As filed with the Securities and Exchange

Commission on April 8, 2014

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

STEVIA CORP.

(Exact name of registrant as specified in

its charter)

|

Nevada

|

|

700

|

|

98-0537233

|

|

(State or jurisdiction of

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Classification Code Number)

|

|

Identification No.)

|

7117 US 31S

Indianapolis, IN 46227

(888) 250-2566

(Address and telephone number of principal

executive offices and principal place of business)

CSC Services of Nevada, Inc.

2215-B Renaissance Drive

Las Vegas, NV 89119

(702) 740-4244

(Name, address

and telephone number of agent for service)

Copies to:

Mark C. Lee

Saxon Peters

GREENBERG TRAURIG, LLP

1201 K Street, Suite 1100

Sacramento, California 95814

Telephone: (916) 442-1111

Facsimile: (916) 448-1709

Approximate date of proposed sale to

the public:

From time to time after the effective date

of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box.

þ

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering.

¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act. (Check one):

|

Large accelerated filer

¨

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Smaller reporting company

þ

|

|

|

|

(Do not check if a smaller reporting company)

|

|

|

|

CALCULATION OF REGISTRATION FEE

|

|

|

Amount of shares

|

|

|

Proposed maximum

|

|

|

Proposed maximum

|

|

|

Amount of

|

|

|

Title of each class of

|

|

to be

|

|

|

offering price

|

|

|

aggregate

|

|

|

Registration

|

|

|

securities to be registered

|

|

Registered

|

|

|

per share

|

|

|

offering price

|

|

|

Fee

|

|

|

Common Stock Underlying the Principal of Convertible Notes

|

|

|

10,674,182

|

(1)

|

|

$

|

0.266

|

(2)

|

|

$

|

2,839,332.41

|

|

|

$

|

365.71

|

|

|

Common Stock Underlying the Interest of Convertible Notes

|

|

|

508,905

|

(3)

|

|

$

|

0.266

|

(2)

|

|

$

|

135,368.73

|

|

|

$

|

17.44

|

|

|

Common Stock Underlying the Principal of Convertible Notes

|

|

|

12,809,018

|

(4)

|

|

$

|

0.266

|

(2)

|

|

$

|

3,407,198.79

|

|

|

$

|

438.85

|

|

|

Common Stock Underlying the Interest of Convertible Notes

|

|

|

610,687

|

(5)

|

|

$

|

0.266

|

(2)

|

|

$

|

162,442.74

|

|

|

$

|

20.92

|

|

|

Common Stock Underlying Warrants

|

|

|

20,296,139

|

(6)

|

|

$

|

0.053365

|

|

|

$

|

1,083,103.46

|

|

|

$

|

139.50

|

|

|

Common Stock Underlying a Convertible Note

|

|

|

3,000,000

|

(7)

|

|

$

|

0.266

|

(2)

|

|

$

|

798,000.00

|

|

|

$

|

102.78

|

|

|

Total

|

|

|

47,898,931

|

|

|

|

|

|

|

$

|

8,425,446.13

|

|

|

$

|

1085.20

|

|

|

|

(1)

|

Represents shares of common stock issuable by the registrant upon the conversion of the principal amount of the registrant’s Senior Convertible Note issued March 3, 2014 (the “Initial Nomis Bay Note”).

|

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average high and low prices of the common stock as reported on the OTCQB on March 26, 2014.

|

|

|

|

|

|

|

(3)

|

Represents shares of common stock issuable by the registrant upon the conversion of interest accrued under

the Initial Nomis Bay Note.

|

|

|

|

|

|

|

(4)

|

Represents shares of common stock issuable by the registrant upon the conversion of the principal amount of the registrant’s Senior Convertible Note to be issued to Nomis Bay Ltd. (the “Secondary Nomis Bay Note”) after the effectiveness of this registration statement upon the terms and conditions set forth in the Securities Purchase Agreement dated March 3, 2014.

|

|

|

|

|

|

|

(5)

|

Represents shares of common stock issuable by the registrant upon the conversion of interest to be accrued

under the Secondary Nomis Bay Note.

|

|

|

(6)

|

Represents the number of shares of common stock offered for resale following the exercise of certain warrants to purchase common stock.

|

|

|

(7)

|

Represents shares of common stock issuable by the registrant upon the conversion of the registrant’s

promissory note issued July 10, 2013

(the “JMJ Note Shares”)

|

In the event of stock splits, stock dividends,

or similar transactions involving the Registrant’s common stock, the number of Shares registered shall, unless otherwise

expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated

under the Securities Act of 1933, as amended (the “Securities Act”); provided however that any additional shares received

due to subsequent equity issuances by the Registrant at a lower price per share than the current exercise price of any applicable

warrants would not be covered by this registration statement and would require separate registration or an exemption prior to sale.

We hereby amend this registration statement

on such date or dates as may be necessary to delay its effective date until we shall file a further amendment which specifically

states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act

or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant

to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED APRIL 8,

2014

PROSPECTUS

47,898,931 Shares of Common Stock

STEVIA CORP.

Common Stock

This prospectus relates

to the resale of 47,898,931 shares of common stock, by the selling stockholders named in this prospectus. The shares of common

stock subject to this prospectus include:

|

|

(i)

|

24,602,792 shares of common stock issuable upon conversion of the principal amount of the registrant’s

Senior Convertible Note issued March 3, 2014 (the “Nomis Bay Note Shares”). Based upon current market price of the

Company’s common stock, the amount of Nomis Bay Note Shares being registered may be in excess of the number of shares into

which the Senior Convertible Note may currently be converted, however the parties have agreed upon the aggregate number of shares

to be registered to account for market fluctuations;

|

|

|

(ii)

|

23,026,318 shares of common stock issuable following the exercise of certain warrants issued in

accordance with a Warrant Exercise Reset Offer Letter Agreement entered into on May 3, 2013 as adjusted pursuant to its terms for

certain dilutive issuances, less 5,290,665 shares of common stock previously registered pursuant to the registrant’s Registration

Statement on Form S-1/A filed December 30, 2013 (the “Anson Reset Shares”);

|

|

|

(iii)

|

2,560,486 shares of common stock issuable following the exercise of certain warrants issued to

a selling stockholder in accordance with a Securities Purchase Agreement entered into on August 1, 2012, as adjusted pursuant to

the anti-dilution provision contained therein and the Common Stock Purchase Warrant issued February 20, 2014, less 683,202 shares

of common stock previously registered pursuant to the registrant’s Registration Statement on Form S-1/A filed December 30,

2013, plus an additional 683,202 shares of common stock issuable following the exercise of the warrant issued February 20, 2014

with an exercise price of $0.053365 per share (the “Cranshire Warrant Shares”); and

|

|

|

(iv)

|

3,000,000 shares of common stock issuable upon the conversion of the registrant’s $400,000

Promissory Note issued July 10, 2013 (the “JMJ Note Shares”);

|

We will not receive

any proceeds from the resale of any of the shares offered hereby. We may receive gross proceeds of up to $1,083,103.46 if all of

the warrants set forth above (the “Warrants”) are exercised for cash. The proceeds will be used for working capital

or general corporate purposes. We will bear all costs associated with this registration.

