprus, Israel, and Turkey.

B. As used herein, “RBC’s Exclusive Territory” shall be comprised of the countries in regions as outlined below:

1. Region D: North America comprising the following countries: Antigua and Barbuda, The Bahamas, Barbados, Belize, Canada, Costa Rica, Cuba, Dominica, Dominican Republic, El Salvador, Greenland, Grenada, Guatemala, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Panama, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Trinidad and Tobago and the United States (“US”).

2. Region E: The following countries in Asia: Taiwan, Australia, New Zealand, Hong Kong, Singapore, Malaysia, Philippines, Thailand, Vietnam, Indonesia, Cambodia, Laos, South Korea, India, Japan and China.

| |

A. | Current prices for all Products available for purchase by CCI are set forth in Appendix A effective from date of this Agreement (the “Price List”) and shall be paid in US Dollars, ex-factory and export packed at RBC’s facility in Irving, Texas, USA. The parties acknowledge that such prices are subject to change as set forth in Section II(B) below and that all Products are available for purchase with the RBC brand labels or the CCI brand labels. CCI shall be responsible for all |

land, sea, or airfreight charges, wharfage, and storage charges. CCI at its sole expense shall arrange any insurance desired by CCI to cover the Products while in transit.

| |

B. | The Product order process shall consist of two (2) stages, preorder and confirmed order, as follows: |

1. Preorder - CCI shall send a preorder for Products to RBC. The quantity of each Product preordered shall be a production run quantity. The preorder shall include all information reasonably required by RBC to provide a quote. Within two (2) weeks of receipt of the preorder, RBC shall provide a written quote to CCI or the reason why a quote cannot be provided at that date. The quote provided to CCI shall include, at a minimum, the following information: the price of Product(s) preordered, the date through which each quoted price is effective (which RBC shall endeavor to make not less than 90 days) and the lead time to deliver each Product from the date the confirmed order for such product is placed.

2. Confirmed Order - Prior to the expiration date of the quoted price(s), CCI shall place a confirmed order for Product(s) at its discretion and pay the deposit required by Section V. Upon placement of a confirmed order by CCI, RBC shall confirm the date on which each ordered Product is to be delivered (“Quoted Delivery Date”).

III. DELIVERY

| |

A. | RBC shall Deliver (as hereinafter defined) Products ordered by CCI in accordance with the Product Specifications (as defined in Section VI(F). RBC shall endeavor to ensure that the quoted lead time for Delivery of each Product ordered is no more than eight (8) weeks from the time the confirmed order is placed |

| |

B. | “Delivery” shall be defined as the date CCI is notified that Products are segregated in RBC’s warehouse for CCI’s account and available for shipment. Upon Delivery, title to the Products and all risk of loss or damage shall pass to CCI, except loss or damage that occurs while Products are located in RBC’s warehouse. |

| |

C. | RBC will consider requests from CCI for new products, modified formulations or modified packaging. RBC, at its sole discretion, shall determine whether and under what terms such requests shall be fulfilled. |

| |

D. | For any Product that has been registered by CCI with a governmental authority in any country in which distribution of such Product is permitted under the terms of this Agreement, CCI shall provide to RBC any registered specification related to such Product that, at CCI’s discretion, is to be included in the Product Specifications. Upon receipt of notification from CCI, RBC shall incorporate the registered specification into the Product Specifications. |

| |

E. | RBC shall not be obliged to proceed with the fulfillment of any order for which payment has not been received pursuant to the provisions of Section V below. |

IV. DELAYS

| |

A. | RBC is not liable for failure to perform its obligations under this Agreement if such failure is as a result of acts of God (including fire, flood, earthquake, storm, tornados, hurricane or other natural disaster), war, invasion, act of foreign enemies, hostilities (regardless of whether war is declared), civil war, rebellion, revolution, insurrection, military or usurped power or confiscation, terrorist activities, nationalization, government sanction, acts or the failure to act by any government authority, blockage, embargo, labor dispute, strike, lockout or interruption or failure of electricity or telephone service. No party is entitled to terminate this Agreement under Section XVI in such circumstances. |

| |

B. | If RBC asserts that any event described in Section IV(A) is a reason for its failure to perform obligation(s) under this Agreement, RBC shall timely provide CCI written notice that shall include a description of the event(s), the impact the event(s) had on RBC’s ability to meet its obligation(s) and the reasonable steps RBC took to minimize delay or damages caused by such event(s). |

