U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(c)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14(a)-6(e)(2)) |

| ☐ | Definitive Information Statement |

| SKKYNET CLOUD SYSTEMS, INC. |

| (Name of the Company as Specified in its Charter) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee Computed on table below per Exchange Act Rules 14a- 6(I)(4) and 0-11. |

| | 1. | Title of each class of securities to which transaction applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | Proposed aggregate offering price: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box is any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | Amount previously paid: |

| | 2. | Form, schedule, or registration statement number: |

Notes:

INFORMATION STATEMENT

December __, 2022

SKKYNET CLOUD SYSTEMS, INC.

2233 Argentia Road Suite 302

Mississauga, Ontario CANADA L5N 2X7

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is furnished by the Board of Directors of SKKYNET CLOUD SYSTEMS, INC., a Nevada corporation (the “Company”), to the holders of record at the close of business on December 1, 2022 (“Record Date”), of the Company’s outstanding common voting stock, par value $0.001 per share (“Common Stock”) pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (“Exchange Act”).

THE COMPANY IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement informs shareholders of actions taken and approved on November 29, 2022 by the principal shareholders of the Company’s common stock including 36,307,600 (collectively, the “Majority Shareholders”). The Majority Shareholders are the beneficial owners of approximately 68.32% of the issued and outstanding shares. The only business of the meeting was as follows:

| | (i) | To elect six (6) members to the Company's Board of Directors to hold office until the Company's Annual Meeting of Shareholders in 2023 or until their successors are duly elected and qualified; and |

| | (iii) | To ratify the reappointment of Fruci & Associates II, PLLC (“Fruci & Associates”) as the Company's independent certified public accountants for the fiscal year ending October 31, 2022. |

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS AND NO

SHAREHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED

HEREIN. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO

SEND US A PROXY

The Company’s Majority Shareholders are the beneficial owners of approximately 68.32% of the issued and outstanding shares of the Company’s $0.001 par value common voting stock (the “Common Stock”). The Majority Shareholders have voted for the election of members of the Board of Directors and the ratification of Fruci & Associates, and the Company has received their executed Written Consents, effective on November 29, 2022. A complete summary of this matter is set forth herein.

The stockholders of record at the close of business on December 1, 2022 are being furnished copies of this Information Statement. This Information Statement is being mailed to the stockholders of the Company, commencing on or about December __, 2022.

Accordingly, all necessary corporate approvals in connection with the matter referred to herein have been obtained, and this Information Statement is furnished solely for the purpose of informing the Company’s stockholders, in the manner required under the Securities Exchange Act of 1934, as Amended, of these corporate actions. This Information Statement is circulated to advise the Company’s shareholders of action already approved by written consent of the Majority Shareholders who collectively hold a majority of the voting power of our Common Stock. Pursuant to Rule 14c-2 under the Exchange Act the proposals will not be effective until on or about December __, 2022, or twenty (20) days after the date this Information Statement is filed with the Securities and Exchange Commission and mailed to the shareholders. Therefore, this Information Statement is being sent to you for informational purposes only.

NO DISSENTERS’ RIGHTS

Pursuant to the Nevada Revised Statues, NRS 92A.300 to 92A.500 inclusive, none of the corporate actions described in this Information Statement will afford to stockholders the opportunity to dissent from the actions described herein and to receive an agreed or judicially appraised value for their shares.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A

PROXY. STOCKHOLDER APPROVAL HAS BEEN PREVIOUSLY OBTAINED FROM THE

MAJORITY SHAREHOLDERS

Table of Contents

CONSENTING SHAREHOLDERS

As of November 30, 2022, the Company had 53,143,822 issued and outstanding shares of Common Stock of which were entitled to one vote on any matter brought to a vote of the Company’s stockholders. By written consent in lieu of a meeting, dated November 29, 2022, the Board of Directors and the Majority Shareholders approved the following actions:

| | (i) | To elect six (6) members to the Company's Board of Directors to hold office until the Company's Annual Meeting of Shareholders in 2023 or until their successors are duly elected and qualified; and |

| | (iii) | To ratify the reappointment of Fruci & Associates II, PLLC as the Company's independent certified public accountants for the fiscal year ending October 31, 2022. |

