TPG Telecom Set to Challenge with New Mobile Network -- Update

12 April 2017 - 11:39AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--TPG Telecom Ltd. (TPM.AU) will invest more

than US$1 billion taking on Australia's incumbent mobile telecoms

operators with plans for its own network that will target a large

swathe of the country.

The communications firm had for some time flagged its ambition

to become Australia's fourth network operator, responding to the

increasing shift by consumers to mobile devices and competition

from other companies reselling capacity on the government-built

National Broadband Network being rolled out countrywide.

The fiber network that is now the core of TPG's fixed-line

telecommunications business will be the cornerstone of its national

mobile network, and allow it build out the new network in a

cost-efficient manner, the company said.

"This is a significant investment for the group but one that I

expect to be fantastic for our long-term outlook," said David Teoh,

chairman and chief executive of TPG.

TPG and existing operator Vodafone Hutchison Australia were

successful bidders in an auction of unallocated mobile bandwidth by

the federal government, collectively spending 1.55 billion

Australian dollars (US$1.16 billion) on spectrum used in current

fourth-generation networks. TPG picked up two lots of 10 megahertz

in the 700 MHz spectrum for A$1.26 billion. Singapore

Telecommunications Ltd.-owned (Z74.SG) Optus, another incumbent,

lost out in the auction.

TPG said the spectrum would be paid for in three annual

instalments. Another A$600 million would be spent over the three

years to build a mobile network focused on densely-populated areas

and using current technology, it said.

The mobile licenses are set to begin in April 2018 and run

through the end of 2029. TPG said it expected its network would be

break-even at an earnings before interest, tax, depreciation and

amortization level with 500,000 subscribers.

The investment would be funded through operating cash flows,

borrowing and other options, it said. It also would seek to raise

A$400 million to pay down debt with an offer of new shares at a

sharp discount to the last traded price.

Mr. Teoh said TPG has a number of new-entrant advantages over

current operators, which include the largest operator Telstra Corp.

(TLS.AU), such as its brand and existing fixed-line customer base.

It expected to bundle mobile and fixed services, he added.

Last August, TPG expressed an interest in the government

spectrum auction, having previously invested in 1,800-megahertz

bandwidth. However, some analysts have pointed to the risk the

investment needed to build a network would weigh on profits for

several years. Analysts have also been wary of TPG's purchase of

mobile spectrum in Singapore.

Since it was founded in 1986 as Total Peripherals Group, TPG has

expanded rapidly and picked up a number of rivals, including iiNet

in 2015. It now offers a range of services to retail and business

customers, including broadband, fixed-line telephone and mobile

access via Vodafone's network.

-Rob Taylor in Canberra contributed to this article.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 11, 2017 21:24 ET (01:24 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

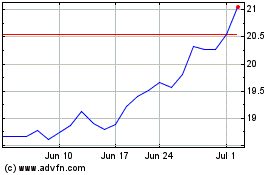

Singapore Telecommunicat... (PK) (USOTC:SGAPY)

Historical Stock Chart

From Nov 2024 to Dec 2024

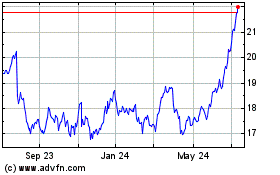

Singapore Telecommunicat... (PK) (USOTC:SGAPY)

Historical Stock Chart

From Dec 2023 to Dec 2024