| |

C. | RBC acknowledges that its failure to timely Deliver Products to CCI that are timely ordered in accordance with the terms of this Agreement can adversely affect CCI’s business. Therefore, if RBC fails to Deliver a Product by the date thirty (30) days after the Quoted Delivery Date, RBC will grant to CCI a ten percent (10%) discount on the purchase price of such Product. If RBC fails to Deliver a Product by the date sixty (60) days after the Quoted Delivery Date, RBC will grant to CCI an additional five percent (5%) discount on the purchase price of such Product. If RBC fails to Deliver a Product by the date one hundred twenty (120) days after the Quoted Delivery Date, CCI may cancel the purchase order for such Product, at its option. In addition, CCI will receive a credit from RBC equal to fifteen percent (15%) of the purchase price of the Product on the cancelled Purchase order for use against a future purchase order. |

V. PAYMENT

| |

A. | Payment for Products ordered shall be made in two installments or as otherwise mutually agreed to by the parties in writing. The first payment is due at the time CCI places its confirmed order with RBC. The payment will be sent via wire transfer or check drawn in US funds on a US funds bank account to RBC, in the amount of twenty-five percent (25%) of the order amount. The remaining balance payment of seventy-five percent (75%) will be sent to RBC via wire transfer or check drawn in US funds on a US funds bank account, upon Delivery of the Products. |

| |

B. | CCI agrees to remit to RBC a logistics fee equal to Nine Thousand Six Hundred US Dollars (US$9,600) per month for warehousing and product fulfillment services rendered with respect to the Products. The logistics fee is due on the first day of each month for such month and shall be paid to RBC via wire transfer or check drawn in US funds on a US funds bank account. At its discretion, CCI may terminate these services upon thirty (30) days written notice. Should CCI provide written notice of termination of these services on any day other than the 1st of the month, the next month’s payment will be prorated accordingly. |

VI. GOVERNMENTAL AUTHORIZATION

| |

A. | All sales hereunder shall be subject to the export control laws and regulations of the US. |

| |

B. | CCI shall be responsible for the timely obtaining of any governmental authorizations required such as import licenses, exchange permits, registration, or any other specific governmental authorization in any country where CCI imports and/or sells Products under the terms of this Agreement. |

| |

C. | RBC shall provide to CCI at no charge the documents it maintains to comply with US good manufacturing practice regulations (“GMP” or “GMPs,” as the case may be) promulgated by the US Food and Drug Administration and to conduct business as an international distributor of foods, dietary supplements and cosmetics (such as Certificate of Analysis, Certificate of Manufacture, Certificate of Free Sale, Certificate of Composition and GMP Certification), or other documentation that may be reasonably requested by a country’s government as proof that the Products comply with any applicable standards, requirements, tests, or procedures within the country. Should CCI require additional information or additional tests not required by GMPs, CCI shall be responsible for all costs associated with obtaining such information or tests. |

| |

D. | RBC shall not be liable if any approval/authorization described in this Section VI is delayed, denied, revoked, restricted, or not renewed, and CCI shall not be relieved thereby of its obligations to pay RBC for any Products already ordered and/or Delivered to CCI at its request. |

E. RBC at its cost shall comply with GMPs, which may from time-to-time require the inspection of the facilities of its suppliers. Nothing in this Agreement shall be construed to obligate RBC (i) to pay for the inspection of its facilities or the facilities of any supplier to satisfy governmental agencies or authorities in any country other than the US, or (ii) to otherwise incur any costs or expenses to qualify its facilities or the facilities of any supplier pursuant to the governmental regulations of any country other than the US. If the governmental regulations of any country in which CCI desires to sell Products require an inspection of RBC’s facilities, RBC shall cooperate with such inspection at CCI’s sole cost and expense.

F. RBC shall Deliver to CCI Products manufactured in accordance with the product specifications (the “Product Specifications”), which are attached hereto as Appendix B. Products not in conformity with the Product Specifications, or which may otherwise be defective, may, at RBC’s option, be destroyed or returned by CCI to RBC at RBC’s expense upon written authorization from RBC. Products that do not conform to the Product Specifications shall not be deemed Delivered for purposes of determining whether a delay has occurred pursuant to Section IV(C).