Effective on November 30, 2022, the following Majority Shareholders of Record on November 30, 2022, who collectively owned approximately 36,307,600 shares, or 68.32% of our voting common stock, consented in writing to the proposed actions:

| Present Issued and Outstanding | | | 53,143,822 | | | | 100 | % |

| | | Shares | | | | |

| Name of Consenting Shareholder | | Eligible | | | Percent(%) | |

| | | | | | | |

| Andrew Thomas | | | 22,308,300 | | | | 41.98 | % |

| Paul Benford | | | 8,660,400 | | | | 16.29 | % |

| Paul Thomas | | | 5,338,900 | | | | 10.05 | % |

| Total Effective Votes | | | 36,307,600 | | | | 68.32 | % |

We are not seeking written consent from any of our shareholders and our other shareholders will not be given an opportunity to vote with respect to the transactions. All necessary corporate approvals have been obtained, and this Information Statement is furnished solely for the purpose of:

| | · | Advising shareholders of the action taken by written consent by Nevada Law; and |

| | · | Giving shareholders advance notice of the actions taken, as required by the Exchange Act. |

Shareholders who were not afforded an opportunity to consent or otherwise vote with respect to the actions taken have no right under Nevada law to dissent or require a vote of all our shareholders.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of November 30, 2022, the number of shares of Common Stock which were owned beneficially by (i) each person who is known by the Company to own beneficially more than 5% of its Voting Common Stock, and “Affiliates” of the Company, (ii) each director, (iii) each executive officer and affiliate and (iv) all directors and executive officers as a group. As of November 30, 2022, there were a total of 53,143,822 shares of our common stock issued and outstanding and 193,661 shares of our Series B Preferred Stock, whereby each share of Series C is convertible into ten shares of our common stock.

The number of shares beneficially owned by each 5% stockholder, director or executive officer is determined under the rules of the Securities and Exchange Commission, or SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under those rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and also any shares that the individual or entity has the right to acquire through the exercise of any stock option, warrant or other right, or the conversion of any security. Unless otherwise indicated, each person or entity has sole voting and investment power (or shares such power with his or her spouse) with respect to the shares set forth in the following table. The inclusion in the table below of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of those shares as of October 31, 2022.

| Name and Address (1) | | Shares of Common Stock Beneficially Owned | | | Percent of Common Stock | | | Exercisable Options | |

| Andrew S. Thomas 2233 Argentia Road, Suite 302, Mississauga, Ontario, Canada, L5N 2X7 | | | 22,308,300 | | | | 41.98 | | | | 769,020 | |

| Paul E. Thomas 2233 Argentia Road, Suite 302, Mississauga, Ontario, Canada, L5N 2X7 | | | 5,388,9000 | | | | 10.05 | | | | 431,580 | |

| Paul Benford 2233 Argentia Road, Suite 302, Mississauga, Ontario, Canada, L5N 2X7 | | | 8,660,400 | | | | 16.29 | | | | 491,080 | |

| Lowell Holden (2) 2233 Argentia Road, Suite 302, Mississauga, Ontario, Canada, L5N 2X7 | | | 208,989 | (2) | | | 0.39 | | | | 103,500 | |

| Norman Evans (1) 2233 Argentia Road, Suite 302, Mississauga, Ontario, Canada, L5N 2X7 | | | 245,600 | | | | 0.46 | | | | 71,250 | |

| Kenneth Jennings (1) 2233 Argentia Road, Suite 302, Mississauga, Ontario, Canada, L5N 2X7 | | | 308,600 | | | | 0.58 | | | | 256,800 | |

| John X Adiletta(1) 2233 Argentia Road, Suite 302, Mississauga, Ontario, Canada, L5N 2X7 | | | 185,533 | | | | 0.35 | | | | 63,750 | |

| Xavier Mesrobian (1) 2233 Argentia Road, Suite 302, Mississauga, Ontario, Canada, L5N 2X7 | | | 86,400 | | | | 0.00 | | | | 462,250 | |

| | | | | | | | | | | | | |

| All directors and officers as a group as of October 31, 2022 | | | 37,280,822 | | | | 70.10 | | | | 2,649,230 | |

| (1) | Denotes officer or director. |

| (2) | Mr. Holden holds 198,989 of his shares directly and 10,000 indirectly through a related party. |

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that the Company’s directors and executive officers, and persons who own more than ten percent (10%) of the Company’s outstanding Common Stock, file with the Securities and Exchange Commission (the “Commission”) initial reports of ownership and reports of changes in ownership of Common Stock. Such persons are required by the Commission to furnish the Company with copies of all such reports they file. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representation, all the Section 16(a) filing requirements applicable to its officers, directors and greater than 10% beneficial owners have been satisfied, and all filings were made in a timely fashion.

