0000084112

false

FY

P6Y

0000084112

2022-05-01

2023-04-30

0000084112

RSKIA:ClassCommonStock0.10ParValueMember

2022-05-01

2023-04-30

0000084112

RSKIA:ConvertiblePreferredStock20StatedValueMember

2022-05-01

2023-04-30

0000084112

2023-07-28

0000084112

2023-07-31

0000084112

2023-04-30

0000084112

2022-04-30

0000084112

us-gaap:NoncumulativePreferredStockMember

2023-04-30

0000084112

us-gaap:NoncumulativePreferredStockMember

2022-04-30

0000084112

2021-05-01

2022-04-30

0000084112

us-gaap:PreferredStockMember

2021-04-30

0000084112

RSKIA:CommonStockClassAMember

2021-04-30

0000084112

us-gaap:PreferredStockMember

2022-04-30

0000084112

RSKIA:CommonStockClassAMember

2022-04-30

0000084112

us-gaap:AdditionalPaidInCapitalMember

2021-04-30

0000084112

RSKIA:TreasuryStockCommonClassAMember

2021-04-30

0000084112

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-04-30

0000084112

us-gaap:RetainedEarningsMember

2021-04-30

0000084112

2021-04-30

0000084112

us-gaap:AdditionalPaidInCapitalMember

2022-04-30

0000084112

RSKIA:TreasuryStockCommonClassAMember

2022-04-30

0000084112

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-30

0000084112

us-gaap:RetainedEarningsMember

2022-04-30

0000084112

us-gaap:PreferredStockMember

2021-05-01

2022-04-30

0000084112

RSKIA:CommonStockClassAMember

2021-05-01

2022-04-30

0000084112

us-gaap:AdditionalPaidInCapitalMember

2021-05-01

2022-04-30

0000084112

RSKIA:TreasuryStockCommonClassAMember

2021-05-01

2022-04-30

0000084112

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-05-01

2022-04-30

0000084112

us-gaap:RetainedEarningsMember

2021-05-01

2022-04-30

0000084112

us-gaap:AdditionalPaidInCapitalMember

2022-05-01

2023-04-30

0000084112

RSKIA:TreasuryStockCommonClassAMember

2022-05-01

2023-04-30

0000084112

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-05-01

2023-04-30

0000084112

us-gaap:RetainedEarningsMember

2022-05-01

2023-04-30

0000084112

us-gaap:PreferredStockMember

2023-04-30

0000084112

RSKIA:CommonStockClassAMember

2023-04-30

0000084112

us-gaap:AdditionalPaidInCapitalMember

2023-04-30

0000084112

RSKIA:TreasuryStockCommonClassAMember

2023-04-30

0000084112

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-30

0000084112

us-gaap:RetainedEarningsMember

2023-04-30

0000084112

2022-11-01

2022-11-30

0000084112

RSKIA:WinterParkGrandCountyCOMember

2002-11-30

0000084112

RSKIA:WinterParkGrandCountyCOMember

srt:MinimumMember

2002-11-01

2002-11-30

0000084112

RSKIA:WinterParkGrandCountyCOMember

srt:MaximumMember

2002-11-01

2002-11-30

0000084112

RSKIA:WinterParkGrandCountyCOMember

2002-11-01

2002-11-30

0000084112

RSKIA:NonCompeteAgreementMember

2022-05-01

2023-04-30

0000084112

RSKIA:DiesJigsAndMoldsMember

srt:MinimumMember

2023-04-30

0000084112

RSKIA:DiesJigsAndMoldsMember

srt:MaximumMember

2023-04-30

0000084112

RSKIA:DiesJigsAndMoldsMember

2023-04-30

0000084112

RSKIA:DiesJigsAndMoldsMember

2022-04-30

0000084112

us-gaap:MachineryAndEquipmentMember

srt:MinimumMember

2023-04-30

0000084112

us-gaap:MachineryAndEquipmentMember

srt:MaximumMember

2023-04-30

0000084112

us-gaap:MachineryAndEquipmentMember

2023-04-30

0000084112

us-gaap:MachineryAndEquipmentMember

2022-04-30

0000084112

us-gaap:FurnitureAndFixturesMember

srt:MinimumMember

2023-04-30

0000084112

us-gaap:FurnitureAndFixturesMember

srt:MaximumMember

2023-04-30

0000084112

us-gaap:FurnitureAndFixturesMember

2023-04-30

0000084112

us-gaap:FurnitureAndFixturesMember

2022-04-30

0000084112

us-gaap:LeaseholdImprovementsMember

srt:MinimumMember

2023-04-30

0000084112

us-gaap:LeaseholdImprovementsMember

srt:MaximumMember

2023-04-30

0000084112

us-gaap:LeaseholdImprovementsMember

2023-04-30

0000084112

us-gaap:LeaseholdImprovementsMember

2022-04-30

0000084112

RSKIA:BuildingsMember

srt:MinimumMember

2023-04-30

0000084112

RSKIA:BuildingsMember

srt:MaximumMember

2023-04-30

0000084112

RSKIA:BuildingsMember

2023-04-30

0000084112

RSKIA:BuildingsMember

2022-04-30

0000084112

RSKIA:AutomotiveMember

srt:MinimumMember

2023-04-30

0000084112

RSKIA:AutomotiveMember

srt:MaximumMember

2023-04-30

0000084112

RSKIA:AutomotiveMember

2023-04-30

0000084112

RSKIA:AutomotiveMember

2022-04-30

0000084112

RSKIA:SoftwareMember

srt:MinimumMember

2023-04-30

0000084112

RSKIA:SoftwareMember

srt:MaximumMember

2023-04-30

0000084112

RSKIA:SoftwareMember

2023-04-30

0000084112

RSKIA:SoftwareMember

2022-04-30

0000084112

us-gaap:LandMember

2023-04-30

0000084112

us-gaap:LandMember

2022-04-30

0000084112

us-gaap:MunicipalBondsMember

2023-04-30

0000084112

us-gaap:MunicipalBondsMember

2022-05-01

2023-04-30

0000084112

us-gaap:RealEstateInvestmentMember

2023-04-30

0000084112

us-gaap:RealEstateInvestmentMember

2022-05-01

2023-04-30

0000084112

us-gaap:EquitySecuritiesMember

2023-04-30

0000084112

us-gaap:EquitySecuritiesMember

2022-05-01

2023-04-30

0000084112

RSKIA:MoneyMarketsAndCDsMember

2023-04-30

0000084112

RSKIA:MoneyMarketsAndCDsMember

2022-05-01

2023-04-30

0000084112

us-gaap:MunicipalBondsMember

2022-04-30

0000084112

us-gaap:MunicipalBondsMember

2021-05-01

2022-04-30

0000084112

us-gaap:RealEstateInvestmentMember

2022-04-30

0000084112

us-gaap:RealEstateInvestmentMember

2021-05-01

2022-04-30

0000084112

us-gaap:EquitySecuritiesMember

2022-04-30

0000084112

us-gaap:EquitySecuritiesMember

2021-05-01

2022-04-30

0000084112

RSKIA:MoneyMarketsAndCDsMember

2022-04-30

0000084112

RSKIA:MoneyMarketsAndCDsMember

2021-05-01

2022-04-30

0000084112

1997-12-30

1998-01-01

0000084112

RSKIA:JoelWiensMember

2023-04-30

0000084112

RSKIA:JoelWiensMember

2022-04-30

0000084112

RSKIA:JoelWiensMember

2022-05-01

2023-04-30

0000084112

RSKIA:JoelWiensMember

2021-05-01

2022-04-30

0000084112

RSKIA:SecurityAlarmProductsMember

2023-02-01

2023-04-30

0000084112

RSKIA:SecurityAlarmProductsMember

2022-05-01

2023-04-30

0000084112

RSKIA:SecurityAlarmProductsMember

2021-05-01

2022-04-30

0000084112

RSKIA:CableAndWiringToolsMember

2023-02-01

2023-04-30

0000084112

RSKIA:CableAndWiringToolsMember

2022-05-01

2023-04-30

0000084112

RSKIA:CableAndWiringToolsMember

2021-05-01

2022-04-30

0000084112

RSKIA:OtherProductsMember

2023-02-01

2023-04-30

0000084112

RSKIA:OtherProductsMember

2022-05-01

2023-04-30

0000084112

RSKIA:OtherProductsMember

2021-05-01

2022-04-30

0000084112

2023-02-01

2023-04-30

0000084112

RSKIA:CorporateGeneralMember

2023-02-01

