SouthCorp Capital Announces Corporate Plan

07 August 2014 - 11:00PM

Business Wire

SouthCorp Capital, Inc. (OTCQB: STHC) announced its plan of

operations and expansion plan. The Company’s corporate plan is to

initially acquire houses to renovate and flip. The Company wants to

use the cash generated from the sale of these houses to acquire

properties such as apartment complexes, senior living facilitates

and/or mobile home parks. The goal is that these properties will

provide a steady and predicable income that can be distributed to

our shareholders. Our goal is to be able to increase our dividends

to $150,000 - $200,000 per month without any major change to our

current share structure. Then we want to begin to increase that

from the income generated from the apartment complexes, senior

living facilitates and/or mobile home parks.

The Company plans on flipping one house a month to build up our

cash position. Then we want to increase it to 2-3 houses a month

within the next 90 days. We expect the average profit per house to

be between $35,000 and $70,000.

The Company recently sold its property located at 602 Wagner

Street in Fort Wayne, Indiana for $35,000. The Company’s costs

related to the property were approximately $10,000. This equates to

a 250% ROI. The Company does not expect its ROI to continue to be

that high, but we look at properties where we can obtain an ROI of

40-60%. The Company decided to begin in Indiana for a few of

reasons: (1) we believe we can achieve the targeted ROI, (2) our

officers have previously bought and sold properties in Indiana, and

(3) the capital outlay is lower than other areas.

Flip Model: It has been

reported that the average flip generates a profit of approximately

$100,000 and typically have an average purchase price of around

$210,000. But those numbers never reflect renovation costs and are

based on the purchase price of house and the sales price. As a

result, the actual profit is usually much less. The Company expects

its total expenses per flip to be between $35,000 and $70,000 with

expected profits of $30,000 to $45,000. So with the $210,000 to

purchase one house, the Company can purchase and renovate between

4-6 houses and have expected profits of $150,000 - $200,000. This,

in management’s opinion, provides a better model and is expected to

provide higher dividends to our shareholders.

The Company expects to provide updates on its properties on

Wednesdays via press releases. The Company will also provide

updates in 8-Ks in accordance with the requirements of Form

8-K.

About SouthCorp Capital. The

Company focus is on the acquisition and renovation of single-family

and mutli-family properties in the U.S. with the intent of

reselling the property after renovations have occurred. Our real

estate investments are expected to focus properties undervalued

and/or in need of some repairs.

Notice Regarding Forward-Looking

Statements in this press release which are not purely

historical are forward-looking statements and include any

statements regarding beliefs, plans, expectations or intentions

regarding the future. Actual results could differ from those

projected in any forward-looking statements due to numerous

factors. These forward-looking statements are made as of the date

of this news release, and we assume no obligation to update the

forward-looking statements, or to update the reasons why actual

results could differ from those projected in the forward-looking

statements. Although we believe that any beliefs, plans,

expectations and intentions contained in this press release are

reasonable, there can be no assurance that any such beliefs, plans,

expectations or intentions will prove to be accurate.

Contacts:SouthCorp Capital, Inc.Joseph

Wade661-418-7842info@southcorpcapital.comwww.southcorpcapital.com

SouthCorp Capital, Inc.Joseph Wade,

661-418-7842info@southcorpcapital.comwww.southcorpcapital.com

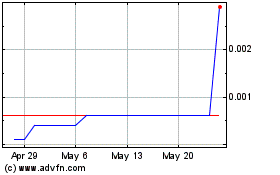

Southcorp Capital (CE) (USOTC:STHC)

Historical Stock Chart

From Jan 2025 to Feb 2025

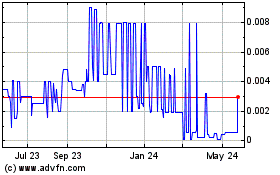

Southcorp Capital (CE) (USOTC:STHC)

Historical Stock Chart

From Feb 2024 to Feb 2025