VII. EXCLUSIVITY

| |

A. | RBC agrees that it will not sell or deliver the Products to any person or entity in CCI’s Exclusive Territory without obtaining the written consent of CCI. In addition, RBC shall use commercially reasonable efforts to preclude any other person or entity from selling or delivering the Products in CCI’s Exclusive Territory. |

| |

B. | With respect to the sale or delivery of Products by CCI, CCI agrees that it will not sell or deliver the Products to any person or entity except as permitted by the terms of the group(s) to which each Product is assigned, as set forth in Appendix C. The terms of each group are as follows: |

| |

a. | Group A - Products in Group A may be sold or delivered by CCI with either the RBC brand label or the CCI brand label in any country except countries in Regions D and E. |

| |

b. | Group B - Products in Group B may be sold or delivered by CCI with CCI brand labels in any country. |

| |

c. | Group C - Products in Group C may be sold or delivered by CCI with CCI brand labels in any country, except the CCI brand label may not use or refer in any way to the trade name under which such Product is sold when labeled with the RBC brand label. |

| |

d. | Group D - Products in Group D may not be sold or delivered by CCI in any country in Regions D and E. |

CCI shall use commercially reasonable efforts to preclude any other person or entity (except those authorized by RBC) from selling or delivering the Products contrary to the provisions of this paragraph.

| |

C. | CCI shall notify RBC in writing of its intention to sell or deliver any Product in any country not included in CCI’s Exclusive Territory prior to such sale or delivery. |

Notwithstanding the preceding, RBC may sell or deliver the Products to customers residing in CCI’s Exclusive Territory as long as (i) the customer purchases the Products only for personal use and not for resale (ii) the customer does not recruit other customers or otherwise attempt to build a downline organization, and (iii) RBC notifies CCI of the existence of such customer.

VIII. SALES ACTIVITIES & PURCHASER RESPONSIBILITIES/OBLIGATIONS

| |

A. | CCI shall use commercially reasonable efforts to promote and sell the Products in CCI’s Exclusive Territory and any other country where CCI sells Products under the terms of this Agreement in compliance with applicable government laws and regulations. CCI hereby acknowledges that it is its obligation to ensure that its business policies, procedures and practices conform to the legal requirements in each country where it promotes and sells the Products. |

| |

B. | CCI is not an agent of RBC for any purpose and is not granted any express or implied right to assume or create any obligation in the name of RBC or to bind RBC in any manner. |

| |

C. | Upon reasonable request, RBC will make available to CCI samples of audio, video, and photography used in its US-based training, promotional, and business sales aids materials for use by CCI. In turn, CCI will develop at its own expense all training, promotional and business sales aids, including any translation and printing costs, for use in countries where CCI promotes and sells the Products under the terms of this Agreement. |

| |

D. | At CCI’s sole cost and expense, RBC shall produce Product labels, including artwork and copy layout, as required by CCI to facilitate the sale of Products in countries permitted under the terms of this Agreement, These Product labels shall be produced in accordance with specifications provided by CCI based on legal requirements and other considerations and, at CCI’s discretion, include artwork supplied by CCI. |

| |

E. | RBC and CCI each acknowledge that the other has its own independent distributor commission plan and related computer software. |

IX. CONFIDENTIALITY

| |

A. | As used in this Section, “Confidential Information” means information disclosed by one party to the other, or known by either party as a consequence of, or through, the affiliation with the other, not generally known in the industry in which RBC and CCI are active or may become engaged, specific examples of which are set forth in the following Section IX(B). |

| |

B. | Neither RBC nor CCI shall disclose any information pertaining to the other party that is not publicly known about the Products, processes, and services; including but not limited to information relating to research and development, customer lists, Product formulations, inventions, manufacturing, manufacturing methods, purchasing, suppliers, accounting, engineering, marketing, merchandising, selling, pricing, business methods, software systems, internal policies, and any lawsuits, legal work, communications with attorneys or other information received as a consequence of the business affiliation between RBC and CCI. |

| |

C. | The parties shall not, at any time, divulge to any person, firm, or corporation any of the Confidential Information received by it during the term of the Former Agreement or this Agreement, and all such information shall be kept confidential and shall not, in any manner, be revealed to anyone except as may be required by legal process or the order of any court of competent jurisdiction. The obligations of the parties set forth in this Section IX shall survive the termination of this Agreement for a period of five (5) years. |

| |

D. | Notwithstanding the preceding, the parties shall not be precluded from disclosing the terms of this Agreement, if RBC or CCI shall reasonably determine that disclosure is required for compliance with governmental regulations or laws, including the requirements of the US Securities and Exchange Commission. |

X. TAXES

| |

A. | All US taxes, whether federal or state, are included in the prices, except sales, use, excise, and similar taxes, which have been excluded on the basis that the transaction is presumed to involve resale and/or export by CCI. CCI shall furnish evidence of export or other appropriate tax exemption evidence acceptable to the taxing authorities if requested by RBC. |