ELECTION OF DIRECTORS

The following table sets forth certain information with respect to persons elected to the Board of Directors of the Company by the Written Consent:

| NAME | | AGE | | POSITION WITH THE COMPANY |

| | | | | |

| Andrew S. Thomas | | 59 | | Chairman of the Board, CEO & Director |

| Paul E. Thomas | | 48 | | Director, President & Secretary |

| Paul Benford | | 56 | | Director & COO |

| Norman Evans | | 68 | | Independent Director |

| Kenneth W. Jennings | | 74 | | Independent Director |

| John X. Adiletta | | 74 | | Independent Director |

| Lowell Holden | | 80 | | CFO & Treasurer |

Business Experience: The following is a brief account of the business experience for the past five years of the directors and executive officers, indicating their principal occupations and employment during that period, and the names and principal businesses of the organizations in which such occupations and employment were carried out.

ANDREW S. THOMAS: Mr. Andrew S. Thomas has been the Chief Executive Officer and the Chairman of the Board of Director of Skkynet since November 1, 2011. From May 1995 to the present, Mr. Thomas has been the founder, President and CEO of Cogent Real-Time Systems, Inc. our wholly-owned subsidiary. Prior thereto from 1992-1995 Mr. Thomas was an independent process control consultant and systems integrator and software developer of real time data communications systems. Mr. Thomas received a Master of Applied Science in Engineering from the University of Waterloo in 1991 and a B.A. in Applied Science from the University of Waterloo in 1987. Mr. Andrew Thomas’s qualifications to serve as a director of the Company consist of his experience in our products and services development and strategic planning, and his broad, fundamental understanding of the business drivers affecting the Company.

PAUL E. THOMAS: Mr. Paul E. Thomas has been the President and Assistant Secretary of Skkynet since November 26, 2011 and became a member of the Board of Directors on March 26, 2013. Mr. Paul Thomas has also been Vice President of Intellectual Property for Cogent since January 1, 2012. Mr. Paul Thomas is the brother of our CEO and Board Chairman, Andrew S. Thomas. From September 2008 to the present Mr. Thomas has been the founder and principal of a group of affiliated companies, LifeCycle IP Management, Inc. and LifeCycle Capital Partners, Inc. that are engaged in various IP related businesses including valuations, due diligence, transactions analysis and structuring, strategic partnering and filing and processing IP applications to regulatory authorities. Prior thereto, from January to September 2008, Mr. Thomas was Assistant General Counsel at Iovate Health Sciences at which he managed the global IP portfolio of more than 100 patent families of products. Prior thereto, Mr. Thomas from 2007 to 2008 Mr. Thomas was IP and Corporate Development Counsel at Cipher Pharmaceuticals, Ltd., and during the period between 2000-2007 Mr. Thomas practiced intellectual property law as an associate lawyer at three different law firms in Toronto Canada. Mr. Thomas is a registered patent agent with the U.S Patent and Trademark Office and a registered patent and trademark agent with the Canadian Patent Office. Mr. Thomas received his J.D. from the University of British Columbia in 2000. He also received a Master of Applied Science in Chemical Engineering from the University of British Columbia in 1998 and a B.A in Applied Science, Chemical Engineering from Queen’s University, Kingston in 1995. Mr. Paul Thomas’s qualifications to serve as a director of the Company consist of his experience in fund raising activities for developing companies, public and private, and proper planning for intellectual property development and protection of our products and services.