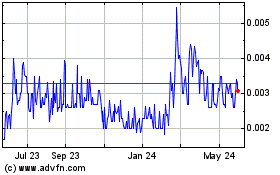

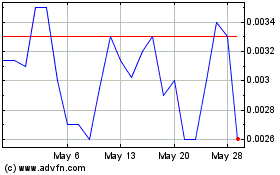

Our common stock is

quoted on the OTCQB under the symbol “STEV.” On March 26, 2014, the closing bid price of our common stock was

$0.28 per share.

INVESTING IN OUR

COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 2 OF THIS PROSPECTUS.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS

PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The information in

this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with

the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell these securities and we are not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted or would be unlawful prior to

registration or qualification under the securities laws of any such state.

TABLE OF CONTENTS

|

|

Page

|

|

|

|

|

PART I - INFORMATION REQUIRED IN PROSPECTUS

|

|

|

|

|

|

PROSPECTUS SUMMARY

|

1

|

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

|

7

|

|

RISK FACTORS

|

7

|

|

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

|

7

|

|

RISKS RELATED TO DOING BUSINESS IN VIETNAM AND OTHER DEVELOPING COUNTRIES

|

12

|

|

RISKS RELATED TO AN INVESTMENT IN OUR SECURITIES

|

14

|

|

USE OF PROCEEDS

|

15

|

|

DETERMINATION OF OFFERING PRICE

|

15

|

|

SELLING SECURITY HOLDER

|

15

|

|

PLAN OF DISTRIBUTION

|

17

|

|

DESCRIPTION OF SECURITIES TO BE REGISTERED

|

18

|

|

INTERESTS OF NAMED EXPERTS AND COUNSEL

|

20

|

|

INFORMATION WITH RESPECT TO THE REGISTRANT

|

20

|

|

PROPERTIES

|

32

|

|

LEGAL PROCEEDINGS

|

32

|

|

MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

|

32

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

33

|

|

DIRECTORS AND EXECUTIVE OFFICERS

|

37

|

|

EXECUTIVE COMPENSATION

|

38

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

39

|

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

40

|

|

DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

41

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

41

|

|

FINANCIAL STATEMENTS

|

F-1

|

|

|

|

|

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS

|

42

|

|

|

|

|

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

42

|

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

42

|

|

RECENT SALES OF UNREGISTERED SECURITIES

|

44

|

|

EXHIBIT INDEX

|

49

|

|

UNDERTAKINGS

|

50

|

|

SIGNATURES

|

53

|

You should rely only on the information

contained in this Prospectus. We have not authorized anyone to provide you with different information. We are not making an offer

of these securities in any state where the offer is not permitted.

PROSPECTUS SUMMARY

You should read the following summary

together with the more detailed information and the financial statements appearing elsewhere in this Prospectus. This Prospectus

contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those

anticipated in these forward-looking statements as a result of certain factors, including those set forth under “Risk Factors”

and elsewhere in this Prospectus. Unless the context indicates or suggests otherwise, references to “we,”

“our,” “us,” the “Company,” “Stevia” or the “Registrant” refer to Stevia

Corp., a Nevada corporation and its subsidiaries.

Overview

Stevia Corp. was incorporated on May 21,

2007 in the State of Nevada. On June 23, 2011, we closed a voluntary share exchange transaction with Stevia Ventures International

Ltd., a business company incorporated in the British Virgin Islands, pursuant to which we acquired the rights to purchase certain

strains of stevia leaf growing in Vietnam, including certain assignable exclusive purchase contracts and an assignable supply agreement

related to the stevia leaf.

We are a farm management company primarily

focused on crop agronomics from plant breeding to good agricultural practices to development of crop derived products, which can

be used for human consumption as well as for aquaculture and agriculture applications.

We have established a field test research

center in Vietnam on 10 Ha (25 acres) of leased land which is designed to support our commercial field trials that are on-going

in Vietnam and began our first commercial trial harvests in March 2012. We confirmed elite plant varieties, developed propagation

techniques, conducted field trials across several provinces, documented local operating procedures and post-harvest techniques,

and began commercial harvests in February 2013.

In July 2012 we formed a joint venture

with Tech-New Bio-Technology, a technology company in Hong Kong and acquired intellectual property covering several formulations

utilizing stevia extracts together with probiotics and enzymes which have applications for agriculture, aquaculture and post harvest

processing. We do not operate an extraction facility, but Tech-New Bio-Technology’s affiliate company in China has technologies

and the facility for the extraction and refinement of high purity stevia; we entered into a multi-year supply contract in March

2012 where they are committed to purchase all of our stevia leaf production for the first two years and we also have the ability

to use the resulting stevia extract to formulate our products. While we believe that our joint venture with Tech-New Bio-Technology

will increase the visibility of our intended services and products, there is no guarantee that such visibility will occur.

Our formulated products consist of ecological

fertilizers that address soil acidification, compaction and fertility decline caused by chemical fertilizer overuse; foliar fertilizers

that help plants resist infection and disease; feed formulations for livestock, fish and shrimp that enhance digestion and help

strengthen immunity; microbiological preparations that address pollution in marine environments that negatively impact aquaculture

activities; and natural preparations which aid in the preservation of crops after harvest and during processing. We also provide

private label pure stevia extracts which are suitable for food and beverage applications.

In August of 2012 we began to use our formulated

products as feed and fertilizer inputs under our farm management model and currently service several commercial operations providing

feed supplements for shrimp and fish production and fertilizer inputs for farmland as well as using it on our own trial farms.

In September 2012 we began providing samples

of stevia extract to food and beverage companies and we are working closely with local parties in several South East Asian countries

to provide technical information in support of recipe development. Although we believe that this product line will have growth

potential, there is no guarantee that a high volume of stevia will be utilized by our customers. We expect companies will take

another year to plan product launches.