XI. WARRANTIES

| |

A. | RBC hereby warrants that the Products shall be manufactured in accordance with the Product Specifications and in conformity with all applicable GMPs and that Products shall conform to the Product Specifications at time of Delivery. RBC further warrants that it will make no changes to the Product Specifications without CCI’s written approval. |

| |

B. | CCI’s exclusive remedy for any cause of action relating to a breach of this warranty shall be limited to (i) the prompt replacement by RBC of the defective Product; or a financial amount, issued as a credit against a future purchase order, agreed upon by both parties, for any loss of sales, calculated as described below, due to the unavailability of the Product plus (ii) reimbursement of any freight and delivery charges incurred by CCI to ship the defective Product from RBC’s warehouse to CCI’s warehouse, if such Product was defective at the time of shipment. For purposes of this paragraph, loss of sales shall be calculated by multiplying ten percent (10%) of CCI’s average daily sales of such Product for the preceding six (6) calendar months by the number of days the Product is out of stock. For purposes of this calculation, the number of days the Product is out of stock is the number of days between the date that RBC and CCI mutually agree that this warranty has been breached, or the date that CCI ships the last available unit of such Product in its inventory, whichever is later, and the date that replacement Product is Delivered. CCI agrees to provide, at RBC’s reasonable request, supporting documentation from CCI’s books and records used to determine CCI’s average daily sales of any Product for which a financial claim is made pursuant to this paragraph. |

| |

C. | EXCEPT AS OTHERWISE PROVIDED HEREIN, RBC MAKES NO WARRANTY OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR WARRANTIES EITHER EXPRESSED OR IMPLIED, OR ANY AFFIRMATION OF FACT OR REPRESENTATION. RBC SHALL NOT BE LIABLE TO CCI FOR ANY LIABILITY, CLAIM, LOSS, DAMAGE, OR EXPENSE OF ANY KIND OR FOR ANY DIRECT, CONSEQUENTIAL, COLLATERAL, OR INCIDENTAL DAMAGES RELATIVE TO OR ARISING FROM OR CAUSED DIRECTLY OR INDIRECTLY BY THE PRODUCTS OR THE USE THEREOF, UNLESS EXPRESSLY SET FORTH IN OR CONTEMPLATED BY THIS AGREEMENT. EXCEPT AS OTHERWISE PROVIDED HEREIN, CCI’S EXCLUSIVE REMEDY FOR ANY CAUSE OF ACTION RELATING TO BREACH OF THIS WARRANTY SHALL BE LIMITED TO THE PROMPT REPLACEMENT BY RBC OF THE DEFECTIVE PRODUCT, AND RBC’S LIABILITY TO THE CONSUMER FOR ANY AND ALL LOSSES OR DAMAGES RESULTING FROM ANY BREACH OF ANY PRODUCT WARRANTY, INCLUDING NEGLIGENCE, SHALL IN NO EVENT EXCEED THE PURCHASE PRICE OF THE PRODUCT AS SET FORTH IN THE PRICE LIST, OR, AT THE ELECTION OF RBC, THE REPLACEMENT OF THE PRODUCT, EXCEPT AS CONTEMPLATED BY SECTION XI(D) BELOW. |

| |

D. | Product Liability Insurance - RBC hereby agrees, at its expense, during the Term of this Agreement, to maintain product liability insurance with the named insured thereon being RBC. The insured limits shall be no less than $1,000,000 per occurrence, and not less than $2,000,000 in aggregate. This product liability insurance shall cover all Products sold by RBC to CCI. A Certificate of Insurance evidencing such coverage is attached hereto as Appendix D. CCI shall undertake to obtain its own product liability insurance to cover potential claims either not covered by RBC’s product liability coverage or associated with causes of action attributable to the conduct of CCI. Should a judgment be entered by a court of competent jurisdiction against CCI and/or RBC with respect to a product liability claim related to one or more Products sold or delivered by CCI to the plaintiff, where such claim is based on a Product defect (not including Product labeling), RBC shall bear the cost of such judgment to the extent such judgment is not covered by applicable product liability insurance. |

XII. PATENTS

| |

A. | If CCI receives a claim that any Product or part thereof manufactured or distributed by RBC infringes any patent in the US, unless the Product formula or infringing part thereof was provided by CCI to RBC, CCI shall notify RBC promptly in writing and give RBC information, assistance, and exclusive authority to evaluate, defend, and settle such claim. |

| |

B. | Upon receipt of such notice, RBC shall at its own expense and option: |

| |

b. | Procure for CCI the right to use and sell such Product, |

| |

c. | Replace or modify the Product to avoid infringement, |

| |

d. | Remove the Product and refund CCI’s purchase price, or |

| |

e. | Defend against such claim. |

| |

C. | Provided timely notice has been given by CCI, should any court of competent jurisdiction hold such Product to constitute infringement, RBC shall indemnify CCI for all costs and damages finally awarded on account of such infringement and, if the use of such Product is enjoined, RBC shall at its option and sole expense, take one or more of the actions listed in Section XII(B) above. |

