NetworkNewsWire

Editorial Coverage: Financial technology is currently making

new era advances, providing innovative, accessible solutions for

entrepreneurs and small businesses. As part of this movement,

Global Payout, Inc. (OTC: GOHE) (GOHE

profile) has created a flexible

platform for dealing with finance across a business’s

infrastructure, as well as a specialist payment system for

high-risk businesses. Glance Technologies, Inc. (OTCQB:

GLNNF) has produced a mobile phone payment system that is

secure, simple to use, and helps local businesses reach their

customer base. MassRoots Retail (OTCQB: MSRT) uses

technological solutions to help businesses develop links with

consumers and is moving into financial technology through the

development of a cryptocurrency. Support company mCig, Inc.

(OTC: MCIG) has set up a cryptocurrency consulting

division to help with the spread of this technology, as well as

investing in state-of-the-art ATMs. Medical Cannabis

Payment Solutions (OTC: REFG) has provided retailers with

a secure payment processing system that helps to automate financial

processes such as tax collection and sales tracking.

As financial technology leaps forward, small businesses are

empowered by the products of these innovators.

Creating Greater Access to Finance

Access to finance is a vital part of any business — not only

obtaining the money to fund an enterprise but also gaining access

to the financial facilities needed to run a working business. The

bigger finance-related companies have typically focused on

providing both finance and financial services to other larger,

traditional businesses. This is a logical move because the rewards

are larger and the outcomes more certain. But this has meant that

entrepreneurs, small-business owners and high-risk enterprises have

sometimes been overlooked.

That trend is changing, however, thanks to the revolutionary

changes currently taking place in financial technology.

Developments such as blockchain are transforming core components of

the finance industry, thereby providing unprecedented access to

investment capital and financial services for previously overlooked

groups. As the technology matures, these advancements are

empowering marginalized enterprises across the world.

Offering Financial Innovation

For someone setting up a small business or an entrepreneur

looking to work more efficiently, traditional financial systems can

seem frustrating, inaccessible and inefficient. Fortunately,

fintech companies such as Global

Payout, Inc. (OTC: GOHE) are offering novel

solutions.

Global Payout is a provider of financial technology, with a

focus on payment solutions. Its aim is to make payment processing

faster, smarter and more efficient. By creating better systems,

Global Payout is also making efficient payment processing available

to a wider range of businesses.

The company’s main payment system is the Global Reserve Platform

(GRP). This highly customizable system is designed to be adapted to

the needs of individual businesses rather than providing a

one-size-fits-all approach. At the same time, the system is easy to

deploy and use, an important part of making fintech accessible.

A complete “banking in a box” system, GRP isn’t just about

payment processing. It can be used for online banking, P2P

payments, loans, management, FOREX and almost any other transaction

a business might need. By connecting these systems together, it

improves efficiency and record keeping, making it easier to process

and track financial interactions. By using a single adaptable tool,

a business can avoid the inefficiencies that arise from jumping

between systems and styles of working.

Global Payout’s success comes in large part from paying

attention to the wider market around it. CEO James Hancock noted

that “with the FINTECH industry currently experiencing exponential

growth, the Global Payout management team has devoted much of its

recent time and efforts on meticulously observing current and

projected trends within the industry to identify the key market

sectors (http://nnw.fm/Bi2nC).” It is this attention to the

market that has allowed the company to identify and target the most

profitable areas.

Working with Small Businesses

One of the four sectors that Global Payout’s team has

specifically targeted is small and medium enterprises. Having seen

the gap in support for such businesses, the company is seizing the

opportunity to expand in that niche and, in the process, provide

superior services to underserved customers.

For small companies, Global Payout is determined to ease the

difficulties experienced in areas such as international payments

and money transfer. These challenges can limit the expansion of a

business, preventing it from achieving its potential. The solution

is a single platform for financial services. Global Payout’s cloud

architecture provides a simple process for making and receiving

international payments, while its customer interface can adopt

local language modifications, making it accessible for clients

around the world.

To be genuinely useful for small business clients, a financial

platform has to be inexpensive, fully functional and usable on an

array of mobile devices. This is an important part of what Global

Payout provides — solutions that entrepreneurs the world over can

both use and afford.

Looking to the Future

In addition to traditionally underserved areas of the economy,

Global Payout has recently turned its attention to a new and

growing market sector — high-risk businesses.