In January 2014 we entered into a Farm

Management and Technology Agreement with ebbu LLC to provide farm management consultancy and technical expertise related to growing

the cannabis plant and extracting its cannabinoids. The cannabis plant produces many chemical compounds called cannabinoids and

there are more than 85 different cannabinioids that have been identified and isolated from the cannabis plant that exhibit varied

effects and many of these are being studied for their psychoactive and medical properties. Cannabis plants that have been bred

to produce high levels of tetrahydrocannabinol (“THC”), a psychoactive constituent, are commonly referred to as marijuana.

Current federal and most state regulations prevent us from participating directly in the marijuana industry and we cannot guarantee

that our services or technology will provide value if the laws do not evolve in favor of marijuana production and the commercial

sale of marijuana derived products.

In February 2014 we registered a wholly

owned subsidiary, Real Hemp LLC, as part of our strategy to enter the US hemp industry to import, manufacture and license products

containing hemp seeds, oil, protein, milk, fiber and cannabidiol. Hemp is the common term for cannabis plants that produce very

low levels of THC and are grown for industrial purposes and foodstuff products. Cannabidiol (“CBD”) is one of the active

cannabinoids in the cannabis plant and is a major constituent of hemp, accounting for up to 40% of the plants extract, and is considered

to have a wider scope of medical applications than THC. Hemp products, including CBD extracts, can be legally imported and traded

in the United States. We are currently exploring product opportunities and expect to launch our first products during 2014. There

is no guarantee that we will launch products containing hemp or that such products will be successful.

All of our formulated products used for

agriculture and aquaculture are approved for use in our areas of operation and the largest obstacle we will face will be farmer

confidence to use new products. We believe that we can overcome this obstacle by building a successful and demonstrable track record

working with the current operations of Tech-New Bio-Technology and its affiliates. All of the ingredients in the products are natural

compounds and are approved by the major developed countries if we choose to expand to other markets in the future. A list of the

major developed countries that have approved the use of stevia as a food additive can be found on page 29.

The stevia industry is segmented into several

business processes, which can broadly be categorized as i) plant breeding and propagation, ii) farming, iii) extraction and refining,

iv) product formulation, v) distribution and retail. As we achieve vertical integration along the supply chain we will continue

to focus on acquisitions and intellectual property development to support further downstream integration into the agriculture and

aquaculture sectors. We believe that over the long-run this will position the Company to become an industry leader, producing a

number of value-added stevia-enhanced products.

Our Business

We are a farm management company primarily

focused on stevia agronomics from plant breeding to good agricultural practices to development of stevia derived products which

can be used for human consumption as well as for aquaculture and agriculture applications. We plan to invest in research and development

and intellectual property acquisition and provide farm management services to contract growers and other industry growers integrating

our stevia focused research and development and intellectual property acquisitions.

Our farm management services include training

the farmers on the correct protocols and methodologies and providing ongoing technical assistance during the crop cycle as well

as providing inputs such as the seedlings, fertilizers and additives they are required to use.

We employ our services under three business

models which we classify as 1) contract farming model, 2) revenue share model and 3) product supply model.

Under the contract farming and revenue

share models we do not charge for the services and inputs, but rather our services provide us with a competitive advantage to secure

growers who are willing to dedicate their land and resources to grow crops with an expectation of high yielding, high quality crops

and guaranteed purchase prices. Under these models we will generate our revenue from the crops that are grown and we only enter

into production agreements with growers when there is already a committed buyer for the end crop. Under the contract farming model

we will purchase the crop from the grower at a fixed price and sell to our own customer. Under the revenue share model,

the grower already has their own buyer and we will share the revenue.

Under the product supply model we will

market our products in combination with technical services to buyers and charge a fee. We believe that this model will contribute

a small part of our overall revenue initially until we establish a proven track record and solid reputation for our services and

products under the first two models. We do not expect to focus on providing strictly farm management or technical services

for a fee and it is difficult to estimate what we would charge for such services.

We continue to focus on research and

development to further evolve and develop new protocols, methodologies and intellectual properties and believe that this will be

key to maintain our competitive advantage.

We utilize the contract farming model

to produce stevia leaf for our trial harvests and use the stevia extracts to produce our proprietary formulated products, which

we are applying under the revenue share model to an aquaculture operation beginning August 2012 and a chili operation beginning

October 2012.

Our mission is to maximize stockholder

value by consistently developing and acquiring the latest intellectual property and expanding our suite of formulated products

and their applications and leveraging our farm management business model to maximize market penetration and revenue margins.

To achieve these goals we intend to develop

a suite of intellectual property relating to stevia and its extracts that will enhance the value of our farm management operations.

Through our relationships with Tech-New Bio-Technology, Growers Synergy and local institutes, we are exploring the market for commercial

applications of stevia which will be vertically integrated into our services and production. We have engaged Growers Synergy, a

regional farm management services provider, to provide farm management operations and back-office and regional logistical support

for our Vietnam and Indonesia operations for a period of two years. George Blankenbaker, our president, director and stockholder

is the managing director of Growers Synergy. Growers Fresh Pte Ltd (“Growers Fresh) owns a 51% interest in Growers Synergy

and Mr. Blankenbaker controls a 49% interest in Growers Fresh.

Our current burn rate is approximately

$150,000 per month and we currently have approximately $350,000 in cash on hand. We are dependent on additional capital to continue

to operate. Failure to complete a financing will have an adverse effect on our ability to operate and execute our business plan.

We believe that $3 million of funding is sufficient for us to break-even and achieve self-sufficiency on a cash flow basis. Based

on the current burn rate, the Company does not currently have sufficient capital to operate and we are doing so on a very limited

budget, relying primarily on our goodwill with Growers Synergy and our other vendors, and during this period we will need to raise

additional capital and generate revenue. As a result, our accounts payable are expected to grow. However, there are no assurances

that Growers Synergy or our other vendors will continue to extend credit to the Company, and if they cease extending credit to

us, and we are unable to raise capital or generate sufficient revenue, we will have to liquidate or sell certain assets.

Our target markets are initially Vietnam,

Indonesia and China where we have contracted with growers and have established our own nurseries and test fields. In China we are

producing our proprietary formulated products and applying them to aquaculture projects under our revenue share model. Although

our priority is Asia, our services are not limited to specific countries and we plan to pursue viable opportunities in other markets.

Our operations to-date have primarily consisted

of securing purchase and supply contracts, office space and a research center, developing relationships with potential partners,

and developing products derived from the stevia plant. We have earned limited revenues since inception. For the nine month period

ended December 31, 2013 we incurred a net loss of $2,017,484 and for the period from inception (April 11, 2011) to March 31, 2013,

we have incurred a net loss of $4,359,415. Our assets total $3,641,781 and $2,194,251 as of as of December 31, 2013 and March 31,

2013, respectively. Further, our auditors have issued a going concern opinion in their audit report dated July 15, 2013. This means

that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional

capital.