2023-04-30

0000084112

RSKIA:CorporateGeneralMember

2022-05-01

2023-04-30

0000084112

RSKIA:CorporateGeneralMember

2021-05-01

2022-04-30

0000084112

RSKIA:SecurityAlarmProductsMember

2023-04-30

0000084112

RSKIA:SecurityAlarmProductsMember

2022-04-30

0000084112

RSKIA:CableAndWiringToolsMember

2023-04-30

0000084112

RSKIA:CableAndWiringToolsMember

2022-04-30

0000084112

RSKIA:OtherProductsMember

2023-04-30

0000084112

RSKIA:OtherProductsMember

2022-04-30

0000084112

RSKIA:CorporateGeneralMember

2023-04-30

0000084112

RSKIA:CorporateGeneralMember

2022-04-30

0000084112

RSKIA:WellsFargoBankMember

2023-04-30

0000084112

RSKIA:WellsFargoBankMember

2022-04-30

0000084112

RSKIA:SalesSecurityAlarmMember

us-gaap:CustomerConcentrationRiskMember

RSKIA:CustomerMember

2022-05-01

2023-04-30

0000084112

RSKIA:SalesSecurityAlarmMember

us-gaap:CustomerConcentrationRiskMember

RSKIA:CustomerMember

2021-05-01

2022-04-30

0000084112

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

RSKIA:CustomerMember

2022-05-01

2023-04-30

0000084112

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

RSKIA:CustomerMember

2021-05-01

2022-04-30

0000084112

RSKIA:SalesSecuritySwitchMember

us-gaap:CustomerConcentrationRiskMember

RSKIA:CustomerMember

2022-05-01

2023-04-30

0000084112

RSKIA:SalesSecuritySwitchMember

us-gaap:CustomerConcentrationRiskMember

RSKIA:CustomerMember

2021-05-01

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

us-gaap:MunicipalBondsMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

us-gaap:MunicipalBondsMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

us-gaap:MunicipalBondsMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

us-gaap:RealEstateInvestmentMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

us-gaap:RealEstateInvestmentMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

us-gaap:RealEstateInvestmentMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:RealEstateInvestmentMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EquitySecuritiesMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EquitySecuritiesMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EquitySecuritiesMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

RSKIA:MoneyMarketsAndCDsMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

RSKIA:MoneyMarketsAndCDsMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

RSKIA:MoneyMarketsAndCDsMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

RSKIA:MoneyMarketsAndCDsMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

2023-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

us-gaap:MunicipalBondsMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

us-gaap:MunicipalBondsMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

us-gaap:MunicipalBondsMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MunicipalBondsMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

us-gaap:RealEstateInvestmentMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

us-gaap:RealEstateInvestmentMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

us-gaap:RealEstateInvestmentMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:RealEstateInvestmentMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EquitySecuritiesMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EquitySecuritiesMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EquitySecuritiesMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

RSKIA:MoneyMarketsAndCDsMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

RSKIA:MoneyMarketsAndCDsMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

RSKIA:MoneyMarketsAndCDsMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

RSKIA:MoneyMarketsAndCDsMember

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

2022-04-30

0000084112

us-gaap:FairValueMeasurementsRecurringMember

2022-04-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended April 30, 2023

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from __________ to _________

Commission

File Number: 000-05378

George

Risk Industries, Inc.

(Exact

name of registrant as specified in its charter)

| Colorado |

|

84-0524756 |

| (State

of incorporation) |

|

(IRS

Employer Identification No.) |

| |

|

|

802

South Elm St., Kimball, NE

|

|

69145

|

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number (308) 235–4645

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Name

of Exchange on Which Registered |

| None |

|

None |

Securities

registered under Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock, $0.10 par value |

|

RSKIA |

|

OTC

Markets |

| Convertible

Preferred Stock, $20 stated value |

|

RSKIA |

|

OTC

Markets |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Sections 15(d) of the Act.

Yes

☐ No ☒

Indicate

by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject

to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 229-405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☐ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes

☐ No ☒

The

aggregate market value, as of July 28, 2023, of the common stock (based on the average of the bid and asked prices of the shares on the

OTCM of George Risk Industries, Inc.) held by non-affiliates (assuming, for this purpose, that all directors, officers and owners of

5% or more of the registrant’s common stock are deemed affiliates) was approximately $21,926,000.

The

number of outstanding shares of the common stock as of July 31, 2023 was 4,928,508.

Part

I

Preliminary

Note Regarding Forward-Looking Statements and Currency Disclosure

This

annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance.

In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”,

“plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”

or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve

known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that

may cause our, or our industry’s, actual results, levels of activity, performance or achievements to be materially different from

any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

of activity, performance, or achievements. We do not intend to update any of the forward-looking statements to conform these statements

to actual results except as required by applicable law, including the securities laws of the United States.

Our

financial statements are stated in United States dollars, rounded to the nearest thousand, and are prepared in accordance with United

States Generally Accepted Accounting Principles.