XIII. TRADEMARKS

| |

A. | The Products shall be delivered to CCI with RBC branded labels or CCI branded labels at CCI’s discretion in accordance with the terms of this Agreement. CCI acknowledges that RBC is, to its knowledge, the owner of or has rights to certain trademarks and trade names, including but not limited to, “RBC Life Sciences”, “Pure Life”, “Royal BodyCare”, Stem-Kine”, and “Royal Botanica”. |

| |

B. | The Products Delivered to CCI with a CCI branded label may be labeled with the trademark CCI logo or any other logo affiliated with CCI. |

| |

C. | CCI acknowledges that its only right with respect to the trademark and trade name “RBC”, “RBC Life Sciences” and “Royal BodyCare”, or any other RBC trademark or trade name, is to sell and promote the Products bearing such trademark(s) and trade name(s) in CCI’s Exclusive Territory and other countries in accordance with the terms of this Agreement. |

| |

D. | CCI shall not register any RBC trademark and/or trade name in its own name or in the name of any other entity other than RBC. CCI is authorized to use the name “RBC” or “Royal BodyCare” or “RBC Life Sciences” as CCI reasonably sees fit. CCI’s right to use any RBC trademark and/or trade name shall immediately cease upon termination or expiration of this Agreement. |

XIV. LIMITATION OF LIABILITY

| |

A. | EXCEPT AS OTHERWISE PROVIDED HEREIN, THE TOTAL LIABILITY OF RBC TO CCI ON ANY CLAIM, WHETHER IN CONTRACT, TORT, OR OTHERWISE, ARISING OUT OF, CONNECTED WITH, OR RESULTING FROM THE MANUFACTURE, SALE, DELIVERY, RESALE, REPLACEMENT OR USE OF ANY PRODUCTS SHALL NOT EXCEED THE PRICE ALLOCABLE TO THE PRODUCTS OR PART THEREOF WHICH GIVES RISE TO THE CLAIM. |

| |

B. | EXCEPT AS OTHERWISE PROVIDED HEREIN, IN NO EVENT SHALL RBC BE LIABLE TO CCI FOR ANY SPECIAL OR CONSEQUENTIAL DAMAGES INCLUDING, BUT NOT LIMITED TO, DAMAGES FOR LOSS OF REVENUE, COST OF CAPITAL, CLAIMS OF CUSTOMERS FOR SUPPLY INTERRUPTIONS OR FAILURE OF SUPPLY, AND COSTS AND EXPENSES INCURRED IN CONNECTION WITH TRANSPORTAION OR SUBSTITUTE FACILITIES OR SUPPLY SOURCES. THE FOREGOING NOTWITHSTANDING, EACH PARTY MAY BE LIABLE FOR DAMAGES CAUSED TO THE OTHER PARTY BY MEANS OF FRAUD, TRANSMISSION OF FALSE INFORMATION, OR VIOLATIONS OF LAW. SUCH DAMAGES WILL BE LIMITED TO COST OF GOODS, FREIGHT, AND ACTUAL DAMAGES. |

XV. MUTUAL INDEMNIFICATION AND HOLD HARMLESS

| |

A. | RBC HEREBY UNDERTAKES TO INDEMNIFY AND HOLD HARMLESS CCI FROM ANY AND ALL ACTIONS, CAUSES OF ACTION, SUITS, DEBTS, DUTIES, ACCOUNTS, BONDS, CONTRACTS, CLAIMS AND DEMANDS WHATSOEVER RESULTING FROM ANY ACTION OR OMISSION; INCLUDING WITHOUT LIMITATION ANY FAILURE TO FILE ANY CORPORATE OR OTHER RETURNS OR REPORTS ON BEHALF OF RBC ARISING OUT OF ANY CAUSE, MATTER OR THING WHATSOEVER EXISTING FROM SIGNING OF THIS AGREEMENT TO THE TERMINATION OF THIS AGREEMENT. |

