false

0001022505

0001022505

2024-05-07

2024-05-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 7, 2024

SideChannel,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-28745 |

|

86-0837077 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

146

Main Street, Suite 405, Worcester, MA 01608

(Address

of principal executive offices) (Zip Code)

(508)

925-0114

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

SDCH |

|

OTC

Markets Group (OTCQB) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2

of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

On

May 7, 2024, SideChannel, Inc. (the “Company”) issued a press release announcing the results of its 2024 second quarter financial

results from its Form 10-Q for the reporting period ended March 31, 2024, filed with the Securities and Exchange Commission (the “SEC”)

on May 7, 2024.

The

information included in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required

to be disclosed solely to satisfy the requirements of Regulation FD.

Item

9.01 Financial Statements and Exhibits

(a)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SideChannel,

Inc. |

| |

|

| Date:

May 7, 2024 |

By:

|

/s/

Brian Haugli |

| |

Name:

|

Brian

Haugli |

| |

Title:

|

Chief

Executive Officer |

Exhibit

99.1

SideChannel

Reports Positive Quarterly Cash Flow from Operations

Trailing

twelve month revenue exceeds $7 million; Revenue up 15.8% year-to-date

WORCESTER,

MA / ACCESSWIRE / May 7, 2024 / SideChannel, Inc. (OTCQB:SDCH) (“SideChannel”), a leading provider of cybersecurity

services and technology to emerging and middle market companies, today announced its financial results for the three and six months ended

March 31, 2024.

Second

Quarter Fiscal Year 2024 Highlights

| |

● |

Second

quarter revenue of $1.9 million; 19.2% greater than the second quarter of Fiscal Year (“FY”) 2023 and11.0% greater than

the first quarter of FY 2024. |

| |

● |

Year-to-date

revenue of $3.7 million; 15.8% greater than the $3.2 million reported for first six months of FY 2023. |

| |

● |

Second

quarter gross margin of 45.0%; gross margin was 45.6% for the second quarter of FY 2023. |

| |

● |

Second

quarter operating expenses decreased $467,000 or 29.3% compared to the second quarter of FY 2023. |

| |

● |

Second

quarter net loss of $253,000 or $0.00 per share. |

| |

● |

Trailing

twelve month revenue reaches $7.1 million for the period ended March 31, 2024. |

| |

● |

Revenue

retention of 74.6% for the trailing twelve months ended March 31, 2024. |

| |

● |

Cash

increased to $851,000 compared to $819,000 as of December 31, 2023; cash provided by operations during the second quarter was $32,000. |

Management

Comments

Brian

Haugli, President and Chief Executive Officer of SideChannel stated “I am proud of our team for delivering an increase in cash

this quarter. We continue to make progress on achieving quarterly profitability and remain committed to achieving that goal. Our sales

channels are expanding with new referral partners and complimentary third-party service providers. We are growing our Enclave pipeline

while we process the feedback and insights received from our beta customers. Our novel approach to microsegmentation is proving to be

a significantly cost-effective alternative to the legacy IT methods of using hardware.”

SideChannel

will host a conference call on May 7, 2024, at 4:30 P.M. Eastern Time to discuss its first quarter results and provide an update on the

Company’s initiatives.

SECOND

QUARTER CALL INFORMATION

| Date:

|

|

Tuesday,

May 7, 2024 at 4:30 P.M. Eastern Standard Time. |

| |

|

|

| Dial

In: |

|

Toll

Free: 888-506-0062 |

| |

|

International:

973-528-0011 |

| |

|

Participant

Access Code: 789473 |

A

webcast of the call will also be available: https://www.webcaster4.com/Webcast/Page/2071/49678

Participants

may register in advance for the call using the webcast link.

The

conference call will include management remarks and a live question and answer session. The conference call host will provide participants

with instructions for joining the queue to asks questions at the conclusion of management remarks. Questions may also be submitted prior

to the meeting using ir@sidechannel.com.

Second

Quarter 2024 Review

The

second quarter Form 10-Q is accessible in its entirety at https://investors.sidechannel.com/sec-filings.