Item

1 Business

(a)

Business Development

George

Risk Industries, Inc. (GRI or the Company) was incorporated in 1967 in Colorado. The Company is presently engaged in the design, manufacture,

and sale of custom computer keyboards, proximity switches, security alarm components and systems, pool access alarms, EZ Duct wire covers,

water sensors, electronic switching devices, high security switches and wire and cable installation tools.

Products,

Market, and Distribution

The

Company designs, manufactures, and sells computer keyboards, proximity switches, security alarm components and systems, pool access alarms,

water sensors, electronic switching devices, high security switches, and wire and cable installation tools. The Security sales division,

which concentrates on selling products for security purposes, comprises approximately 96.6% of net revenues and these goods are sold

to distributors and alarm dealers/installers.

The

security segment has approximately 1,000 current customers. One of the distributors, Ademco, Inc. (previously known as ADI), accounts

for approximately 35.8% of the Company’s sales of these products. Anixter, Inc. accounts for another 24.2% of the security segment

of the Company sales. The loss of these distributors would be significant to the Company. However, both companies have purchased from

the Company for many years and are expected to continue. Also, the Company has a written agreement with Ademco. This agreement was signed

in February 2011 and was initiated by the customer. The contents of the agreement include product terms, purchasing, payment terms, term

and termination, product marketing, representations and warranties, product support, mutual confidentiality, indemnification and insurance,

and general provisions.

The

keyboard and proximity switch segment has approximately 300 customers. These products are primarily sold to original equipment manufacturers

to their specifications and to distributors of off-the-shelf keyboards of proprietary design.

Competition

The

Company has intense competition in the keyboard/proximity and security/burglar alarm lines.

The

security/burglar alarm segment has approximately six major competitors. The Company competes well based on price, product design, quality,

customization and having products made in the USA.

The

competitors in the keyboard/proximity segment are larger companies with automated production facilities. GRI has emphasized small custom

order sales that many of its competitors decline or discourage.

Research

and Development

The

Company performs research and development for its customers when needed and as requested. Costs in connection with such product development

have been borne by the customers. Costs associated with the development of new products are expensed as incurred. The Company also does

R&D for itself to help in the development of new products.

Employees

GRI

has approximately 175 employees.

Item

2 Properties

The

Company owns the manufacturing and the office facilities that it operates in. Total square footage of the plant in Kimball, Nebraska

is approximately 50,000 sq. ft. A 7,500 sq. ft. warehouse for raw material storage was purchased in June 2017 when the Company acquired

its cable and wiring segment and another 9,600 sq. ft. building was purchased in April 2020 for additional expansion. Additionally, the

Company purchased the 15,000 sq. ft. building that it previously leased from Bonita Risk, which has been used mainly for offices, in

November 2019. Bonita Risk is a director of the Company.

The

Company also owns a building in Gering, NE that is 7,200 sq. ft. in size. This is used for manufacturing. Currently, there are approximately

34 employees at the Gering site.

Item

3 Legal Proceedings

None.

Item

4 Submission of Matters to a Vote of Security Holders

Not

applicable.

Part

II

Item

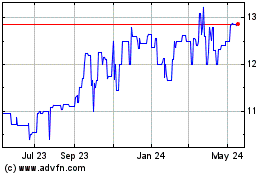

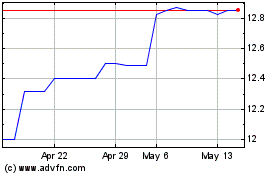

5 Market for the Registrant’s Common Equity and Related Stockholders’ Matter

Principal

Market

The

Company’s Class A Common Stock, which is traded under the ticker symbol RSKIA, is currently quoted on the OTC Bulletin Board by

one market maker.

Stock

Prices and Dividends Information

| 2023

Fiscal Year | |

High | | |

Low | |

| May 1—July 31 | |

$ | 12.24 | | |

$ | 11.02 | |

| August 1—October 31 | |

| 12.00 | | |

| 9.52 | |

| November 1—January 31 | |

| 11.60 | | |

| 10.35 | |

| February 1—April 30 | |

| 11.69 | | |

| 10.62 | |

| 2022

Fiscal Year | |

High | | |

Low | |

| May 1—July 31 | |

$ | 13.05 | | |

$ | 12.30 | |

| August 1—October 31 | |

| 14.50 | | |

| 12.50 | |

| November 1—January 31 | |

| 15.84 | | |

| 13.20 | |

| February 1—April 30 | |

| 15.50 | | |

| 12.00 | |

On

September 30, 2022, a dividend of $.60 per common share was declared for the fiscal year ending April 30, 2023.

For

the prior fiscal year, a dividend of $.50 per common share was declared on September 30, 2021.

The

number of holders of record of the Company’s Class A Common Stock as of April 30, 2023, was approximately 1,101.

Repurchases

of Equity Securities

On

September 18, 2008, the Board of Directors approved an authorization for the repurchase of up to 500,000 shares of the Company’s

common stock. Purchases can be made in the open market or in privately negotiated transactions. The Board did not specify an expiration

date for the authorization.

The

following tables show repurchases of GRI’s common stock made on a quarterly basis:

| 2023

Fiscal Year | |

Number

of shares repurchased | |

| May 1—July 31 | |

| 200 | |

| August 1—October 31 | |

| 70 | |

| November 1—January 31 | |

| 175 | |

| February 1—April 30 | |

| 200 | |

| 2022

Fiscal Year | |

Number

of shares repurchased | |

| May 1—July 31 | |

| 13 | |

| August 1—October 31 | |

| 2,000 | |

| November 1—January 31 | |

| 700 | |

| February 1—April 30 | |

| 12,568 | |

There

are still approximately 225,000 shares available to be repurchased under the current resolution.

Item

6 Selected Financial Data

Not

Applicable

Item

7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Executive

Overview

George

Risk Industries, Inc. (GRI) (the “Company”) is a diversified manufacturer of electronic components, encompassing the security

industry’s widest variety of door and window contact switches, environmental products, wire and cable installation tools, proximity

switches and custom keyboards. The security products division comprises the largest portion of GRI sales and products are sold worldwide

through distributors, who in turn sell these products to security installation companies. These products are used for residential, commercial,

industrial and government installations. International sales accounted for approximately 11.1% of revenues for fiscal year 2023 and 10.7%

for 2022.

GRI

is known for its quality American made products, top-notch customer service and the willingness to work with customers on their special

applications.

GRI

owns and operates its main manufacturing plant and offices in Kimball, Nebraska with a satellite plant 40 miles away in Gering, Nebraska.

The

Company has substantial marketable securities holdings and these holdings have a material impact on the financial results. For the fiscal

year ending April 30, 2023, the percentage of other income (expense) was a gain of 12.98% of income before income taxes. In comparison,

for the year ending April 30, 2022, the percentage of other income (expense) was a loss of 30.11% of the income before income taxes.