Recent Developments

The table below sets forth shares of our

common stock that have been recently issued in exchange for certain services and rights.

|

Date

|

|

Issuance of Shares for Services and/or Rights

|

|

February 26, 2014

|

|

We issued an aggregate of 28,300,000

shares of our common stock to various service providers in exchange for services rendered, including 20,000,000 shares to Blankenbaker

Ventures (Asia) Pte. Ltd. on behalf of George Blankenbaker, our president, director and stockholder and 3,000,000 shares to Growers

Synergy Pte Ltd., a corporation organized under the laws of Singapore (“Growers Synergy”). Thomas Ong, a director of

the Company is a director of Growers Synergy and is also a 25% shareholder of Agriventure Pte Ltd., which is a 49% shareholder

of Growers Synergy. Growers Fresh Pte Ltd (“Growers Fresh) owns a 51% interest in Growers Synergy and Mr. Blankenbaker controls

a 49% interest in Growers Fresh.

|

|

February 26, 2014

|

|

We issued 16,744,682 shares of our common stock to Blankenbaker Ventures (Asia) Pte. Ltd. on behalf of George Blankenbaker, our president, director and stockholder, in exchange for the cancellation of approximately $893,579.93 of working capital advances provided by Mr. Blankenbaker and his affiliated companies.

|

|

|

|

|

Corporate

Information

Our principal executive offices are located

at 7117 US 31 S., Indianapolis, IN, 46227. Our telephone number is 888-250-2566. We maintain a corporate website at http://www.steviacorp.us.

Stock Transfer Agent

Our stock transfer agent is Securities

Transfer Corporation, and is located at 2591 Dallas Parkway, Suite 102, Frisco, Texas 75034. The agent’s telephone

number is 469-633-0101.

The Offering

|

Issuer

|

|

Stevia Corp.

|

|

|

|

|

|

Securities Offered for Resale

|

|

47,898,931 shares of Common Stock underling convertible notes and warrants to purchase Common Stock

|

|

|

|

|

|

Common Stock Outstanding Before the Offering

|

|

145,972,713 shares

|

|

|

|

|

|

Common Stock to be Outstanding After the Offering assuming all of the Securities are Resold

|

|

193,871,644 shares

|

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the resale of the shares of common stock underlying the Warrants. We may receive proceeds in the event the Warrants are exercised for cash. Such proceeds from the offering will be used for working capital and general corporate purposes. See “Use of Proceeds.”

|

|

|

|

|

|

Trading

|

|

Our common stock is quoted on the OTCQB under the symbol “STEV.”

|

|

|

|

|

|

Risk Factors

|

|

You should carefully consider the information set forth in the section entitled “Risk Factors” beginning on page 2 of this prospectus in deciding whether or not to invest in our common stock.

|

Nomis Bay Note Shares

This offering, with respect to the Nomis Bay Note Shares, relates

to the resale of shares of common stock of the Company underlying a Senior Convertible Note, issued March 3, 2014 (the “Nomis

Bay Note”). On March 3, 2014, pursuant to a Securities Purchase Agreement (the “Purchase Agreement”) with Nomis

Bay Ltd., a Bermuda company (“Nomis Bay”), we issued the Nomis Bay Note with an initial principal amount of $500,000

for a purchase price of $340,000. The Nomis Bay Note matures on December 27, 2014 (subject to extension as provided

in the Nomis Bay Note) and, in addition to the 32% original issue discount, accrues interest at the rate of 8% per annum. The Purchase

Agreement also provides that, upon the terms and subject to the conditions set forth therein, the Company may require Nomis Bay

to purchase from the Company on or prior to the 10

th

trading day after the effective date of the registration statement

registering the shares issuable upon conversion of the Initial Convertible Note, an additional senior convertible note with an

initial principal amount of $600,000 (the “Additional Convertible Note” and together with the Nomis Bay Note, the “Convertible

Notes”) for a purchase price of $600,000. If issued, the Additional Convertible Note will mature on the date that is the

10-month anniversary of the date of issuance of the Additional Convertible Note (subject to extension as provided in the Initial

Convertible Note) and will accrue interest at the rate of 8% per annum. The Nomis Bay Note is convertible at any time, in whole

or in part, at Nomis Bay’s option into shares of the Company’s common stock, par value $0.001 per share (the “Common

Stock”), at a conversion price equal to the lesser of (i) the product of (x) the arithmetic average of the lowest three (3)

volume weighted average prices of the Common Stock during the 10 consecutive trading days ending and including the trading day

immediately preceding the applicable conversion date and (y) 40% (the “Variable Conversion Price”), and (ii) $0.30

(as adjusted for stock splits, stock dividends, stock combinations or other similar transactions). If issued, the Additional Convertible

Note will be convertible at any time, in whole or in part, at Nomis Bay’s option into shares of Common Stock at a conversion

price that will be equal to the lesser of (i) the Variable Conversion Price and (ii) $0.30 (as adjusted for stock splits, stock

dividends, stock combinations or other similar transactions). At no time will Nomis Bay be entitled to convert any portion of the

Convertible Notes to the extent that after such conversion, Nomis Bay (together with its affiliates) would beneficially own more

than 4.99% of the outstanding shares of Common Stock as of such date. The shares of common stock underlying the Nomis Bay Note

were issued in reliance upon an exemption from the registration requirements of the Securities Act and/or Rule 506 of Regulation

D promulgated thereunder.

Anson Reset Shares

This offering, with respect to the Anson

Reset Shares, relates to the resale of shares of common stock of the Company underlying three warrants in the amounts of 1,877,333,

1,066,666 and 2,346,666, with exercise prices of $0.20, $0.25 and $0.25 per share (the “Anson Warrants”). Pursuant

to the terms of a warrant exercise reset offer letter between the Company and the investor, the Anson Warrants were issued in consideration

for the investor’s agreement to immediately cash exercise an existing warrant to purchase 853,333 shares of common stock

of the Company at an exercise price of $0.20 per share for aggregate consideration to the Company of $170,666 originally issued

pursuant to the terms of the Securities Purchase Agreement, dated August 1, 2012 (the “Purchase Agreement”). Each Anson

Warrant has a five year term and was issued on May 3, 2013. Each Anson Warrant provides for adjustment of the exercise price and

share amount in the event of certain dilutive issuances by the Company. On February 20, 2014, the Company issued a notice to the

holder that the aggregate number of Anson Warrants had been adjusted to 23,026,318 and the exercise price of each had been adjusted

to $0.053365 as a result of certain other offerings of the Company. 5,290,665 of the shares underlying the Anson Warrants were

previously registered by the Company pursuant to the Registration Statement on Form S-1/A filed December 30, 2013. The warrants

and the shares of common stock underlying the warrants were issued in reliance upon an exemption from the registration requirements

of the Securities Act and/or Rule 506 of Regulation D promulgated thereunder.

