athenahealth Implements MU2 - Analyst Blog

10 October 2013 - 9:00AM

Zacks

athenahealth, Inc. (ATHN) successfully

implemented the Meaningful Use Stage 2 (MU2) criteria across its

nationwide, cloud-based network. Amid negative market vibes

regarding stagnating booking growth and saturated underlying

markets for the company, this positive piece of news should boost

investor confidence in the stock. The company’s stock returned an

impressive 44.3% to its investors on a year-to-date basis.

At the Medical Group Management Association (MGMA), ATHN announced

that its athenaNet clients can start practicing under the MU2

criteria from this month. This has allowed eligible professionals

to report as per Stage 2 rules and has also provided them the

opportunity for attestation in the first quarter of 2014. Upon

attestation, eligible providers and hospitals will qualify for

funding under the Medicare and Medicaid EHR Incentive Programs.

athenahealth also plans to release its ICD-10 readiness center in

this quarter, as part of the company’s ICD-10 guarantee. The center

will use ATHN’s resources to provide its customers a complete view

of organizational, payer, and supply chain readiness.

Moreover, in its "Better Now -- Guaranteed" initiative, management

guarantees that all eligible providers who partner with ATHN to

attest for Stage 1 or Stage 2 incentive payments will receive them

within the first year in which they qualify. All providers who use

athenaClinicals now use a 2014 Certified Complete EHR.

Despite a 20% provider dropout rate from the Meaningful Use (MU)

program in 2012, management asserted that 96% of its clients

successfully attested in 2012 that helped them to receive

incentives. Moreover, the company considers 2014 to bring in

significant changes within the healthcare sector, and thus remains

committed to assist its clients with MU attestation as well as

ICD-10 transition.

Additionally, the company will be showcasing its athenaClinicals,

athenaCommunicator, Epocrates and the new Epocrates Bugs + Drugs at

the MGMA conference. Recently, athenahealth’s subsidiary Epocrates

launched a new mobile application (app), Epocrates Bugs + Drugs,

which combines cloud-based clinical data with a user-friendly

mobile interface.

The app is designed to locate local bacterial superbugs

(bacteria that are resistant to antibiotics) and assist physicians

to timely prescribe appropriate antibiotics. The much awaited

“Epocrates Bugs + Drugs” is now available for free on iOS 7 devices

in the Apple App Store.

Currently, athenahealth has a Zacks Rank #5 (Strong Sell). The

company had reported disappointing results in the second quarter of

2013. Adjusted loss per share of 21 cents was a major setback,

lagging the Zacks Consensus Estimate of earnings of 8 cents per

share. Moreover, the result was worse than the year-ago earnings

per share of 13 cents.

While we strongly recommend avoiding this stock, other

better-placed medical stocks that are worth a look include

Cardinal Health, Inc. (CAH), Bio-Rad

Laboratories, Inc. (BIO) and STRAUMANN HLD N

AKT (SAUHF). All these stocks carry a Zacks Rank #1

(Strong Buy).

ATHENAHEALTH IN (ATHN): Free Stock Analysis Report

BIO-RAD LABS -A (BIO): Free Stock Analysis Report

CARDINAL HEALTH (CAH): Free Stock Analysis Report

STRAUMANN (SAUHF): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

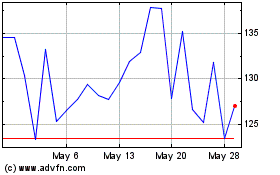

Straumann (PK) (USOTC:SAUHF)

Historical Stock Chart

From Dec 2024 to Jan 2025

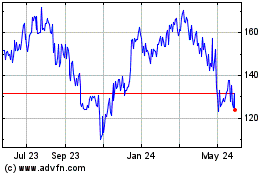

Straumann (PK) (USOTC:SAUHF)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Straumann Holding AG (PK) (OTCMarkets): 0 recent articles

More Straumann Holding (PC) News Articles