Management’s philosophy behind having holdings in marketable securities is to keep the money working and to gain interest on the

cash that is not needed to be put back into the business. Over the years, the investments have kept the earnings per share up when the

results from operations have not fared as well.

Management

is always open to the possibility of acquiring a business that would complement our existing operations, which is exactly what took place

in October 2017 when the Company purchased substantially all of the assets from Labor Saving Devices, Inc. (“LSDI”) and Roy

Bowling (“Bowling”).

There

are no known seasonal trends with any of GRI’s products, since the Company mostly sells to distributors and original equipment

manufacturers (OEMs). The products are tied to the housing industry and will fluctuate with building trends.

Liquidity

and Capital Resources

Operating

Net

cash decreased by $1,135,000 during the year ended April 30, 2023 compared to a decrease of $1,248,000 during the year ended April 30,

2022. Accounts receivable decreased by $627,000 during the current year while showing a $326,000 increase in the prior year. The current

decrease in cash flow from accounts receivable is the result of a combination of slightly faster collection of accounts receivable and

decreased sales. At April 30, 2023, 79.90% of receivables were less than 60 days and 4.95% were over 90 days. In comparison, 75.19% of

the receivables were considered current (less than 60 days) and 7.86% of the total were over 90 days past due for the prior year during

the same period.

Inventories

increased by $3,604,000 in the fiscal year ended April 30, 2023, while the prior year showed an increase of $2,430,000 at year end. The

current year increase is a result of having more raw materials on hand since sales had increased previously and having the raw material

costing more than before. In turn, with material and labor costs rising, the work in process and finished goods inventories have also

increased.

Prepaid

expenses decreased by $761,000 while they increased $903,000 in the current and prior year, respectively. The current year decrease is

due to not having as many prepayments of raw materials than at year-end last year and not having to renew multi-year subscriptions in

the current year.

Income

tax overpayment increased by $680,000 for the year ended April 30, 2023, compared to a $196,000 increase in income tax payable for the

year ended April 30, 2022. The current increase is largely due to having slightly lower sales and income before tax and not making larger

income tax estimates than last year.

For

the year ended April 30, 2023, accounts payable increased by $226,000 as compared to a decrease of $157,000 for the same period the year

before. The change in cash with regards to accounts payable is largely based on timing. Payables are paid within terms and fluctuate

based primarily on inventory needs for production. Accrued expenses increased $111,000 for the year ended April 30, 2023, due to having

significantly more accrued customer liability refund calculated compared to the prior year.

Investing

As

for investment activities, $548,000 was spent on purchases of property and equipment during the current fiscal year, compared to $390,000

during the year ended April 30, 2022 These capitalized costs mainly consisted of purchases of machinery and equipment and making capital

improvements. Additionally, the Company continues to purchase marketable securities, which include municipal bonds and quality stocks.

Cash spent on purchases of marketable securities for the year ended April 30, 2023 was $764,000 versus the $787,000 spent for the corresponding

period last year. Conversely, net proceeds from the sale of marketable securities were $25,000 and $452,000 at April 30, 2023 and 2022,

respectively. The Company uses “money manager” accounts for most stock transactions. By doing this, the Company gives an

independent third-party firm, who are experts in this field, permission to buy and sell stocks at will. The Company pays quarterly service

fees based on the value of the investments.

Financing

Cash

used in financing activities consists of two items. First, for the year ended April 30, 2023, $2,689,000 was spent on the payment of

dividends. The Company declared a dividend of $0.60 per share of common stock on September 30, 2022 for the current fiscal year, while

a $0.50 per share of common stock dividend was declared on September 30, 2021 and issued in the prior fiscal year. Second, the Company

continues to purchase back its Class A common stock when the opportunity arises. For the year ended April 30, 2023, the Company purchased

$7,000 of treasury stock and $211,000 was bought back for the year ended April 30, 2022. In an effort to repurchase its Class A Common

Stock, the Company has been actively searching for stockholders that have been “lost” over the years.

At

April 30, 2023, working capital increased 3.28% in comparison to the previous fiscal year. The Company measures liquidity using the quick

ratio, which is the ratio of cash, securities and accounts receivables to current obligations. The Company’s quick ratio decreased

to 14.648 for the year ended April 30, 2023 compared to 15.549 for the year ended April 30, 2022.

Results

of Operations

GRI

completed the fiscal year ending April 30, 2023 with a net profit of 23.81% of net sales. Net sales were at $19,979,000, down 3.65% over

the previous fiscal year. The decrease in sales is a result of a slowing economy which has seen inflation grow to some of its highest

levels in the last 15 years. Cost of goods sold was 53.08% of net sales for the year ended April 30, 2023 and 51.70% for the same period

last year. Management aims to keep the cost of goods sold percentage within 50% and was just slightly over that percentage for the current

fiscal year. Management strives to be as efficient as possible since wages and material costs continue to increase, due to the increased

inflation in our economy. Management offset some of these added expenses by implementing a 10% price increase effective January 1, 2023.

Operating

expenses were 21.59% of net sales for the year ended April 30, 2023 as compared to 21.06% for the corresponding period last year. Management’s

goal is to keep the operating expenses around 30% or less of net sales, so the goal has been met for the current fiscal year. Income

from operations for the year ended April 30, 2023 was at $5,060,000, which is a 10.41% decrease from the corresponding period last year,

which had income from operations of $5,648,000.

Other

income and expense results for the fiscal year ended April 30, 2023 produced a gain of $755,000. This is in comparison to a loss of $1,307,000

for the fiscal year ending April 30, 2022. Dividend and interest income was $1,068,000, which is up 3.99% over the prior year. Dividend

and interest income at April 30, 2022 was $1,027,000. Investments in marketable securities are presented at fair value and an unrealized

gain or loss is recorded within the statements of operations, a non-cash entry. As a result, an unrealized loss of $31,000 was recorded

for the fiscal year ended April 30, 2023 and an unrealized loss of $2,764,000 was recorded for the prior year ended April 30, 2022. Net

loss on the sale of investments for the current fiscal year was $291,000, which is a 170.29% decrease over the net gain on the sale of

investments of $414,000 for the fiscal year ending April 30, 2022.

Net

income for the year ended April 30, 2023 was $4,757,000, which is up 33.40% from the prior year, which produced net income of $3,566,000.

Basic and diluted earnings per common share (“EPS”) for the year ended April 30, 2023 was $0.96 per share. Basic and diluted

EPS for the year ended April 30, 2022 was $0.72 per share.