Cranshire Warrant Shares

This offering, with respect to the Cranshire

Warrant Shares, relates to the resale of the shares of common stock underlying a warrant in the amount of 2,560,486 with an exercise

price of $0.053365. The warrant has a five (5) year term and was issued pursuant to the terms of the Purchase Agreement. The warrant

was originally issued in the amount of 213,334 shares at an exercise price of $0.6405. Pursuant to the anti-dilution adjustment

provision contained therein, on February 20, 2014, the Company issued a notice to the holder that the total share amount had been

increased to 2,560,486 and the exercise price had been reduced to $0.053365 as a result of certain other offerings of the Company.

683,202 of the shares underlying the Cranshire Warrants were previously registered by the Company pursuant to the Registration

Statement on Form S-1/A filed December 30, 2013. Additionally, on February 20, 2014 in consideration for the investor’s agreement

to immediately cash exercise a portion of the Cranshire Warrants for aggregate consideration to the Company of $36,459, the Company

agreed to issue the investor an additional warrant to purchase 683,202 shares of common stock. The warrants and the shares of common

stock underlying the warrants were issued in reliance upon an exemption from the registration requirements of the Securities Act

and/or Rule 506 of Regulation D promulgated thereunder.

JMJ Note Shares

This offering, with respect to the JMJ Note Shares, relates

to the resale of 3,000,000 shares of common stock of the Company underlying a $400,000 Promissory Note issued July 10, 2013 (the

“JMJ Note”). The JMJ Note is subject to a one-time interest charge equal to 12% of the principal sum and is due and

payable July 10, 2014. The JMJ Note provides that it may be converted into common stock of the Company at any time at the election

of the holder, at a conversion price equal to the lesser of $0.26 or 65% of the lowest trade price in the 25 trading days previous

to the conversion. The JMJ Note and the shares of common stock underlying the JMJ Note were issued in reliance upon an exemption

from the registration requirements of the Securities Act and/or Rule 506 of Regulation D promulgated thereunder.

SUMMARY OF FINANCIAL INFORMATION

The following selected financial information

is derived from the Company’s Financial Statements appearing elsewhere in this Prospectus and should be read in conjunction

with the Company’s Financial Statements, including the notes thereto, appearing elsewhere in this Prospectus.

Summary of Statements of Operations

For the Three Months Ended December 31, 2013:

|

Total revenue

|

|

$

|

388,746

|

|

|

|

|

|

|

|

|

Net income

|

|

|

(831,410

|

)

|

|

|

|

|

|

|

|

Net income per common share (basic and diluted)

|

|

$

|

(0.01

|

)

|

|

|

|

|

|

|

|

Weighted average common shares

|

|

|

79,632,959

|

|

For the Nine Months Ended December 31, 2013:

|

Total revenue

|

|

$

|

1,893,865

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(2,017,484

|

)

|

|

|

|

|

|

|

|

Net loss per common share (basic and diluted)

|

|

$

|

(0.03

|

)

|

|

|

|

|

|

|

|

Weighted average common shares

|

|

|

72,842,975

|

|

For the Fiscal Year Ended March 31, 2013:

|

Total revenue

|

|

$

|

2,168,093

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(2,035,864

|

)

|

|

|

|

|

|

|

|

Net loss per common share (basic and diluted)

|

|

$

|

(0.03

|

)

|

|

|

|

|

|

|

|

Weighted average common shares

|

|

|

62,092,487

|

|

Statement of Financial Position

|

|

|

December 31, 2013

|

|

|

|

|

|

|

|

Cash

|

|

$

|

85,366

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

$

|

164,988

|

|

|

|

|

|

|

|

|

Seeds

|

|

$

|

1,807,000

|

|

|

|

|

|

|

|

|

Prepayments and other current assets

|

|

$

|

74,946

|

|

|

|

|

|

|

|

|

Total current assets

|

|

$

|

2,132,300

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

3,641,781

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

$

|

2,591,869

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

$

|

798,339

|

|

|

|

|

|

|

|

|

Non-controlling interest

|

|

$

|

(345,946

|

)

|

|

|

|

|

|

|

|

Equity

|

|

$

|

452,393

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

$

|

3,641,781

|

|

|

|

|

March 31,

2013

|

|

|

|

|

|

|

|

Cash

|

|

$

|

424,475

|

|

|

|

|

|

|

|

|

Accounts Receivable

|

|

|

158,008

|

|

|

|

|

|

|

|

|

Prepayments and other current assets

|

|

|

33,096

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

615,579

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

2,194,251

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

$

|

1,457,531

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

$

|

464,765

|

|

|

|

|

|

|

|

|

Non-controlling interest

|

|

$

|

(214,158

|

)

|

|

|

|

|

|

|

|

Equity

|

|

$

|

250,607

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

$

|

2,194,251

|

|

DISCLOSURE REGARDING FORWARD-LOOKING

STATEMENTS

Except for statements of historical

facts, this Prospectus contains forward-looking statements involving risks and uncertainties. The words “anticipate,”

“believe,” “estimate,” “expect,” “future,” “intend,” “plan”

or the negative of these terms and similar expressions or variations thereof are intended to forward looking statements. Such statements

reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and

other factors (including the risks contained in the section of this registration statement on Form S-1 entitled “Risk Factors”)

relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that

may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions

prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that

the expectations reflected in the forward looking statements are reasonable, the Registrant cannot guarantee future results, levels

of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States,

the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The

following discussion should be read in conjunction with the Registrant’s financial statements and the related notes included

in this registration statement on Form S-1.

RISK FACTORS

You should carefully consider the risks

described below together with all of the other information included in our public filings before making an investment decision

with regard to our securities. If any of the following events described in these risk factors actually occurs, our

business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could

decline, and you may lose all or part of your investment.

RISKS RELATING TO OUR BUSINESS AND INDUSTRY

We have a limited operating history on which to evaluate

our business or base an investment decision.