| |

B. | CCI HEREBY UNDERTAKES TO INDEMNIFY AND HOLD HARMLESS RBC FROM ANY AND ALL ACTIONS, CAUSES OF ACTION, SUITS, DEBTS, DUTIES, ACCOUNTS, BONDS, CONTRACTS, CLAIMS AND DEMANDS WHATSOEVER RESULTING FROM ANY ACTION OR OMISSION; INCLUDING WITHOUT LIMITATION ANY FAILURE TO FILE ANY CORPORATE OR OTHER RETURNS OR REPORTS ON BEHALF OF CCI ARISING OUT OF ANY CAUSE, MATTER OR THING WHATSOEVER EXISTING FROM SIGNING OF THIS AGREEMENT TO THE TERMINATION OF THIS AGREEMENT. |

| |

C. | In case any claim, demand, or action shall be brought by any third party including, but not limited to, any governmental authority, against a party entitled to indemnity under Section XV(A) or XV(B) above, such party shall promptly notify the other party from whom indemnity is or may validly be sought, in writing, and the indemnifying party or parties shall assume the defense thereof. Any settlement of any action subject to indemnity hereunder shall require the consent of the indemnified and the indemnifying party, which consent shall not be unreasonably withheld. The indemnifying party shall not be liable for any settlement of any action effected without its consent, but if settled with the consent of the indemnifying party, or if there be a final judgment for the plaintiff in any such action, the indemnifying party shall indemnify and hold harmless the indemnified party from and against any loss or liability by reason of such settlement or judgment. If requested by the indemnifying party, the indemnified party shall cooperate with the indemnifying party and its counsel and use its best efforts in contesting any such claim or, if appropriate, in making any counter-claim or cross-complaint against the party asserting the claim, provided that the indemnifying party will reimburse the indemnified party for reasonable expenses incurred in so |

cooperating. The indemnifying party and its representatives shall have full and complete access during reasonable hours to all books, records, and files of the indemnified party expressly related to the defense of any claim for indemnification undertaken by the indemnifying party pursuant to this Section, or for any other purpose in connection therewith, provided that the indemnifying party shall safeguard and maintain the confidentiality of all such books, records, and files.

| |

D. | The provisions hereof shall inure to the benefit of, and shall be binding upon the successors, assigns and representatives of each of the parties. |

XVI. TERM AND TEMINATION

| |

A. | This Agreement will be effective as of the date first written above and shall continue for two (2) years thereafter. Unless one party provides written notice of termination to the other in no less than one hundred and eighty (180) days prior to the end of the term of this Agreement, this agreement shall automatically renew for a successive one-year period (a “Renewal Term”). |

| |

B. | The proceeding notwithstanding, this Agreement may be terminated at any time by mutual agreement by both parties or otherwise in accordance with the terms hereof. |

| |

C. | In addition to the provisions of Section XVI(A) above, this Agreement may be terminated with immediate effect upon the occurrence of any for the following events: |

| |

a. | The insolvency of either party; its suffering or committing any act of insolvency, or the inability of either party to pay its debts when due or within one hundred and eighty (180) days of the due date; |

| |

b. | Either party’s bankruptcy or liquidation, whether voluntary or involuntary, or the appointment for it of a receiver or liquidator; |

| |

c. | An attempted assignment of this Agreement, except as provided in Section XVIII below; |

| |

d. | Any non-payment by CCI to RBC of any indebtedness under this Agreement, provided CCI has received written notice of such default and has had thirty (30) days to rectify such default but failed to do so; |

| |

e. | The failure of a breaching party to remedy a breach of this Agreement within thirty (30) days after written notice of a breach has been served on the breaching party by the non-breaching party indicating the nature of the breach or purported breach. |

| |

D. | Upon termination of this Agreement, CCI will immediately cease to use in any manner all RBC trademarks and/or trade names, including, but not limited to, “Royal BodyCare” “RBC Life Sciences” and “RBC”, and will not sell any goods under such trademarks or trade names or any similar names and marks. |

| |

E. | To permit each party to protect its respective business interests, each party hereby agrees to give reasonable notice to the other in the event of a material adverse change in its business or financial condition. Any event so reported shall not constitute a breach of this Agreement, unless such event is an event as set forth in Section XVI(C) above. |

XVII. MINIMUM PERFORMANCE STANDARDS

| |

A. | In consideration of the rights granted to CCI in this Agreement, CCI agrees to purchase Products from RBC in the aggregate minimum amount of Three Million Six Hundred Thousand US Dollars (US$3,600,000) during each year of this Agreement’s term. |

| |

B. | In the case that CCI in any one year does not purchase Products from RBC in the aggregate minimum amount of Three Million Six Hundred Thousand US Dollars (US$3,600,000), RBC may, at its option, convert the exclusive rights granted to CCI into non-exclusive rights, providing that RBC has fulfilled orders placed by CCI during such year in accordance with the terms of this Agreement. |