Management

is hopeful that sales will increase for the fiscal year ending April 30, 2024. Opportunities for Management include focusing on finding

ways to get our products out to our customers in a timelier manner. One way we are doing this is by looking into more automation. Challenges

facing Management include obtaining certain raw materials and the increased costs of most raw materials because of inflation. The Company

also struggles to get enough workers to fill production needs. Our Security sales division, which is our largest sales generator, is

directly tied to the housing industry and we normally experience the same fluctuations. We are always researching and developing new

products that will help our sales increase. There were a few new or improved products that were successfully launched in fiscal year

2023, and we are confident that more new products will be released soon, and we are searching for products that complement our current

offerings. Management is always open to the possibility of acquiring a business or product line that would complement our existing operations.

Due to the Company’s strong cash position, management believes this could be achieved without the need for outside financing. The

intent is to utilize the equipment, marketing techniques and established customers to deliver new products and increase sales and profits.

New

product development

The

GRI Engineering department continues to develop enhancements to our existing products as well as to develop new products that will continue

to secure our position in the industry.

Explosion

proof contacts that will be UL listed for hazardous locations are in development. There has been demand from our customers for this type

of high security magnetic reed switch.

The

Company is developing magnetic contacts which are listed under UL 634 Level 2. These sensors are for high security applications such

as government buildings, military use, nuclear facilities, and financial institutions.

Research

is being done on updating our small profile glass break detector, in addition to looking at development of programmable temperature and

humidity sensors with built-in hysteresis.

Wireless

technology is a main area of focus for product development. We are considering adding wireless technology to some of our current products.

A wireless contact switch is in the final stages of development. Also, we are working on wireless versions of monitoring devices which

include glass break detection, tilt sensing and environmental monitoring. A redesign of our brass water valve shut-off system is near

completion.

Critical

Accounting Policies

The

discussion and analysis of the financial condition and results of operations are based upon the financial statements, which have been

prepared in conformity with generally accepted accounting principles in the United States. The preparation of these financial statements

requires the use of estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses reported

in those financial statements. These judgments can be subjective and complex, and consequently actual results could differ from those

estimates. The most critical accounting policies relate to accounts receivable; marketable securities; inventory; income taxes; and segment

reporting.

Accounts

receivable—Accounts receivable are customer obligations due under normal trade terms. The Company sells its products to security

alarm distributors, alarm installers, and original equipment manufacturers. Management performs continuing credit evaluations of its

customers’ financial condition and the Company generally does not require collateral.

The

Company records an allowance for credit losses based on an analysis of specifically identified customer balances. The Company has a limited

number of customers with individually large amounts due at any given date. Any unanticipated change in any one of these customers’

credit worthiness or other matters affecting the collectability of amounts due from such customers could have a material effect on the

results of operations in the period in which such changes or events occur. After all attempts to collect a receivable have failed, the

receivable is written off.

Marketable

securities—The Company has investments in publicly traded equity securities, state and municipal debt securities, and real-estate

investment trusts (REITs). The investments in securities are reported at fair value. The Company uses the average cost method to determine

the cost of securities sold and any unrealized gains or losses on equity securities are reported in the respective period’s earnings.

Unrealized gains and losses on debt securities are excluded from earnings and reported separately as a component of stockholder’s

equity. Dividend and interest income are reported as earned.

In

accordance with the Generally Accepted Accounting Principles in the United States (US GAAP), the Company evaluates all marketable securities

for other-than temporary declines in fair value. When the cost basis exceeds the fair market value for approximately one year, management

evaluates the nature of the investment, cause of impairment and number of investments that are in an unrealized loss position. When it

is determined that a security will likely remain impaired, a recognized loss is booked and the investment is written down to its new

fair value. The investments are periodically evaluated to determine if impairment changes are required.

Inventories—Inventories

are valued at the lower of cost or net realizable value. Costs are determined using the average cost-pricing method. The Company uses

actual costs to price its manufactured inventories, approximating average costs. The reported net value of inventory includes finished

saleable products, work-in-process and raw materials that will be sold or used in future periods. Inventory costs include raw materials,

direct labor and overhead. The Company’s overhead expenses are applied, based in part, upon estimates of the proportion of those

expenses that are related to procuring and storing raw materials as compared to the manufacture and assembly of finished products. These

proportions, the method of their application, and the resulting overhead included in ending inventory, are based in part on subjective

estimates and approximations and actual results could differ from those estimates.

In

addition, the Company records an inventory obsolescence reserve, which represents the cost of the inventory that has had no movement

in over two years. There is inherent professional judgment and subjectivity made by management in determining the estimated obsolescence

percentage. In addition, and as necessary, the Company may establish specific reserves for future known or anticipated events.

Income

Taxes—US GAAP requires use of the assets and liability method; whereby current and deferred tax assets and liabilities are

determined based on tax rates and laws enacted as of the balance sheet date. Deferred tax expense represents the change in the deferred

tax asset/liability balances.

Segment

Reporting and Related Information—The Company designates the internal organization that is used by management for allocating

resources and assessing performance as the source of the Company’s reportable segments. US GAAP also requires disclosures about

products and services, geographic area, and major customers.

Related

Party Transactions — One of the directors of the board, Joel Wiens, is the principal shareholder of FirsTier Bank. FirsTier

Bank is the financial institution the Company uses for its day-to-day banking operations. Year end balances of accounts held at this

bank are $4,637,000 for the year ended April 30, 2023 and $5,058,000 for the year ended April 30, 2022. The Company also received interest

income from FirsTier Bank in the amount of approximately $102,700 for the fiscal year ended April 30, 2023 and approximately $58,800

was received for the fiscal year ended April 30, 2022.

Item

8 Financial Statements

Index

to Financial Statements

George

Risk Industries, Inc.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Board of Directors and

Stockholders

of George Risk Industries, Inc.

Opinion

on the Financial Statements

We

have audited the accompanying balance sheets of George Risk Industries, Inc. (the Company) as of April 30, 2023 and 2022, and the related

statements of income, comprehensive income, stockholders’ equity, and cash flows for each of the years in the two-year period ended

April 30, 2023, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements

present fairly, in all material respects, the financial position of the Company as of April 30, 2023 and 2022, and the results of its

operations and its cash flows for each of the years in the two-year period ended April 30, 2023, in conformity with accounting principles

generally accepted in the United States of America.

Basis

for Opinion

These

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s

financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board

(United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities

laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We

conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company

is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits,

we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion

on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our

audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error

or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding

the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant

estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits

provide a reasonable basis for our opinion.

Critical

Audit Matters

The

critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated

or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial

statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters

does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit

matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Critical

Audit Matter – Revenue Recognition – Refer to Note 1 of the Financial Statements

Critical Audit Matter Description

The

Company primarily generates revenue through non-complex sales transactions that require limited judgement. However, there are instances

in which revenue contracts contain complexities that are subject to critical judgment around when the performance obligation is satisfied.