Our business prospects are difficult to

predict because of our limited operating history, early stage of development and unproven business strategy. Stevia is still a

relatively new product in the sweetener marketplace and it has historically not been commercially grown in Vietnam or many of our

other target locations. Both the continued growth of the stevia market in general, and our ability to introduce commercial development

of stevia to new regions, face numerous risks and uncertainties. In particular, we have not proven that we can produce stevia in

a manner that enables us to be profitable and meet manufacturer requirements, develop intellectual property to enhance stevia production,

develop and maintain relationships with key growers and strategic partners to extract value from our intellectual property, raise

sufficient capital in the public and/or private markets, or respond effectively to competitive pressures. If we are unable to accomplish

these goals, our business is unlikely to succeed and you should consider our prospects in light of these risks, challenges and

uncertainties.

We have incurred significant losses

and our auditors have expressed uncertainty about our ability to continue as a going concern.

Our auditors have expressed uncertainty

as to our ability to continue as a going concern as of our fiscal year ended March 31, 2013. As of December 31, 2013, we had an

accumulated deficit of $6,376,899. We anticipate that our existing cash and cash equivalents will not be sufficient to fund our

longer term business needs and we will need to generate additional revenue or receive additional investment in the Company to continue

operations. Such financing may not be available in sufficient amounts, or on terms acceptable to us and may dilute existing

stockholders.

If we fail to raise additional capital,

our ability to implement our business model and strategy could be compromised.

We have limited capital resources and operations.

On March 3, 2014, we raised $340,000 (subject to certain fees) through the issuance of a convertible promissory note (the “Initial

Convertible Note”), pursuant to a Securities Purchase Agreement (the “Purchase Agreement”) with Nomis Bay Ltd.,

a Bermuda company (“Nomis Bay”). The Purchase Agreement provides that, upon the terms and subject to the

conditions set forth therein, we may require Nomis Bay to purchase from the Company on or prior to the 10

th

trading

day after the effective date of the registration statement registering the shares issuable upon conversion of the Initial Convertible

Note, an additional senior convertible note with an initial principal amount of $600,000 (the “Additional Convertible Note”)

for a purchase price of $600,000. There is no guarantee that we will be able to meet the conditions for the funding of the Additional

Convertible Note and investors should not expect us to be able to do so.

To date, our operations have been funded

entirely from the proceeds from debt and equity financings. We expect to require substantial additional capital in the near future

to develop our intellectual property base and to establish the targeted levels of commercial production of stevia. We may not be

able to obtain additional financing on terms acceptable to us, or at all. Even if we obtain financing for our near term operations,

we expect that we will require additional capital beyond the near term. If we are unable to raise capital when needed, our business,

financial condition and results of operations would be materially adversely affected, and we could be forced to reduce or discontinue

our operations.

We face intense competition which could

prohibit us from developing a customer base and generating revenue.

The industries within which we compete,

including the sweetener industry and the fertilizer and feed industries, are highly competitive with companies that have greater

capital resources, facilities and diversity of product lines. Additionally, if demand for stevia continues to grow, we expect many

new competitors to enter the market as there are no significant barriers to stevia production. More established agricultural companies

with much greater financial resources which do not currently compete with us may be able to easily adapt their existing operations

to production of stevia. Due to this competition, there is no assurance that we will not encounter difficulties in obtaining revenues

and market share or in the positioning of our services or that competition in the industry will not lead to reduced prices for

the stevia leaf. Our competitors may also introduce new non-stevia based low-calorie sweeteners or be successful in developing

a fermentation-derived stevia ingredient or other alternative production method which could also increase competition and decrease

demand for stevia-based products.

Inability to protect our proprietary

rights could damage our competitive position.

Our business will be heavily dependent

upon the intellectual property we develop or acquire. Any infringement or misappropriation of our intellectual property could damage

its value and limit our ability to compete. We will rely on patents, copyrights, trademarks, trade secrets, confidentiality provisions

and licensing arrangements to establish and protect our intellectual property. We may have to engage in litigation to protect the

rights to our intellectual property, which could result in significant litigation costs and require a significant amount of our

time. In addition, our ability to enforce and protect our intellectual property rights may be limited in certain countries outside

the United States, which could make it easier for competitors to capture market position in such countries by utilizing technologies

that are similar to those developed or licensed by us.

Competitors may also harm our sales by

designing products that mirror the capabilities of our products or technology without infringing our intellectual property rights.

If we do not obtain sufficient protection for our intellectual property, or if we are unable to effectively enforce our intellectual

property rights, our competitiveness could be impaired, which would limit our growth and future revenue.

A successful claim of infringement against

us could result in a substantial damage award and materially harm our financial condition. Even if a claim against us is unsuccessful,

we would likely have to devote significant time and resources to defending against it.

We may also find it necessary to bring

infringement or other actions against third parties to seek to protect our intellectual property rights. Litigation of this nature,

even if successful, is often expensive and disruptive of a company’s management’s attention, and in any event may not

lead to a successful result relative to the resources dedicated to any such litigation.

We may be unable to effectively develop

an intellectual property portfolio or may fail to keep pace with advances in technology.

We have a limited operating history in

the agriculture industry and there is no certainty that we will be able to effectively develop a viable portfolio of intellectual

property. The success of our farm management services, which are the core of our business, depends upon our ability to create such

intellectual property.

Even if we are able to develop, manufacture

and obtain any regulatory approvals and clearances necessary for our technologies and methods, the success of such services will

depend upon market acceptance. Levels of market acceptance for our services could be affected by several factors, including:

|

|

·

|

the availability of alternative services from our competitors;

|

|

|

·

|

the price and reliability of the our services relative to that of our competitors; and

|

|

|

·

|

the timing of our market entry.

|

Additionally, our intellectual property

must keep pace with advances by our competitors. Failure to do so could cause our position in the industry to erode rapidly.

Confidentiality agreements with employees

and others may not adequately prevent disclosure of our trade secrets and other proprietary information.

Our success depends upon the skills, knowledge

and experience of our technical personnel, our consultants and advisors as well as our licensors and contractors. Because we operate

in a highly competitive field, we will rely significantly on trade secrets to protect our proprietary technology and processes.

However, trade secrets are difficult to protect. We enter into confidentiality and intellectual property assignment agreements

with our corporate partners, employees, consultants, outside scientific collaborators, developers and other advisors. These agreements

generally require that the receiving party keep confidential and not disclose to third parties confidential information developed

by us during the course of the receiving party’s relationship with us. These agreements also generally provide that inventions

conceived by the receiving party in the course of rendering services to us will be our exclusive property. However, these agreements

may be breached and may not effectively assign intellectual property rights to us. Our trade secrets also could be independently

discovered by competitors, in which case we would not be able to prevent use of such trade secrets by our competitors. The enforcement

of a claim alleging that a party illegally obtained and was using our trade secrets could be difficult, expensive and time consuming

and the outcome would be unpredictable. In addition, courts outside the United States may be less willing to protect trade secrets.