The growth of the legal cannabis market has created a whole new

challenge for payment systems. Cannabis businesses often cannot

access legal banking because of complications arising from the

drug’s legal standing. As a result, cannabis merchants have had to

work on a cash basis, increasing the risks of fraud, theft and

error. Their experience has highlighted the needs of the wider

category of high-risk businesses that are looking for payment

solutions to move them out of the cash-only economy.

To serve this community, Global Payout has turned to its partner

MoneyTrac. MoneyTrac is applying blockchain technology, one of the

most exciting new areas in programming, to create innovative

payment solutions for high-risk businesses, many of which are also

small businesses. Its recently launched MTRAC payment system

(http://nnw.fm/c4eoX) allows cannabis merchants

to accept payments electronically without having to rely on banks.

New technology allows the system to sidestep the inefficiencies and

restrictions of traditional banking, while still letting businesses

see the money in their accounts at the end of the day.

MoneyTrac also supplies a wider network of support services to

small businesses. By recognizing that businesses which need payment

services may also need support in other areas as well, MoneyTrac is

bolstering its customer base and ensuring a healthy future for

small-scale, high-risk businesses.

New Payment Solutions for a New World

Such innovative solutions aren’t limited to high-risk areas.

Glance Technologies, Inc. (OTCQB: GLNNF) has

created a simple, secure mobile phone payment system. Like

MoneyTrac, Glance Technologies used blockchain to create a secure,

fast system that maximizes the potential of modern technology. This

system offers merchants customization and data tools previously

only available to large businesses, allowing smaller-scale

entrepreneurs to better leverage their position and gain attention

from local customers. The system offers customers a secure, simple

payment system accompanied by loyalty rewards and the ability to

identify the best small-scale local providers. The company’s Glance

Pay system, which started out in Canada, is also now available in

the United States.

MassRoots Retail (OTCQB: MSRT) uses technology

to help businesses establish links with consumers. Its dispensary

portal and social platform help cannabis merchants understand their

local market and cannabis consumers identify the best products and

sellers in their areas. The company is now looking to expand into

financial technology with a cannabis-oriented cryptocurrency. This

will provide companies with another way to make payments within the

cannabis market. This new technology will also help MassRoots

reward customers who provide helpful reviews on its system,

increasing the value of the data to both customers and

businesses.

Cryptocurrency plays a central role in the cannabis market;

consequently, more cannabis companies are moving to adopt this

technology. mCig, Inc. (OTC: MCIG), a diversified

support company for the cannabis industry, has stepped into the

cryptocurrency arena in a number of ways. Late last year, it

created a cryptocurrency consulting division named ICOMethod, LLC.,

to help blockchain companies with business strategy, development

and technology integration. It has also become involved in taking

cryptocurrency to the high street by investing in

multicryptocurrency ATMs.

Another company providing payment solutions to the cannabis

industry is Medical Cannabis Payment Solutions (OTC:

REFG). Its Green payment system provides a secure way for

cannabis merchants to receive and process payments. The company’s

systems provide complete end-to-end management of a business’s

finances, including tax collection and sales tracking.

Financial technology has seen big leaps forward in recent years,

providing accessible solutions for small businesses. The needs of

specialist markets are providing a drive towards further

innovation, leading to a host of sophisticated systems for smaller

businesses.

For more information on Global Payout, Inc., please visit

Global Payout,

Inc. (GOHE).

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content

distribution company that provides (1) access to a network of wire

services via NetworkWire to

reach all target markets, industries and demographics in the most

effective manner possible, (2) article and editorial syndication to

5,000+ news outlets (3), enhanced press release services to ensure

maximum impact, (4) social media distribution via the Investor

Brand Network (IBN) to nearly 2 million followers, (5) a full array

of corporate communications solutions, and (6) a total news

coverage solution with NNW Prime. As a

multifaceted organization with an extensive team of contributing

journalists and writers, NNW is uniquely positioned to best serve

private and public companies that desire to reach a wide audience

of investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

For more information, please visit https://www.NetworkNewsWire.com

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

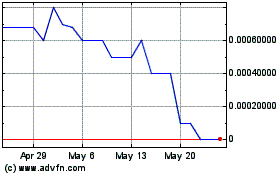

Medical Cannabis Payment... (CE) (USOTC:REFG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Medical Cannabis Payment... (CE) (USOTC:REFG)

Historical Stock Chart

From Feb 2024 to Feb 2025