PAUL BENFORD: Mr. Paul Benford has been the Chief Operating Officer of Skkynet since November 1, 2011 and became a member of our Board of Directors on March 26, 2013. From 1995 to the present Mr. Benford has been the Business Manager of Cogent. Prior thereto, from 1992 through 1995 Mr. Benford was an independent process control consultant and an application engineer. Mr. Benford received a Master of Applied Science in Mineral Process Engineering from the University of British Columbia in 1993, and a B.A. with honors from the Camborne School of Mines in Cornwall, United Kingdom in 1990. Mr. Paul Benford’s qualifications to serve as a director of the Company consist of his experience in the fields of strategies of customer development and forms of communication with a variety of corporate constituencies in the industries within which we operate.

NORMAN EVANS: Mr. Norman Evans has been a director of the Company since August 2013 and has retired as the Chief Financial Officer of Cipher Pharmaceuticals Inc., a Canadian publicly-listed pharmaceutical company. Mr. Evans is also a Chartered Accountant with over 25 years of business experience. Prior to his work at Cipher, from 1996 to 2006, Mr. Evans was Vice-President of Finance at MDS Pharma Services, a pharmaceutical services company, and prior thereto was a Partner at Ernst & Young Inc. Mr. Evans received a B.Sc. from Concordia University and received his Canadian Chartered Accountant designation in 1980. Mr. Evans’ qualifications to serve as a director of Skkynet consist of his experience in conducting audits, corporate governance and financial reporting for public companies.

KENNETH JENNINGS: Mr. Kenneth Jennings has been a director if the Company since August 2013 and is also Vice President of Kinesis Identity Security System Inc., a software security company. Prior to his work at Kinesis, from 1991 to 2009, Mr. Jennings held senior roles including VP of Manufacturer Solutions & Consulting, VP of Marketing, and VP of Sales at ADP Dealer Services, a division of ADP Inc., the payroll outsourcing company. Mr. Jennings’ qualifications to serve as a Director of Skkynet consist of over 30 years of experience in business development, strategy and in leading business-to-business software sales and marketing teams.

JOHN X. ADILETTA: Mr. Adiletta has been a director of the Company since September 2014. Since 2015, Mr. Adiletta has been the President and Chief Executive Officer of EMR Technology Solutions, Inc., a U.S. based holding company that acquires medical technology related products and services. As managing partner of PCS Management Group since its founding in 1993, Mr. Adiletta has hands on experience in mergers and acquisitions as they pertain to medical and security products and services, telecommunications providers, data carriers, and related suppliers. He has also served on boards of directors for technology companies in various capacities including the audit, compensation, and corporate governance committee.

LOWELL HOLDEN: Lowell Holden has been the CFO and Chief Accounting Officer of the Company since March 2012. Since 1983, Mr. Holden has owned and operated his own consulting firm, LS Enterprises, Inc., which provides business consulting, accounting and other services to businesses. Mr. Holden has a broad range of business experience including managing, securing financing, structuring of transactions, and is experienced and knowledgeable in managing relationships with customers, financing institutions and stockholders. He also serves as CFO and director of Nascent Biotech (NBIO), PTS, Inc (PTSH), and CFO and director of EMR Technology Solutions Inc. Mr. Holden also has a background in assisting companies in fulfilling their financial auditing and SEC reporting requirements. Mr. Lowell Holden has a Bachelor of Science degree from Iowa State University.

Conflict of Interest

Although each of our employment agreements permit the employee to engage in other business activities, Mr. Andrew S. Thomas and Mr. Paul Benford, respectively, our CEO and COO, devote substantially all of their business activities time to the business of the Company and its subsidiary, Cogent. Mr. Paul E. Thomas and Mr. Lowell Holden devote not less than 80% and 15%, respectively, of their overall business activities to the business of the Company and its subsidiaries. There will be occasions when the time requirements of the Company’s business conflict with the demands of their other business and investment activities. Such conflicts may require that the Company attempt to employ additional personnel. There is no assurance that the services of such persons will be available or that they can be obtained upon terms favorable to the Company.

There is no procedure in place which would allow the Officers and Directors to resolve potential conflicts in an arms-length fashion. Accordingly, they will be required to use their discretion to resolve them in a manner which they consider appropriate.

Although the Company is not subject to the director independence requirements of the national securities exchanges or FINRA, at this time, three of the members of the Board of Directors would be deemed to be “independent.”