These specific elements of revenue are variable considerations, returns and allowances.

Consideration

in contracts with customers is variable due to anticipated reductions such as discounts, rebates, and allowances. Accordingly, revenues

are recorded net of estimated variable consideration, returns and allowances, based on known or expected values.

This

matter was considered a critical audit matter as there is a high degree of auditor effort in performing procedures and evaluation of

audit evidence related to contractual terms in customer arrangements to determine the amounts of consideration.

How

the Critical Audit Matter was Addressed in the Audit

Our

principal procedures related to the Company’s revenue recognition for these specific elements are the following:

| |

● |

We

evaluated management’s significant accounting policies related to various elements of revenue recognition. |

| |

|

|

| |

● |

We

performed analytical procedures to test the reasonableness of recorded balances. |

| |

|

|

| |

● |

For

a sample of transactions, we inspected source documents, including customer contracts or purchase orders, third-party shipping information,

invoices, and relevant communication. |

| |

|

|

| |

● |

Evaluated

contractual terms in customer arrangements that impact management determination of the variable consideration related to the productions

and related recognition of revenue on a sample basis. |

Critical

Audit Matter – Valuation of Investments – Refer to Note 1 and Note 3 of the Financial Statements

Critical Audit Matter Description

The

company has investments in publicly traded equity securities, state and municipal debt securities, REITS, and money markets and they

are recorded at fair value. Some of these investments are Level 2 investments and can be hard to value. In addition, as the securities

held at fair value, management must assess securities that are in a significant unrealized loss position for other than temporary impairment.

For these securities, management must make difficult and subjective judgements about the ability of the issuer to be able to meet its

obligations under terms of the security. These judgements can have a significant impact on the Company’s reported earnings if they

should prove to be significantly inaccurate.

How

the Critical Audit Matter was Addressed in the Audit

Our

principal procedures related to the Company’s process for debt securities valuations as well as the process for equity securities

other than temporary impairment evaluation included are the following:

| |

● |

We

evaluated management’s significant accounting policies related to the identification of other than temporary impairment. |

| |

|

|

| |

● |

Valuation

specialists, with specialized skills and knowledge, were involved in the assessment of the fair values for a sample of Level 2 investments. |

| |

|

|

| |

● |

We

performed testing over a sample of securities to determine if conclusions reached by management regarding other than temporary impairment

were appropriate. |

| /s/

Haynie and Company |

|

| |

|

| We

have served as the Company’s auditor since 1992. |

|

| Littleton, CO |

|

| Firm ID 457 |

|

| July 31, 2023 |

|

George

Risk Industries, Inc.

Balance

Sheets

As

of April 30, 2023 and 2022

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and

cash equivalents | |

$ | 4,943,000 | | |

$ | 6,078,000 | |

| Investments and securities | |

| 31,363,000 | | |

| 30,979,000 | |

| Accounts receivable: | |

| | | |

| | |

| Trade, net of allowance

for credit losses of $17,922 and $33,531 for 2023 and 2022, respectively | |

| 3,503,000 | | |

| 4,114,000 | |

| Other | |

| 59,000 | | |

| 16,000 | |

| Income tax overpayment | |

| 403,000 | | |

| — | |

| Inventories, net | |

| 11,443,000 | | |

| 7,940,000 | |

| Prepaid

expenses | |

| 651,000 | | |

| 1,362,000 | |

| Total Current Assets | |

| 52,365,000 | | |

| 50,489,000 | |

| | |

| | | |

| | |

| Property and Equipment, at cost, net | |

| 1,997,000 | | |

| 1,782,000 | |

| | |

| | | |

| | |

| Other Assets | |

| | | |

| | |

| Investment in Limited

Land Partnership, at cost | |

| 344,000 | | |

| 344,000 | |

| Projects in process | |

| 83,000 | | |

| 83,000 | |

| Other | |

| 13,000 | | |

| 62,000 | |

| Total Other Assets | |

| 440,000 | | |

| 489,000 | |

| | |

| | | |

| | |

| Intangible Assets,

net | |

| 1,149,000 | | |

| 1,271,000 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 55,951,000 | | |

$ | 54,031,000 | |

The

accompanying notes are an integral part of these financial statements.

George

Risk Industries, Inc.

Balance

Sheets (Continued)

As

of April 30, 2023 and 2022

| | |

2023 | | |

2022 | |

LIABILITIES

AND STOCKHOLDERS’ EQUITY

| |

| | |

| |

| | |

| | |

| |

| Current Liabilities | |

| | | |

| | |

| Accounts payable,

trade | |

$ | 546,000 | | |

$ | 320,000 | |

| Dividends payable | |

| 2,565,000 | | |

| 2,296,000 | |

| Deferred income | |

| 43,000 | | |

| — | |

| Accrued expenses | |

| 421,000 | | |

| 354,000 | |

| Income

tax payable | |

| — | | |

| 277,000 | |

| Total Current Liabilities | |

| 3,575,000 | | |

| 3,247,000 | |

| | |

| | | |

| | |

| Long-Term Liabilities | |

| | | |

| | |

| Deferred

income taxes | |

| 1,727,000 | | |

| 1,742,000 | |

| Total Long-Term Liabilities | |

| 1,727,000 | | |

| 1,742,000 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 5,302,000 | | |

| 4,989,000 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| — | | |

| — | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Convertible preferred stock,

1,000,000 shares authorized, Series 1—noncumulative, $20 stated value, 25,000 shares authorized, 4,100 issued and outstanding | |

| 99,000 | | |

| 99,000 | |

| Common stock, Class A,

$.10 par value, 10,000,000 shares authorized, 8,502,881 shares issued and outstanding | |

| 850,000 | | |

| 850,000 | |

| Additional paid-in capital | |

| 1,934,000 | | |

| 1,934,000 | |

| Accumulated other comprehensive

income (loss) | |

| (161,000 | ) | |

| (137,000 | ) |

| Retained earnings | |

| 52,481,000 | | |

| 50,843,000 | |

| Less:

treasury stock, 3,572,338 and 3,571,693 shares, at cost | |

| (4,554,000 | ) | |

| (4,547,000 | ) |

| Total Stockholders’

Equity | |

| 50,649,000 | | |

| 49,042,000 | |

| | |

| | | |

| | |

| TOTAL LIABILITES AND

STOCKHOLDERS’ EQUITY | |

$ | 55,951,000 | | |

$ | 54,031,000 | |

The

accompanying notes are an integral part of these financial statements.

George

Risk Industries, Inc.