In

thousands, except shares and per share data | |

Three

Months Ended | |

| | |

| | |

Change | | |

| | |

Change | |

| | |

| 3/31/2024 | | |

| 3/31/2023 | | |

| $ | | |

| % | | |

| 12/31/2023 | | |

| $ | | |

| % | |

| Revenue | |

$ | 1,927 | | |

$ | 1.617 | | |

$ | 310 | | |

| 19.2 | % | |

$ | 1,736 | | |

$ | 191 | | |

| 11.0 | % |

| Gross

profit | |

| 868 | | |

| 737 | | |

| 131 | | |

| 17.8 | % | |

| 845 | | |

| 23 | | |

| 2.7 | % |

| Gross

margin | |

| 45.0 | % | |

| 45.6 | % | |

| | | |

| | | |

| 48.7 | % | |

| | | |

| | |

| Operating

expenses | |

| 1,128 | | |

| 1,595 | | |

| (467 | ) | |

| -29.3 | % | |

| 1,104 | | |

| 24 | | |

| 2.2 | % |

| Operating

loss | |

| (260 | ) | |

| (858 | ) | |

| 598 | | |

| | | |

| (259 | ) | |

| (1 | ) | |

| | |

| Net

loss | |

| (253 | ) | |

| (856 | ) | |

| 603 | | |

| | | |

| (246 | ) | |

| (7 | ) | |

| | |

| Net

loss per common share | |

$ | (0.00 | ) | |

$ | (0.01 | ) | |

$ | 0.01 | | |

| | | |

$ | (0.00 | ) | |

$ | 0.00 | | |

| | |

| Weighted

average common shares outstanding – basic and diluted | |

| 222,773,052 | | |

| 148,928,663 | | |

| | | |

| | | |

| 214,578,923 | | |

| | | |

| | |

| |

|

As

of

March

31,

2024

|

|

|

As

of

September

30, 2023 |

|

| Cash |

|

$ |

851 |

|

|

$ |

1,053 |

|

| Current

Assets |

|

|

2,387 |

|

|

|

2,448 |

|

| Current

Liabilities |

|

|

1,062 |

|

|

|

954 |

|

About

SideChannel

SideChannel

helps emerging and mid-market companies protect their assets. Founded in 2019, the Company delivers comprehensive cybersecurity plans

through a series of actions branded SideChannel Complete.

SideChannel

deploys a combination of skilled and experienced talent, and technological tools to offer layered defense strategies supported by battle-tested

processes. SideChannel also offers Enclave; a network infrastructure platform that eases the journey from zero to zero-trust. Learn more

at sidechannel.com.

Investors

and shareholders are encouraged to receive to press releases and industry updates by subscribing to the investor email newsletter

and following SideChannel on X and LinkedIn.

You

may contact us at:

SideChannel

146

Main Street, Suite 405

Worcester,

MA 01608

Investor

Contact

Ryan

Polk

ir@sidechannel.com

Forward-Looking

Statements

This

press release may contain forward-looking statements, including information about management’s view of SideChannel’s future

expectations, plans and prospects, subject to the safe harbor provisions under The Private Securities Litigation Reform Act of 1995 (the

“Act”). In particular, when used in the preceding discussion, the words “believes”, “hopes”, “expects”,

“intends”, “plans”, “anticipates”, “potential”, “could”, “should”

or “may”, and similar conditional expressions are intended to identify forward-looking statements within the meaning of the

Act and are subject to the safe harbor created by the Act and otherwise. Examples of forward-looking statements include, among others,

statements relating to future sales, earnings, cash flows, results of operations, uses of cash and other measures of financial performance.

Because

forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and other factors that may cause SDCH’s

actual results and financial condition to differ materially from those expressed or implied in the forward-looking statements. These

risk factors include, but are not limited to: that we have incurred net losses since inception, our need for additional funding, the

substantial doubt about our ability to continue as a going concern, and the terms of any future funding we raise; our dependence on current

management and our ability to attract and retain qualified employees; competition for our products; our ability to develop and successfully

introduce new products, improve current products and innovate; unpredictability in our operating results; our ability to retain existing

licensees and add new licensees; our ability to manage our growth; our ability to protect our intellectual property (IP), enforce our

IP rights and defend against claims that we infringed on the IP of others; the risk associated with the concentration of our cash in

one financial institution at levels above the amount protected by FDIC insurance; and other risk factors included from time to time in

documents we file with the Securities and Exchange Commission, including, but not limited to, our Forms 10-K, 10-Q and 8-K. These reports

are available at www.sec.gov.

Other

unknown or unpredictable factors also could have material adverse effects that could cause actual results to differ materially from those

projected or represented in the forward-looking statements. Further, factors that we do not presently deem material as of the date of

this release may become material in the future. The forward-looking statements included in this press release are made only as of the

date hereof. SideChannel cannot guarantee future results, levels of activity, performance, or achievements. Accordingly, you should not

place undue reliance on these forward-looking statements. Finally, SideChannel undertakes no obligation to update these forward-looking

statements after the date of this release, except as required by law, nor any obligation to update or correct information prepared by

third parties.

v3.24.1.u1

Cover

|

May 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 07, 2024

|

| Entity File Number |

000-28745

|

| Entity Registrant Name |

SideChannel,

Inc.

|

| Entity Central Index Key |

0001022505

|

| Entity Tax Identification Number |

86-0837077

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

146

Main Street

|

| Entity Address, Address Line Two |

Suite 405

|

| Entity Address, City or Town |

Worcester

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01608

|

| City Area Code |

(508)

|

| Local Phone Number |

925-0114

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

SDCH

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

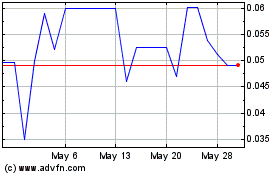

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From Apr 2024 to May 2024

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From May 2023 to May 2024