Compensation

The following tables summarize annual and long-term compensation paid to the Company’s Board of Directors and its Chief Executive Officer and the Company’s four other most highly compensated executive officers whose total annual salary and bonus compensation exceeded $100,000 who were serving as of October 31, 2022 for all services rendered to the Company and its subsidiaries during the last fiscal year.

DIRECTORS and OFFICERS - COMPENSATION

| | | | Annual compensation | | | Long-term compensation | | | | |

| | | | | | | | | | | | | Awards | | | Payouts | | | | | | | |

| Name and Principal Position | | Year | | Salary ($) | | | Bonus ($) | | | Other annual compen -sation ($) | | | Restricted stock award(s) ($) | | | Securities under- lying options/ SARs (#) | | | LTIP payouts ($) | | | All other compen- sation ($) | | | Total Compensation | |

| Andrew S. Thomas, (1,4,7) | | 2022 | | | 132,056 | | | | -- | | | | - | | | | -- | | | | - | | | | -- | | | | -- | | | | 132,056 | |

| Chief Executive Officer | | 2021 | | | 111,340 | | | | 42,542 | | | | - | | | | -- | | | | - | | | | -- | | | | -- | | | | 153,882 | |

| | 2020 | | | 126,457 | | | | 45,046 | | | | -- | | | | -- | | | | -- | | | | | | | | -- | | | | 171,503 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Paul Benford, (1,7) | | 2022 | | | 132,056 | | | | -- | | | | - | | | | -- | | | | - | | | | - | | | | - | | | | 132,056 | |

| Chief Operating Officer | | 2021 | | | 111,340 | | | | 42,542 | | | | - | | | | -- | | | | - | | | | - | | | | - | | | | 157,989 | |

| | 2020 | | | 126,457 | | | | 31,532 | | | | - | | | | -- | | | | - | | | | - | | | | - | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Lowell Holden, (2) | | 2022 | | | 48,000 | | | | -- | | | | - | | | | -- | | | | - | | | | - | | | | - | | | | 48,000 | |

| Chief Financial Officer | | 2021 | | | 48,000 | | | | 7,755 | | | | - | | | | -- | | | | - | | | | - | | | | - | | | | 55,755 | |

| | 2020 | | | 48,000 | | | | 10,000 | | | | - | | | | -- | | | | - | | | | - | | | | - | | | | 58,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Paul E. Thomas, (3,7) | | 2022 | | | 132,056 | | | | -- | | | | - | | | | -- | | | | - | | | | - | | | | - | | | | 132,056 | |

| President | | 2021 | | | 111,340 | | | | 42,542 | | | | - | | | | -- | | | | - | | | | - | | | | - | | | | 153,882 | |

| | 2020 | | | 126,457 | | | | 31,532 | | | | - | | | | -- | | | | - | | | | - | | | | - | | | | 157,989 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Xavier Mesrobin. Vice | | 2022 | | | 104,868 | | | | -- | | | | 33,451 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 138,319 | |

| President Sales(6,7) | | 2021 | | | 107,364 | | | | 21,673 | | | | 29,301 | | | | -- | | | | -- | | | | -- | | | ---- | | | | 158,338 | |

| | 2019 | | | 100,422 | | | | 31,157 | | | | 17,539 | | | | -- | | | | -- | | | | -- | | | | | | | | 149,318 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Norman Evans, | | 2022 | | | -- | | | | - | | | | 30,000 | | | | - | | | | - | | | | - | | | | -- | | | | 30,000 | |

| Director (5) | | 2021 | | | -- | | | | - | | | | 30,000 | | | | - | | | | - | | | | - | | | | - | | | | 30,000 | |

| | 2020 | | | -- | | | | - | | | | 30,000 | | | | - | | | | - | | | | - | | | | - | | | | 30,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kenneth Jennings, | | 2022 | | | -- | | | | -- | | | | 30,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 30,000 | |

| Director(5) | | 2021 | | | -- | | | | -- | | | | 30,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 30,000 | |

| | 2020 | | | -- | | | | -- | | | | 30,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 30,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John X Adiletta, | | 2022 | | | -- | | | | -- | | | | 30,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 30,000 | |