Income

Statements

For

the years ended April 30, 2023 and 2022

| | |

Year ended | | |

Year ended | |

| | |

April

30, 2023 | | |

April

30, 2022 | |

| | |

| | |

| |

| Net Sales | |

$ | 19,979,000 | | |

$ | 20,735,000 | |

| Less: Cost of Goods

Sold | |

| (10,605,000 | ) | |

| (10,720,000 | ) |

| Gross Profit | |

| 9,374,000 | | |

| 10,015,000 | |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| General and Administrative | |

| 1,380,000 | | |

| 1,426,000 | |

| Selling | |

| 2,836,000 | | |

| 2,857,000 | |

| Engineering | |

| 98,000 | | |

| 84,000 | |

| Total Operating Expenses | |

| 4,314,000 | | |

| 4,367,000 | |

| | |

| | | |

| | |

| Income From Operations | |

| 5,060,000 | | |

| 5,648,000 | |

| | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | |

| Other Income | |

| 6,000 | | |

| 16,000 | |

| Dividend and Interest

Income | |

| 1,068,000 | | |

| 1,027,000 | |

| Unrealized (Loss) on

Equity Securities | |

| (31,000 | ) | |

| (2,764,000 | ) |

| Gain (Loss) on Sale

of Investment | |

| (291,000 | ) | |

| 414,000 | |

| Gain

on Sale of Assets | |

| 3,000 | | |

| — | |

| Total Other Income (Expense) | |

| 755,000 | | |

| (1,307,000 | ) |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Provisions for Income Taxes | |

| | | |

| | |

| Current Expense | |

| 1,226,000 | | |

| 1,669,000 | |

| Deferred

tax (benefit) | |

| (168,000 | ) | |

| (894,000 | ) |

| Total

Income Tax Expense | |

| 1,058,000 | | |

| 775,000 | |

| | |

| | | |

| | |

| Net Income | |

$ | 4,757,000 | | |

$ | 3,566,000 | |

| | |

| | | |

| | |

| Earnings Per Share of Common Stock | |

| | | |

| | |

| Basic | |

$ | 0.96 | | |

$ | 0.72 | |

| Diluted | |

$ | 0.96 | | |

$ | 0.72 | |

| | |

| | | |

| | |

| Weighted Average Number of Common Shares

Outstanding (Basic) | |

| 4,930,835 | | |

| 4,941,825 | |

| Weighted Average Number of Common Shares

Outstanding (Diluted) | |

| 4,951,335 | | |

| 4,962,325 | |

The

accompanying notes are an integral part of these financial statements.

George

Risk Industries, Inc.

Statements

of Comprehensive Income

For

the years ended April 30, 2023 and 2022

| | |

Year ended | | |

Year ended | |

| | |

April

30, 2023 | | |

April

30, 2022 | |

| | |

| | |

| |

| Net Income | |

$ | 4,757,000 | | |

$ | 3,566,000 | |

| | |

| | | |

| | |

| Other Comprehensive (Loss), Net of Tax | |

| | | |

| | |

| Unrealized (loss) on

debt securities: | |

| | | |

| | |

| Unrealized holding (losses)

arising during period | |

| (33,000 | ) | |

| (344,000 | ) |

| Income

tax benefit related to other comprehensive income | |

| 9,000 | | |

| 99,000 | |

| Other

Comprehensive (Loss) | |

| (24,000 | ) | |

| (245,000 | ) |

| | |

| | | |

| | |

| Comprehensive Income | |

$ | 4,733,000 | | |

$ | 3,321,000 | |

The

accompanying notes are an integral part of these financial statements.

George

Risk Industries, Inc.

Statements

of Stockholders’ Equity

For

the Years Ended April 30, 2023 and 2022

| | |

| | | |

| | | |

| | | |

| | |

| | |

Preferred

Stock | | |

Common

Stock

Class

A | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | |

| Balances,

April 30, 2021 | |

| 4,100 | | |

$ | 99,000 | | |

| 8,502,881 | | |

$ | 850,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Purchases of common stock | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Dividend declared at $0.50 per common share

outstanding | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain (loss), net of tax effect | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Balances,

April 30, 2022 | |

| 4,100 | | |

| 99,000 | | |

| 8,502,881 | | |

| 850,000 | |

| Balances | |

| 4,100 | | |

| 99,000 | | |

| 8,502,881 | | |

| 850,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Prior period adjustment for provisions related

to depreciation | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Purchases of common stock | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Dividend declared at $0.60 per

common share outstanding | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain (loss), net of tax effect | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Balance,

April 30, 2023 | |

| 4,100 | | |

$ | 99,000 | | |

| 8,502,881 | | |

$ | 850,000 | |

| Balance | |

| 4,100 | | |

$ | 99,000 | | |

| 8,502,881 | | |

$ | 850,000 | |

The

accompanying notes are an integral part of these financial statements.

George

Risk Industries, Inc.

Statements

of Stockholders’ Equity

For

the Years Ended April 30, 2023 and 2022

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| |

Paid-In | | |

Treasury

Stock (Common Class A) | | |

Accumulated Other

Comprehensive | | |

Retained | | |

| |

| |

Capital | | |

Shares | | |

Amount | | |

Income

(Loss) | | |

Earnings | | |

Total | |

| Balances,

April 30, 2021 |

$ | 1,934,000 | | |

| 3,556,412 | | |

$ | (4,336,000 | ) | |

$ | 108,000 | | |

$ | 49,749,000 | | |

$ | 48,404,000 | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Purchases

of common stock |

| — | | |

| 15,281 | | |

| (211,000 | ) | |

| — | | |

| — | | |

| (211,000 | ) |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividend declared at $0.50

per common share outstanding |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,472,000 | ) | |

| (2,472,000 | ) |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain (loss),

net of tax effect |

| — | | |

| — | | |

| — | | |

| (245,000 | ) | |

| — | | |

| (245,000 | ) |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

Income |

| — | | |

| — | | |

| — | | |

| — | | |

| 3,566,000 | | |

| 3,566,000 | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances,

April 30, 2022 |

| 1,934,000 | | |

| 3,571,693 | | |

| (4,547,000 | ) | |

| (137,000 | ) | |

| 50,843,000 | | |

| 49,042,000 | |

| Balances |

| 1,934,000 | | |

| 3,571,693 | | |

| (4,547,000 | ) | |

| (137,000 | ) | |

| 50,843,000 | | |

| 49,042,000 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Prior period adjustment

for provisions related to depreciation |

| — | | |

| — | | |

| — | | |

| — | | |

| (161,000 | ) | |

| (161,000 | ) |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Purchases of common stock |

| — | | |

| 645 | | |

| (7,000 | ) | |

| — | | |

| — | | |

| (7,000 | ) |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividend declared at $0.60

per common share outstanding |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,958,000 | ) | |

| (2,958,000 | ) |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain (loss),

net of tax effect |

| — | | |

| — | | |

| — | | |

| (24,000 | ) | |

| — | | |

| (24,000 | ) |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

Income |

| — | | |

| — | | |

| — | | |

| — | | |

| 4,757,000 | | |

| 4,757,000 | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance,

April 30, 2023 |

$ | 1,934,000 | | |

| 3,572,338 | | |

$ | (4,554,000 | ) | |

$ | (161,000 | ) | |

$ | 52,481,000 | | |

$ | 50,649,000 | |

| Balance |

$ | 1,934,000 | | |

| 3,572,338 | | |

$ | (4,554,000 | ) | |

$ | (161,000 | ) | |

$ | 52,481,000 | | |

$ | 50,649,000 | |

The

accompanying notes are an integral part of these financial statements.

