ROI Land Investments, Ltd. Announces Investment Banking Agreement With Tokyo Based Dragoon Capital, Inc.

07 April 2014 - 8:00PM

ROI Land Investments, Inc. (OTCQB:ROII) ("ROI" or the "Company"),

announced today it has entered into an investment banking agreement

with Tokyo based Dragoon Capital Inc. ("Dragoon"). Dragoon will

assist the Company in connection with land acquisition financing

and bond offerings in Asia and worldwide.

Dragoon is a full service investment-banking firm (Japanese

Financial Service Agency License No. 1032) headquartered in Tokyo,

Japan, providing financial solutions to institutional investors and

corporate clients throughout the world. Founded in 2003, Dragoon

has been successful in sourcing emerging growth companies in Japan,

Asia, United States and Canada to investors worldwide.

Under this agreement, the Company has engaged Dragoon as its

exclusive placement agent and financial advisor in Tokyo, Japan, in

connection with the Company's acquisition financing of up to

US$6,500,000 in secured debt. The funds will be used for the

purpose of acquiring a 211-unit residential development project

based in Beauport, Quebec, Canada ("the Beauport/Cambert Project"

or "the Project"), a suburb of Quebec City, Quebec. The

appraised value for the Beauport/Cambert Project has been estimated

at CDN$8,200,000, according to an independent evaluation conducted

by the Group Altus, a world-renowned independent appraisal and

consulting firm http://www.altusgroup.com

The Beauport/Cambert Project is the only low-density residential

project planned in Beauport for the next 10 years. The Project

should be developed in the next three years. There was a

6.45% total population growth in the 2003-2011 period in the

Beauport area, compared to a 5.87% growth for the Province of

Québec and a 4.46% growth for Canada over the same period,

according to Statistics Canada. Quebec City has demonstrated a

solid economy where the unemployment rate is very low and the

economic growth has been stable since 2009.

The Company's Director, Chairman, Sebastian Cliche said, "We are

very pleased to establish this relationship with

Dragoon. Dragoon's team has an impressive track record

spanning more than 10 years that includes successfully handling

numerous capital-raising transactions and providing advisory

services to companies in a full spectrum of industries throughout

the world. We expect the assistance of this well-established

investment banking firm to accelerate our growth strategy through

acquisitions and with their assistance, move to the NASDAQ."

More detailed information on the land acquisition targets and

Debt Bond Offering shall be disclosed to the public in due

course.

About ROI Land Investments, Ltd.

ROI Land Investments, Ltd. ("ROI") is a real estate investment

company specializing in land development. ROI's business model

consists of acquiring attractive land developments free of zoning

restrictions, obtaining the necessary development permits,

outsourcing the development of the infrastructure and profiting

from the sale of the subdivided land units to known large regional

developers. For more information, please visit

www.roilandinvestments.com

About Dragoon Capital, Inc.

Dragoon Capital Inc. is an independent investment banking firm

that provides advice to institutional investors and middle-market

and emerging growth companies in Japan and

worldwide. Together, the firm's management professionals have

more than 80 years of experience providing private and public

companies with a broad spectrum of investment banking and financial

advisory services, including: mergers and acquisitions; equity and

debt capital raises; and restructurings. The firm provides

objective, unbiased, results-focused services that clients need to

achieve their goals. For more information, please visit:

http://www.dragoon.co.jp/en/index.html

SAFE HARBOR AND INFORMATIONAL STATEMENT: This press release may

contain forward-looking information within the meaning of Section

21E of the Security Exchange Act of 1934, as amended (the Exchange

Act), including all statements that are not statement of historical

fact regarding the intent, belief or current expectations of the

company, its directors or its officers with respect to, among other

things: (i) the company's financing plans; (ii) trends affecting

the company's financial conditions or results of operations; (iii):

the company's growth strategy and operating strategy; and (iv) the

declaration and payment of dividends.

The words "may", "would", "will", "expect", "estimate",

"anticipate", "believe", "intend", and similar expressions and

variations thereof are intend to identify forward-looking

statements. Investors are cautioned that any such forward-looking

statement are not a guarantee of future of future performance and

involve risks and uncertainties, many of which are beyond the

company's ability to control, and that actual results may differ

materially from those projected in the forward-looking statements

as a result of various factors including the risk disclosed in the

company's statements and reports filed with the OTC Markets. The

Company claims the safe harbor provided by Section 21E(c) of the

Exchange Act for all forward-looking statements.

For more information please visit our website:

www.roilandinvestments.com

CONTACT: Philippe Germain, VP of Investor Relations

T: +1 (514) 667 9470

M: +1 (418) 264 7134

Email: pgermain@roilandinvestments.com

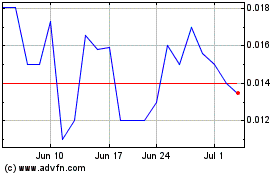

RiskOn (CE) (USOTC:ROII)

Historical Stock Chart

From Nov 2024 to Dec 2024

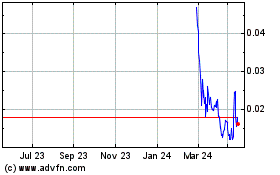

RiskOn (CE) (USOTC:ROII)

Historical Stock Chart

From Dec 2023 to Dec 2024