| Director(5) | | 2021 | | | -- | | | | -- | | | | 30,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 30,000 | |

| | 2020 | | | -- | | | | -- | | | | 30,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 30,000 | |

| (1) | Mr. Andrew S. Thomas and Mr. Benford each received cash salary paid by Cogent Real-Time Systems Inc. of $132,056., respectively. |

| (2) | Mr. Holden through LS Enterprises, Inc., a company of which he is President, received $48,000. |

| (3) | Mr. Paul E. Thomas received cash payments of $132,056 for consulting services through LifeCycle IP Management Inc., which he owns. |

| (4) | Ms. Shizuka Thomas, wife of Mr. Andrew S. Thomas, was paid $41,947 during fiscal year 2022 for services as a Japanese business manager and translator. |

| (5) | Directors fees of $30,000 per year per director were paid in cash to three outside directors. |

| (6) | Mr. Mesrobian was paid in cash $104,868 in salary and $33,451 in commissions. |

| (7) | Compensation is calculated in US dollars for reporting purposes causing a variance from year to year on persons paid in Canadian dollars. |

Options

The following table provides information related to options held by our named executive officers during the fiscal year ended October 31, 2022.

Option Awards

| Recipient | | Title | | Number Options | |

| Andrew Thomas | | Officer and Director | | | 806,300 | |

| Paul Benford | | Officer and Director | | | 512,400 | |

| Paul Thomas | | Officer and Director | | | 528,900 | |

| Lowell Holden | | Officer | | | 172,500 | |

| Xavier Mesrobian | | Officer | | | 1,349,500 | |

| Kenneth Jennings | | Director | | | 263,100 | |

| Norman Evans | | Director | | | 77,500 | |

| John X Adiletta | | Director | | | 67,500 | |

| Total | | | | | 3,777,700 | |

As of the date of this filing, none of the members of the Board of Directors have entered into any arrangements regarding compensation for their services as such.

Related Transactions

Sakura Software, a corporation owned by our CEO and Chairman of the Board of Directors, Andrew S. Thomas, and Benford Consultancy, a corporation owned by our COO and a member of our Board of Directors, Paul Benford, own, respectively, 72.34% and 27.66% of the issued and outstanding shares of Real Innovations International LLC (“Real Innovations”) a corporation organized under the laws of Nevis, West Indies. In March 2012, Cogent, our operating subsidiary, assigned all its intellectual property including the pending patent applications for its real-time data transmission and display technology (the “IP”) to Real Innovations under an assignment of intellectual property agreement (the “Assignment Agreement”). In return for the assignment, Real Innovations required a one-time payment of $30,000 to Cogent. Cogent elected to forgo the payment allowing Real Innovations to offset future expenses against the payment. There is no ongoing royalty payment or other form of compensation from Real Innovations to Cogent under the Assignment Agreement.

Real Innovations, in turn, entered into a master intellectual property license agreement (the “License Agreement”) with Cogent for all the same IP. Under the License Agreement Real Innovations granted a royalty-free license in perpetuity to Cogent for the use and exploitation of the IP in return for which Cogent agreed to: (i) pay all operating expenses of Real Innovations incurred in connection with the continued prosecution of pending patent applications and others that may be prepared; (ii) prosecute all claims for infringement of the IP; (iii) defend and indemnify Real Innovations from and against all claims of infringement of the IP asserted by third parties against Real Innovations, Cogent or our Company; (iv) purchase liability insurance in favor of Real Innovations for this purpose. Under the termination provision of the license agreement, there is no unilateral right of termination. Termination may occur by mutual consent of the parities, the Company ceasing doing business, by breach by the Company or by the Company failing to maintain the license and the support to prosecute and protect the license under applicable laws.

Under the License Agreement, Messrs. Andrew S. Thomas and Paul Benford will benefit indirectly from their indirect ownership of their shares of Real Innovations to the extent of any such payments or other undertakings by Cogent on behalf of Real Innovations, but the exact amount of these benefits cannot be determined at this time. As of October 31, 2022, the Company has not made payments per the agreement.