XVIII. TRANSFER OF RIGHTS

| |

A. | No party hereto shall assign its rights or obligations under this Agreement without the prior written consent of the other party, which consent shall not be unreasonably withheld or denied. |

| |

B. | Either party can assign this Agreement without the necessity of obtaining prior written consent of the other party where such assignment is to a wholly owned subsidiary or other entity controlled by it, provided that as a condition to any such assignment, the assignee shall assume and become liable for any and all of the assignor’s obligation under this Agreement. |

| |

C. | In the case of a change in ownership of RBC, this Agreement will continue for the full term in accordance with all provisions set forth herein. However, notwithstanding the preceding, if the new owners wish to renegotiate the terms and provisions of this Agreement through RBC’s management, CCI will take this request into consideration. |

| |

D. | Except as otherwise provided herein, this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective permitted successors and assigns. |

XIX. MISCELLANEOUS

| |

A. | This Agreement, together with any and all Appendices, Exhibits, and attachments hereto, constitutes the entire Agreement between the parties and there are no agreements or commitments except as set forth herein. |

| |

B. | This Agreement may be amended, modified in whole or in part, or supplemented by an agreement in writing that makes reference to this Agreement and is executed by authorized officers of the parties. |

| |

C. | Any notices required or permitted to be given under this Agreement shall be in writing and shall be given by addressing the same to such other party at the address set forth below. |

| |

D. | Such notices shall be given to all parties by: |

| |

a. | Overnight or highest priority expedited delivery by an internationally recognized air freight courier service (e.g. UPS, FedEx, Purolator) (herein referred to as “Courier Service”), |

| |

b. | Delivery of same; personally to an authorized officer of such other party, or |

| |

c. | Transmitting by facsimile and mailing of the original. |

| |

E. | Any such notice shall be deemed to have been given ten (10) business days after the timely delivery to a Courier Service; if by personal delivery, upon such delivery; or if by facsimile, seven (7) business days following the day of transmission if made within customary business hours, or if not transmitted within customary business hours, eight (8) business days following the day of transmission. |

Notices to RBC shall be addressed and delivered to:

RBC Life Sciences, Inc.,

2301 Crown Court,

Irving, Texas 75038,

USA

Telephone: (972) 893-4000

Facsimile: (972) 893-4111

Attn: Steve Brown - President

Notices to CCI shall be addressed and delivered to:

Coral Club International Inc.,

255 Duncan Mill Road,

Suite 806,

Toronto, ON M3B 3H9,

Canada

Telephone: (416) 663-4425

Email address: lappl@rogers.com

Attn: Leonid Lapp - President

| |

F. | Separability of Provisions. A judicial or administrative declaration by any court of competent jurisdiction of the invalidity of any one or more of the provisions hereof shall not invalidate the remaining provisions of the Agreement in any jurisdiction, nor shall such declaration have any effect on the validity or interpretation of this Agreement outside of that jurisdiction. The parties undertake, however, to negotiate in good faith to find a substitute provision as close as possible to the invalid provision, taking into consideration each party’s intention with respect to this Agreement. |

| |

G. | Waiver of Compliance. Any failure by any party hereto to enforce at any time any term or condition under this Agreement shall not be construed as a waiver of that party’s right to enforce each and every term of this Agreement. |

XXX. DISPUTES

| |

A. | Any controversy arising out of or in relation to this Agreement, or the breach or alleged breach thereof, which cannot be settled amicably, shall be settled by arbitration in accordance with the Commercial Arbitration Rules of the International Arbitration Association and the provisions of this Section. |

| |

B. | Any party may initiate arbitration by giving written notice to the other party of an intention to arbitrate and by filing with JAMS International located in Toronto, Ontario (or such other arbitration and mediation center location as parties may agree) three (3) copies of such notice and three (3) copies of this Agreement together with the appropriate filing fee. |

| |

C. | The arbitration proceedings shall be held at the center location agreed to by the parties and shall be subject to the arbitration rules described in Section XXX(A) above. |

| |

D. | The arbitrator(s) may grant any legal and/or equitable relief to which a party may be entitled under the law and legal theory under which the party seeks relief, provided however, that no claim may be made for any special, indirect, consequential, or punitive damages arising out of or related to this Agreement, or of any act, omission, or event occurring in connection therewith, except that punitive damages may be awarded for willful or wanton misconduct. |

| |

E. | The arbitration award shall be settled within six (6) months from the date the final arbitration award is granted by the arbitrator(s). |

| |

F. | The award shall not serve as precedent or authority in any subsequent proceeding, provided, however, that if the losing party should fail to comply with the award, the prevailing party may apply to any court having jurisdiction for an order confirming the award in accordance with applicable law. |

| |

G. | The award can be enforced in any court having jurisdiction. |

| |

H. | Unless otherwise required by law or court orders, the substance of any arbitration proceedings shall be kept confidential by all parties and by the arbitrator(s); however, the fact that such a proceeding exists, or that an award has been rendered, need not be kept confidential. |

| |

I. | The costs of the proceedings, including the fees and costs of attorneys, accountants, witnesses, and the compensation of the arbitrator(s) shall be assessed by the arbitrator(s) against the parties according to the arbitrator(s)’ determination of fault. |