The failure to obtain or maintain meaningful trade secret protection could adversely affect our competitive position.

We will produce products for consumption

by consumers that may expose us to litigation based on consumer claims and product liability.

The stevia produced at our farms will be

integrated into stevia-based products which will be consumed by the general public. Additionally, we may manufacture and sell private

label stevia-based food products. Even though we intend to grow and sell products that are safe, we have potential product risk

from the consuming public. We could be party to litigation based on consumer claims, product liability or otherwise that could

result in significant liability for us and adversely affect our financial condition and operations.

If our services do not gain acceptance

among stevia growers, we may not be able to recover the cost of our intellectual property development.

Our business model relies on the assumption

that we will be able to develop methods and protocols, secure valuable plant strains and develop other intellectual property for

stevia farming that will be attractive to both stevia growers and manufacturers. We spent $383,360 for this purpose as of March

31, 2013 and issued 3,000,000 shares to acquire intellectual property related to stevia and we estimate spending approximately

fifteen percent of our operating expense budget to continue developing and improving this intellectual property portfolio. If we

are unable to secure such intellectual property or if our methods and protocols do not gain acceptance among growers or manufacturers,

our intellectual property will have limited value. A number of factors may affect the market acceptance of our products and services,

including, among others, the perception by growers of the effectiveness of our intellectual property, the perception among manufacturers

of the quality of stevia produced using our intellectual property, our ability to fund marketing efforts, and the effectiveness

of such marketing efforts. If such products and services do not gain acceptance by growers and/or manufacturers, we may not be

able to fund future operations, including the expansion of our own farming projects and development and/or acquisition of additional

intellectual property, which inability would have a material adverse effect on our business, financial condition and operating

results.

Any failure to adequately establish

a network of growers and manufacturers will impede our growth.

We expect to be substantially dependent

on manufacturers to purchase the stevia produced both at our own farms and at those of our customers. We have entered into a supply

agreement with a manufacturer and two purchase agreements with growers and are in the process of establishing a network of growers

to produce stevia using the methods and protocols we are developing. The relationship with this manufacturer and its perception

of the stevia produced using our farm management services will determine its willingness to enter into purchase contracts with

us and our customers on attractive terms. Our ability to secure such contracts will influence our attractiveness to growers who

are potentially interested in partnering with us. Achieving significant growth in revenue will depend, in large part, on our success

in establishing this production network. If we are unable to develop an efficient production network, it will make our growth more

difficult and our business could suffer.

If we are unable to deliver a consistent,

high quality stevia leaf at sufficient volumes, our relationship with our manufacturers may suffer and our operating results will

be adversely affected.

Manufacturers will expect us to be able

to consistently deliver stevia at sufficient volumes, while meeting their established quality standards. If we are unable to consistently

deliver such volumes either from our own farms, or those of our grower partners, our relationship with these manufacturers could

be adversely affected which could have a negative impact on our operating results.

Laws and regulations affecting the

cannabis and marijuana industries are constantly changing, which could detrimentally affect our contemplated business, and we cannot

predict the impact that future regulations may have on us.

Local, state and federal cannabis and

marijuana laws and regulations are constantly changing and they are subject to evolving interpretations, which could require us

to incur substantial costs associated with compliance or to alter one or more of our contemplated service offerings. In addition,

violations of these laws, or allegations of such violations, could disrupt our contemplated business and result in a material adverse

effect on our revenues, profitability, and financial condition. We cannot predict the nature of any future laws, regulations, interpretations

or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures,

when and if promulgated, could have on our contemplated business. Any change in law or interpretation could have a material

adverse effect on our contemplated business, financial condition, and results of operations.

Marijuana remains illegal under federal law.

Marijuana remains illegal under federal law. It is

a schedule-I controlled substance. Even in those jurisdictions in which the use of medical marijuana has been legalized

at the state level, its prescription is a violation of federal law. Federal law criminalizing the use of marijuana trumps

state laws that legalize its use for medicinal purposes, although the current President’s administration has expressed a

reluctance to enforce federal law in this regard in jurisdictions where it conflicts with state law. However, a change in the federal

attitude towards enforcement could occur at any time and could cripple the industry.

It is possible that our contemplated activities

could be deemed to be facilitating the selling or distribution of marijuana in violation of the federal Controlled Substances Act,

or to constitute aiding or abetting, or being an accessory to, a violation of that Act. Federal authorities have not focused their

resources on such tangential or secondary violations of the Act, nor have they threatened to do so. However, if the federal government

were to change its practices, or were to expend its resources attacking providers of services or equipment that could be usable

by participants in the marijuana industry, such action could have a materially adverse effect on our contemplated business, financial

condition, and results of operations.

Hemp remains illegal to grow under federal

law.

Hemp

remains illegal to grow in the United States under federal law due to its relation to marijuana. However, it may be legally imported

and sold in the United States. In certain states, the cultivation of hemp is legal, however federal law criminalizing such cultivation

trumps state laws in this regard. The

current President’s administration has expressed a reluctance to enforce federal

law in this regard in jurisdictions where it conflicts with state law. However, a change in the federal attitude towards enforcement

could occur at any time and could cripple the industry.

It is possible that our contemplated activities

could be deemed to be facilitating hemp cultivation in violation of the federal Controlled Substances Act, or to constitute aiding

or abetting, or being an accessory to, a violation of that Act. Federal authorities have not focused their resources on such tangential

or secondary violations of the Act, nor have they threatened to do so. However, if the federal government were to change its practices,

or were to expend its resources attacking providers of services or equipment that could be usable by participants in the hemp cultivation

industry, such action could have a materially adverse effect on our contemplated business, financial condition, and results of

operations.

Changes in consumer preferences or negative

publicity or rumors may reduce demand for our products.

Recent data suggests consumers are adopting

stevia as a sweetener in many products. However, stevia is a relatively new ingredient in consumer products and many consumers

are not familiar with it. Therefore, any negative reports or rumors regarding either the taste or perceived health effects of stevia,

whether true or not, could have a severe impact on the demand for stevia-based products. Manufacturers may decide to rely on alternative

sweeteners which have a more established history with consumers. Primarily operating at the grower level, we will have little opportunity

to influence these perceptions and there can be no assurance that the increased adoption of stevia in consumer food and beverage

products will continue. Additionally, new sweeteners with similar characteristics to stevia may emerge which could be cheaper to

produce or be perceived to have other qualities superior to stevia. Any of these factors could adversely affect our ability to

produce revenues and our business, financial condition and results of operations would suffer.