Mr. Andrew S. Thomas and Mr. Paul Benford were each paid $132,056 as salary, for the fiscal year ended October 31, 2022 for serving as the CEO and COO of Cogent. Ms. Shizuka Thomas, the wife of Mr. Andrew S. Thomas, received $41,947 as salary for the fiscal year ended October 31, 2022 for services as a Japanese business manager and translator.

Mr. Lowell Holden, the Chief Financial Officer of the Company, was paid $48,000 during the year ended October 31, 2022 in consulting fees by the Company

Mr. Paul E. Thomas, the President of the Company was paid $132,056 for services for the fiscal year ended October 31, 2022.

During the year ended October 31, 2022 the Company issued 11,250 options to three independent directors with a value of $3,180.

During the year ended October 31, 2022 five officers and directors exercised 1,567,700 options for 1,567,700 shares of common stock with a value of $1,568

Litigation

None of the above-named members of the Board of Directors have been party to litigation in which the Company is the adverse party or have had any material interest adverse against the Company.

Board Meeting

While the Board of Directors had no regularly scheduled physical or special meetings held during fiscal 2022, the Board of Directors business was conducted via Consent(s) to Action in Lieu of Meeting, held Electronically, Telephonically, or In Person, (the “Consent(s)”)). There were a total of 3 written consents obtained during fiscal 2022 and all members of the then Board of Directors attended at least 75% of all meetings held by the above listed Consent(s).

Shareholders may send communications to the Company’s Board of Directors at the address stated below under the heading “Additional Information”.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors has decided at this time not to have committees reporting to the Board of Directors.

RATIFICATION OF REAPPOINTMENT OF AUDITORS

The Board of Directors has re-appointed Fruci & Associates II, PLLC, as the Company's independent certified public accountants for the fiscal year ending October 31, 2022. Fruci & Associates were the independent public auditor of the Company for the fiscal year ended October 31, 2022 and 2021.

There have been no disagreements between the Company and the Auditors during the term of its relationship.

Audit Related Fees

The aggregate fees billed for the fiscal year ended October 31, 2021 for professional services rendered by Fruci & Associates for the audit and quarterly reviews of the Company’s financial statements were $31,200 and $17,400 for fiscal 2020.

Audit-Related Fees

Fruci & Associates did not bill us for any assurance or related services that were related to the performance of the audit of the financial statements.

Tax Fees

Since October 31, 2020, Fruci & Associates has not provided any professional services for tax compliance, tax advice and tax.

Other Fees

No other fees were paid to Fruci & Associates.

SHAREHOLDERS SHARING AN ADDRESS

The Company will deliver only one information statement to multiple shareholders sharing an address unless the Company has received contrary instructions from one or more of the shareholders. The Company undertakes to deliver promptly, upon written or oral request, a separate copy of the information statement to a shareholder at a shared address to which a single copy of the information statement is delivered. A shareholder can notify the Company that the shareholder wishes to receive a separate copy of the information statement by contacting the Company at the address or phone number set forth below. Conversely, if multiple shareholders sharing an address receive multiple information statements and wish to receive only one, such shareholders can notify the Company at the address or phone number set forth below.

ADDITIONAL INFORMATION

If you have any questions about the actions described above, you may contact Paul Thomas, Secretary, at 2233 Argentia Road Suite 302, Mississauga, Ontario CANADA L5N 2X7, Telephone 888-702-7851.

SIGNATURE

Pursuant to the requirements of the Exchange Act of 1934, as amended, the Company has duly caused this Information Statement to be signed on its behalf by the undersigned hereunto authorized.

| | By Order of the Board of Directors |

| | |

| | /s/ Andrew S. Thomas | |

| | Andrew S. Thomas |

| | Chairman and CEO |

December 2, 2022

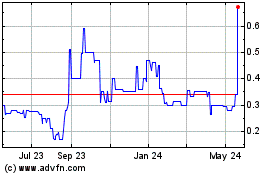

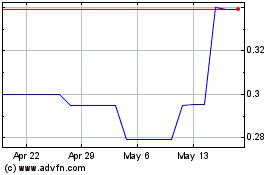

Skkynet Cloud Systems In (QB) (USOTC:SKKY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Skkynet Cloud Systems In (QB) (USOTC:SKKY)

Historical Stock Chart

From Nov 2023 to Nov 2024