XXI. TRANSITION FROM THE FORMER AGREEMENT

| |

A. | As of the effective date of this Agreement, the Former Agreement is rendered void and without force and effect and is hereby replaced and superseded in all respects by this Agreement except as otherwise provided herein. |

| |

B. | The parties acknowledge that certain provisions in this Agreement with respect to payments between the parties are different than the Former Agreement. To facilitate the transition between this Agreement and the Former Agreement, the parties agree as follows: |

1. Confirmed Orders. The price of the Products on all confirmed orders not Delivered as of the effective date of this Agreement shall be increased twenty percent (20%).

2. Confirmed Order Payments. The aggregate amount of the first installment payment due to RBC in accordance with Section V of the Former Agreement shall be reduced to 25% of the aggregate amount of all confirmed orders not Delivered as of the effective date of this Agreement, which calculation shall be made after adjustment of the price of the Products in accordance with Section XXI(B)(1). If this adjustment results in an amount owing to CCI from RBC, this amount shall be applied to the gross payment due from CCI to RBC pursuant to Section XXI (B) (3) below.

3. Marketing Service Fee. CCI acknowledges that, as of July 31, 2014, it held unsold Products in its inventory that were purchased under the Former Agreement (the “Unsold Products”). CCI further acknowledges that, in accordance with the terms of the Former Agreement, it will owe RBC a marketing service fee upon sale of the Unsold Products. The parties hereby agree that, In lieu of calculating and paying such marketing service fee, CCI shall pay to RBC an amount equal to the purchase price of the Unsold Products multiplied by twenty percent (20%). The parties further agree that this payment shall be deemed earned in full by RBC on the effective date of this Agreement and is not contingent upon future sales of the Unsold Products. This payment shall be paid to RBC in eighteen (18) equal monthly installments, the first of which shall be due October 1, 2014 with the remaining installments due on the first day of each successive month thereafter until paid in full. In connection with this payment CCI shall provide to RBC a listing of Unsold Products and their respective purchase prices. Further, the marketing service fee due to RBC under the Former Agreement with respect to sales of Products in July 2014 shall be paid to RBC by August 31, 2014; however, no marketing service fee shall be due to RBC upon the sale of any Products after July 31, 2014.

XXII. ADDITIONAL SECTIONS

| |

A. | Governing Law. The rights and obligations of the parties under this Agreement shall be governed by the provisions of the 2010 United Nations Convention on Contracts for the International Sale of Goods. |

| |

B. | Captions; Counterparts. The captions in this Agreement are for convenience only and shall not be considered a part of or affect the construction or interpretation of any provision of this Agreement. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. |

| |

C. | Further Instruments. The parties hereto agree to execute and deliver such instruments and take such other action as shall be reasonably necessary, or as shall be reasonably requested by any other party, in order to carry out the transactions and agreements contemplated by this Agreement. |

IN WITNESS WHEREOF, the parties hereto have executed this Agreement in duplicate as of the date first written above, by their duly authorized representatives.

RBC Life Sciences, Inc., Coral Club International Inc.,

a Nevada Corporation an Ontario Corporation

By: __/s/ Steven E. Brown_______ By: __/s/ Leonid Lapp________

Steve Brown, President Leonid Lapp, President

Date: _August 22,_________, 2014 Date: __August 1,_______, 2014

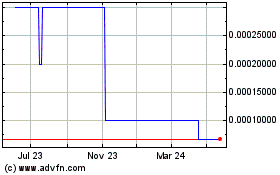

RBC Life Sciences (CE) (USOTC:RBCL)

Historical Stock Chart

From Oct 2024 to Nov 2024

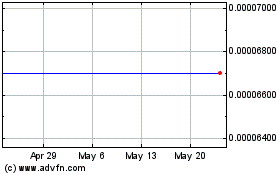

RBC Life Sciences (CE) (USOTC:RBCL)

Historical Stock Chart

From Nov 2023 to Nov 2024