George

Risk Industries, Inc.

Statements

of Cash Flows

| | |

Year ended | | |

Year ended | |

| | |

April

30, 2023 | | |

April

30, 2022 | |

| | |

| | |

| |

| Cash

Flows From Operating Activities: | |

| | | |

| | |

| Net Income | |

$ | 4,757,000 | | |

$ | 3,566,000 | |

| Adjustments to reconcile

net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 445,000 | | |

| 435,000 | |

| Realized (gain) loss

on sale of investments | |

| 224,000 | | |

| (414,000 | ) |

| Impairment on investments | |

| 67,000 | | |

| — | |

| Unrealized loss on equity

securities | |

| 31,000 | | |

| 2,764,000 | |

| Provision for credit

losses on accounts receivable | |

| (16,000 | ) | |

| 24,000 | |

| Reserve for obsolete

inventory | |

| 100,000 | | |

| 113,000 | |

| (Gain) on sale of assets | |

| (3,000 | ) | |

| — | |

| Deferred income taxes | |

| (167,000 | ) | |

| (894,000 | ) |

| Changes in assets and

liabilities: | |

| | | |

| | |

| (Increase) decrease

in: | |

| | | |

| | |

| Accounts receivable | |

| 627,000 | | |

| (326,000 | ) |

| Inventories | |

| (3,604,000 | ) | |

| (2,430,000 | ) |

| Prepaid expenses | |

| 761,000 | | |

| (903,000 | ) |

| Other receivables | |

| (43,000 | ) | |

| — | |

| Income tax overpayment | |

| (680,000 | ) | |

| — | |

| Increase (decrease)

in: | |

| | | |

| | |

| Accounts payable | |

| 226,000 | | |

| (157,000 | ) |

| Accrued expenses | |

| 111,000 | | |

| (5,000 | ) |

| Income

tax payable | |

| — | | |

| 196,000 | |

| Net cash from operating

activities | |

| 2,836,000 | | |

| 1,969,000 | |

| | |

| | | |

| | |

| Cash

Flows From Investing Activities: | |

| | | |

| | |

| Proceeds from sale of

assets | |

| 12,000 | | |

| — | |

| (Purchase) of property

and equipment | |

| (548,000 | ) | |

| (390,000 | ) |

| Proceeds from sale of

marketable securities | |

| 25,000 | | |

| 452,000 | |

| (Purchase)

of long-term investment | |

| — | | |

| (24,000 | ) |

| Net cash from investing

activities | |

| (1,275,000 | ) | |

| (749,000 | ) |

| | |

| | | |

| | |

| Cash

Flows From Financing Activities: | |

| | | |

| | |

| (Purchase)

of treasury stock | |

| (7,000 | ) | |

| (211,000 | ) |

| Dividends

paid | |

| (2,689,000 | ) | |

| (2,257,000 | ) |

| Net

cash from financing activities | |

| (2,696,000 | ) | |

| (2,468,000 | ) |

| | |

| | | |

| | |

| Net

Change in Cash and Cash Equivalents | |

| (1,135,000 | ) | |

| (1,248,000 | ) |

| | |

| | | |

| | |

| Cash

and Cash Equivalents, beginning of year | |

| 6,078,000 | | |

| 7,326,000 | |

| | |

| | | |

| | |

| Cash

and Cash Equivalents, end of year | |

$ | 4,943,000 | | |

$ | 6,078,000 | |

| | |

| | | |

| | |

| Supplemental

Disclosure for Cash Flow Information: | |

| | | |

| | |

| Cash payments for: | |

| | | |

| | |

| Income taxes paid | |

$ | 2,070,000 | | |

$ | 1,575,000 | |

| Interest expense | |

| — | | |

| — | |

| | |

| | | |

| | |

| Cash receipts for: | |

| | | |

| | |

| Income taxes | |

$ | 176,000 | | |

$ | 114,000 | |

The

accompanying notes are an integral part of these financial statements.

George

Risk Industries, Inc.

Notes

to Financial Statements

April

30, 2023

| |

1. |

Nature

of Business and Summary of Significant Accounting Policies |

George

Risk Industries, Inc. (GRI or the Company) was incorporated in 1967 in Colorado. The Company is presently engaged in the design, manufacture,

and sale of custom computer keyboards, proximity switches, security alarm components and systems, pool access alarms, EZ Duct wire covers,

water sensors, electronic switching devices, high security switches, and wire and cable installation tools.

Nature

of Business — The Company is engaged in the design, manufacture, and marketing of custom computer keyboards, proximity sensors,

security alarm components, pool access alarms, liquid detection sensors, raceway wire covers, wire and cable installation tools and various

other sensors and devices.

Cash

and Cash Equivalents — The Company considers all investments with a maturity of three months or less to be cash equivalents.

The Company maintains its cash in bank deposit accounts, the balances of which at times may exceed federally insured limits. The Company

continually monitors its banking relationships and consequently has not experienced any losses in such accounts. The Company believes

it is not exposed to any significant credit risk on cash and cash equivalents.

Accounts

Receivable and Allowance for Estimated Credit Losses — Accounts receivable are customer obligations due under normal trade

terms. The Company sells its products to security alarm distributors, alarm installers, and original equipment manufacturers. The Company

extends credit to its customers based on their credit worthiness and performs continuing credit evaluations of its customers’ financial

condition. If the Company believes the extension of credit is not advisable, other payment methods such as prepayments are required.

Balances deemed uncollectible by the Company are written off against our allowance for credit loss accounts.

The

Company maintains an allowance for estimated credit losses related to accounts receivable for future expected credit losses resulting

from the inability or unwillingness of our customers to make required payments. We estimate our allowance for credit losses based on

relevant information such as historical experience, current conditions, and future expectation of specifically identified customer balances.

This allowance is adjusted as appropriate to reflect current conditions. The Company has recorded an allowance for estimated credit losses

of $17,922 for the year ended April 30, 2023 and $33,531 for the year ended April 30, 2022 For the fiscal year ended April 30, 2023,

the provision for credit losses on accounts receivable was a credit of $17,171 compared to an expense of $24,199 for the fiscal year

ended April 30, 2022.