Failure to effectively manage growth

of internal operations and business may strain our financial resources.

We intend to significantly expand the scope

of our farming operations and our research and development activities in the near term. Our growth rate may place a significant

strain on our financial resources for a number of reasons, including, but not limited to, the following:

|

|

·

|

The need for continued development of our financial and information management systems;

|

|

|

·

|

The need to manage strategic relationships and agreements with manufacturers, growers and partners; and

|

|

|

·

|

Difficulties in hiring and retaining skilled management, technical and other personnel necessary to support and manage our business.

|

Additionally, our strategy envisions a

period of rapid growth that may impose a significant burden on our administrative and operational resources. Our ability to effectively

manage growth will require us to substantially expand the capabilities of our administrative and operational resources and to attract,

train, manage and retain qualified management and other personnel. Our failure to successfully manage growth could result in our

sales not increasing commensurately with capital investments. Our inability to successfully manage growth could materially adversely

affect our business.

Adverse weather conditions, natural

disasters, crop disease, pests and other natural conditions can impose significant costs and losses on our business.

Weather-related events could significantly

affect our results of operations. We do not currently maintain insurance to cover weather-related losses and if we do obtain such

insurance it likely will not cover all weather-related events and, even when an event is covered, our retention or deductible may

be significant. Cooler temperatures in the regions where we operate could negatively affect us, while not affecting our competitors

in other regions.

Our crops, and those of our grower partners,

could also be affected by drought, temperature extremes, hurricanes, windstorms and floods. In addition, such crops could be vulnerable

to crop disease and to pests, which may vary in severity and effect, depending on the stage of agricultural production at the time

of infection or infestation, the type of treatment applied and climatic conditions. Unfavorable growing conditions caused by these

factors can reduce both crop size and crop quality. In extreme cases, entire harvests may be lost. These factors may result in

lower production and, in the case of farms we own or manage, increased costs due to expenditures for additional agricultural techniques

or agrichemicals, the repair of infrastructure, and the replanting of damaged or destroyed crops. We may also experience shipping

interruptions, port damage and changes in shipping routes as a result of weather-related disruptions.

Competitors and industry participants may

be affected differently by weather-related events based on the location of their production and supply. If adverse conditions are

widespread in the industry, it may restrict supplies and lead to an increase in prices for stevia leaf, but our typical fixed-price

supply contracts may prevent us from recovering these higher costs.

Our operations

and products are regulated in the areas of food safety and protection of human health and the environment.

Our operations and products are subject

to inspections by environmental, food safety, health and customs authorities and to numerous governmental regulations, including

those relating to the use and disposal of agrichemicals, the documentation of food shipments, the traceability of food products,

and labeling of our products for consumers, all of which involve compliance costs. Changes in regulations or laws may require,

operational modifications or capital improvements at various locations. If violations occur, regulators can impose fines, penalties

and other sanctions. The costs of these modifications and improvements and of any fines or penalties could be substantial. We can

be adversely affected by actions of regulators or if consumers lose confidence in the safety and quality of stevia, even if our

products are not implicated.

If we are unable to continually innovate

and increase efficiencies, our ability to attract new customers may be adversely affected.

In the area of innovation, we must be able

to develop new processes, plant strains, and other technologies that appeal to stevia growers. This depends, in part, on the technological

and creative skills of our personnel and on our ability to protect our intellectual property rights. We may not be successful in

the development, introduction, marketing and sourcing of new technologies or innovations, that satisfy customer needs, achieve

market acceptance or generate satisfactory financial returns.

Global economic conditions may adversely

affect our industry, business and result of operations.

Disruptions in the global credit and financial

market could result in diminished liquidity and credit availability, a decline in consumer confidence, a decline in economic growth,

an increased unemployment rate, and uncertainty about economic stability. These economic uncertainties can affect businesses such

as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. Such conditions

can lead consumers to postpone spending, which can cause manufacturers to cancel, decrease or delay orders with us. We are unable

to predict the likelihood of the occurrence, duration or severity of such disruptions in the credit and financial markets and adverse

global economic conditions and such economic conditions could materially and adversely affect our business and results of operations.

Our business depends substantially on

the continuing efforts of our executive officers and our business may be severely disrupted if we lose their services.

Our future success depends substantially

on the continued services of our executive officers, especially our President and director, Mr. George Blankenbaker. We do not

maintain key man life insurance on any of our executive officers and directors. If one or more of our executive officers are unable

or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business

may be severely disrupted, and we may incur additional expenses to recruit and retain new officers. In addition, if any of our

executives joins a competitor or forms a competing company, we may lose some of our customers.

Our engagement of Growers Synergy Pte

Ltd. may represent a potential conflict of interest.

We have engaged Growers Synergy Pte Ltd,

a regional farm management services provider, to provide farm management operations and back-office and regional logistical support

for our Vietnam and Indonesia operations for a period of two years. During the fiscal year ended March 31, 2012, Growers Synergy

received $180,000 for consulting services rendered to the Company and during the fiscal year ended March 31, 2013, Growers Synergy

received $240,000 for consulting services rendered to the Company. George Blankenbaker, our president, director and stockholder

is the managing director of Growers Synergy. Growers Fresh Pte Ltd (“Growers Fresh) owns a 51% interest in Growers Synergy

and Mr. Blankenbaker controls a 49% interest in Growers Fresh. As a result, there is a potential conflict of interest on Mr. Blankenbaker’s

role in the Company and Growers Synergy and such potential conflict could materially affect the terms of any engagement entered

into by the Company and Growers Synergy. Such terms, if not negotiated at arms length may not be in the best interest of the Company

and our stockholders.

Litigation may adversely affect our

business, financial condition and results of operations.

From time to time in the normal course

of our business operations, we may become subject to litigation that may result in liability material to our financial statements

as a whole or may negatively affect our operating results if changes to our business operation are required. The cost to defend

such litigation may be significant and may require a diversion of our resources. There also may be adverse publicity associated

with litigation that could negatively affect customer perception of our business, regardless of whether the allegations are valid

or whether we are ultimately found liable. As a result, litigation may adversely affect our business, financial condition and results

of operations.

We may be required to incur significant

costs and require significant management resources to evaluate our internal control over financial reporting as required under

Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse

effect on our stock price.

As a smaller reporting company as defined

in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, we are required to evaluate our internal control over financial

reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Section 404 requires us to include an

internal control report with our Annual Report on Form 10-K. This report must include management’s assessment of the effectiveness

of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of

any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse

results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect

on the trading price of our equity securities. As of December 31, 2013, the management of the Company assessed the effectiveness